How to invest in IPOs

Investing in IPOs enables investors to be the first to own publicly traded shares in a company before they are admitted for general trading.

The process of floating on a stock exchange involves an initial round of funding where investors can secure shares at a specific price before they start trading, this is the IPO price.

Depending on the demand for the shares, IPOs can sometimes be oversubscribed due to high demand which can be a good indication of potential performance of the shares in the early days of trading.

This situation is of course highly desirable for investors and can provide significant returns in a short period of time as well as giving long term investors a head start on those that buy after the IPO.

Snap, the owner of social app Snapchat, is good example of this having had an IPO price of $17, investors could have sold as high is $29.40 in the following days.

Click here for more information on upcoming IPOs

Of course, not all IPOs provide gains initially and some can fall heavily if the market feels the IPO price was too high and overvalued the company.

Casual Dining Group reports £60m loss

Cafe Rouge owner, Casual Dining Group, reported a steep loss in profits in the year to May 2017, in another blow to the British high street.

The group said losses across the year at its dining locations such as Cafe Rouge and Bella Italia, increased 18 percent to £60 million.

The restaurant group attributed the stark decline in profits “due to consumer confidence levels and the broader impact on discretionary spending”.

Alongside Cage Rouge, Casual Dining Group (CDG) also operate La Tasca and Belgo chains.

However, its not all bad news for the restaurant operator. Last month CDG announced the launch of a delivery brand.

The delivery service will focus upon Cafe Rouge diner favourites such as croque monsieur sandwiches and burgers.

It is set to go live in the next coming weeks, as the brand looks to compete with online delivery offerings such as Deliveroo and UberEats.

However, amid rising costs and an uncertain economic climate, many restaurant chains across the UK have been suffering as of late, amid a persistently difficult trading environment.

Jamie Oliver’s Italian restaurant chain has also come under pressure in recent months.

Last month, Jamie’s Italian this month agreed creditors and landlords to shut 12 locations, alongside paying lower rent on others for a period of up to two years.

This comes amid Italian restaurant chain, Prezzo, announced the closure of up to a third of branches across the U.K.

Around 100 of its locations are set to close, alongside all of its Chimichango locations.

Restaurant chains across the U.K aren’t alone in facing mounting challenges as consumer patterns adapt in recent years.

Last month high-street retailers Toys R Us and Maplins both announced its fall into administration, after both stores failed to find a buyer.

High-street stores have been suffering from the marked drop in footfall in recent years, as shoppers increasingly turn to the ease of online platforms to make their purchases.

Stellar Diamonds shares rally amid Newfield Resources merger

Shares in Stellar Diamonds (LON:STEL) rallied on Monday, after the company announced the board recommended a merger with Newfield Resources.

The deal was proposed last month, and the two groups have since been negotiating terms.

Last month chief Executive Karl Smithson said of the proposed deal:

“The loan will also be used to pay legal and corporate financial advisor costs including those related to the possible offer for the company.

“Working capital will therefore remain constrained as we continue discussions with Newfield Resources regarding the possible offer.” He continued.

Australian firm Newfield will offer shares of 12.5p per Stellar share, valuing the diamond miner at £7.74 million.

The company will also lend Stellar $3 million to cover any urgent short-term cash needs, while undertaking a right issue to raise $30 million to re-finance the enlarged group.

Existing Stellar shareholders will own 8.14 percent of the group following the merger and financing.

As of currently, Stellar holds a portfolio of diamond assets in both Sierra Leone and Guine, with a main emphasis upon Tongo with its Tonguma project.

Earlier this month, CEO Mr Smithson commented on the “extremely difficult” market for capital raising.

Last year, the company reported a $984,928mln loss for 2017, closing the year with just over $50,000 in cash and assets.

As a result, the diamond miner was searching for fund raising alternatives to strengthen its position and facilitate the development of its Tongo-Tonguma project.

“The interim reporting period has primarily been focused on sourcing the necessary funding to bring the Tongo-Tonguma project into production. The capital markets in the UK have proven extremely difficult to raise funds for junior mining companies in recent years,” Smithson said.

As of currently, shares in Stellar Diamonds are up more than 50 percent, trading up 55.69 percent as of 12.50PM (GMT).

Melrose increases GKN takeover bid to £8.1 billion

Melrose has increased its offer for UK engineering firm GKN (LON:GKN) from £7.4 billion to £8.1 billion.

The offer was announced by the company in a brief statement released on Monday morning.

Melrose said this would be its “final offer” for the company, which would equal 467p per share.

The bid would give GKN shareholders a 60pc stake in the merged company, an increase from 57pc offered previously.

In response to the revised bid, GKN’s chairman, Mike Turner, told investors on Monday that Melrose “lacks experience in several critical areas and that its priorities are inappropriate for running a global technology-based business like GKN”.

“Melrose is offering a premium lower than any relevant FTSE 100 takeover in the last 10 years, and substantially lower than any of its previous acquisitions,” Turner added.

Back in January GKN rejected a £7.4 billion hostile takeover bid from Melrose, which specialises in acquisitions.

GKN had rejected an initial bid of £7 billion, which the company declared as “opportunistic”.

GKN became takeover target after issuing a series of profit warnings last year.

In particular, its aerospace division encountered difficulties, in light of “operational challenges” and lower profit margins.

Moreover, last November the company announced the departure of incoming chief executive, Kevin Cummings, a mere few weeks before he was supposed to assume the role.

It was announced that non-director, Anne Stevens, a former senior Ford executive would instead assume the role as interim chief executive in January.

GKN is headquartered in Worcestershire in the UK and has more than 59,000 employees across 30 countries.

The British multi-national firm produces wing tips for Airbus, alongside various parts for car-makers.

Shares in GKN are currently trading down marginally by 0.32 percent as of 10.57AM (GMT).

Bumper Non-Farm Payrolls buoy dollar while stocks rise

The monthly US jobs report smashed estimates on Friday as Non-Farm Payrolls for February came in at 313,000, well above the expected 200,000.

A rise in the participation rate lead to sharp decline in those out of work and the unemployment rate fell to just 4%.

Despite the strong jobs numbers, wage growth remained elusive fuelling the argument the quality of jobs was still lacklustre and could hold the Fed back from a violent tightening cycle.

“The underlying economic growth is quite strong, but there’s no real pressures from a wages and inflation standpoint…it’s very good for risk assets.” said Greg Peters, senior investment officer at PGIM Fixed Income.

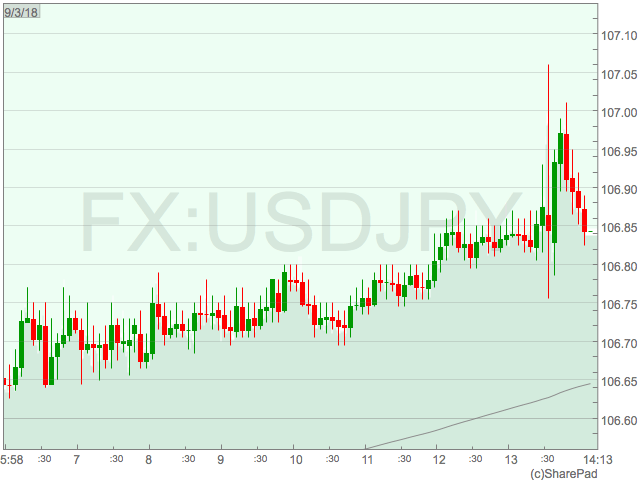

In an initial reaction to the release the dollar strengthened against major currencies with USD/JPY hitting 107.62 before falling back.

Stocks remained relatively unchanged as market participants grappled with an improving economic picture and the prospect of the Federal Reserve hiking rates.

Stocks remained relatively unchanged as market participants grappled with an improving economic picture and the prospect of the Federal Reserve hiking rates.

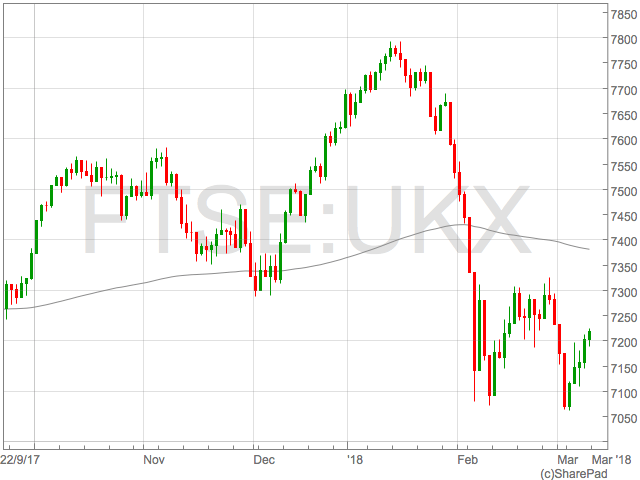

The FTSE 100 continued to rally on Friday, continuing a week of gains which has seen the index form a double bottom formation around 7070-7090.

Technical analysts will be eyeing 7310 and three weeks high for the next level of potential resistance which could open up the way to 7500-7550 if broken significantly.

The FTSE 100 continued to rally on Friday, continuing a week of gains which has seen the index form a double bottom formation around 7070-7090.

Technical analysts will be eyeing 7310 and three weeks high for the next level of potential resistance which could open up the way to 7500-7550 if broken significantly.

Stocks remained relatively unchanged as market participants grappled with an improving economic picture and the prospect of the Federal Reserve hiking rates.

Stocks remained relatively unchanged as market participants grappled with an improving economic picture and the prospect of the Federal Reserve hiking rates.

The FTSE 100 continued to rally on Friday, continuing a week of gains which has seen the index form a double bottom formation around 7070-7090.

Technical analysts will be eyeing 7310 and three weeks high for the next level of potential resistance which could open up the way to 7500-7550 if broken significantly.

The FTSE 100 continued to rally on Friday, continuing a week of gains which has seen the index form a double bottom formation around 7070-7090.

Technical analysts will be eyeing 7310 and three weeks high for the next level of potential resistance which could open up the way to 7500-7550 if broken significantly. Financial advisory industry routinely deters women from angel investing

There is a substantial gender deficit in the world of business investment, according to a new report by the UKBAA, with women continually deterred from entering the traditionally ‘male’ world of angel investment. In the light of International Women’s Day, the ‘The Barriers and Opportunities for Women Angel Investing in Europe’ hopes to highlight the challenges women face when making a mark in the finance industry.

The report found that women were offered very little advice on how to get into angel investing by the financial advisory community or financial media, with many financial advisors assuming women prefer investments with a lower risk.

Whilst the financial advisory community may be seen as a key means to enable women to identify the opportunity to back small businesses, the majority of women investor respondents to the survey said that the advisory community directed them towards conventional and deemed low risk areas of investment such as stocks and shares, followed by bonds and pension funds.

A much smaller group of women were advised about the opportunity for investing in small businesses and the relevant tax breaks offered in the partner countries concerned. 136 of the women surveyed said they hadn’t tried angel investing because it seemed too risky compared to stocks and shares.

One UK female investor said, “My financial advisor assumed, as a woman, I was risk averse and I should look at safe options. He never mentioned Angel investing or the EIS tax relief scheme.”

According to the report, a significant number of women respondents also felt there was an image presented in the media an press of – usually male – business angels being extremely rich and highly successful, meaning few women feel they have achieved sufficient success or wealth to participate.

136 of the women surveyed also admitted to having other financial commitments and family priorities, with 67 saying they have no control over the family finances.

Getting more women interested in angel investing could be beneficial for female business owners too. Women investors have a strong track history of backing other female founders or co-founders with a majority (54%), of those who invested in women-founded businesses having invested in at least one company founded by women, with nearly 20 percent having invested in 3 to 10 women founders.

This compares to only a small minority of male investors who choose to back businesses led by women. If nothing else, it is this highlights the importance of enlarging the pool of women engaged in angel investing in the coming year.

Aviva raises dividend by 18pc, but share price falls

Insurance company Aviva (LON:AV) reported a 2 percent rise operating profit for the full year on Thursday, as expected by analysts, alongside an 18 percent dividend hike.

Operating profit rose to £3.07 billion in 2017, up from from £3.01 billion the previous year, prompting the company to approve an 18 percent dividend hike.

Assets under management at Aviva Investors increased by 9 percent to £490 billion, reporting a 14 percent increase in fund management revenue.

“In 2017, Aviva delivered growth in profits, in dividends, in capital and in cash. Aviva grew operating earnings per share by 7 percent and our full year dividend by 18 percent, the fourth consecutive year of double-digit dividend growth,” said Mark Wilson, Aviva’s Chief Executive Officer.

“Aviva has broad-based growth, with six of our eight major markets delivering double-digit profit improvement. We now have a collection of strong and growing businesses.”

Shares in Aviva fell 2.11 percent on Thursday morning, despite the strong results, and are currently trading at 496.90 (0930GMT).

G4S shares fall despite 5% dividend hike

Shares in security company G4S (LON:GFS) sunk over 3 percent on Thursday morning, despite hiking their dividend for the 2017 year.

The group raised their final dividend was raised by 5 percent to 6.11p per share, taking the full-year dividend to 9.7p per share.

The results released on Thursday also showed a 3.2 percent rise in revenue from continuing businesses, hitting £7.43 billion, as well as a 5.7 percent earnings boost to £277 million. Profit after tax grew to £281 million from £263 million the previous year.

Developed markets showed the strongest growth, with revenues up 3.7 percent, with emerging markets revenue growth benefitting from a 2.9 percent rise. Technology-related security revenues which grew 11.4 percent.

Chief executive Ashley Almanza said: “G4S has delivered another year of profitable growth and good cash generation, enabling us to invest in our growth, technology and productivity programmes and, at the same time, strengthen our balance sheet.”

“The outlook for the Group is positive: our strong market positions, commercial discipline, growing technology-related revenues, positive cash generation and on-going productivity programmes provide substantial confidence that the Group is well positioned to deliver a strong performance over the next three years.”

Adjusted PBITA came in at £496 million, an increase of 4.2 percent, with net debt to EBITDA up 2.4x from 2.8x in 2016.

Shares in G4S (LON:GFS) are currently trading down 3.45 percent at 254.90 (0859GMT).

Starcom shares edge up after reporting 46% profit rise

Wireless solutions group Starcom (LON:STAR) saw shares rise in early trading, after reporting a 46 percent rise in profits over the 2017 year.

Revenues increased 6 percent over the year to $5.4 million, with profits hitting $2.1 million, up from $1.4 million the previous year.

Gross margin rose to 38.2 percent, with EBITDA loss, excluding share options provision, at $193,000. Net loss after taxation fell to $1.3 million, including a charge of $204,000 (2016: $59,000) for exchange rate differences.

Starcom CEO Avi Hartmann commented: “2017 proved to be a turning point in the history of Starcom, with significant progress being made both in the development of our technology and the acceptance of that technology by some major companies and organisations.

“Despite the unfortunate errors made in our announcement in January of our expected results for 2017 we have, most importantly, delivered improvements in both revenues and gross margins, as well as significantly reducing losses.

“2018 has begun strongly, with more visibility than normal at this time of year on future orders, and with a number of new projects under active discussion.

“Although the current year is at an early stage, the indications we have point to good growth in revenues and a continuing improvement in gross margins.”

Starcom shares are currently trading up 0.97 percent at 2.60 (0846GMT).

Dominos Pizza shares fly as group sells one pizza every three seconds

Dominos Pizza (LON:DOM) shares rose over 7 percent on Thursday morning, after posting significant jumps in both revenue and sales over the course of 2017.

Britain’s biggest pizza delivery company posted a 29.3 percent rise total revenue to £474.6 million, alongside a 15.1 percent rise in group system sales.

System sales in the UK & Ireland rose 9.2 percent, with sales in the UK alone up 8.6 percent. On average, the company sold one pizza every three seconds, reporting a record overall annual sales of 97 million pizzas.

David Wild, Chief Executive Officer, said:

“2017 has been a year of significant progress for Domino’s, despite the weaker consumer demand and cost inflation affecting the sector. Given this backdrop, I am particularly pleased with our performance. In the UK, system sales broke through £1 billion for the first time, helped by a record 95 new store openings.

“We continue to take share in the pizza delivery market, and the investment in our new supply chain centre in Warrington will leave us well placed to meet our ambition to get to at least 1,600 sites. I remain confident in the long term growth potential of the business.”

The group said it had ploughed record investment into UK over the course of the year in order to support long term growth potential.

Shares in Dominos (LON:DOM) are currently trading up 7.42 percent at 341.50 (0827GMT).