Aquis weekly movers: Guanajuato Silver Company drilling results

Guanajuato Silver Company Ltd (LON: GSVR) was the best performer of the week with a 31.5% gain to 35.5p, which is its highest level since trading started on the Aquis Stock Exchange. The silver explorer announced positive drilling results at the San Ignacio mine Some of the drilling has encountered high grades. There could be a new area of thick mineralisation. This will help to extend the mine life.

Cannabis supplier Ananda Developments (LON: ANA) says preparations are underway for a medicinal cannabis flower processing facility. The MRX1 cannabidiol medical cannabis oil will be launched commercially in June and it may be used in two randomised controlled trials. The share price is 30.6% ahead at 0.64p.

NFT Investment (LON: NFT) has announced a general meeting on 26 May to gain shareholder approval for a proposed tender offer by April 2024. The tender will be for up to 857.1 million shares and the price will be the greater of 3.5p a share or NAV for each share. The share price is 23.3% higher at 1.85p.

Invinity Energy Systems (LON: IES) has been awarded an £11m grant from the UK government under phase 2 of the Longer Duration Storage Demonstration competition. This will deploy a 30MWh vanadium flow battery. The share price is 18.8% higher at 41p.

The Gunsynd (LON: GUN) share price improved by 14.3% to 0.4p on the back of limited share trading. Investee company Omega Oil and Gas (ASX: OMA) says initial results from the Canyon-2 well in Queensland have exceeded expectations.

Cadence Minerals (LON: KDNC) investee company Evergreen Lithium joined the ASX on 11 September. Cadence Minerals, whose share price is 6.96% higher at 10.375p, has 8.74% stake in Evergreen Lithium and the share price nearly doubled to A$0.57 during the week.

After the market closed on Friday Arbuthnot Banking (LON: ARBB) announced a £12m share issue at 925p a share. Prior to that the share price had risen by 0.3% to 965p. Chairman and chief executive Henry Angest will invest £6.75m of that money. The cash will be used to grow the loan book.

==========

Fallers

Marula Mining (LON: MARU) has entered into commercial agreements for its investments in Tanzania projects. Takela Mining is the partner for the Nyorinyori and Bagamoyo graphite projects and Kusini Gateway Industrial Park Ltd for the Bagamoyo graphite project. The share price fell 10.8% to 11.375p.

Shareholders in Apollon Formularies (LON: APOL) have agreed to the disposal of selling IP assets to Canada-listed Global Hemp Group for $250,000 in cash and 10 million shares in the acquiror at C$0.015 each, as well as a new investing strategy. Global Hemp is continuing its due diligence. The share price declined by 9.76% to 0.185p.

EPE Special Opportunities (LON: EO.P) had an NAV of 309.57p a share at the end of March 2023. The share price slipped 5.88% to 160p.

AIM weekly movers: Spectral MD Nasdaq reversal

Spectral MD (LON: SMD) reached its highest level for more than 18 months following the news that it is merging with Nasdaq-listed SPAC Rosecliff Acquisition Corp 1. The share price is 57.1% higher at 44p. The deal values Spectral MD at $170m, or 101p a share. In June 2021, the AIM flotation price was 59p. The AIM quotation will be cancelled. There is likely to be a $15m placing. This will provide additional cash to finance the commercialisation of the DeepView woundcare analysis technology. The transaction should complete in the third quarter.

Kodal Minerals (LON: KOD) has risen 55.9% to 0.795p on the week following the announcement that Hainan Mining has received approvals from the Chinese authorities for its proposed £82m funding package for the Bougouni lithium project in Mali and the £14.6m share subscription in Kodal Mining. A $7m deposit has already been achieved. This is the highest the share price has been since 2014.

Immupharma (LON: IMM) will hold a meeting with the FDA in the US concerning a phase 2/3 trial study protocol on 16 May. The protocol is for P140 in chronic idiopathic demyelinating polyneuropathy. This is a rare autoimmune disorder affecting around 50,000 individuals in the UK and Europe. The share price moved up by 51.5% to 2.95p.

Ocean Harvest Technology (LON: OHT) continued its share price rise following last week’s placing that raised £6m, or £4.5m after expenses, at 16p. This week the share price rose 37.3% to 24.2p, even though Terence Butler Holdings sold one million shares at 22.97p each. Ocean Harvest Technology produces ingredients for animal feed using seaweed under the OceanFeed brand name. Its main facility is in Vietnam.

==========

Fallers

Circle Property (LON: CRC) shares have gone ex-entitlement for the £16.1m return of capital. That is equivalent to 55p a share. The share price is 63.6% lower at 20p. Once the remaining property sales are completed there will be another pay out.

In-content advertising technology company Mirriad Advertising (LON: MIRI) admits that there is not ging to be a bid. The share price has slumped 42.2% to 0.94p. There was £7.5m in the bank at the end of March. Management is seeking a source of more funding, but there is no certainty that more cash will be secured. Mirriad is partnering with broadband and video delivery services provider Harmonic Inc to help broadcasters to target audiences.

Shares in Beacon Energy (LON: BCE) have been readmitted following the acquisition of Rhein Petroleum. This brings with a producing oilfield with potential production of up to 4,000 barrels of oil per day in the coming years. Beacon Energy has certified 2P net reserves of 3.85mmbbl across four assets in Germany. The share price dropped 34.3% to 0.115p.

Kibo Energy (LON: KIBO) is repricing 1.13 billion warrants to 0.1p, the loan notes will be convertible at 0.14p a share and the bridge loan has been amended to a 24-month loan. For each warrant exercised before the end of June 2023, there will be one incentive warrant issued that is exercisable at 0.25p. This could help to fund the spinning-out of Ultimate Sustainable Energy as a separate AIM company. The share price has fallen 28.2% to 0.07p.

FTSE 100 touches 7,900 as US banks impress

The FTSE 100 added to a consistent week of gains as the index briefly touched 7,900 on Friday following the release of US retail sales data and upbeat US banking earnings.

The FTSE 100 was trading at 7,896 at the time of writing.

Strong results from US banks helped lift sentiment early on Friday, with Citigroup, Wells Fargo and JP Morgan all beating analyst estimates. JP Morgan shares rose over 7%.

However, shortly before the US open, mixed US retail sales data sapped some enthusiasm from investors and again raised questions about the underlying health of the US economy.

“Headline numbers were weaker than expected, coming in 1% down MoM and continuing the recent market theme of softening US data. Excluding autos, gas and the control group, the numbers were stronger than expected, which may cloud the market reaction and potential positioning squaring into the weekend by market participants,” said Ryan Brandham, Head of Global Capital Markets, North America at Validus Risk Management.

In a sign of underlying interest for stocks, the S&P 500 rebounded quickly from a lower open and was closing in on the highest levels since August.

UK banks

The plethora of upbeat earnings results from US banks sparked a rally in FTSE 100 banks on hopes US strength would be evident in the next round of updates from UK counterparts.

Standard Chartered was the FTSE 100’s top riser with a 4% gain. HSBC and Barclays were not far behind, adding 3.8% and 3.2%, respectively.

Barclays shares are now only about 10% away from recovering all losses incurred since the beginning of the SVB saga. Standard Chartered – the heaviest hit FTSE 100 bank during the mini-crisis – needs around a 25% rally.

The necessity of big oil in the transition to net zero

John Bennett, Portfolio Manager of the Henderson European Focus Trust explains why big oil companies are essential for an orderly transition to a low carbon economy.

It is a simple fact that society cannot go cold turkey on hydrocarbons, as much as the more extreme ends of the green lobby would like to believe. While we agree with the sentiment behind ‘Stop Oil’, any attempt to do this must happen in an orderly fashion that takes society with it. Such a journey will take time. The oil & gas industry has in place the infrastructure, technology, cash flow and ability to fund new investment, which makes the industry essential for change to happen.

Big oil sets ambitious climate targets

In recent years big oil has aggressively pivoted to align corporate strategy to a net zero world, setting increasingly ambitious emissions targets; yet as recently as 2019, none of the three largest European oil majors had set a 2030 emissions target. We should note, however, that these targets are not set in stone. Rather, they are likely to shift as the realities of achieving an ‘orderly’ transition sets in. This was most recently the case in February when BP moderated its climate targets to meet immediate energy requirements in response to limited supply from Russia. It would not surprise us to see other oil majors scale up and down the intensity of their climate targets as required. Disclosure and consistency (different base years for example) will also remain a challenge for comparing ambitions. Regardless, the direction for oil companies is clear.

Oil & gas companies environmental targets tend to come in two forms:

- absolute carbon emissions targets (in MtCO2e) using Scope 1, 2 &/or 3; and

- carbon intensity targets of products (in gCO2e/MJ) which considers the company’s absolute carbon emissions emitted per MJ of energy provided from its defined products.

Scope 1 emissions are generated directly through a company’s own operations. For oil firms, the main ways to reduce these emissions involve reducing flaring (capturing excess gas rather than burning it or simply managing the oil field more efficiently) and exiting from carbon-intensive projects. Scope 2 emissions include those indirectly produced from power consumption. In this case, many oil companies are using electricity provided from low carbon sources, fuel switching, recycling heat and increasing energy efficiency.

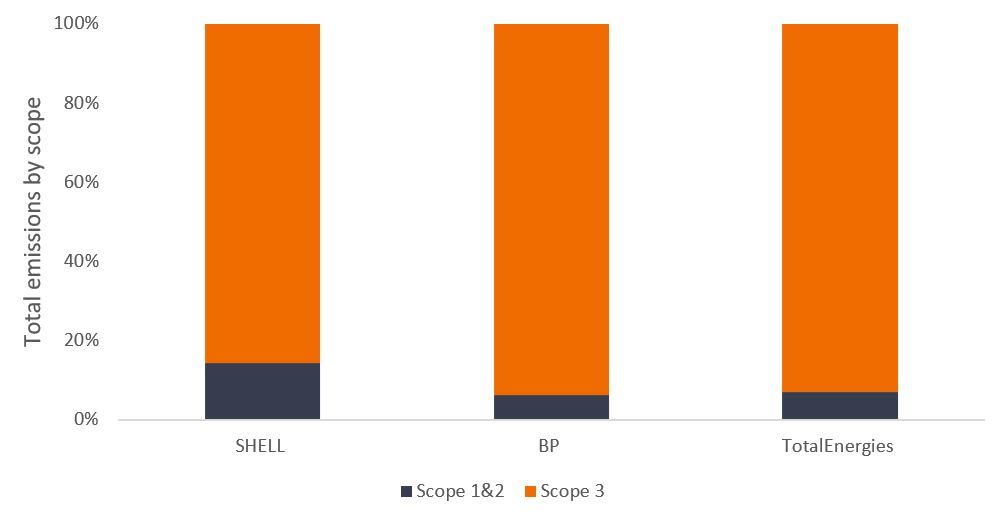

Focusing on emissions reduction from the companies’ own operations is usually considered the easiest win and it is therefore these first two scopes that we have seen the most aggressive targets. By 2030, Shell and BP have targeted a 50% reduction in scope 1 and 2 emissions, and TotalEnergies a 40% reduction.1 However, while these emission reductions should be material by 2030, they are somewhat limited and comprise a relatively small portion of overall emissions– chart 1.

Scope 3 emissions are those associated with the consumption of products sold. These represent the vast majority of ‘well to wheel’ emissions and are those where a longer transition is required. By their nature, scope 3 reduction targets are more difficult to control and therefore make up a much smaller portion of overall reduction targets.

Chart 1: Scope 3 emissions versus scope 1 & 2 for big oil

As is the case for many sectors, the method to calculate scope 3 emissions is not consistent across the oil & gas industry. Regardless of the exact methodology, we know that scope 3 represents a significant portion of emissions and is therefore key to long term decarbonisation.

The driver of scope 3 emission reductions lies in the company’s sales and production mix. The main ways for oil companies to reduce scope 3 emissions include:

- shifting production from oil to gas (liquified natural gas releases approximately 20-25% less emissions than traditional fossil fuels)

- expanding downstream integration in gas (with production refining, retail marketing and power supplied from gas)

- increasing sales of biofuels and carbon capture

- natural sinks to reduce net emissions

- replacing fossil fuel sales with renewables

Renewables roll out

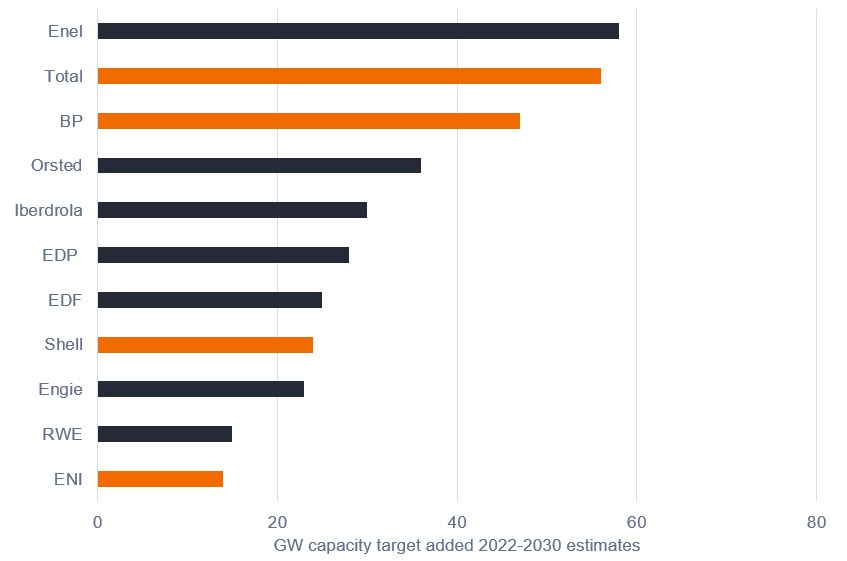

The scale and commitment of energy companies to increase solar and wind in their production mix often gets overlooked due to its low base versus traditional fuels. However, in absolute terms the shifts are far more dramatic.

In 2022, Shell, Total Energies and BP had a combined low-carbon capital expenditure (capex) in the region of $9bn, and these numbers are set to grow, with targets of 20-50% capex by 2025/2030.2 This expenditure translates to the oil majors having some of the largest renewable energy growth plans in Europe; chart 2 shows big oil growth plans compared to the incumbent developers, utilities.

Chart 2: European players have big growth plans

In addition, these companies have become disciplined when it comes to exploring/extracting for new oil projects which will see the percentage of renewables increase in the mix even further. To supplement this renewable-led electrification of our energy supply we are also seeing companies with large retail networks committing to charging point roll outs – Shell targets 2.5m by 2030 aiding the demand side of the equation as well as the supply side.3

Solutions for hard-to-abate sectors

While electrification is often touted as the main solution to reduce dependence on hydrocarbons, the energy density of electricity is far less than hydrocarbons which could prove troublesome in some instances. Currently, the battery size required for a plane to reach take-off speed would hinder the ability to take off at all. Other hard-to-abate sectors alongside aviation include steel, shipping, cement and similar chemical processes. The solutions, some of which are noted below, also look likely to heavily involve the oil majors.

- Carbon Capture, Utilisation and Storage (CCUS) involves the capture of CO2 from large point sources that release emissions – such as power generation, oil wells or industrial facilities – and has been used by energy companies for many years to reduce their own emissions. CCUS can also capture CO2 directly from the atmosphere. If not utilised on-site, captured CO2 is compressed and transported to be used in a range of applications or injected into deep geological formations which trap the CO2 for permanent storage. Until recently, this process was considered a cost of doing business. Many oil majors are now looking to increase their CCUS capabilities to start selling the service externally by charging per tonne of CO2 captured for external carbon emitters. Given their history in this area, oil companies are uniquely positioned for this opportunity.

- Biofuels are created using an organic material (‘feedstock’), typically blended with traditional diesel/aviation fuel. While these fuels still release emissions on combustion, they are considered sustainable because of the carbon captured during the growth of the organic material. Although biofuels might not be the ultimate solution, they could certainly be part of the transition, especially as the primary feedstocks (sugar-starch crops and oils from rapeseed or palm oil) can put the process at odds with food security. Other feedstocks being explored include agricultural waste (cow manure) and sea algae. Both European pulp and paper company UPM and Neste have been pioneering technology in this area, but it is also a significant element of the oil majors transition strategies.

- Hydrogen could be considered the ultimate solution. Green hydrogen (produced using purely renewable energy and electrolysis) has no emissions at point of use and can be stored for long periods and transported large distances compared to electricity. The main problem is that much of the existing property, plant, equipment and devices for hydrogen production are currently running on fossil fuels and will need to be completely replaced. Again, oil companies’ experience in the operation of upstream and midstream infrastructure necessary to deliver a gas to market will be vital in this transition.

For us, how these processes can interact in tandem is where the scale of the oil majors shows their benefit. Through their trading businesses, oil firms could be a one-stop shop for a company’s energy needs – working with them to reach the best combination to meet their specific energy needs.

Conclusion

The complexity of the carbon chain in society means that the transition to lower carbon solutions cannot happen overnight. The good news is that the technology is either ready (the cost of wind and solar is competitive with traditional fuels) or fast approaching (hydrogen and biofuels). Oil majors are committing huge amounts of capital to aide this shift, thus far in a way that largely aligns all stakeholders. Ultimately, these companies are fast moving from being major oil companies to integrated energy companies with whom the energy transition is totally reliant. We prefer those names that exhibit strong capital discipline whilst showing a strong commitment to a transformational shift within their businesses.

Important Information

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe, or purchase. Holdings are subject to change without notice.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. [We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.]

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

European Equity Opportunities in Q2 with Morningstar’s Michael Field

The UK Investor Magazine Podcast was thrilled to welcome Michael Field, CFA, European Market Strategist at Morningstar.

We take a deep dive into the European equity market and explore the opportunities identified by Michael Field’s European equity team.

Get Morningstar’s European Outlook for Q2 2023

Our conversation starts with the key macro considerations before progressing to individual sectors identified as presenting value.

Michael outlines the opportunity in the energy sector and how energy majors could benefit from the energy transition.

Advert:

Fully regulated, OANDA offers competitive spreads on a wide range of CFD markets, including indices, forex, commodities, metals, and bonds.

Voted “Most Popular Broker” by TradingView in 2022, 2021, and 2020.

Trade with OANDA and get access to one year’s subscription to TradingView Pro.*

*Get TradingView Pro for 1 year when you start trading with OANDA and meet the minimum volume requirements.

Disclaimer:

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AIM movers: Director buying at Bradda Head and Circle Property return of cash

Bradda Head Lithium (LON: BHL) director Jim Mellon acquired eight million shares at 4.5p each, taking his stake to 18.7%. The share price increased 28.9% to 6.25p. The lithium explorer has acquired three additional inlier lode claims in Arizona.

Spectral MD (LON: SMD) reached its highest level since 2021 following announcement earlier this week that it is merging with Nasdaq-listed SPAC Rosecliff Acquisition Corp 1. The share price is 22.2% higher at 44p. The deal values Spectral MD at $170m, or 101p a share. The AIM quotation will be cancelled. There is likely to be a $15m placing. This will provide additional cash to finance the commercialisation of the DeepView woundcare analysis technology. The transaction should complete in the third quarter.

Kodal Minerals (LON: KOD) has risen a further 15.5 % to 0.79p following yesterday’s announcement that Hainan Mining has received approvals from the Chinese authorities for its proposed £82m funding package for the Bougouni lithium project in Mali and £14.6m share subscription in Kodal Mining. A $7m deposit has already been achieved. This is the highest the share price has been since 2014.

One trade worth £6,000 has pushed up the Gunsynd (LON: GUN) share price by 9.59% to 0.4p. Investee company Omega Oil and Gas (ASX: OMA) says initial results from the Canyon-2 well in Queensland have exceeded expectations.

Circle Property (LON: CRC) shares have gone ex-entitlement for the £16.1m return of capital. That is equivalent to 55p a share. The share price is 32.5p lower at 22.5p.

In-content advertising technology company Mirriad Advertising (LON: MIRI) says that there is no prospect of a bid. The share price has slumped 34.5% to 0.95p. There was £7.5m in the bank at the end of March. Management is seeking a source of more funding, but there is no certainty that more cash will be secured. Mirriad is partnering with broadband and video delivery services provider Harmonic Inc to help broadcasters to target audiences.

Van Elle (LON: VANL) says that 2022-23 results will be in line with previously upgraded expectations. However, next year’s forecast is being downgraded. The ground engineering contractor says the construction sector has been slowing down and there are continuing supply issues. The 2022-23 pre-tax profit forecast is £5.2m, while the 2023-24 forecast has been cut from £6m to £5m. The share price has fallen 10% to 45p.

Superdry – founder Julian Dunkerton confidently ready to pump more funds into his recovering style brand, while shares fall 18%

Although it is showing good retail sales growth, it is at a slower than hoped-for rate.

The iconic style brand Superdry (LON:SDRY) is battling away at its turnaround plan, while also looking to strengthen its balance sheet, so a round of fresh financing is being considered.

Operating in over 50 countries globally, the group has 219 physical stores and around 450 franchisees and licensees.

Through its distinct collections, defined by consumer style choices, the company considers that Its mission is to be the Number 1 sustainable style destination.

It designs affordable, premium quality clothing, accessories and footwear which are sold around the world.

The company has a clear strategy for delivering continued growth via a multi-channel approach combining stores, e-commerce, and wholesale.

After Christmas showing strong demand

In January the group stated that its brand recovery was back on track with strong demand in the pre-Christmas weeks at its stores, however its wholesaling side was some 5.2% weaker.

Against that it had to contend with expected macroeconomic hassles and founder and CEO Julian Dunkerton stated that he did not expect market conditions to become easier any time soon, even so he approached the year ahead with optimism.

South-Korea deal for cash

Well, that was in late January – since when the group has sorted out its financing pressures and arranged a $50m (£34m) deal out in Asia for the sale of the group’s intellectual property in the APAC region.

The net proceeds from the Sale will be used to increase the strength of the company’s balance sheet, boost liquidity, and fund its ongoing working capital requirements, including the implementation of a significant cost reduction programme.

The recovery plan is still underway

The late March announced deal mentioned that the company is also considering additional steps to further strengthen its balance sheet in connection with its turnaround programme, which is being delivered in a challenging market, which could include a potential equity issue.

In its latest Trading Statement, the group is now looking for its current year revenue to be in the range of £615m to £635m, up slightly from last year’s £609m and accordingly it has withdrawn its profit guidance to the market from previously expecting a ‘broadly break-even’ result.

Founder ready to pump in more cash

It states that there are more savings to be put into operation, while it is considering an equity raise of up to 20% in new capital.

Dunkerton has declared that he has confidence in the prospects for Superdry and that he will fully support and materially participate in such an equity issue.

“The Superdry brand continues to evolve but there is no doubt that the market conditions we face are challenging, compounded by the issues we have previously disclosed and are working to address in Wholesale. As a result, while we continue to deliver like-for-like growth in retail sales, we need to ensure our business is in the right shape to navigate these difficult times, which is why we are looking hard at our cost base.”

Analyst Opinion – a Buy worth 250p a share

Analyst Wayne Brown at Liberum Capital still rates the shares as a Buy but has halved his Target Price for the group’s shares from 500p down to just 250p – which is still significantly higher than the pre-statement price of 106.8p at which the company was capitalised at £87m.

His pre-tax expectation for the April year-end is for £614m sales and a loss of £12.0m (£21.9m profit).

For the coming year Brown is hopeful for some £622m of turnover and a bounce back to £20.3m profits, worth 18.9p per share in earnings.

Jumping forward the retail sector specialist estimates £645m sales, £43.3m profits and 40.3p of earnings per share, hence his Target Price aim.

The group’s shares fell 18% on the news to 86p.

FTSE 100 flat as UK economy stalls, housebuilders upgraded

The FTSE 100 reflected an indecision in markets on Thursday as the UK economy flatlined in February and investors digested the latest Federal Reserve minutes.

The FTSE 100 edged up just 0.2% points to 7,843 at the time of writing on Thursday. Tesco rose after releasing preliminary results, and housebuilders enjoyed broker upgrades.

From a macro perspective, investors were mulling over insights from the Federal Reserve and attempting to predict the next move in interest rates.

UK growth was dead flat in February, so the UK looks set to avoid recession in the near term – but its hardly an environment conducive to igniting animal spirits.

Inflation and rates considerations

US CPI inflation data yesterday was quickly followed by Federal Reserve minutes that provided little certainty to markets about the next move in interest rates.

“Minutes from the latest FOMC meeting didn’t signal a clear intention by the Federal Reserve to immediately stop hiking its key rate further or to lower it by the end of the year, despite acknowledging a material tightening of financial conditions,” said George Lagarias, Chief Economist at Mazars.

Lagarias continued to explain that while there wasn’t a clear path ahead, there was a general feeling we were nearing the end of the hiking cycle.

“However, we don’t think there’s a basis for immediate investor disappointment. Some policymakers are having second thoughts about further hikes, and we appear to be very close to the end of this rate hike cycle. One or two more rate hikes will not make a significant difference at this point,” Lagarias said.

The S&P 500 closed down 0.4% overnight and looked set to open modestly higher on Thursday.

In addition to concerns around central banks, investors will also be weighing the possibility of a US recession.

“The sceptre of recession in the world’s largest economy continues to loom in the near distance and could cloud sentiment for some time,” said AJ Bell investment director Russ Mould.

Tesco

Tesco’s preliminary results reflected the dour mood around the UK economy currently. Tesco’s revenue grew less than market expectations, and profit before tax halved compared to a year ago.

However, the reaction in Tesco shares suggested some investor saw a light at the end of the tunnel.

Housebuilders rose after HSBC analysts issued upgrades across the sector.

Of the FTSE 100 housebuilders, HSBC upgraded Persimmon to a ‘buy’ from hold with a 1,550p price target, Barratt Developments to a ‘buy’ from hold with a 570p price target, and Taylor Wimpey to a ‘buy’ from hold with a 150p price target.

HSBC raised Berkeley Group to ‘hold’ from reduce and issued a 4,000p price target.