SSE shares rose on Wednesday as earnings beat expectations in the recent half year as strong operational performance and a lower effective tax rate offset lower revenue due to better weather.

SSE saw a 14.9% decrease in half-year revenue, falling to £4.8 billion.

Despite this decline, the company managed to outperform group guidance in terms of underlying earnings per share, reporting 37.0p, which was higher than anticipated.

In response to its financial performance, SSE declared an interim dividend of 20p. However, the full-year payment forecast has been adjusted down to 60p as the company invests in improving its network.

The company said the decision to rebase the full-year dividend reflects SSE’s strategic approach in light of its overall financial position and market conditions.

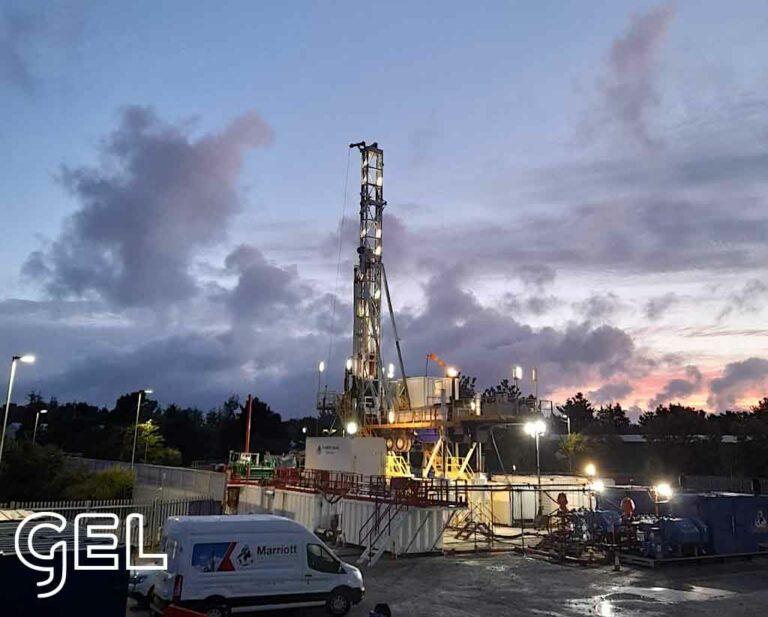

This includes building additional renewable energy sources; the company currently owns nearly 2GW of operational onshore wind capacity and has over 1GW in development.

These financial moves by SSE indicate a nuanced performance, with revenue challenges balanced by a better-than-expected showing in underlying earnings per share and a strategic adjustment in dividend payments to align with the company’s broader financial strategy.

Weather hits revenue

Power utility SSE had anticipated a return to typical weather conditions in the second quarter to boost its renewable energy assets, following a slow start to the year.

However, this expectation did not materialise, as adverse weather conditions resulted in renewable output being 19% lower than expected.

According to equity analyst at Hargreaves Lansdown, Aarin Chierkie, “That means other parts of the business are having to pick up the slack, leaving little room for further slippage if full-year guidance is to be hit.”

Aarin Chierkie further added that “looking ahead, SSE’s staying the course with its pivot towards renewable energy. The five-year investment budget’s been increased to a mammoth £20.5bn, with 90% of that set to be invested in electricity networks and renewables. Turbo-charging efforts towards renewables are a bold and admirable move. But the shift comes with a hefty dose of risk—they’re not always reliable. Fortunately, the thermal division’s flexible gas-fired plants helped to plug the energy shortfall, and profits here more than tripled. “

Currently, SSE’s energy portfolio includes about 4GW of onshore wind, offshore wind, and hydro projects.

The company has announced plans to increase its renewable energy output, aiming to triple it from 2019 levels to 30TWh by 2030.