FTSE 100 slips as Bank of England hikes rates

The FTSE 100 slipped on Thursday after the Bank of England hiked rates and set out their revised forecast for the UK economy.

As expected, the Bank of England raised rates by 0.25% to 4.5%. However, the market-moving elements of the bank’s instalment were their UK economic forecasts and press conference. The prospect of additional rate hikes this year curtailed demand for UK risk assets.

The FTSE 100 was down 0.34% at the time of writing during the Bank of England’s press conference.

The BoE now expects the UK economy will avoid a recession but still sees persistently high inflation levels through the rest of 2023. The bank sees sharp drops in inflation this year, but with inflation currently in double digits, inflation will still be significantly higher than their 2% target.

“Sticky inflation means the Bank of England has once again turned to its weapon of choice in hope of stamping out the inflationary pressures the economy is facing,” said Rachel Winter, Partner at Killik & Co.

Winter continued to explain markets are predicting further interest rate hikes later this year – a contrast to the current trajectory for rates in the US.

“While the Federal Reserve recently indicated that it was ready to hit the pause button on rate hikes in the US, markets in the UK are currently pricing in a peak of 4.85% in September.”

GBP/USD fell despite the bank predicting 0.25% growth in 2023 – and will avoid a recession. In February, the bank had predicted a 0.5% contraction in 2023.

FTSE 100 movers

Airtel Africa was the FTSE 100 top faller after reporting 2022 full-year results. Investors were disappointed with falling earnings due to currency fluctuations. Airtel Africa shares were down 7% at the time of writing.

Rolls Royce slipped as the defence and aviation firm kept guidance for the year unchanged. Roll Royce shares were down 5% on Thursday but are still up 58% on the year.

Miners were under pressure as concerns about Chinese demand for natural resources sapped interest in the sector. Rio Tinto, Anglo American and Glencore were down between 2%-3%.

ITV

Former FTSE 100 constituent ITV’s hopes of being promoted back to London’s leading index were dealt a blow after poor trading in Q1.

ITV was down 4.5% after its Q1 2023 trading update was released. The media group said sales faltered in the period, primarily due to lower advertising revenue.

“TV advertising faces both a structural challenge, as the audience for linear television declines, and a cyclical challenge as companies trim their advertising spend thanks to an uncertain economic outlook,” said Russ Mould, investment director at AJ Bell.

“This was reflected in free-to-air broadcaster ITV’s first quarter trading update which, not unexpectedly, showed a big decline in advertising revenue and signalled a weak showing on this front in the current quarter too.

“Advertising spend on its digital platforms is proving more resilient but not sufficiently so that it can make up for the drop off elsewhere.”

ITV’s shares need to rally by around a third to be in contention for promotion to the FTSE 100.

Why Rolls Royce shares are falling after their Q1 2023 trading update

On Thursday, Rolls Royce issued their Q1 2023 trading update and provided insight into recent sales activity and outlook for the rest of the year.

Rolls Royce said they were keeping operating profit guidance of £0.8-£1.0bn and free cash flow guidance of £0.6-£0.8bn unchanged.

The company noted its civil aerospace business unit was approaching pre-pandemic levels and several awards in their defence unit. Rolls Royce alluded to progress in their transformation strategy and robust customer demand.

Despite reasonable operational progress, Rolls Royce shares were down 3.5% at the time of writing on Thursday following the release.

Analysts suggested the new CEO’s honeymoon period was coming to an end, and investors took the opportunity to book profits after a strong run in the stock.

“Tough talk which suggested he got the seriousness of the challenge facing the company and a decent first set of numbers took new Rolls-Royce CEO Tufan Erginbilgic a long way with the market,” said Russ Mould, investment director at AJ Bell.

“However, today’s trading update saw the first sign of investors taking a tougher line.

“There was nothing to really frighten the horses, trading is in line and the company’s key aerospace business is mirroring the recovery in the wider aviation sector to edge back towards pre-pandemic levels.

“A fall in the share price may just have represented some profit taking after an exceptionally strong run for the stock, but there were some less than positive hints in the statement.”

Mould continued to explain the lack of news on their new business segment, which includes small modular reactors, as another possible reason for investor disappointment.

“Perhaps most significantly there was nothing on the company’s New Markets business – which encompasses its investments in areas like small modular reactors (seen as a cheaper and quicker way of developing nuclear power) and electrical aviation.

“On this front, recent news the development of small modular reactors in the UK will be put out to public tender was a blow for Rolls. Its participation in this process was seen as a potential slam dunk but now international rivals could swoop in and take a piece of the action.”

AIM movers: Block Energy production increases and ex-dividends

Block Energy (LON: BLOE) increased average daily oil and gas production by 5% to 450 barrels of oil equivalent in 2022 and this April it has increased to more than 620 barrels. Revenues increased by 35% to $8.26m and the loss decreased in 2022. The share price rose 16% to 1.45p.

Ilika (LON: IKA) has made its first shipments of Stereax M300 batteries from its UK facility. They are used for IOT and healthcare products. The outsourced manufacturing contract is still being negotiated. The share price is 11.1% higher at 50p.

Andrada Mining (LON: ATM) has appointed Barclays Bank as strategic financial adviser to its lithium prospect in the Erongo region of Namibia. Management says that Barclays offers experience and access to financial markets. The share price rose 5.66% to 5.6p.

Keywords Studios (LON: KWS) is acquiring US-based Hardsuit Labs, which offers video games development services. Last year’s revenues were $11m and the maximum consideration is $15m, with $6.75m based on growth targets over two years. The share price increased 4.54% to 2279p.

Malaysia-based Mobility One (LON: MBO) has been asked for further information relating to its application for UK electronic money institution authorisation, and this led it to withdraw its application. It is assessing alternatives. The share price slumped 31.3% to 5.5p.

Oil and gas producer Serinus Energy (LON: SENX) generated revenues of $4.9m and a loss of $1.3m in the first quarter of 2023. European gas prices weakened during the period. Shore says Serinus Energy will find it difficult to meet 2023 forecasts. It may reduce its risked NAV of 70p a share. The share price fell 26.1% to 4.25p.

Cell engineering company MaxCyte Inc (LON: MXCT) has reduced its guidance for 2023 revenue growth from 21%-26% to 8%-12%. First quarter revenues fell 26% to $8.6m. Pharma companies are focusing on developing their internal assets. The share price declined 17.8% to 312.5p.

Scientific Instruments supplier SDI Group (LON: SDI) says that additional investment means that although revenues increased in the year to April 2023, pre-tax profit will be flat at £11.9m. The pre-tax profit forecast for the current year has been reduced by 17% to £9.8m, because of disappointing sales of higher margin products. The share price slipped 14% to 150.5p.

Ex-dividends

Avingtrans (LON: AVG) is paying an interim dividend of 1.7p a share and the share price is unchanged at 410p.

TJ & JH Braime (LON: BMTO) is paying a final dividend of 9p a share and the share price is unchanged at 1750p.

TJ & JH Braime (LON: BMT) is paying a final dividend of 9p for each A share and the share price is unchanged at 1350p.

Epwin (LON: EPWN) is paying a final dividend of 2.55p a share and the share price slipped 2p to 67.5p.

Greencoat Renewables (LON: GRP) is paying a dividend of 1.6 cents a share and the share price is 0.75 cents lower at 109.75 cents.

Gresham House (LON: GHE) is paying a final dividend of 16p a share and the share price fell 15p to 785p.

James Halstead (LON:JHD) is paying an interim dividend of 2.25p a share and the share price declined 0.5p to 210.5p.

Tandem Group (LON: TND) is paying a final dividend of 6.57p a share and the share price is unchanged at 240p.

The Property Finance Group (LON: TPFG) is paying a final dividend of 8.8p a share and the share price fell 2.5p to 315p.

Focusrite (LON: TUNE) is paying an interim dividend of 2.1p a share and the share price is unchanged at 570p.

ITV shares fall as advertisers tighten belts

ITV shares were weaker on Thursday as the UK media giant revealed advertisers reduced spending in the first quarter and their studio’s business flatlined.

ITV’s total external revenue for the first quarter fell 7% to £776m with media and entertainment revenue sinking 9%. Their studio’s business revenue was flat at £457m.

Total advertising revenue for the period fell 10% to £419m.

“ITV’s first quarter held few surprises. Double digit declines in advertising revenue were expected, but these are due to get worse in the new quarter. That reflects the very real challenges that come with relying on above-the-line spending during times of economic stagnation,” said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

Although the wider media and entertainment unit’s revenue fell, the new streaming service ITVX continued to build momentum and total digital revenue rose 29% while total streaming hours through the service were up 49% in Q1.

“ITV is throwing a lot at its digital transformation, and digital advertising revenue is proving more resilient. However, this isn’t enough to stem losses elsewhere, showing how deeply rooted ITV still is in traditional broadcasting,” Lund-Yates said.

“Studios revenue is on track to deliver mid-single digit revenue growth. This area of the business is sitting on a well of future demand thanks to the huge swell in appetite for content from other providers. There are tricky elements to deal with in content creation though. It’s a very tough business in which to inflate margins, and is a large reason ITV’s operating profit expectations have been dialled back.”

ITV shares were 4.5% weaker at the time of writing.

Eyes turn to the East

by Alex Crooke, Head of Equities – EMEA and Asia Pacific | Portfolio Manager

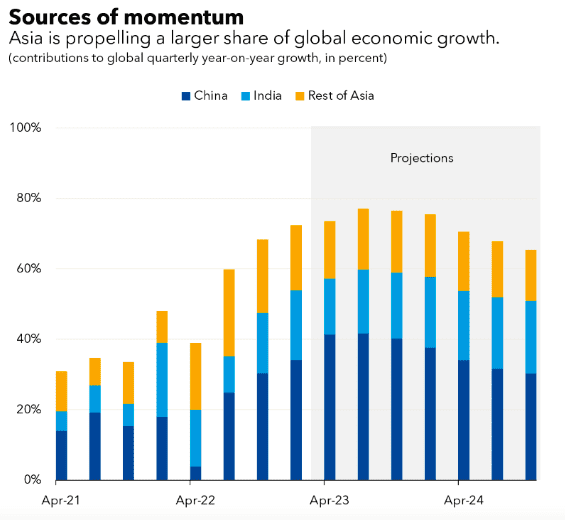

With western developed markets still mired in high inflation and economic uncertainty, Asia offers a brighter prospect for investors. The reopening of China and strength of south Asian economies makes BNKR, with its solid position in the region, an attractive proposition.

Nowhere to hide

Surging inflation, high interest rates and a slowdown in global growth meant that overall, performance in 2022 was disappointing for investors across the board. In every region, financial markets posted steep losses, with many registering the worst performance since the 2008 downturn. Little could be done to mitigate the influences of international events, including the fallout from the pandemic, and food and energy supply imbalances caused by war in Ukraine. Short of investing exclusively in energy companies, there were no fool-proof strategies available to insulate investors from poor market performance.

The Bankers Investment Trust (BNKR) was no exception and performance reflected these uncertain markets. The NAV total return was down 11.3%, underperforming the FTSE World Index on a relative basis. A key part of this underperformance can be attributed to weakness in Asian markets, as Covid continued to affect trade and travel. However, with Asian economies looking buoyant following China’s faster-than-expected reopening, is BNKRs now positioned to capture the upside?

What will the year of the rabbit bring?

To answer this question, the first place to look is China, the second biggest economy in the world. It has been the biggest contributor to global GDP growth since the financial crisis and between 2010 and 2020, the country’s economy grew by $11.6trn.i According to the International Monetary Fund (IMF), the Chinese economy is forecast to grow by roughly 5.2% in 2023, versus 3.0% last year.ii Much of this growth is going to be driven by the release of pent-up consumer demand among a Chinese middle class sitting on record-high domestic savings, accrued during extended periods of lockdown.

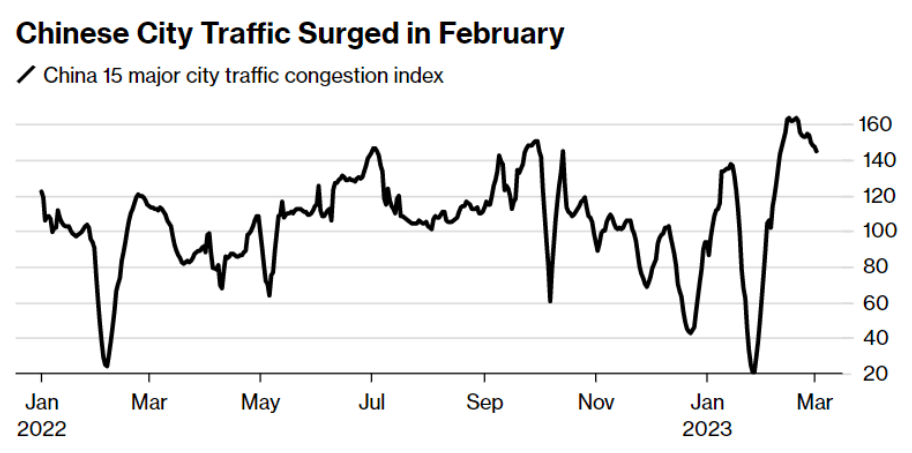

As activity picks up, sectors likely to benefit are those reliant on consumption and mobility. In fact, consumption has already rebounded strongly, with retail sales rising by 3.5% year-on-year in the first two months of 2023.iii There has also been an uptick in domestic travel and hotel revenues have also increased by around 20% compared to 2022. The latest spending patterns suggest that Chinese consumers are generally engaging in travel closer to home and are more focused on domestic consumption.

Note: January 2021 congestion = 100

These trends bode well for our positions in China, including leading food producers ChaCha Food and Inner Mongolia and beverage companies Kweichow Moutai and Wuliangye Yibin. The uptick in domestic travel should also serve as a tailwind to China Tourism Group, which provides tourism, hotel, scenic passenger transport and other travel-related services domestically and across the Asia Pacific region. Our holdings in Sungrow Power, a solar power inverter maker and EV battery producers Contemporary Amperex Technology and Yunnan Energy New Material, reflect our longer-term belief these companies will have a role to play in China’s transition towards a cleaner, more sustainable economy.

Strength is building across Asia

China’s reopening and growth will also be good news for the Asia Pacific region, as its consumer wealth and exports will flow outwards into the wider Asian market. Currently the most dynamic of the world’s economic regions, in February the IMF described Asia as a “bright spot in a slowing global economy”, with growth set to hit 4.7% this year.iv

There is no guarantee that past trends will continue, or forecasts will be realised

Generally, Asian economies are not suffering from the malaise of high inflation to the same extent as the West. As a result, interest rates have not risen as high to counter inflation. This combination of lower inflation and lower rates means that consumers are not under the same cost pressures to tighten their belts. Add to this a drop in oil and food prices, and there are better prospects for spending.

South Asia fared better than the region’s more northerly countries during 2022, and we expect to see further growth throughout 2023 in commodity-heavy economies such as Malaysia, where the outlook is based on resilient domestic demand and contained inflation. In Indonesia, foreign investment and favourable commodity prices are helping to support the economy. Meanwhile, Thailand has seen its most profitable sector – tourism – bounce back, with an estimated 25 million visitors forecast for 2023, more than double its 2022 haul.v

A reversal in fortunes for BNKRs

Global diversification is valuable during periods of uncertainty, acting as an insurance policy against poor market performance in any one region. It allows us to take advantage of the different regional dynamics at play. While our positioning in Asia detracted last year, due to short-term market drivers (the Covid-19 pandemic and supply chain disruptions), the longer-term thesis still holds. The rise of the middle class in Asia will continue to increase, Asian economies are shifting from production to consumption, and the region will be instrumental in the shift towards a cleaner global economy.

With a particular focus on cash generation and dividend growth over the medium term, our regional investment specialists take an agile approach to stock picking, based on their local market expertise. This allows us to find businesses that will not only perform well in normal market conditions but will also be resilient during difficult periods and come out of the other side. As the short-term noise/disruptions subside, we believe the regional trends and dynamics that are tied into the medium-and-long term structural growth drivers will come back into the fore. As such, BNKRs is well placed to capitalise on these trends. Following 56 years of dividend increases, we are confident that we will continue to deliver strong long-term performance.

Sources

i Source: The implications of China’s mid-income trap | Financial Times (ft.com)

ii Source : https://www.imf.org/en/News/Articles/2023/02/02/cf-chinas-economy-is-rebounding-but-reforms-are-still-needed

iii Source: https://www.ft.com/content/a67c7717-c117-4778-b2f3-324d1c9fdd11

v Source: https://www.bbc.co.uk/news/business-64369279

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

IMPORTANT INFORMATION

Please read the following important information regarding funds related to this article.

Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions.

- Global portfolios may include some exposure to Emerging Markets, which tend to be less stable than more established markets. These markets can be affected by local political and economic conditions as well as variances in the reliability of trading systems, buying and selling practices and financial reporting standards.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company’s shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company’s assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- Using derivatives exposes the Company to risks different from – and potentially greater than – the risks associated with investing directly in securities. It may therefore result in additional loss, which could be significantly greater than the cost of the derivative.

- All or part of the Company’s management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.

AIM movers: Comptoir revenues grow

Restaurants operator Comptoir (LON: COM) says revenues grew in double digits and there are plans to open more restaurants. Pre-tax profit fell from £1.5m to £902,000 because of higher overheads. The share price increased 12% to 7p.

Brazil-focused gold producer Serabi Gold (LON: SRB) has signed a strategic exploration alliance with Vale, which will assess large scale copper projects on the Palito Complex. There are four phases during which Vale can earn up to 90% of the project. Serabi would have a put option to sell the other 19% for $10m and a 1.5% net smelter royalty. There will be an initial $5m investment in exploration. The share price rose 9.68% to 34p.

Afrenta (LON: AET) has acquired small stakes in two oil exploration blocks for $17m, plus $10m deposit. The share is 6.35% ahead.

Shares in Zenova Group (LON: ZED) rose 4.76% to 5.5p when it announced an insulation project at Liverpool John Moores University. This uses the company’s insulation paint.

Marwyn Investment Management has decided not to invest£10m at 10.5p a share in Unbound Group (LON: UBG) and the share price has slumped by 55.2% to 3.25p. There is concern about the footwear retailer’s trading. Management says that it will require further covenant waivers from its funders. Options for raising cash are being considered.

Live Company Group (LON: LVCG) is selling two underperforming tours: Mythical Beasts and Outer Space. They will raise £350,000 in staged payments. The company is trying to replace the funding that Jason Lee did not come up with as promised. The share price decreased by 20.5% to 1.75p.

SkinBioTherapetics (LON: SBTX) is launching its AxisBiotix-Ps psoriasis in European markets, but sales are still slow to build up. There is positive news from partner Croda, which is putting further investment into commercialising SkinBiotix technology. M&A opportunities are still being assessed. The share price fell 8.63% to 15.875p.

Credit hire company Anexo (LON: ANX) reported flat 2022 pre-tax profit of £23.9m with housing disrepair work heling to improve revenues. There were additional costs for vehicle emissions litigation, which has some way to go before it is settled. A decline in pre-tax profit to £18.1m is forecast for 2023 as new credit hire business is reduced. That is to improve cash collection and reduce debt. The share price is 3.5% lower at 96.5p.

FTSE 100 briefly turns positive on softer US CPI

Highly anticipated US CPI released on Wednesday helped support equities and saw early FTSE 100 losses evaporate as the index turned briefly positive in afternoon trade.

US CPI for April was slightly less than expected at 4.9% compared to economists’ consensus of 5%. April consumer prices also marked a reduction in inflation from March’s 5% read.

Global equities popped higher on hopes the slower inflation rate could mean the Federal Reserve pauses rate hikes in the coming months.

“US CPI came in mostly as expected – although a touch softer at the margin. This should be supportive of equities and a slightly bearish USD for the trading session today as the market breathes a sigh of relief for now,” said Ryan Brandham, Head of Global Capital Markets, North America at Validus Risk Management.

London’s leading index had traded as low as 7,743 earlier in the session before rally to trade positive in the immediate reaction to US CPI. The FTSE 100 was down 13 points at the time of writing. Trade will likely be choppy for the rest of the session.

US stocks started the session on the front foot but gains faded as trade got underway.

With the US debt ceiling limit fast approaching, attention will likely turn to political wrangling in Washington and the prospect of the US government running out of money in early June.

Melrose

Melrose was the FTSE 100’s best performer at the time of writing adding nearly 5% following an upbeat trading update. After recently demerging their automotive unit, Melrose expects revenue for FY2023 between £3.35 billion and £3.45 billion. Adjusted EBITDA is expected to be between £495 million and £515 million.

Investors would have been pleased to hear the Melrose Chief Executive say he expects this to rise further in the coming years.

“Aerospace has huge embedded value and an EBITDA of £1 billion is achievable within the next few years, much of this coming from the premium Engines business,” said Simon Peckham, Chief Executive of Melrose Industries.

“With the new simplified strategy for Melrose announced today, we look forward to explaining the full potential of Aerospace at the upcoming Capital Markets Event next week, including the route to realising this value.”

Melrose’s optimistic forecast for their aerospace unit helped peer Roll Royce rise 2.5% in sympathy.

Admiral was the top faller after Peel Hunt analysts cut their price target from 2,150p to 2,130p.

The Top Five Trading Mistakes

Trading can create a whole host of feelings, from exhilaration to nervousness, and everything in between. Of course, when you start to win, it’s exciting. But when the pressure starts to build, it can get stressful. At all points in the journey, traders need to remember that as much as the wins may be on the horizon, there’s also the risk of losing it all.

From risking more than you can afford to acting on emotions, it’s easy to slip up – especially when you’re just starting out.

Here are five common mistakes to avoid as you navigate your first few months as a private investor or retail trader.

- Treating trading like gambling

New traders sometimes apply a gambling mindset to the markets – aiming to make quick cash with little strategy and lots of luck.

But effective trading is a skill to be honed over time. It requires discipline, a solid understanding of fundamental and technical analysis and a clear strategy. Treat your trading abilities as a muscle to strengthen through continued training.

- Starting out without practising

Don’t assume that you’ll succeed straight away. Trading takes time to get to grips with. It requires skill and practice to generate real returns.

Fortunately, there are lots of resources available online to help you develop these skills. We recommend practising on the demo version of online trading applications before you risk your money.

- Trading without a plan

To avoid impulsive or emotion-driven decision making, it’s essential to have a plan – including clear objectives, strong analysis, realistic profit and loss forecasts and reasonable time frames.

Take time to create a trading plan that is tailored to your unique trading style, risk tolerance, and financial goals. And remember to review and adjust it regularly to reflect changes in the market and your personal circumstances.

- Ignoring risk management

Many early traders get lost in the glory of their wins and forget to monitor the risks involved in each trade.

Remember to carefully examine your risk exposure and avoid excessive leverage when trading, continually measuring the profit and loss involved in each trade to ensure a potential reward justifies and outweighs the potential risk.

Also consider that many retail traders also like to diversify their trading, as having a range of instruments to trade means they can build portfolios that reflect their risk appetite and hedge against volatility.

Finally, you can mitigate the risk of losses with risk management techniques, for example, by using Guaranteed Stop Loss Orders which ensure your position is always closed at your pre-selected price.

- Letting your emotions take hold

Even once you’ve practised, developed a strategy and carefully analysed the performance of your early trades, it’s easy to let strong emotions such as excitement, fear and hope cloud your judgement, leading to impulsive trading decisions.

Avoid making decisions based on news or market noise; instead, trust your plan and focus on the fundamentals of the market. When pressure mounts and emotions run high, those who remain disciplined will reap the rewards.

Trading is a complex art – and it can take years to master. But by taking a disciplined and informed approach, as well as using a powerful platform, early traders can accelerate their development and improve their chances of success in the market.