The RUA Life Sciences (LON: RUA) share price has perked up following its interim results. Revenues grew by two-thirds to £917,000 and the medical devices developer had net cash of £2.51m at the end of September 2022. Preparations are underway for clinical trial for large bore vascular grafts and a decision on which prototype aortic heart valve is better should be made soon. The share price has risen 21.2% to 40p, which is the highest it has been for two months.

Velocys (LON: VLS) has been awarded two UK government grants. The larger one is a £27m grant for the Altato sustainable aviation fuel project in Immingham. This is being developed in partnership with BA. Velocys has to obtain matching funding from the private sector. Velocys will contribute up to £8m. A further £2.5m grant is for a new e-fuels project to make aviation fuel from carbon dioxide and hydrogen. The share price is 17.1% higher at 5.15p.

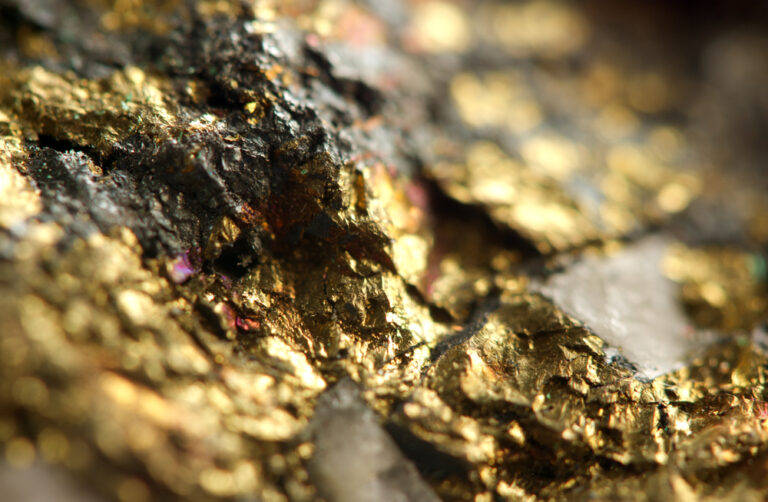

Oriole Resources (LON: ORR) has published a maiden JORC resource for the Bibemi gold project in Cameroon. The pit-constrained resource is estimated to be 4.3 million tonnes grading 2.19/t gold equating to 305,000 ounces. There could be up to 148,000 of additional gold in other resource blocks. The share price moved 13.6% ahead at 0.125p.

Artemis Resources (LON: ARV) says that drilling at the Paterson Central project in Western Australia reveals that the Apollo copper gold target is one part of a 1.5km magnetic regional anomaly. It is a similar structure to the nearby Havieron deposit. The share price rose 8.62% to 1.575p.

Engage XR (LON: EXR) warns that the fourth quarter has been slower than expected and 2022 revenues will be below €4m, rather than the previously forecast €4.9m. The extended reality technology developer says customers have delayed contract decisions. Net cash should be €1.9m at the end of 2022. Cost savings are being considered. The share price divided 44.2% on the news.

Capital Metals (LON: CMET) shares slumped by 42.1% to 2.75p following the receipt of a notice from the Sri Lanka Geological Surveys and Mines Bureau (GSMB) concerning the Eastern Minerals project. This notice concerns the ownership structure of the mineral sands project, which has not obtained approval from the authorities. That means the mining licences have been temporarily suspended. Changes to the GSMB management could delay the resolution of this problem.

Weak buyer confidence has prompted housebuilder Springfield Properties (LON: SPR) to temper its expectations for 2022-23 and next year. Revenues will still grow, helped by the recent acquisition, but increasing building costs will hit margins. The six months to November 2022 will not be as affected, but it will show through in the second half. The full year pre-tax profit forecast has been cut from £27.5m to £17m and the expected dividend has been reduced to 4.6p a share, down from 6.2p a share. The share price is 14.4% lower at 77p.

Poolbeg Pharma (LON: POLB) says that initial data from the 36 volunteer phase 1b challenge study with potential flu treatment POLB001 shows it is safe and well tolerated. Efficacy data should be available in the middle of 2023. Partnership discussions are ongoing. Even so, the share price fell 6.92% to 7.4p.