MicroSalt makes another step towards AIM IPO with celebrity chef partnership

Although we are yet to learn the exact date of Tekcapital’s MicroSalt IPO, the recent news flow would suggest things are beginning to heat up.

Today, Tekcapital announced MicroSalt have brought in Rick Stein’s son Jack as a brand ambassador. Such a significant move signals the company is positioning itself towards the UK market.

“I am absolutely delighted to be working with MicroSalt to show how a true low-sodium salt can produce the same taste while providing significant benefits to health. As a chef, salt is the most important ingredient, and this product is game changing, said Jack Stein, Chef Director for Rick Stein.

Mr Stein will help develop MicroSalt’s culinary audience and educate consumers about the health benefits of lower sodium consumption.

Today’s announcement follows yesterday’s news MicroSalt had secured distribution in an additional 400 US stores.

MicroSalt has recorded many successes with distribution agreements across 1000s of US stores, including Kroger – one of the United States’ largest supermarkets.

The move to align themselves with a prominent UK chef highlights intentions to raise their profile in the UK, not only for a possible product launch but for a listing on AIM.

MicroSalt appointed Zeus Capital as their NOMAD last year in preparation for an AIM IPO. Tekcapital previously said they were targeting an IPO in 2023, but with the current state of capital markets and near-constant commercial updates, it is understandable why MicroSalt are biding their time.

FTSE 100 edges higher as global equities rally

The FTSE 100 edged higher on Thursday in a broad global equity rally which saw European and US equities gain.

Downbeat economic data has been responsible for stock declines so far this week. However, the deterioration in US data has caused a shift in market expectations of interest rate trajectories.

Markets now predict the Federal Reserve will pause interest rate hikes in the coming months. On Thursday, the prospect borrowing costs will not increase again in the short term helped support sentiment and risk assets.

The FTSE 100 gained 0.2% on Thursday, while the S&P 500 had jumped 0.4% at the time of writing.

Despite improving sentiment on Thursday, analysts cautioned the looming debt ceiling could bring today’s positivity to an abrupt end.

“Despite this positive sentiment, there remains a large elephant in the room. Joe Biden is dangerously close to the 1 June deadline to reach an agreement on raising the US debt limit, otherwise the US government will default on its bills,” said Russ Mould, investment director at AJ Bell.

“That could cause all kinds of problems with federal workers and to the US economy and likely cause a global stock market correction.”

FTSE 100 movers

A day after saying they were targeting record £1 billion earnings this year, JD Sports received broker upgrades sending shares over 5% higher. JP Morgan has hiked their price target to 215p from 210p.

JD Sports shares were 5.4% higher at 172p at the time of writing.

BT

BT shares sank on Thursday after the telecoms group announced full-year results. Revenue was down 1%, and operating profit slipped 12%.

The group is taking steps to cut costs by slashing 55,000 jobs, but concerns about cash generation sent the stock down by around 5%.

“Headlines will no doubt focus on the job cuts, with up to 55,000 to come over the next decade as BT looks to find more ways to cut costs despite a cost-cutting plan already delivering £2.1bn in savings. It’s drastic, but it’s not overly surprising given the mounting costs and slim margins in the wider business,” said

“Once the Openreach and 5G networks are built out the strategy shifts to monetising the infrastructure that’s in place and leveraging new technologies to do that. Progress on both is looking promising, BT’s 5G now covers 68% of the population and Openreach is on track to reach 25m premises by 2026.

“Challenges are looming, though, not least a pension review in the coming months that’s likely to result in a write-down, which will add to the burdens on cash, whether in the form of increased payments now or an extension to the deficit recovery timeframe.”

Burberry

Burberry shares were over 5% weaker following the release of full-year results. Burberry saw improvement last year as China reponed, but kept guidance the same and highlighted poor macroeconomic conditions.

Investors took the comments as a signal to book profits in the company after a bumper run in the stock.

The UK lithium supply chain: 4 UK-based lithium companies

This article was published by Kemeny Capital

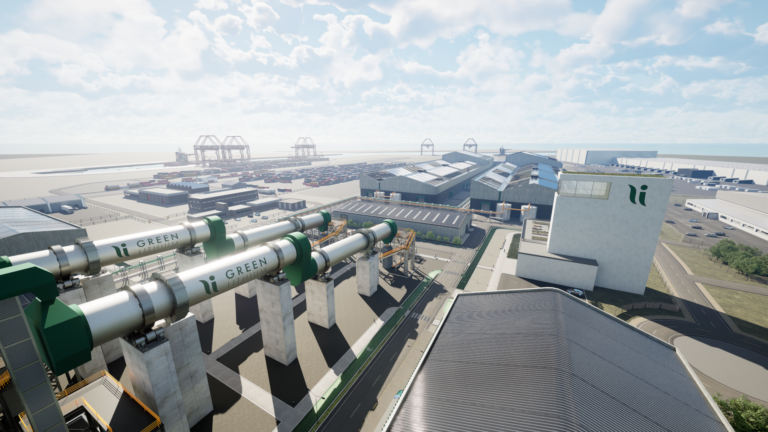

Green Lithium

Green Lithium is establishing Europe’s first merchant lithium refinery in Teesside. The Green Lithium plant will be close to PD Port, enabling them to supply lithium to Europe’s growing battery manufacturing industries.

Green Lithium will secure unrefined lithium and refine it into a product for sale to battery makers and EV companies. Green Lithium has partnered with Trafigura to secure the supply of lithium feedstock.

Watch Green Lithium Investor Presentation.

China dominates lithium refining currently, and companies manufacturing electric vehicles and lithium batteries rely on the Chinese supply of refined products.

Green Lithium aims to establish the UK as an integral part of the European lithium supply chain, making the UK and EU more competitive and less dependent on Chinese exports.

The company has secured investment from the UK Government’s Automotive Transformation Fund and will generate 100s of jobs in the area.

When visiting Green Lithium, Grant Schapps, Secretary of State for the Department for Energy Security and Net Zero, said: “We’re backing companies, like Green Lithium here in Teesside, to grow the new, green industries across the UK, sparking jobs and growth for decades to come.”

You can find out more about Green Lithium here.

Northern Lithium

Northern Lithium has arranged mineral licenses and is undertaking exploration activities in County Durham, North East England.

Northern Lithium began drilling in May 2022 and, in September 2022, confirmed the presence of economically viable lithium encounters in geothermal waters at the Ludwell Gate project.

The company is targeting 5,000-10,000 tonnes per year of battery-grade lithium in the next 5-8 years.

Northern Lithium is evaluating Direct Lithium Extraction (DLE) techniques.

The company was founded by Richard Morecombe, who has a small and mid-cap broking background and is currently President and Head of Equities at Panmure Gordon.

Cornish Lithium

In 2021, Cornish Lithium announced a JORC-compliant maiden resource at their Trelavour Lithium Project of 51.7mt Inferred Mineral Resource at 0.24% lithium oxide for a total of 122.4kt of contained Li20.

The subsequent scoping study in 2022 gave the project an estimated NPV8 of $318.6 million and a post-tax IRR of 24.4%. Capital expenditure is initially forecast to be $243.8 million, including contingency.

Cornish Lithium and Northern Lithium announced a collaboration in 2022 which aims to share their expertise and develop DLE techniques for UK-based lithium mines.

Cornish Lithium and Northern Lithium are focusing on geothermal brines, which require several stages of evaporation and processing before a saleable product is achieved.

DLE is an experimental form of lithium extraction, and many companies globally are trialling pilot plants and processing techniques.

Should Cornish Lithium’s efforts yield positive results for the efficient and low-emission extraction of lithium from brines, other mines may adopt their process in the future.

British Lithium

British Lithium was the first company to make a significant lithium discovery in the UK and has since received more than £5m in grants from the UK government.

British Lithium plans to develop its project based in the St Austell area of Cornwall after encountering clay lithium deposits in a 2019 drill campaign.

The company claims to be the only integrated lithium pilot plant in Europe to integrate a quarry, beneficiation plant and refinery. British Lithium plans to produce over 20,000 tpa of lithium carbonate.

Burberry shares sink on outlook warning

Burberry shares were down heavily on Thursday after the luxury brand suggested the macro environment was not conducive to substantial growth in the year ahead.

Reported operating profit rose 21% in the year to 1st April compared to the year prior. The company benefited from returning tourists after the pandemic and removing restrictions in mainland China.

Although the brand enjoyed the return of Chinese tourists, the associated jump in sales activity may prove transitory.

“Burberry’s sales have been boosted by the resurgence of Chinese tourists in Europe. Nevertheless, our experts caution that this lift is likely to be short-lived as an uneven economic rebound in China puts the shackles on some travellers,” said Zainab Atiyyah, Analyst at Third Bridge.

Over the past year, luxury stocks have been somewhat of a safe haven in the consumer-facing retail sector. However, the possibility of a broad downturn and flat guidance spurred a bout of selling of Burberry shares on Thursday.

“Having a wealthy clientele is an advantage in the current economic climate as Burberry’s typical customer is going to be less affected by the rising cost of living than someone whose pay packet is almost entirely gobbled up by bills and everyday essentials,” said Russ Mould, investment director at AJ Bell.

“However, that doesn’t mean Burberry is immune from an economic downturn. We’ve seen in recent months signs of cracks in the luxury goods market. Diamond prices have been falling, so too the value of second-hand luxury watches as the market is flooded with supply.

“The fact Burberry hasn’t lifted its guidance for the new financial year after reporting such a strong set of results, and reference to it being ‘mindful’ of the macroeconomic and geopolitical environment, appear to have been the trigger for some investors to take profits in the stock, with the share price falling more than 6% on the latest news.”

Burberry shares were down 6.7% at the time of writing on Thursday but are a solid 48% higher over the past year.

AIM movers: SRT Marine contract gain and ex-dividends

SRT Marine Systems (LON: SRT) has signed a $180m (£145m) contract to supply a maritime surveillance and intelligence system to a national coastguard. This deal was initially announced in March. The initial project will take two years and generate £123m. finnCap forecasts a 2023-24 pre-tax profit of £7.3m, increasing to £11.8m the following year. The share price jumped 18.5% to 54.5p.

MyHealthChecked (LON: MHC) is launching an extended range of self-testing products in Boots. Fourteen different test panels will launch this month with a further six to come. They cover areas such as food intolerance and thyroid function. The initial launch will be online, but they will also be sold in 120 stores. The six later tests will be sold in 800 stores. The initial agreement lasts until 17 May 2024. The share price rose 13.6% to 25p.

Kibo Energy (LON: KIBO) says that its listed subsidiary Mast Energy Developments (LON: MAST) has secured a new institutional investor for a joint venture to develop flexible power projects. The Mast Energy Developments share price is 65.7% higher at 1.45p. This helped the Kibo Mining share price improve 7.69% to 0.07p. Progress is also being made by Kibo Mining on the development of the Mbeya power project.

The Purplebricks (LON: PURP) share price has recovered 8.78% to 0.805p. following news that it is selling its business for £1 and assets to Strike Ltd and cancelling its AIM quotation. That leaves £5.5m in cash, but costs will reduce that to around £2m, which is slightly below the market capitalisation.

Mirada (LON: MIRA) has set out plans to cancel its AIM quotations. The IPTV technology provider has been quoted for more than two decades, but a large shareholder with 87.2% has limited liquidity and investor interest. The main lender to Mirada is also related to the main shareholder. This means that the cancellation will happen, and the shares will then be traded by JP Jenkins. That should save costs of $470,000/year. The share price dived 31.6% to 13p.

Shares in IQE (LON: IQE) fell 14.3% to 20.125p after it raised £30m at 20p a share. The semiconductor wafers manufacturer is also trying to raise up to £3m more from a REX retail offer that closes at 5pm today. In 2022, group revenues grew by 9% to £167.5m, while the loss jumped from £22.2m to £75.4m. That includes £68.5m of impairment charges, up from £7.4m the previous year. Costs are being reduced and the cash will provide working capital and fund development spending on newer markets, such as power electronics and MicroLED display.

Mark Thompson has stepped down as executive vice chairman of Tungsten West (LON: TUN) now that the financing has been completed. The share price declined 11.8% to 3.75p.

Professional services provider Christie Group (LON: CTG) shares fell 8.33% to 137.5p after it warned that there would be a heavy second half bias to figures. Transactions are taking longer to complete and will not happen in the first half. These include sales of dental, pharmacy and care home assets. Management believes that it can still achieve a full year pre-tax profit of £4.8m, up from £4.4m, which puts the shares on ten times prospective earnings.

Ex-dividends

Advanced Medical Solutions (LON: AMS) is paying a final dividend of 1.51p a share and the share price fell 3.25p to 249.75p.

Churchill China (LON: CHH) is paying a final dividend of 21p a share and the share price is 10p lower at 1360p.

Eleco (LON: ELCO) is paying a final dividend of 0.5p a share and the share price is unchanged at 82p.

Fintel (LON: FNTL) is paying a final dividend of 2.25p a share and the share price is 1.25p higher at 198.25p.

FRP Advisory (LON: FRP) is paying a dividend of 0.85p a share and the share price is unchanged at 112p.

H&T Group (LON: HAT) is paying a final dividend of 10p a share and the share price is down 3p to 431p.

Holders Technology (LON: HDT) is paying a final dividend of 0.5p a share and the share price is unchanged at 76p.

Jarvis Investment Management (LON: JIM) is paying a dividend of 3.5p a share and the share price is 2.5p lower at 157.5p.

Numis Corporation (LON: NUM) is paying an interim dividend of 6p a share and the share price declined by 5.25p to 334.25p.

Science Group (LON: SAG) is paying a final dividend of 5p a share and the share price fell 9p to 395p.

Vector Capital (LON: VCAP) is paying a final dividend of 1.53p a share and the share price slipped 0.5p to 39p.

India: Beyond the headlines

The Indian economy has been in the limelight as one of the few bright spots in an uncertain world. Some are even calling it ‘India’s decade’. Reforms, digitalisation, improving infrastructure and the government’s Make-in-India initiatives are some reasons backing the above. The strength of the India story has been underpinned by a few structural trends:

- healthy growth in government tax collections

- a revival of private sector capex cycle and the real estate sector

- long-term consumption trends remain intact despite some short-term weakness

- stable currency buoyed by foreign currency reserves of US$ 560bn+ and rising inward remittances

- exports of IT services surpassing the oil import bill taking the pressure off the current account deficit

- domestic institutional investor (DII) emerging as a strong and steady buyer offsetting volatile foreign institutional investor (FII) flows

- well capitalised banks, with no stress in the banking system

With India’s population exceeding China’s and being significantly younger, reinforces this positive commentary. Most overseas visitors who visit India are overwhelmed with the activity and positivity seen in the economy.

We too are strong believers of the above. While much has been written about what is happening in India at a macro level, in this note we highlight some trends, initiatives and developments, which do not get mentioned in the mainstream media but are amongst those that contribute significantly to the positivity we see around us.

The rise of domestic air travellers

April’23 saw the highest ever domestic passenger air traffic in India. The story behind this rising trend goes back to the year 2016 when the Government of India launched a scheme called ‘Ude Desh ka Aam Naagrik’ (UDAN) which means ‘Let the common citizens of the country fly’. The view was that for more broad-based and sustained economic development, it was essential to improve India’s regional connectivity by connecting small cities with large cities by air. Since this initiative, over 74 new airports have been operationalised taking the total to 140+ operating airports in India, and over ~470+ new air traffic routes have been opened (1500+ air traffic routes in India).

The more intriguing part was the implementation of this scheme by the government. New routes were made cost effective for airlines by lower taxes on fuel, reduction in charges and taxes at these regional airports, and also a cap on fares for a percentage of seats to make it more affordable for the common man to fly. More importantly, the Airlines themselves were asked to recommend the routes and airports that should be operationalised given their deep insights about the traffic movements. This was perhaps one of the main reasons for the success of the scheme.

The impact of this scheme is visible even in our daily lives. For a long weekend from a coastal city like Mumbai, even the Himalayas have now become a practical destination with direct connectivity to several cities on the foothills. Similarly, travel times for inter-state and rural-to-urban migrants is cut down by many days without the need to use multiple modes of transportation. Among the new airports, the highest traffic of over 600,000 passengers in a year was from a city called Darbhanga. A Google search shows that it is the 5th largest city in the state of Bihar. Clearly, India is changing.

The highest exposure of India Capital Growth Fund (ICGF) is in companies benefitting from the consumption theme. Within this, a recent entrant in the fund is VIP Industries, India’s largest luggage manufacturer and a direct beneficiary of the boom in domestic tourism.

Rethinking India’s defence policy

When it comes to tourism, one of the relatively unexplored parts of India has been the Himalayas. The entire mountain range borders with Pakistan and China. However, previously, government policies prevented tourists from visiting border areas and the infrastructure was also relatively poor. The reasoning behind this was to limit inroads by the enemy. This policy has now been reversed.

The new thinking is to develop villages in border areas as tourist destinations. This should provide employment and development, and also protect the borders. Consequently, this has resulted in a big build out of infrastructure (roads, bridges, communication) with both Kashmir and Arunachal Pradesh, two of the key states in the border areas being positioned as big tourism destinations. This shift in thinking is across the defence sector with multiple areas of strategic reforms. One of these, which has a large ramification on the economy is the attempt at reducing India’s reliance on defence equipment imports (India is the world’s largest arms and weapons system importer accounting for 11% of global imports). Attempts have been made in the past to reduce the reliance on imports but with limited success because of conflicting interests. However, in the new policy implemented since 2020, the Government, to show its seriousness, has created a list of products and platforms which would be banned from imports over a defined time-period. Till now, four lists comprising 411 products have been banned.

This has created a huge market opportunity in India with the private sector now willing to invest resources in developing these products and consequently, global players also looking to develop partnerships in India.

Mainstreaming of North-East India

There are 8 states in the North-East of the country, which for most of the 75 years since India gained independence viewed themselves as not being a part of India. These regions were cut off from the rest of India through a small corridor (named as chicken neck) with a narrow width of only 23km, with Bangladesh and Nepal on either side. 99% of their borders are international boundaries. Being landlocked with a hilly terrain, less densely populated, culturally different with a large Christian population, the mainstream political system largely ignored this part of the country. Consequently, there was very little infrastructure and economic development, and law and order was a serious issue.

Four of these states had state elections in February this year, and it was the Bharatiya Janata Party (BJP), the current party in the central government along with its regional allies which won all the states. What was surprising was that until the 2014 state elections, the BJP had no presence in these states. They had never even contested an election! So, what changed? The one consistent factor in our opinion is development.

Since the BJP came to power at the centre, an ‘Act East’ policy was formulated with the aim of mainstreaming these states with the rest of the country. The Prime Minister himself visited the North Eastern states on over 50 occasions since 2017, with Union Ministers (part of the senior decision making body of the Government of India) visiting these states frequently. The result is evident.

- Roads: over US$ 50bn invested, 4000km+ roads built, doubling the network

- Railways: 20 projects being implemented, all state capitals being connected

- Airports: 7 new airports built, total operational airports at 17, further 8 in the pipeline

- Number of flights: has increased from ~900 per week to ~1900 per week

It is also no surprise that this region is the fastest growing market for cement companies (India Capital Growth Fund has 6.6% of the portfolio in cement companies). The key takeaway for us is that the BJP victory demonstrates that people are rewarding political parties which are able to deliver on economic development.

Vande Bharat Trains

There is a fair bit of nostalgia when one thinks about the Indian Railways. However, even today, the picture remains much the same, red coaches pulled by locomotives, noisy, rickety loos, etc. The only change has been more choice of air-conditioned trains, and diesel and electric locomotives instead of steam ones. Compared with Europe, the Indian Railways seemed to be stuck in a different era.

When the government decided it was time to change, a team was sent to Europe to study the systems and shortlist partners to import their trains to India. The story goes, that the Prime Minister questioned why these could not be made in India through in-house technology. In the end, the erstwhile Head of Rail Coach manufacturing unit, who had 18 months left to retire took it upon himself to build it out. The project was named ‘Train 18’ and within 18 months, India had the first two prototypes of the train ready for trial runs. The first train was launched between Delhi and Varanasi on 15th February 2019, just 18 months from the start of the project. As we write, there are already 15 trains in service, and orders for another 200 have been placed (each train costing US$15m) with the goal of having 400 trains in service in the next 5 years.

According to ICF (Integral Coach Factory), the manufacturing cost of ‘Train 18’ is approximately half the cost of a similar imported train set and is made under the ‘Make in India’ initiative.

This is expected to transform the Indian Railways. What is even more transformational is that the policy makers are thinking of scale and not focusing on short-term annual orders. With this long-term vision, companies are willing to invest and build capacities e.g. Alstom and Siemens have both set up locomotive plants in India as each of them received orders for 800 / 1200 high powered locomotives over 11 years to haul the e-wagons for the Dedicated Freight Corridor being commissioned. Similarly, Indian railways who used to order 20-35000 wagons per year are now placing orders in excess of 84000 wagons in one go.

This has resulted in all the suppliers running at full capacity for the next 3 years with further visibility to expand capacities. Railways, has thus become one of the key capex driven business stories playing out in India.

One of ICGF’s largest holdings is Ramkrishna Forgings, a big beneficiary of the capex spend in railways. They have seen rising order wins and are also setting up a greenfield plant to manufacture wheels specifically for the Indian Railways.

While there are a lot of counter arguments on some of the above, with people claiming it is more a marketing exercise by the current party in power, and in reality a number of the new airports and routes are actually unviable. Likewise, trains like Vande Bharat are just 10-15% faster than the existing ones. The fact does, however, remain that as we delve deeper into the fine prints, we see a common thread:

- There has been out of the box thinking by the current government.

- Plans are now on a bigger scale and more long term with ambitious targets, some even for the year 2047, when India celebrates 100 years of independence.

- The pace of execution has seen a steep jump providing confidence to the private sector on the future, which further assists in making decisions and in their risk-taking ability.

The changes highlighted above are just the tip of the iceberg. There are several other initiatives that have been attempted, a lot of which are still work in progress, including: 100 smart cities, river Ganges clean up mission, reviving the waterway transport system, affordable housing, clean India mission, to name a few.

The capex story is already yielding results in the economy, particularly in the investments made in the road and railway industry. We believe the momentum remains strong and is expected to continue accelerating. We are now beginning to see the secondary impact of this in rising order books and capex plans of the private sector as well. This is the driving force behind the confidence in the economy. The best we believe is yet to come.

India Capital Growth Fund (ICGF)*, the LSE listed Investment Trust focused on mid and small cap Indian Equities, managed by Ocean Dial Asset Management has delivered a 128% increase in net asset value (NAV) over the last 3 years, ahead of the benchmark which has returned 115.1% in GBP terms. However, its shares have rallied to deliver 223.8% to shareholders, significantly ahead of its benchmark (115.1%) and its peers (average return 74.6%). Data as at 10th May 2023.

To learn more about why we are so excited about the Indian economy and the mid-small cap space, please click here or to subscribe to our monthly newsletter, please click here.

REGULATORY INFORMATION

This document and any related documentation provided herewith (this “Document”) is given on a confidential basis for informational purposes only and does not constitute the provision of investment advice. In any case, this note does not constitute “marketing” in the UK pursuant to the Alternative Investment Fund Managers Regulation 2013. Nothing herein shall imply that information contained herein is correct as of any time subsequent to the date of this Document. The information in this Document does not constitute or contain an offer or invitation for the sale or purchase of any shares in any Fund in any jurisdiction, is not intended to form the basis of any investment decision, does not constitute any recommendation by any Fund, its directors, agents or advisers, is unaudited and provided for information purposes only and may include information from third party sources which has not been independently verified. This Document is not intended for public use or distribution. It is the responsibility of every person reading this Document to satisfy themselves as to the full observance of any laws of any relevant jurisdiction applicable to such person, including obtaining any governmental or other consent which may be required or observing any other formality which needs to be observed in such jurisdiction. While all reasonable care has been taken in the preparation of this Document and all the information prepared in this Document is believed to be accurate, no warranty is given on the accuracy of the information contained herein, nor is any responsibility or liability accepted for any errors of fact or any opinions expressed herein.

This Document is issued by Ocean Dial Asset Management Limited and views expressed in this document reflect the views of Ocean Dial Asset Management Limited and its Mumbai based affiliated company and adviser, Ocean Dial Asset Management India Private Limited as at the date of publication. Comments on individual sectors and companies also reflect those views as at that date. Subsequent events may cause such views to change. It may contain forward-looking statements, which can be identified by words like “anticipate,” “intend,” “believe,” “plan,” “hope,” “goal,” “initiative,” “expect,” “future,” “intend,” “will,” “could” and “should” and by similar expressions, in reliance upon certain “safe harbour” provisions of applicable securities laws. Other information herein, including any estimated, targeted or assumed information, may also be deemed to be, or to contain, forward-looking statements. Prospective investors should not place undue reliance on forward-looking statements as this information is subject to various risks and uncertainties. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results for many reasons. Variations of assumptions and results may be material. This information is for the use of recipients only and may not be reproduced, redistributed or copied in whole or in part without the express consent of Ocean Dial Asset Management Limited. Ocean Dial Asset Management Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered office 13/14 Buckingham Street, London WC2N 6DF. The Fund is not a non-mainstream pooled investment pursuant to the rules of the Financial Conduct Authority.

Trident Royalties encouraged by Thacker Pass developments

Trident Royalties has released an update on the Thacker Pass lithium project located in Nevada. Trident holds a gross revenue royalty over Thacker Pass.

Thacker Pass is the largest know deposit of lithium in the United States and construction is well underway with the expectation production commences in 2026.

Operator Lithium Americas have started early works at Thacker Pass including water pipelines, construction ponds, site fencing and access roads. Major earthworks are expected to commence later this year.

In addition, the United States Department of the Interior has recently announced analysis on the Thacker Pass project consistent with previous solicitor’s opinion which increases the certainty over the future of the project.

Trident holds a 60% royalty over the entire Thacker Pass project. There is the option for Lithium Americas to exercise a partial buyback of the royalty which will result in a $13.2 million consideration attributable to Trident Royalties. Trident would retain a 1.05% gross revenue royalty over the project.

“It is encouraging to see tangible progress being made by the US Government to provide permitting clarity for mine developers, and the references to Thacker Pass reinforce its strategic importance to the United States,” said Adam Davidson, Chief Executive Officer of Trident.

“The BLM record update, which the US DOI confirms is consistent with the new Opinion, is a key deliverable following the February 2023 ruling and provides even further clarity on Thacker Pass’ pathway to production, for which LAC is targeting H2 2026.”

Trident Royalties shares jumped over 4% on the news on Thursday.

IQE seeks investment for growth sectors

Semiconductor wafers manufacturer IQE (LON: IQE) is raising £30m at 20p a share and could generate up to £3m more from a REX retail offer. The $35m bank facility has been extended until May 2026, so IQE is in a good position to weather the tough trading and benefit from the upturn.

Net debt was £15.2m at the end of 2022, rising to £24m at the end of March 2023. The fundraising was announced at the end of the trading day. The share price dipped 0.25p to 23.5p, but there could be a further reaction tomorrow morning.

The REX retail offer closes at 5pm on 18 May. The intermediaries involved are interactive investor, AJ Bell and Hargreaves Lansdown, although there could be additional brokers applying to become involved.

Once an application has been made and accepted it cannot be withdrawn. The minimum subscription is £50.

Cash

The semiconductor sector has been hit by a downturn due to destocking. Orders have been lower than anticipated and AIM-quoted IQE requires the cash to shore up its balance sheet.

IQE is a specialist in the niche market for epitaxial compound semiconductor wafers, which are used in smartphones, lasers and infrared devices. The wafers can incorporate special materials. Because of the initial investment made in production capacity fixed costs are high.

This is also a highly cyclical business. Wireless revenues fell last year and for the first time revenues from photonics were larger.

In 2022, group revenues grew by 9% to £167.5m, while the loss jumped from £22.2m to £75.4m. That includes £68.5m of impairment charges, up from £7.4m the previous year.

New capital spending in existing markets will be below depreciation. Labour costs are being reduced by 10% and other overheads should fall by 7% this year.

IQE is focusing its development spending on newer markets, such as power electronics and MicroLED display. There will be four new Gallium Nitride reactors installed between 2023 and 2025. He deployments will be based on customer-funded product development. This year’s investment will be £8.3m.

First half revenues are expected to be between £50m and £56m. Second half revenues are expected to grow.

IQE should be coming to the bottom of its cycle. It is getting to the point where the shares are an attractive recovery buy if investors take a two or three year view.

Hardide progresses towards breakeven

AIM-quoted advanced surface coatings provider Hardide (LON: HDD) is growing its revenues and efficiency improvements mean that breakeven level has been reduced. There is plenty of spare capacity available as demand from existing and new product areas increases.

Oil and gas remains an important sector for Hardide and that is where the growth come from in the first half. It offset delays in turbine blade coating work and reduced income from industrials.

Aerospace will be increasingly important for Hardide as it gains approvals to supply more coated parts to more of Airbus’ aeroplanes. There are other new markets, such as electric vehicle battery and solar components.

In the six months to March 2023, revenues were 9% higher at £2.9m. There was a £100,000 property gain, which helped the pre-tax loss fall from £800,000 to £600,000. Net debt was £300,000 at the end of March 2023.

There will be £500,000 of cost savings and efficiency improvements achieved by the end of the financial year. That means that breakeven revenues should be between £7.5m and £8m.

Capacity utilisation is at around 60%. A full year loss of £1.3m, down from z£3.2m, is expected with a further decline to £500,000 next year. Winning business in new sectors could speed up the journey to profitability.

The share price was unchanged at 13.5p. The operational gearing means that when the business passes breakeven the profit should grow rapidly.