Robo-advisers could help reduce the “financial advice gap”, says FCA

Morgan Stanley profit report surpasses expectations

Morgan Stanley (NYSE:MS) reported a 57 percent rise in quarterly profits on Wednesday, after a strong growth in bond trading revenue.

The New York-based investment bank posted better-than-expected quarterly figures, reporting a profit of $1.6 billion (81 cents per share), marking a significant 62 percent increase on the $939 million reported for the same period of last year. Conversely, analysts commissioned by Reuters had initially predicted Morgan Stanley to earn around 63 cents a share, on revenue of $8.17 billion.

Morgan Stanley’s chief executive James Gorman said in a statement:

“While the environment was more challenging for our equity underwriting and asset management businesses, our expense initiatives remain on track. Overall the results reflect steady progress against our long term strategic goals.”

In particular the bank saw a rise in bond trading revenue, with profit almost tripling within this sector. Previously the area had been a continued source of concern, as it struggled to profit from difficult capital requirements. Earlier in the year, Morgan Stanley instigated an effective restructuring of the area, reducing 25 percent of staff as well as appointing new management.

Bond trading has generally been profitable across all recently released Wall Street revenue reports, having benefited on the back of the UK’s destabilising vote to leave the European Union.

Additionally, revenue from their wealth management sector, which the bank has been developing for several years, rose 7 percent to $3.9 billion. As a result, the business hit a 23 percent pre-tax margin effectively meeting Gorman’s last quarter target.

Despite strong revenue figures, Morgan Stanley shares were up by less than 1 percent at 0.5 percent in early trading. The Wall Street bank was the last of the leading US-based banks to post profit earnings for the last quarter this week. Similarly, Goldman Sachs Group Inc (NYSE:GS), Morgan Stanley’s largest competitor, reported a better-than-expected 58 percent growth in third-quarter profit on Tuesday.

Apple supplier Laird PLC nose dives on profit warning

19/10/2016

Reckitt Benckiser shares fall after weak sales

Is Clinton really the ‘safer bet’ for the financial markets?

Nikolas Xenofontos, Director of Risk at easymarkets.com on 18/10/2016

Risk warning: Forward Rate Agreements, Options and CFDs (OTC Trading) are leveraged products that carry a substantial risk of loss up to your invested capital and may not be suitable for everyone. Please ensure that you understand fully the risks involved and do not invest money you cannot afford to lose. Our group of companies through its subsidiaries is licensed by the Cyprus Securities & Exchange Commission (Easy Forex Trading Ltd- CySEC, License Number 079/07), which has been passported in the European Union through the MiFID Directive and in Australia by ASIC (Easy Markets Pty Ltd -AFS license No. 246566).

Pearson shares fall by 10 percent

Pearson shares fell by over 10 percent on Monday morning, after reporting a worse-than-expected fall in sales amidst a challenging market.

The educational publisher reported disappointing sales numbers, with underlying sales falling by 7 percent in the first nine months of the financial year and 9 percent in North America. This contrasts initial projections by analysts who had only expected a fall in sales of around 5 percent. Today’s fall in shares for the company marked the biggest fall in the FTSE 100.

However, Pearson are expected to meet its profit targets for 2016 due to various cost-saving precautionary measures. Sales had improved in September and October which, coupled with cost reduction efforts, have enabled the company to achieve its expected profit forecast of between £580 million to £620 million this year.

Pearson reported that the required cutting of 9000 jobs, announced in January, is 90 percent complete. The move is expected to have saved the company around £350 million annually.

“While market conditions continue to be challenging, particularly in higher education, thanks to tight cost management we are on track to deliver our guidance this year and to achieve our long-term growth goal,” commented John Fallon, chief executive of Pearson.

Moreover, the company noted that the weakening of the pound in recent months had proven a boost for profits. The company also indicated that if sterling continued to remain weak for the remainder of the year, this would increase the earnings-per-share guidance range by around 4.5p to 59.5p.

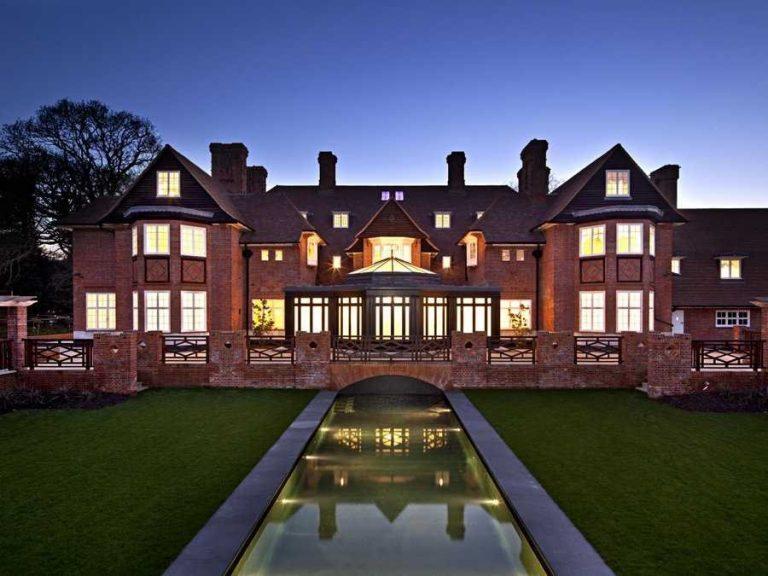

Super-prime property sales fall 86 percent post-Brexit

Sales in the UK’s capital remained stronger than the rest of the country, with all sales within the three months to August being on property in London. This is in comparison to the same period last year where 30 percent took place elsewhere in the country, according to data analysis by London Central Portfolio (LCP).

The reduction in super-prime activity in the last three months could have a negative effect for the British government, who may receive £45 million less in Stamp Duty receipts. According to LCP, these findings could significantly impact next year’s Stamp Duty receipts as top end sales, which were expected to counter lower levels of Stamp Duty under £1m, fall away and prices drop.

Naomi Heaton, CEO of LCP, commented: “Despite roughly stable Stamp Duty takings in the financial year to April reported by HMRC, next year may see a different picture, particularly as the it took account of a major rush in March. Transactions increased 72 percent over February as buyers sought to beat the 3 percent Additional Rate Stamp Duty (ARSD) deadline, buoying overall receipts.”

17/10/2016

New business bank Redwood submits license application

A new business bank is to be founded by Jonathan Rowland and Gary Wilkinson, offering commercial mortgages and business deposit accounts to SMEs across Hertfordshire, Bedfordshire and Buckinghamshire.

Rowland and Wilkinson submitted a banking license application to Financial Conduct Authority and the Prudential Regulation Authority today, and hopes to receive its license in early 2017. The bank will be named Redwood Bank and is expected to attract £50 million worth of investment from a number of high profile investors, including Wildcat Capital Management, Falcon Edge founder Rick Gerson and David ‘Tiger’ Williams of Williams Trading.

AFP’s majority shareholder will the company owned by David and John Rowland, Acorn Global Investments Ltd, who have extensive experience and a successful track record in the banking and finance sectors. Subject to regulatory approval Jonathan Rowland will be the Redwood Bank’s chairman – Jonathan was the Chief Executive of Kaupthing Bank between 2009 ad 2013 and played a leading role in the restructuring and subsequent recapitalisation of the bank into Banque Havilland S.A. and Banque Havilland (Monaco) SAM.

“This is an ideal time to apply for a full banking licence; the major banks have not returned to anywhere near their pre-crisis business lending levels and the uncertainty caused by Brexit is likely to worsen the situation. At the same time, SMEs have shown a strong appetite for new market entrants offering competitive rates and superior customer service. Against this backdrop, we have a compelling opportunity to build a secure, robust and profitable bank”, Jonathan said.

The senior management team of Redwood will be led by Gary Wilkinson as Chief Executive, again subject to regulatory approval. Gary has over 30 years’ experience within financial services, and is the former Chief Executive of Cambridge & Counties Bank, which provides lending and deposit products for SMEs.

Miranda Wadham on 17/10/2016

UK economy ‘faces prolonged weakness’, report says

The UK economy faces a “prolonged period” of weakness, according to the latest report from EY Item Club.

According to a recently released Autumn report, think tank EY Item Club’s research has indicated the UK economy will experience weaker growth as consumer spending slows and businesses begin to reduce investments.

Despite predictions that the economy will grow by 1.9 percent this year, it warned that with inflation levels continuing to rise performance will be negatively affected. The report also warned that the UK economy’s relative stability since June’s Brexit vote was “deceptive”, and markets are yet to feel the full ramifications of the referendum result.

Whilst initial measures undertaken by the Bank of England to calm markets have been somewhat effective, the pound has continually begun to weaken sharply against the euro and the dollar, a worrying sign that the worst is perhaps yet to come. This sentiment was echoed in the comments made by a Bank of England (BOE) official to BBC’s Radio 5, who said inflation may potentially surpass original BOE targets of 2 percent.

The EY report reiterated these concerns, having projected inflation to rise to 2.6 percent in the next year, before settling down to 1.8 percent in 2018. Consumer spending growth is expected to slow from a projected 2.5 percent this year to around 0.5 percent in the following year, and 0.9 percent in 2018.

Business investment has also been forecast to fall due to uncertainty over Britain’s future trading relationship with the EU, dropping 1.5 percent this year and more than 2 percent in 2017.

EY has predicted that the impact of weaker consumer spending combined with lower investment will result in the UK’s GDP growth dropping considerably to 0.8 percent next year, before eventually increasing to 1.4 percent in 2018.

Snapchat moves closer to stock market flotation

14/10/2016