Vistry shares gained on Thursday after the homebuilder released full-year earnings revealing resilience in its partnerships approach to new homes.

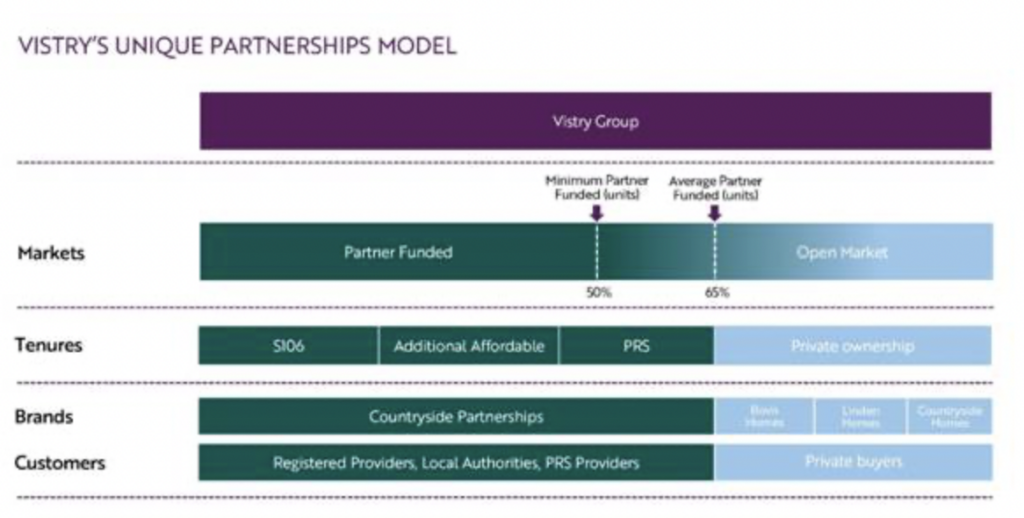

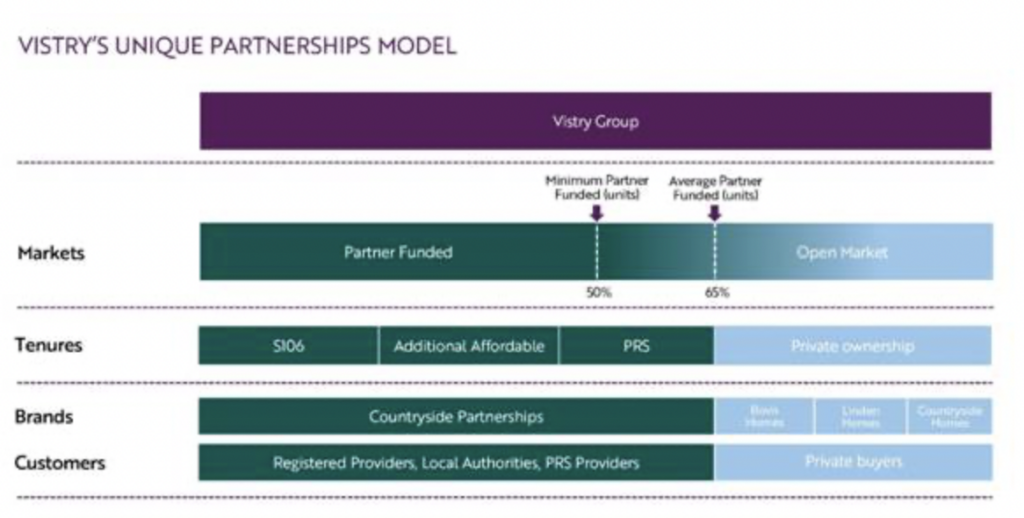

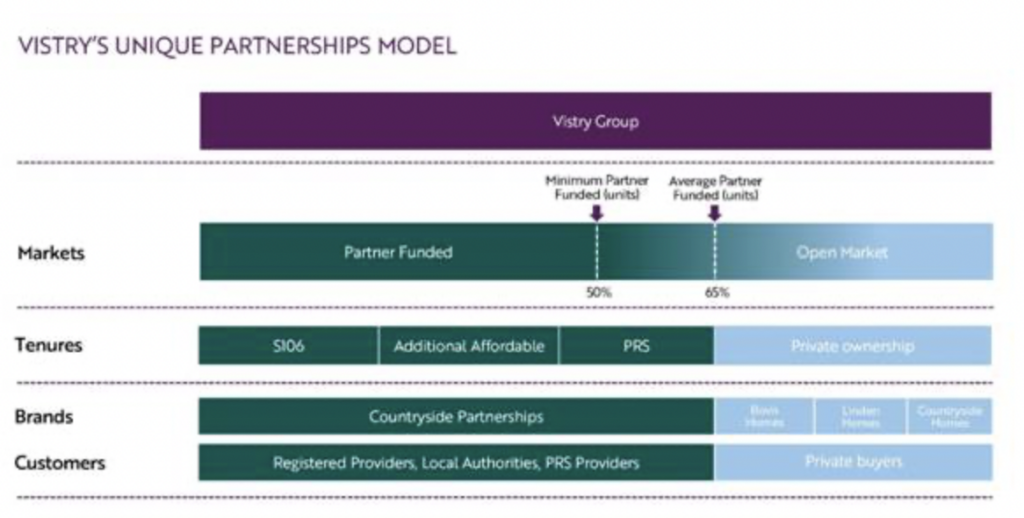

Vistry’s strategy of focusing on affordable housing through partnerships with local authorities and associations delivered 16,118 new homes in 2023, down only 5.4% proforma compared to the prior year.

The company, which operates client-facing Bovis Homes, Linden Homes and Countryside Homes, now delivers the majority of its completed units through partnerships and has enjoyed greater stability than housebuilders focusing on the private market.

The successful integration of Countryside Partnerships has yielded cost synergies as well as greater coverage of the market.

Revenues for the year were 29.6% higher on an adjusted basis to £4.04bn and operating profit rose 8.2%. An enhanced focus on the affordable end of the market will ultimately pressure margins, but the group is now a high-volume operator, and sacrificing margins will be acceptable to shareholders if profits grow.

Vistry shares added 1% on Thursday and are now up 47% over the past year. This compares to a 5.7% gain for Persimmon and 22% rise for Taylor Wimpey. The market clearly sees value in Vistry’s partnership model.

“Vistry’s transition to a partnerships giant has meant its full-year numbers have held up better than many of its peers. Partnerships involve teaming up with local authorities and housing associations to provide affordable housing. These partners foot most of the bill which reduces Vistry’s risk and frees up cash to deploy elsewhere in the business,” said Aarin Chiekrie, equity analyst, Hargreaves Lansdown.

“But it comes at a cost – the profits in this kind of work aren’t as juicy. That’s exactly what we’ve seen play out in 2023. Despite underlying revenue climbing around 30%, underlying operating profit only edged around 8% higher as margins came under pressure.

“Vistry will need to ramp up volumes if it wants to offset the impact of lower volumes on overall profits. The mammoth £4.6bn order book gives investors some comfort in this regard, providing near-term revenue visibility as the group looks to increase completions this year, targeting growth of around 8.5% to 17,500 new homes.”