Semiconductors developer Sondrel (LON: SND) has clawed back some of the share price loss in the past six months. The share price jumped 95.7% to 9.98p, having been as high as 13.5p. Sondrel revealed that it had received £1.5m form the customer where payments had been delayed. This has enabled deferred payments to be made by Sondrel. New business opportunities are being negotiated. Even so, Sondrel needs to raise more cash before the end of March to put it on a sound financial footing. The October 2022 placing price was 55p.

Artemis Resources (LON: ARV) has halted trading in its shares on ASX. Earlier in the week, the company said it has discovered spodumene bearing pegmatites with Li2O grades of up to 1.82% at the Mount Marie prospect in the Greater Carlow project. This is the first tangible proof of spodumene bearing pegmatites and it could be part of a lithium corridor according to WH Ireland. Assay information is being assessed and should be published on 13 February. The share price improved 93.5% to 1.5p.

Helium One Global (LON: HE1) continued its rise last week even though it was curbed by a fundraising. Itumbula West-1 has flowed a high concentration of helium to surface. A measured helium concentration of up to 4.7% equates to nearly 9,000 times normal background levels. The well results will be evaluated. The company raised £4.7m at 1.5p, which is still a 650% premium to the share price prior to positive drilling news. The share price increased 59.3% to 2.195p

RF components and systems developer Filtronic (LON: FTC) has won a £7.8m contract for ground station antenna amplifiers for a leading global supplier of LEO satellite communications equipment. It also released interims with revenues 1% ahead at £8.5m. The cost base has been increased to cope with future growth, so there was a swing from profit to loss. Cavendish has raised its full year revenues expectations from £20.5m to £23.5m and pre-tax profit estimate has more than trebled from £800,000 to £2.5m. The share price is 58.2% higher at 40.5p, which is the highest it has been for nearly ten years.

FALLERS

In-game advertising technology provider Bidstack (LON: BIDS) has been unable to issue additional convertible loan notes to Irdeto because it has not been able to provide information to Bidstack to enable a shareholder circular to be issued. Shareholder approval is required for the convertible issue. Bidstack had drawn down £600,000 from the convertible loan note facility but does not expect to make any more draw downs. The €3m payment from commercial partner Azerion is running out with cash of £1.4m at the end of January and this will run out by the end of March. A strategic review has been initiated. The share price dived 59.1% to 0.225p.

Verditek (LON: VDTK) has agreed terms to sell its solar business and become a shell. The buyers are the holders of secured convertible loan notes in return for the surrender of £528,340 loan notes and £50,000 in cash. The company will transfer the shareholder loan to the new company for nominal consideration. The bondholders are providing Verditek with a loan facility of up to €100,000 to fund the operating costs of the solar business. If the deal does not go ahead by the end of February Verditek will be running out of cash. A new management team is interested in joining Verditek and there are plans to raise £300,000. The share price slumped 43.3% to 0.085p, which is a new low.

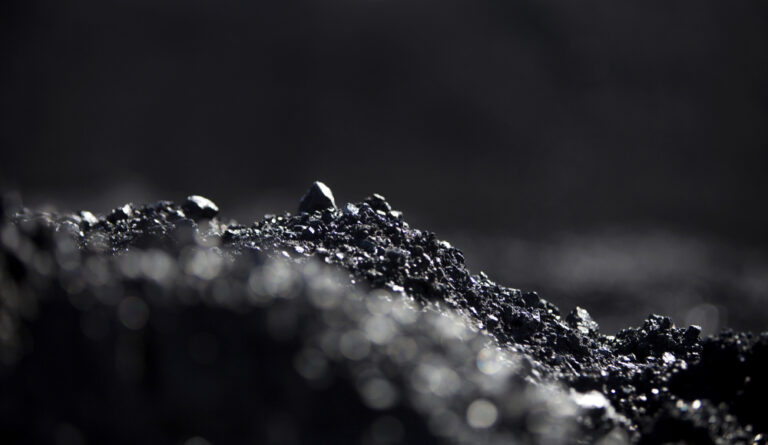

Adam Wilson is stepping down as chief executive of coal supplier Bens Creek (LON: BEN) once a replacement has been found. Lower metallurgical coal prices led to a shortage of cash last year and $13 of convertible loan notes were issued to 29.9% shareholder Avani Resources. That cash should have lasted until the end of 2024. The company blames poor weather in West Virginia for interrupting production and delaying trains transporting coal. Avani Resources has offered another $5m as a working capital facility. While details are worked out Avani has advanced $1.25m. A 12-month offtake agreement for 40,000 short tons of coal is being negotiated with Avani Resources. The share price slumped 34.3% to 5.75p – a new low. The October 2021 placing price was 10p.

Pharma company Aptamer Group (LON: APTA) admits that it will not achieve the expected revenues of £3m in the year to June 2024. Interim revenues were less than £1m. There are more than £1.4m of signed deals for prospective laboratory-based services. There is enough cash to get through to later this year. The share price slid 34.2% to 0.625p, which is a new all-time low.