FTSE 100 gains in risk-on rally as US inflation falls

The global economy has received the welcome news the rate of inflation in the US has again slowed and raised hopes major central banks could be nearing the end of drastically sharp increases in interest rates.

The downside surprise in US CPI will add to the argument inflation is cooling and provide justification for easier monetary policy.

The FTSE 100 jumped above 7,500 as US CPI in November came in at 7.1% versus expectations of 7.3%. US futures surged and European stocks also added to gains in a sharp risk-on rally. S&P 500 futures were 3.1% higher at the time of writing.

The Federal Reserve are meeting to decide on interest rates with a decision due tomorrow evening. This reading is unlikely to impact tomorrow’s announcement. However, the chair’s press conference will be closely watched for any hints of a change in the trajectory of rates in 2023.

The Bank of England and ECB will release their interest rate decisions on Thursday.

FTSE 100 consumer stocks

The FTSE 100 consumer constituents dominated the top gainers on Tuesday as investors hoped the dynamics of the US economy would soon be seen in the UK.

Although the US economy’s composition and factors influencing inflation are very different to the UK, any sign of slowing inflation and better conditions for consumers has been jumped on by traders.

Ocado was the FTSE 100’s top gainer, adding 10%, while JD Sports, Next and Kingfisher all posted respectable gains.

Wealth management stocks were higher on hopes savers would soon be able to despot more in their investment accounts. Hargreaves Lansdown shares gained 5.6% and St James’s Place added 4%.

The FTSE 100’s rally was broad with only 13 of the 100 constituents trading negatively at the time of writing.

Can Greatland Gold shares recover in 2023?

Greatland Gold shareholders will be frustrated by the company’s performance in 2022. The company has announced a series of positive updates on the Havieron gold project, only for the Greatland Gold share price to continue to fall.

The most recent announcement 8th December was arguably positive, but GGP shares were met with selling.

Greatland said good progress was made with evaluating the resource to support further resource expansion. For a long-term holder, this is undoubtedly welcome news. However, short-term traders were evidently perturbed by comments feasibility studies would continue well beyond the end of the year.

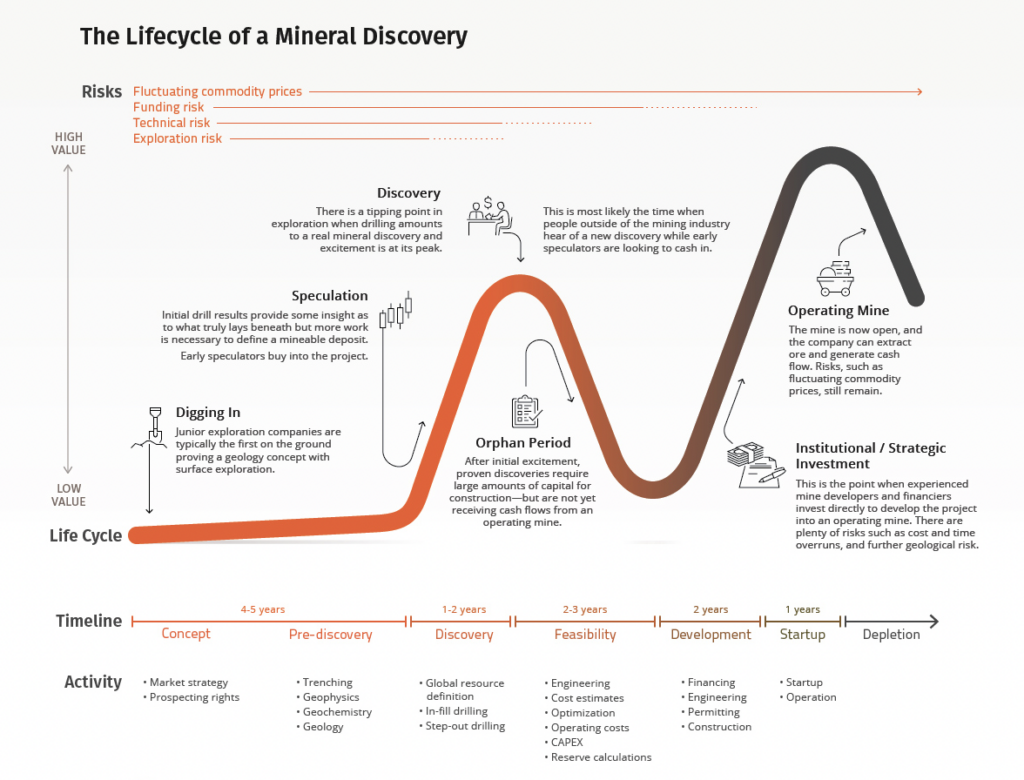

Any disappointment with Greatland Gold is a disconnect between investor’s expectations and the realities of mineral exploration.

Many traders would have bought into Greatland Gold on the high-grade discovery at the Havieron project in 2020, most probably hoping for a quick buck. Many would have achieved this, but many have found their short-term trade has turned into a long-term hold.

Greatland Gold shares are down 50% in 2022 and are over 75% lower than all-time highs.

As illustrated by the below graphic by the Visual Capitalist, some traders would have acquired shares at the beginning of the ‘orphan’ stage of the lifecycle. When these short-term traders grow impatient with ‘slow’ progress they sell shares and create an overhang that leads to a period such as Greatland has experienced this year.

Greatland Gold’s exact stage of the lifecycle is subjective, but the speculative rally is well a truly in the rearview mirror.

Quick gains can be made in mining shares such as Greatland Gold. However, this is usually the result of a speculative strategy that will ultimately produce more losers than winners.

Investors that understand the mineral resource lifecycle will now know Greatland Gold shares could face further downside in the immediate future and the real value will not be achieved in the next 12 months.

Greatland Gold have proven reserves through their 30% stake in Havieron. They are now conducting feasibility studies that will take time to complete. Whether Greatland Gold shares recover in 2023 will be dependant on the timing of feasibility studies and patience of investors.

The completion of feasibility studies will ultimately open the doors to mine construction. The Havieron project has already secured financing, a major feat paying testament to the strength of the resource. Despite having financing in place, production is still some time off.

There is inherent value in the Havieron project and the biggest uncertainty is when this value will be unlocked for Greatland Gold shareholders.

AIM movers: Blackbird partnership paying off and PCF departing

Blackbird (LON: BIRD) has revealed that its major partner is EVS Broadcast Equipment, which has already announced a $50m, ten-year deal with a US broadcaster that includes Blackbird’s video editing technology. The Belgium-based live video technology developer has a strong market position in sport and news and Blackbird completed the development and integration of its technology with EVS earlier this year. The first deal provides Blackbird with a per-seat user licence fee, as well as maintenance and support revenues. Similar deals are likely to be secured in the coming years. The share price rose 10.9% to 12.75p.

Invinity Energy Systems (LON: IES) is selling a 1.5MWh vanadium flow battery to partner Hyosung Heavy Industries and this system will be evaluated by Korea Electric Power Corporation. If the test is successful, then the battery system will be qualified for use in grid scale projects in South Korea. There will be an advanced payment in 2022 and the rest of the revenues will be in 2023. This is the latest deal in Asia. The share price increased by 20.9% to 55p, which is more than double the level at the start of the month.

Data analysis software provider WANdisco (LON: WAND) has announced a third deal with a large European automotive supplier. This is worth $13.2m, taking the total value of contracts to $25.3m. The original contract was to replicate automobile sensor data and the requirements are increasing. The share price improved by 8.01% to 688p.

Touch sensors supplier Zytronic (LON: ZYT) improved full year revenues from £11.7m to £12.3m, while pre-tax profit increased from £453,000 to £705,000 and the dividend has been raised by 47% to 2.2p. There are still supply chain problems. Net cash was £6.4m at the end of September 2022, following £2m of share buybacks. The share price is 5.45% ahead at 145p.

On Monday, shareholders approved the PCF Group (LON: PCF) plan to leave AIM on 19 December and the share price has slumped 44% to 0.35p.

Marketing software services provider Access Intelligence (LON: ACC) almost doubled revenues in the year to November 2022 and EBITDA was better than expected. The company has withdrawn from loss-making contracts. However, management expresses concern about the pace of contract conversion and growth. The share price dived by 27.4% to 63.5p.

Morses Club (LON: MCL) has issued a practice settlement letter to scheme of arrangement creditors. This scheme will largely be finance through an equity issue. The share price fell by more than one-third to 1.56p.

Digital advertising services provider Dianomi (LON: DNM) says revenues will be flat in 2022. New advertiser spending has not grown as expected. This means that 2022 EBITDA will be around 50% of the £3.1m reported for 2021. US digital advertising spending is growing, and long-term prospects are positive. The share price is 15.4% lower at 107.5p.

Atome Energy (LON: ATOM) has raised £2.7m via a placing at 106.2p a share – the share price slipped 6.44% to 109p. Electrolyser developer Clean Power Hydrogen (LON: CHP2) invested £1.5m, whose share price rose 5.79% to 32p, and much of the rest came from management and employees. A retail offer via Primary Bid closes at 7pm. The cash will help to finance the doubling of capacity at the green hydrogen and ammonia project in Paraguay to 120MW.

Argo Blockchain shares halve as trading resumes

Argo Blockchain shares halved on Tuesday morning after the bitcoin miner’s shares recommenced trading on the London Stock Exchange after being suspended.

Investors took the opportunity to dump Argo shares as the crypto company said they expected to run out of money in the coming month.

The company had been selling assets in recent months to help raise cash, but are now at a crunch point that could see them enter Chapter 11 bankruptcy.

Argo’s demise

The febrile state of the company was demonstrated by the premature publishing of a notice on the Argo Blockchain website that they had entered bankruptcy proceedings. This led to the stock being suspended by the London Stock Exchange.

Today, the company confirmed this notice was a mistake and shares were restored for trading.

Going to the extent of instructing their IT department to prepare a notice to inform website visitors they are in bankruptcy would suggest bankruptcy is a real possibility.

The company says it is hopeful it avoids bankruptcy by securing an asset sale. This may prove difficult to do.

Investors have chosen not to hang around and find out whether Argo enters bankruptcy and fled the stock. Argo Blockchain shares were down 48% at the time of writing.

Argo Blockchain share are down 96% in 2022 and trade at just fractions of their all time high.

Lloyds shares: a solid dividend choice for 2023?

Lloyds shares have had mediocre 2022. The first weeks of the year saw the bank’s shares break above 50p as investors geared up for Bank of England rate hikes and the benefits of higher interest rates for Lloyds’ profitability.

However, Lloyds’ foray above the 50p mark was short lived. The tragedy in Ukraine began to unfold and the western world was gripped by a cost of living crisis as energy bills soared.

The Lloyds share price has been in a steady downtrend in 2023, making a series of lower highs, the most recent of which was a failure to break 47.5p.

In November, we questioned whether the Lloyds share price would reach 50p by Christmas. Although there is a possibility this is achieved, the recent pull back from 47.5p will add an additional resistance level to any move to the upside.

Indeed, Lloyds has staged a significant rally over the past 6 weeks, but the 50p level may be a bridge too far before the end of 2022.

Lloyds dividend

Lloyds shares may not be a selection that provides a huge amount of capital appreciation in early 2023. If experts at the Bank of England and UK chancellor are right, the UK is headed for a recession that will impact Lloyds customers and curtail the banks profit growth.

The recession isn’t expected to be deep, but it is expected to be prolonged.

One wouldn’t expect a huge impact on profits as Lloyds will broadly benefit from higher interest rates, but it’s difficult to see a situation where Lloyds profits grow significantly.

A steady level of profit for Lloyds in 2023 means the company will be in a strong position to continue to pay dividends. There is also scope for dividend increases.

Lloyds dividend cover is 3.9x, leaving more than enough room to pay additional dividends to shareholders. Investors should expect a measured approach to increasing dividends by Lloyds and it would be a surprise if payouts aren’t increased incrementally going forward.

A damaging recession could delay a dividend hike but the current 4.4% yield makes Lloyds a solid dividend choice for 2023 with the potential for capital appreciation from a fairly valued Lloyds share price.

Record share trading at Hamak Gold

Liberia-focused gold explorer Hamak Gold (LON: HAMA) was the best performer on Monday after it reported positive results from its first drill hole at the Nimba licence. There were 1.34 million shares traded on the day, which is treble the number traded on the previous record day.

The share price jumped 60% to 12p. Hamak Gold joined the standard list on 1 March when it raised £955,000 at 10p a share. This is the first time the share price has been above the placing price since March.

British Virgin Islands-registered Hamak Gold’s main assets are two gold licences in Liberia that cover 1,752 square kilometres and it has the option to acquire fiver other licences. The Nimba licence is next to the border and near to the Ity gold mine in the Ivory Coast. The Gozohn licence has significant gold diggings and is near to the Kokya mine in the centre of the country.

The drill hole at the Ziatoyah prospect intersected 20 metres at 7g/t. This suggests that there could be a significant mineralised system that is similar to the one at the Ity gold mine.

FTSE 100 dips ahead of key central bank decisions

Traders were positioning for busy week of central bank meetings on Monday as the FTSE 100 slipped 0.3% to 7,448 shortly after lunch.

Markets were bracing for interest rate decisions from the Federal Reserve on Wednesday, and the ECB and Bank of England on Thursday.

The announcements will mark the end of a year punctuated by soaring inflation and a central bank response that has threatened the health of the global economy.

“Caution is in the air in financial markets ahead of a series of crunch central bank meetings around the world this week, with yet more interest rate hikes set to be unwrapped as inflation remains stubborn,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

The Federal Reserve is expected to hike rates 50 bps to 4.5% which would represent a step back from the 75 bps hike last time round.

Economists predict the Bank of England will raise rates by 50 bps to 3.5% and the consensus also points to a 50 bps hike by the ECB.

2023 Interest Rates

Higher rates are largely priced into markets and investors will focus on the accompanying statements and press conferences for further insight into how central banks plan to adjust rates in the early months of 2023.

Recent comments from the Fed suggest a pivot could be around the corner. Indeed, if they are to hike by 50 bps, it would mark a slowing in pace of rate hikes.

The economic backdrop in the US is still not at a point that would warrant keeping rates as they are, given the persistently high level of inflation.

The Bank of England will have to take into consideration a 0.3% GDP contraction between July and October, despite a better than expected 0.5% increase in October.

“October’s bounce back was expected, and the fact the growth was a little more enthusiastic than economists had anticipated is welcome. But this is just an aside – the story is unchanged, the economy is still shrinking and recession feels inevitable,” said Danni Hewson, AJ Bell financial analyst.

The threat of a downturn was evident in the FTSE 100’s consumer-facing stocks with JD Sports, Sainsbury’s, Ocado and Kingfisher among the top fallers.

Hiousebuilders were also weaker, as were global cyclical sectors such as the miners and oil majors.

RBC Wealth Management look to defensive European equities in 2023

RBC Wealth Management have warned of possible downside in European equities in 2023 but highlighted favourable valuations as a mitigating factor for the region.

RBC Wealth Management’s outlook for 2023 struck a cautious tone and said they see an opportunity in positioning towards defensive sectors and companies with a global presence.

Overall, RBC said they were underweight European equities but suggested a discount to US stocks and low valuations have already accounted for a European recession.

“We continue to recommend an Underweight position in European equities given the prevailing uncertainties. However, we acknowledge that the long list of downside risks is partly reflected in sharply discounted valuations and extreme investor caution,” said Thomas McGarrity, Head of Equities at RBC Wealth Management.

“Based on a forward 12-month price-to-earnings (P/E) ratio of 12.9x, the MSCI Europe ex UK Index is trading at a discount to its 10-year median of around 14.5x. On a relative basis, the discount to U.S. equities is much steeper than typical, even taking into account sector differences.

“We continue to prefer defensive sectors over cyclicals, and maintain our bias for quality, globally diversified companies that possess strong pricing power. In particular, we see opportunities in companies which are global leaders within the pharmaceuticals, technology, luxury, and capital goods industries. We are also beginning to see select opportunities in deeply discounted cyclicals where valuations already appear to price in the prospect of a European recession, particularly in sectors such as Industrials and Materials.”

Europe is being particularly heavily hit by energy prices and domestic economies are facing a tough start to the year. This would justify the defensive positioning going into 2023.

However, despite the challenging outlook, RBC argue much of the bad news is largely priced in, and the current valuations are attractive enough to take a measured approach to cyclical names.

Power Metal Resources Q&A with Paul Johnson

The UK Investor Magazine was delighted to welcome Paul Johnson back to the Podcast to answer questions from investors.

Paul presented at the UK Investor Magazine Virtual Investor Conference 7th December and due to the high volume of investor questions at the event, we were unable to deliver all the questions to Paul.

This Podcast will address those questions.

Watch the full Power Metal Resources Virtual Investor Presentation here