The Isle of Man-based Challenger Energy Group (LON:CEG) has an intensive programme of investor presentations over the next two weeks, which will inevitably generate fresh interest in the group and its various prospects.

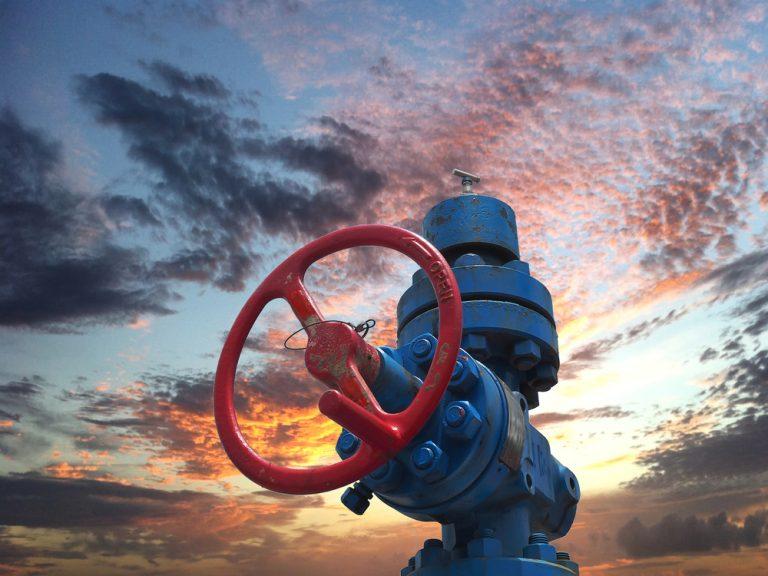

Challenger Energy Group engages in the development, production, appraisal, and exploration of oil and gas properties.

It is a Caribbean and Atlantic-margin focused oil and gas company, with a range of oil production, development, appraisal and exploration assets and licences.

The company’s portfolio of opportunities represents a mix ranging from valuable production assets located onshore in Trinidad and Tobago, near-term appraisal and development projects in Trinidad and Tobago and Suriname, and high impact offshore exploration assets located in The Bahamas, Uruguay and Trinidad and Tobago.

The group’s-management team and staff base have a broad range of skills as well as deep technical and industry experience.

Its property portfolio consists of five producing fields and one dormant field in Trinidad and Tobago; a 100% working interest in AREA OFF-1 block in Uruguay; 100% interest in four exploration licenses in the Bahamas; and a 100% interest in Wag naar Zee Project, Suriname.

I understand that its interest in Suriname and in the Bahamas are now considered ‘non-core’ and that a disposal programme is well underway, the funds from which will be easily reinvested.

The Namibia connection

The company considers that the conjugate margin super-discoveries in Namibia have also validated its early entry strategy in Uruguay.

Specifically, the company was the first operator to enter Uruguay in 2020, pre-dating the conjugate margin discoveries offshore Namibia.

Until the start of 2022, the Company was the only offshore acreage holder in Uruguay, having bid for the AREA OFF-1 licence on the basis of a modest, low-cost work programme.

However, since the discoveries offshore Namibia, five blocks offshore Uruguay have been awarded, all in 2022, to Shell, APA Corporation (formerly, Apache) and YPF (the Argentinian state-owned oil and gas company), such that now all but one available Uruguay offshore blocks is licenced, and the company is the only junior present.

Those blocks secured by the majors surround the Challenger Energy acreage, with those companies having already committed exploration work programs of over $230m.

The Uruguay asset is core to the business and is both highly marketable and highly prospective.

CEO Eytan Uliel stated that:

“In 2020, when no other parties were ready to commit, Challenger Energy was first-mover into offshore Uruguay, securing the AREA OFF-1 block on an uncontested basis and on highly advantageous work terms.

Since then, margin-opening discoveries offshore Namibia by TotalEnergies and Shell have made it possible to correlate what are now proven, oil producing source rocks directly across into the conjugate margin basins of Uruguay’s waters.

As a result, Uruguay has become a new global exploration hotspot, evidenced by the fact that in the last 12 months all but one of the available offshore blocks have been licenced by oil majors and NOCs, bidding sizeable work programs.

The results from the AREA OFF-1 work program have been extremely promising, in that the company now has a technically supported prospect inventory of between 1-2bn barrels in that globally attractive exploration hotspot.

The group’s next-step objective is to farm-out to an industry partner, so that it can fast-track a 3D seismic acquisition. The high-quality data set now compiled, and the intellectual property created, positions the company well, and it is shortly expected to initiate a formal farm-out process.

Significant Shareholders

The Aim-quoted company some 9,620,199,479 shares in issue.

Larger holders include Hargreaves Lansdown Asset Management (10.22%), Bizzell Capital Partners (Stephen Bizzell NED)(9.51%), Choice Investments (Dubbo)Pty (8.70%), Rookharp Capital Pty (5.49%), Jarvis Investment Management (4.35%), Merseyside Pension Fund (4.34%), GP (Jersey) (4.05%), RAB Capital (London) (3.80%), Interactive Investor (3.59%) and Maybank Kim Eng Securities (3.12%).

Private name holdings include Eytan Uliel (CEO) (5.67%), Baktash Manavi (3.51%) Simon Potter (NED)(0.74%) and MHCNZ Trustee (Mark Carnegie) (5.82%).

Analyst Opinions – looking positive

Brendan Long at WH Ireland, the group’s NOMAD and Joint Broker, has produced a lengthy evaluation of the company and is very expressive and positive about its Uruguay interests, describing the company as a ‘hot property’.