by Alex Crooke, Head of Equities – EMEA and Asia Pacific | Portfolio Manager

With western developed markets still mired in high inflation and economic uncertainty, Asia offers a brighter prospect for investors. The reopening of China and strength of south Asian economies makes BNKR, with its solid position in the region, an attractive proposition.

Nowhere to hide

Surging inflation, high interest rates and a slowdown in global growth meant that overall, performance in 2022 was disappointing for investors across the board. In every region, financial markets posted steep losses, with many registering the worst performance since the 2008 downturn. Little could be done to mitigate the influences of international events, including the fallout from the pandemic, and food and energy supply imbalances caused by war in Ukraine. Short of investing exclusively in energy companies, there were no fool-proof strategies available to insulate investors from poor market performance.

The Bankers Investment Trust (BNKR) was no exception and performance reflected these uncertain markets. The NAV total return was down 11.3%, underperforming the FTSE World Index on a relative basis. A key part of this underperformance can be attributed to weakness in Asian markets, as Covid continued to affect trade and travel. However, with Asian economies looking buoyant following China’s faster-than-expected reopening, is BNKRs now positioned to capture the upside?

What will the year of the rabbit bring?

To answer this question, the first place to look is China, the second biggest economy in the world. It has been the biggest contributor to global GDP growth since the financial crisis and between 2010 and 2020, the country’s economy grew by $11.6trn.i According to the International Monetary Fund (IMF), the Chinese economy is forecast to grow by roughly 5.2% in 2023, versus 3.0% last year.ii Much of this growth is going to be driven by the release of pent-up consumer demand among a Chinese middle class sitting on record-high domestic savings, accrued during extended periods of lockdown.

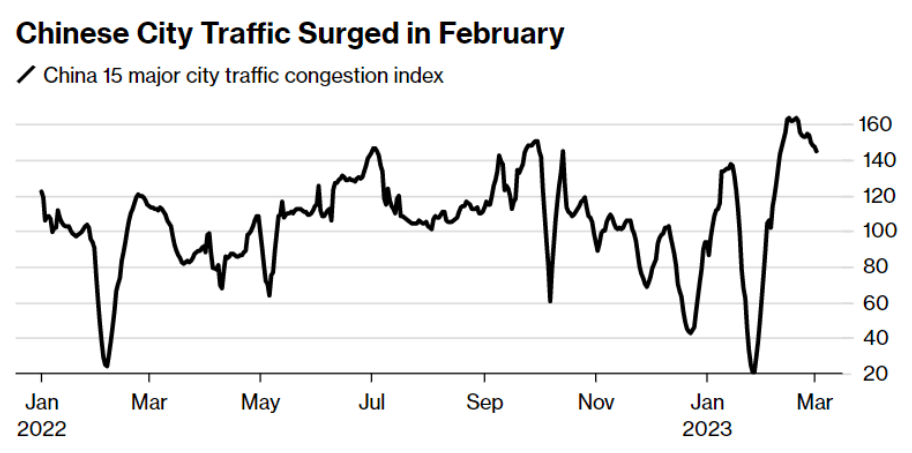

As activity picks up, sectors likely to benefit are those reliant on consumption and mobility. In fact, consumption has already rebounded strongly, with retail sales rising by 3.5% year-on-year in the first two months of 2023.iii There has also been an uptick in domestic travel and hotel revenues have also increased by around 20% compared to 2022. The latest spending patterns suggest that Chinese consumers are generally engaging in travel closer to home and are more focused on domestic consumption.

Note: January 2021 congestion = 100

These trends bode well for our positions in China, including leading food producers ChaCha Food and Inner Mongolia and beverage companies Kweichow Moutai and Wuliangye Yibin. The uptick in domestic travel should also serve as a tailwind to China Tourism Group, which provides tourism, hotel, scenic passenger transport and other travel-related services domestically and across the Asia Pacific region. Our holdings in Sungrow Power, a solar power inverter maker and EV battery producers Contemporary Amperex Technology and Yunnan Energy New Material, reflect our longer-term belief these companies will have a role to play in China’s transition towards a cleaner, more sustainable economy.

Strength is building across Asia

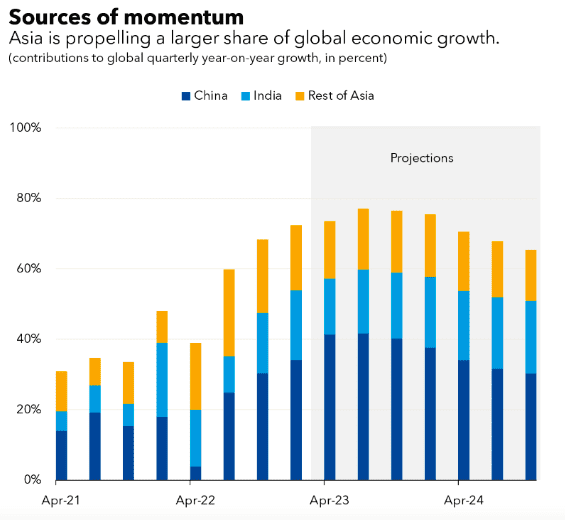

China’s reopening and growth will also be good news for the Asia Pacific region, as its consumer wealth and exports will flow outwards into the wider Asian market. Currently the most dynamic of the world’s economic regions, in February the IMF described Asia as a “bright spot in a slowing global economy”, with growth set to hit 4.7% this year.iv

There is no guarantee that past trends will continue, or forecasts will be realised

Generally, Asian economies are not suffering from the malaise of high inflation to the same extent as the West. As a result, interest rates have not risen as high to counter inflation. This combination of lower inflation and lower rates means that consumers are not under the same cost pressures to tighten their belts. Add to this a drop in oil and food prices, and there are better prospects for spending.

South Asia fared better than the region’s more northerly countries during 2022, and we expect to see further growth throughout 2023 in commodity-heavy economies such as Malaysia, where the outlook is based on resilient domestic demand and contained inflation. In Indonesia, foreign investment and favourable commodity prices are helping to support the economy. Meanwhile, Thailand has seen its most profitable sector – tourism – bounce back, with an estimated 25 million visitors forecast for 2023, more than double its 2022 haul.v

A reversal in fortunes for BNKRs

Global diversification is valuable during periods of uncertainty, acting as an insurance policy against poor market performance in any one region. It allows us to take advantage of the different regional dynamics at play. While our positioning in Asia detracted last year, due to short-term market drivers (the Covid-19 pandemic and supply chain disruptions), the longer-term thesis still holds. The rise of the middle class in Asia will continue to increase, Asian economies are shifting from production to consumption, and the region will be instrumental in the shift towards a cleaner global economy.

With a particular focus on cash generation and dividend growth over the medium term, our regional investment specialists take an agile approach to stock picking, based on their local market expertise. This allows us to find businesses that will not only perform well in normal market conditions but will also be resilient during difficult periods and come out of the other side. As the short-term noise/disruptions subside, we believe the regional trends and dynamics that are tied into the medium-and-long term structural growth drivers will come back into the fore. As such, BNKRs is well placed to capitalise on these trends. Following 56 years of dividend increases, we are confident that we will continue to deliver strong long-term performance.

Sources

i Source: The implications of China’s mid-income trap | Financial Times (ft.com)

ii Source : https://www.imf.org/en/News/Articles/2023/02/02/cf-chinas-economy-is-rebounding-but-reforms-are-still-needed

iii Source: https://www.ft.com/content/a67c7717-c117-4778-b2f3-324d1c9fdd11

v Source: https://www.bbc.co.uk/news/business-64369279

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

IMPORTANT INFORMATION

Please read the following important information regarding funds related to this article.

Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions.

- Global portfolios may include some exposure to Emerging Markets, which tend to be less stable than more established markets. These markets can be affected by local political and economic conditions as well as variances in the reliability of trading systems, buying and selling practices and financial reporting standards.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company’s shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company’s assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- Using derivatives exposes the Company to risks different from – and potentially greater than – the risks associated with investing directly in securities. It may therefore result in additional loss, which could be significantly greater than the cost of the derivative.

- All or part of the Company’s management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.