Markets responded positively to Prime Minister Liz Truss’ energy relief plan, which promised the average household would pay no more than £2,500 per year in energy costs for the next two years.

The FTSE 100 rose 0.2% to 7,254 as a long-awaited burst of optimism swept through the blue-chip index.

Meanwhile, analysts braced for aggressive interest rate hikes from the ECB today, as experts eyed the raging energy crisis across the continent and fears of recession.

“The current theme is not whether central banks will raise rates, but by how much. Investors are also hungry for forward guidance on future policy moves as central bankers try to regain the initiative in the fight against inflation, now that their narrative about the resurgence being transitory has proven – so far – to be wildly inaccurate,” said AJ Bell investment director Russ Mould.

“The European Central Bank is under the spotlight today and there is a feeling we could get a chunky rate hike, potentially as much as a percentage point increase.”

“The ECB was late to the party when it announced a first interest rate increase for the year, and now it has some catching up to do.”

European markets were relatively calm ahead of the decision, with the German DAX down 0.3% to 12,877, the French CAC gaining 0.3% to 6,125.8 and the Italian FTSE MIB falling 0.4% to 21,401.2.

Associated British Foods

Associated British Foods shares plummeted 9% to 1,324p after the company issued a profit warning in its pre-close trading update of a lower adjusted operating profit and EPS for FY 2023.

The Primark owner highlighted a strengthening dollar and spiking energy costs driving higher expenses, along with the cost of living crisis signalling lower sales over the coming year.

The firm said it would not be raising Primark prices due to the cost of living crunch on consumer budgets.

Associated British Foods reported strong adjusted operating profit and EPS for FY 2022, with operating profits for grocery, sugar and agriculture sectors in line with expectations.

“Against this current volatile backdrop and a context of likely much reduced disposable consumer income, we have decided not to implement further price increases next year beyond those already actioned and planned,” said Associated British Foods in a statement.

“We believe this decision is in the best interests of Primark and supports our core proposition of everyday affordability and price leadership.”

Melrose Industries

Melrose Industries shares slid 2.6% to 134p after the group announced a widened statutory operating loss to £317 million in HY1 2022 against £156 million the last year, along with an adjusted operating profit of £171 million compared to £196 million.

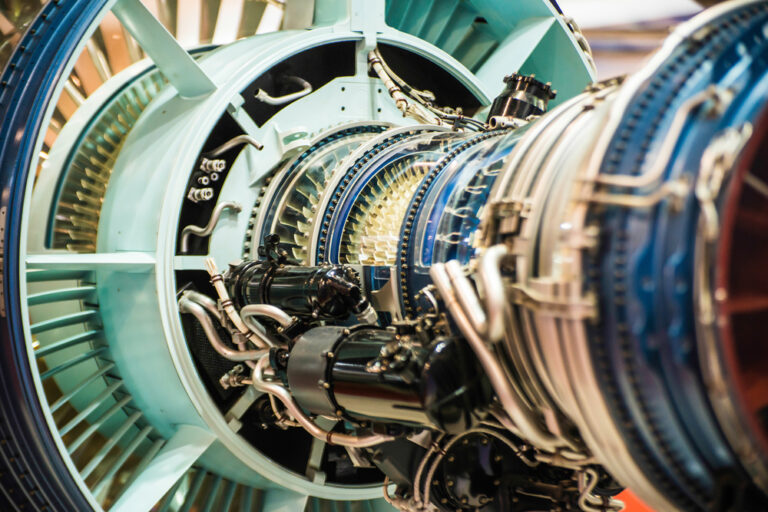

The engineering firm also announced the demerger of its GKN automotive division, with the company set to seek listing on the premium segment of the Official List and trading on the London Stock Exchange Main Market as an independent group located in London.

Melrose Industries confirmed retention of GKN Aerospace in its report.

“Since acquiring GKN in 2018 we have reinvigorated each business to achieve its potential,” said Melrose Industries chair Justin Dowley.

“The proposed demerger now gives each an exciting opportunity to individually grow shareholder value through organic growth and acquisition in both platforms.”

“The demerger is expected to unlock value for shareholders and will allow both Melrose Industries and DemergerCo to fulfil their potential independently in their respective markets with clear organic growth and strategic acquisition rationale.”