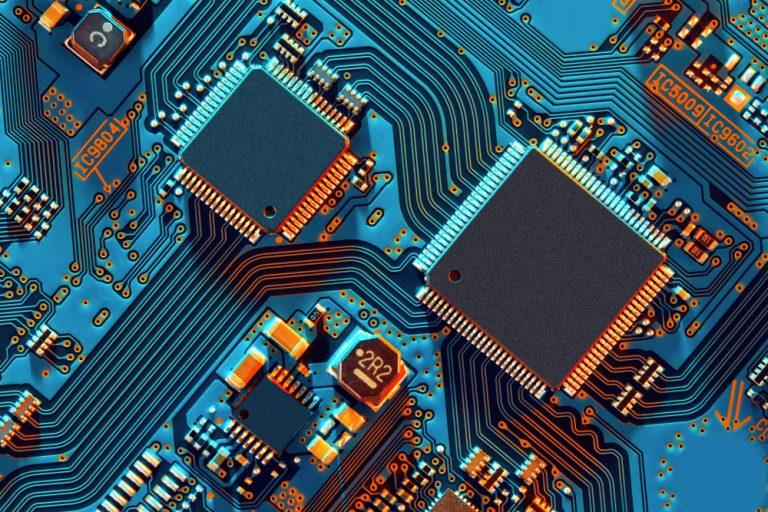

Semiconductors developer Sondrel (LON: SND) has clawed back some of the share price loss in the past six months. The share price jumped 114.3% to 12.75p. Earlier this week, Sondrel revealed that it had received £1.5m form the customer where payments had been delayed. This has enabled deferred payments to be made by Sondrel. New business opportunities are being negotiated. Even so, Sondrel needs to raise more cash before the end of March to put it on a sound financial footing.

Touchstone Exploration (LON: TXP) revealed positive results from the Cascadura-2 well in Trinidad. Testing is planned in the third quarter. Drilling costs were $6m. The Cascadura-3 well will be drilled before the end of the month. The share price improved 16.3% to 53.5p.

Tower Resources (LON: TRP) has received notification from the Cameroon authorities of the extension of the first exploration period of the Thali production sharing contract to 4 February 2025. Tower Resources will have to drill a single well. Financing discussions continue. The share price is 11.6% ahead at 0.024p.

Timber company Woodbois (LON: WBI) says 200 million warrants have been exercised at 1p each. This £2m will be used to scale up production and improve efficiency. Management is in Gabon implementing strategic initiatives. Management has entered into a term sheet for a $5m facility. Full year results should be issued in May. The share price increased 9.15% to 0.775p.

FALLERS

Advanced coatings services provider Hardide (LON: HDD) traded in line with expectations with revenues of £5.5m in the year to September 2023, but the most recent quarter has been weak. Demand from the oil and gas sector has been hit by destocking. Currently, this year’s revenues are expected to be flat and Hardide will continue to lose money. Interim chief executive Steve Paul joins this month. Hardide wants to raise £1m for working capital, so it is not surprising that the share price dipped 23.1% to a new low of 7.5p.

Sanderson Design Group (LON: SDG) achieved pre-tax profit expectations of £12m in the year to January 2024, partly due to licence agreements. Brand sales fell with the UK down 11%. US brand sales were 7% higher. Pre-tax profit is likely to be flat this year with improved revenues offset by higher costs. The share price is 11.5% lower at 112p.

Revolution Beauty (LON: REVB) is rationalising lower margin products and growth in revenues will still be in low single digits this year. The focus is on the Revolution brand. Full year EBITDA is expected to be between £11m and £12m. The £32m debt facility is extended until October 2025. The share price fell 8.59% to 29.25p.

Online marketing services provider XL Media (LON: XLM) says 2023 revenues fell from $71.8m to $50m and EBITDA declined from $17.8m to $12m. The company moved into net debt. The share price decreased 8.33% to 6.6p.

Ex-dividends

AB Dynamics (LON: ABDP) is paying a final dividend of 4.42p/share and the share price fell 10p to 1765p.

Greencoat Renewables (LON: GRP) is paying a dividend of 1.6 cents/share and the share price is down 1.7 cents to 87.9 cents.

Impax Asset Management (LON: IPX) is paying a final dividend of 22.9p/share and the share price is 16.5p lower at 505.5p.

Renew Holdings (LON: RNWH) is paying a final dividend of 12p/share and the share price fell 14.5p to 832.5p.

Victoria Plumbing (LON: VIC) is paying a final dividend of 0.95p/share and the share price decreased 0.5p to 85.6p.