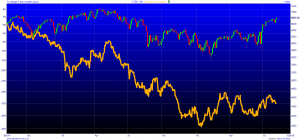

China factory-gate deflation eases further, relieving pressure on policy makers

China’s factory price deflation eased further in July, the latest in a string of evidence that China’s falling prices are beginning to pick up.

Factory-gate deflation moderated for the sixth month in a row, falling just 1.7 percent in July, up from a 2.6 percent drop in June. Increased demand for construction materials, higher commodity prices and pick-up in property sales have led to speculation that the Producer Price Index may well push into positive territory later this year.

The PPI rise will ease pressure on policy-makers in China, decreasing the necessity to cut rates and turning their focus to structural reforms allowing the deflation to ease further.

Warm July weather boosts retail sales

Retail sales rose 1.9 percent in July, according to the British Retail Consortium, alleviating fears of a post-Brexit slump.

The survey, carried out by the BRC and KPMG, cited warmer weather as the cause for the spending increase. David McCorquodale, head of retail at KPMG, said good weather had “boosted the UK feelgood factor”, showing consumers that “life goes on” post-Brexit.

Barclaycard also released a report this morning showing that spending in restaurants and pubs has also risen moving into summer.

China warns on Hinkley Point turnaround

The Chinese ambassador to the UK has warned British leaders about the repercussions failing to go ahead with the Hinkley Point nuclear plant may have on their trade relationship.

Since taking power, Prime Minister Theresa May has put the brakes on the £18 billion project after citing “security concerns”. She has pushed her final decision back to the autumn, to give her government another chance to scrutinise the deal.

However, Chinese ambassador Liu Xiaoming warned the UK that “mutual trust” could be in danger should Britain back out of the agreement, endangering the new relationship between the two countries.

08/08/2016