Natwest shares tank on disappointing trading update, admits Farage failings

Natwest shares tanked on Friday morning after announcing disappointing Q3 trading results punctuated by falling net interest margins and lower profits compared to the previous quarter.

Natwest’s results mark the end of a busy week for banking results.

Barclays results were poor, Lloyds were reasonable, Standard Chartered will hope their Chinese business picks up, and on Friday, Natwest’s results were pretty terrible.

Shares in Natwest were down around 10% at the time of writing as key operation metrics deteriorated.

Compounding the pressure on Natwest, they admitted failings around account closures and announced a raft of measures to investigate. The bank’s leadership will hope today’s admission Natwest are conducting internal reviews into account closures will draw a line under the Farage debacle.

“NatWest has been in a pickle of late following a series of governance issues. Along with third-quarter results, NatWest also released findings from stage 1 of its review into the account scandal following the closure of Nigel Farage’s Coutts account. The independent review found no legal breach, but did pick up on several governance concerns with how the decision was reached – something I think we already knew,” said Matt Britzman, equity analyst at Hargreaves Lansdown.

Although the Farage saga has attracted public interest, it has little to do with the sharp fall in Natwest shares today.

Q3 results were poor. Lower net interest margin (NIM) is a major concern with a material drop to 2.94% from 3.11% before the Bank of England has even suggested cutting rates.

Reducing net interest margin guidance for the full year will be a kick in the teeth for investors.

Profitability is also a concern. Operating profit before tax fell to £1.33bn in Q3 compared to £1.77bn in Q2. The drop in key profitability metrics was the result of rising competition and pressure on the mortgage business.

“Back to results, they were largely disappointing as net interest margin dipped below 3%, and the outlook was lowered. Deposit levels did grow, which is a positive sign that NatWest is pricing itself at the right levels to attract customers searching for higher rates,” said Britzman.

“That trend’s plain to see, with longer-term cash balances jumping to 15% of the book – compared to 11% last quarter. But it’s less profitable business than non/low-interest current accounts. Add in mortgage headwinds as highly profitable business written over the pandemic rolls off, and that’s caused the hit to net interest margin.”

In a small positive, Natwest mirrored other FTSE 100 banks in setting aside less than expected for bad debts.

“As we’ve seen across the sector this week, the consumer remains resilient. Charges taken in anticipation of loan losses were a little lower than expected. Higher borrowing costs are being offset by proactive finance management, wage growth and a strong labour market.”

Tekcapital Investor Presentation October 2023

Tekcapital presents at the UK Investor Magazine Virtual Investor Conference October 2023.

Download the presentation slides here.

Tekcapital creates value from investing in new, university-developed discoveries that can enhance people’s lives and provides a range of technology transfer services to help organisations evaluate and commercialise new technologies. Tekcapital is quoted on the AIM market of the London Stock Exchange (AIM: symbol TEK) and is headquartered in the UK.

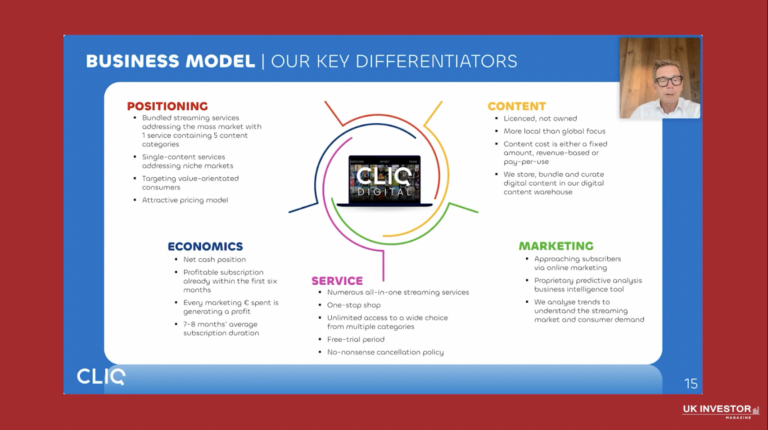

CLIQ Digital Investor Presentation October 2023

CLIQ Digital presents at the UK Investor Magazine Virtual Investor Conference October 2023.

Download the presentation slides here.

The CLIQ Digital Group sells subscription-based streaming services that bundle movies & series, music, audiobooks, sports and games to consumers globally.

The Group licences streaming content from partners, bundles it and sells the content through its numerous streaming services. Over the years, CLIQ Digital has become a specialist in online advertising and creating streaming services that are advertised towards specific consumer groups. CLIQ Digital operates in over 30 countries and employed 164 staff from 37 different nationalities as at 31 December 2022. The company is headquartered in Düsseldorf and has offices in Amsterdam, London, Paris, Barcelona, and Toronto. CLIQ Digital is listed in the Scale segment of the Frankfurt Stock Exchange (ISIN: DE000A0HHJR3, WKN: A0HHJR) and is a constituent of the MSCI World Micro Cap Index.

FTSE 100 negative as US GDP smashes estimates

The FTSE 100 was trading in negative territory on Thursday after the US released bumper GDP growth for the third quarter.

Although the FTSE 100 was down 0.3% at the time of writing, the index was off the worst levels of the day as markets digested a blowout 4.9% increase in US GDP in the third quarter.

Equity markets are expected to remain choppy for the rest of the session as investors weigh positive news for the US economy and what it means for the Federal Reserve and the trajectory for interest rates.

In the Eurozone, the European Central Bank voted to keep rates on hold on Thursday and said rates were expected to remain higher for longer.

The European session had started on the back foot following pessimistic US technology earnings overnight.

“The fall-out from a disappointing performance from Google-owner Alphabet’s cloud division continues as a wider tech sell-off feeds into the performance of European markets on Thursday,” said AJ Bell head of financial analysis Danni Hewson.

“When you consider the negative reaction to Meta Platforms’ warning of weaker ad spend, despite, like Alphabet, posting better-than-expected earnings, then hopes big US tech might continue to drag markets higher on its back are starting to look increasingly forlorn.

“It is notable that, thanks to their extremely strong run, beating earnings expectations is not, in itself, proving enough to support share prices. Investors are looking beyond the headlines to see just how healthy the outlook really is for these businesses.”

Earnings season is also in full swing in London, with Standard Chartered, WPP and Unilever reporting on Thursday. All three were firmly in the red at the time of writing.

Standard Chartered was the FTSE 100’s biggest faller, giving up 10%, in reaction to falling net interest margins and a sharp drop in profits. Their problems stemmed from China and provisions for bad debts related to Chinese property.

“Standard Chartered, the Asia-focused bank, is one of the biggest fallers on the index, dropping like a stone after its pre-tax profits fell 33% in the third quarter. Shareholders are clearly very disappointed by this sharp reversal of fortunes compared to the second quarter. Its exposure to China, where it’s expanded rapidly, is its weakest link, with the real estate sector buckling under a mountain of debt,” said Susannah Streeter, head of money and markets, Hargreaves Lansdown.

WPP is struggling with slow advertising spending by large US technology companies and Unilever’s volumes fell in the most recent quarter.

Pizza Express owner makes bid approach to Restaurant Group

Pizza Express owner Wheel Topco has made a rival bid approach to Restaurant Group (LON: RTN), which has previously agreed a 65p/share bid from US private equity firm Apollo Global Management. This valued the Wagamama owner at £506m or £701m including debt.

Restaurant Group says that it will provide due diligence information to Wheel Topco. The group owns the Wagamama and Brunning & Price chains. No potential bid level has been suggested by Wheel Topco and no there is no guarantee that it will make a bid. The share price rose 2.41% to 68.1p.

Restaurant Group agreed to the Apollo Global bid because the current economic uncertainty made the certain value provided by the bid attractive. The bid multiple for 2023 is 33, falling to 22 in 2024. The Apollo Global bid is more than double the share price at the beginning of the year.

Restaurant Group has previously agreed the sale of the Frankie & Benny’s and Chiquito restaurant chains to Big Table Group for £1m. Restaurants Group is also contributing £7.5m to Big Table Group depending on working capital adjustments.

Oil prices drop on an increase in U.S. crude stockpiles and a rise in the dollar

On Thursday, oil prices fell on a rise in the dollar and a climb in U.S. crude stockpiles, as the Middle East conflict continues to unfold.

WTI Crude price is down by 0.71% and Brent Crude 0.57% at the time of writing.

The dollar index experienced a slight increase on Thursday, contributing to the downward pressure on oil prices.

Oil prices also retreated as the Wall Street Journal reported Israel’s decision to postpone an anticipated Gaza invasion.

Ongoing macroeconomic worries continue to affect the outlook for oil demand, particularly as eurozone business activity unexpectedly declined this month.

According to the Energy Information Administration, U.S. crude inventories rose by 1.4 million barrels in the most recent week, reaching 421.1 million barrels.

Susannah Streeter, head of money and markets at Hargreaves Lansdown commented on the trend: “Nerves are still on edge about the potential for conflict in the Middle East to widen. “, she said.

“There has been no let-up in the bombing of the Gaza strip as Israel prepares for a ground invasion, and a lack of agreement on a pause in fighting for more aid to get through. Brent crude prices are hovering around $90 a barrel as concerns continue that supply could be disrupted across the oil-rich region if other countries are drawn into the conflict.”

WPP shares dip on Q3 revenue drop

Thursday’s Q3 data shows that WPP’s revenue dropped by 1.8%. WPP shares are down by 2.12% and are trading at 676p at the time of writing.

In Q3, revenue, excluding pass-through costs, decreased by 0.6%. Growth in the UK, Western Continental Europe, and the Rest of the World was offset by declines in North America, driven by ongoing challenges with technology clients and in the Chinese market.

$1.4 billion in new business was secured during the third quarter, with notable contributions from Estée Lauder, Hyatt, Lenovo, Nestlé, Unilever, and Verizon. The total net new business won year-to-date amounts to $3.4 billion.

Full-year net revenue growth for LFL is now anticipated to range between 0.5% and 1.0%, marking the second downward adjustment in expectations.

In the third quarter, Global Integrated Agencies saw a marginal revenue increase of 0.1%, contributing to a year-to-date growth of 1.5%, excluding pass-through costs. Integrated creative agencies, however, experienced a decline of 1.1% in Q3, with a year-to-date decrease of 0.9%.

GroupM, on the other hand, exhibited growth of 1.6% in Q3, resulting in a year-to-date expansion of 4.6%, driven by low-single-digit growth in the US and UK.

“Communications and advertising giant WPP’s engines have stalled again. Usually, high-spending technology clients in North America have applied the brakes amid an uncertain economic backdrop. China’s also dragging performance down as the macro environment doesn’t lend itself to loose corporate spending. This has culminated in another reduction in full-year expectations. While seeing growth go in reverse isn’t ideal, it’s not wholly unexpected given that advertising activity is a clear-cut barometer of the economy.” said Sophie Lund-Yates from Hargreaves Lansdown.

“WPP is doing what it can to combat these challenges, including consolidating and streamlining its offering. That could mean the business that emerges from all this could be stronger than what it started with, but there are considerable speed bumps to traverse first. As the digital world transforms at pace, this giant will have to move as nimbly as it can if it wants to thrive,”, she added.

AIM movers: Kromek contract and ex-dividends

Kromek (LON: KMK) has been awarded a $5.9m US government contract for the development of a bio-detection system that provides real-tie threat detection. This should generate £874,000 in the 12-month period to October 2024. The share price continues to recover from its recent all-time low and is 14.5% ahead at 4.75p.

Ironveld (LON: IRON) is raising £450,000 from its largest shareholder Tracarta, while other shareholders will invest £550,000. The subscription price of 0.29p is a premium to the market price, which improved 15.6% to 0.26p. Tracarta’s board nominee Dr John Wardle will become executive chairman. The cash will provide working capital and fund critical repairs at the Rustenburg smelter.

Cornish Metals (LON: CUSN) has commissioned and opened its water treatment plant at the South Crofty tin project in Cornwall. Mine dewatering could take 18 months and the plant will treat the water. The share price rose 7.89% to 10.25p.

A positive AGM statement from telecoms equipment manufacturer Filtronic (LON: FTC) pushed up the share price by 4.13% to 16.4p. Performance is in line with expectations and there is significant potential from the Low Eart Orbit satellite market.

FALLERS

Replacement windows supplier Safestyle (LON: SFE) does not expect to secure additional finance and it is more likely that the business will be sold. The share price slumped 63.8% to 0.58p.

Argentex (LON: AGFX) has appointed Jim Ormonde as interim chief executive. He replaces previous chief executive Harry Adams, who is the second largest shareholder with 12.3%. A strategic review has identified areas of the payments sector to focus on. Jim Ormonde was boss of Cardsave, which was bought by WorldPay, and he has been a consultant to Argentex. Current trading is in line with expectations even though activity levels have been lower. The share price dived 20.9% to 76p, which is the lowest it has been for 15 months.

Hummingbird Resources (LON: HUM) third quarter production figures were slightly better than expected. There was 19,000 ounces of gold produced and the same amount was sold. Selling prices were lower than anticipated and profit was lower than expected. Full year production guidance has been trimmed to 90,000-100,000 ounces. The share price fell 8.65% to 9.5p.

R&Q Insurance Holdings (LON: RQIH) has signed a loss portfolio transfer with a UK motor insurer. This covers a net reserve of $80m. There are a further $900m of similar opportunities. Last week, the company revealed that it is selling its program management business. The disposal should generate $300m of net proceeds. Mazar has been appointed as auditor. The share price dipped a further 3.12% to 15.55p, which is nearly three-quarters down on one week ago.

Ex-dividends

Avingtrans (LON: AVG) is paying a final dividend of 2.8p/share and the share price is unchanged at 380p.

BP Marsh (LON: BPM) is paying a dividend of 2.78p/share and the share price is unchanged at 357p.

Mulberry (LON: MUL) is paying a final dividend of 1p/share and the share price is 2p lower at 183p.

Sylvania Platinum (LON: SLP) is paying a final dividend of 5p/share and the share price is down 5.1p to 73p.

Serica Energy (LON: SQZ) is paying an interim dividend of 9p/share and the share price fell 4.4p to 225.2p.

FW Thorpe (LON: TFW) is paying a final dividend of 4.84p/share and the share price declined 5p to 360p.