The FTSE 100 slipped on Thursday in a bout of profit-taking exacerbated by several big dividend payers trading with the rights to the latest dividends.

Anglo American was one such stock, falling 6%, and Natwest dropped 5% as it traded ex-dividend. Strength in UK property-related stocks and oil majors counterbalanced weakness elsewhere in the market.

Inflation has been high on the agenda this week, and traders are assessing the implications for interest rates and when major central banks will cut rates for the first time.

Data points, including US CPI and UK jobs numbers released this week, did nothing to derail an equity rally spurred on by hopes of rate cuts in June this year. However, hotter-than-expected US PPI data released on Thursday served as a reminder that the timing of rate cuts is far from certain, sending US and UK stocks lower.

“US PPI came in stronger than expected, following on the back of the higher CPI reading earlier this week. This highlights the risk that the last mile on taming inflation in the US might not be as easy as progress made to date,” said Ryan Brandham, Head of Global Capital Markets, North America at Validus Risk Management.

“It could give the Fed even more reason to push back the timing of any interest rate cuts in 2024.”

There is an undercurrent of mild optimism in equity markets, supporting global indices, including the FTSE 100. Although the FTSE declined on Thursday, the losses were contained to 0.3% as the index traded near the highest levels of 2024.

“The FTSE 100 has broadly held onto its gains as investors continue to cheer the news that recession looks like a thing of the past,” said Sophie Lund-Yates, lead equity analyst, Hargreaves Lansdown.

“Hopes of interest rate cuts this summer have been raised, and while there is certainly no guaranteed course of action, the market’s forward-looking eyes seem to be focussed on a brighter near-term, even though there hasn’t been a fresh injection of enthusiasm.”

UK property

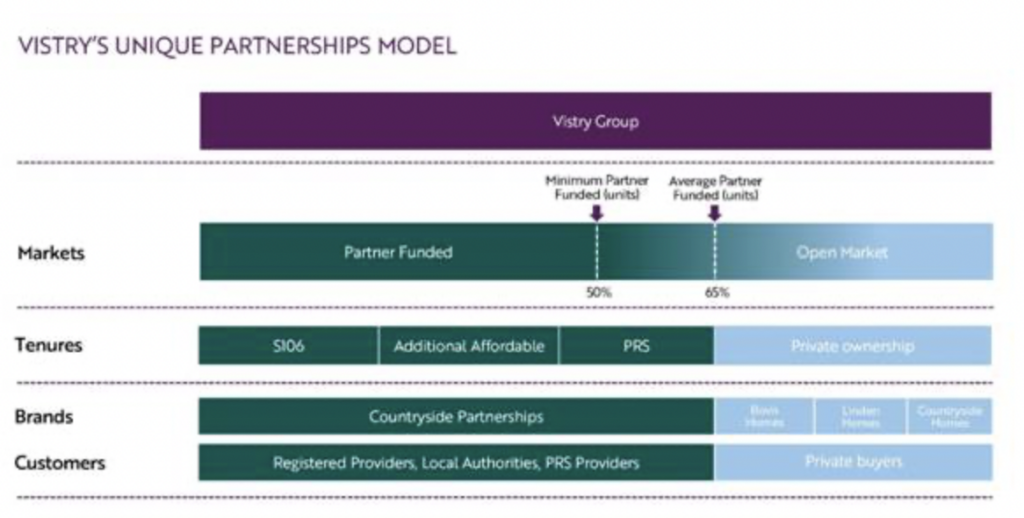

UK property-related stocks were front and centre on Thursday as Rightmove, Berkeley Homes, and Barratt Developments stole spots in the top 10 risers after RICS said the numbers of buyers in the UK housing market increased for a second consecutive month. An increase in buyers is being met with an increased supply of houses for sale— there haven’t been this many properties on the market since 2020.

“The housing market inspired more confidence in February, as buyers slowly resurfaced, and optimism rose among estate agents. However, given the broader picture, there’s still a risk that February may not have been flying after all. It could just have been falling with style,” said Sarah Coles, head of personal finance, Hargreaves Lansdown.

“The return of buyers is something to be celebrated. It comes after such a long period of decline that buyers were looking ready for the endangered list. They’re not flocking back in vast numbers: they’re approaching more tentatively to dip their toes in.”