- The difficulties in China have deterred investors from Asian markets

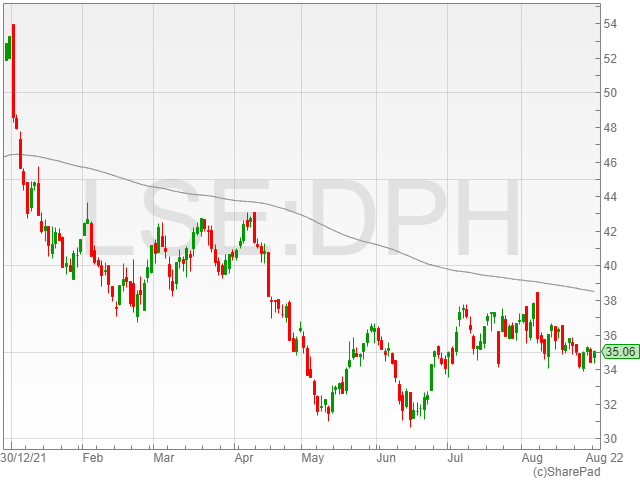

- This has created a widening gap between operational and share price performance

- The relative weakness in markets is creating opportunities

In a tough first half of the year for financial markets, Asia has struggled more than most. The difficulties in China have deterred investors, with the country’s zero Covid policy and slowing growth affecting sentiment towards the wider region. However, Asia has far fewer of the long-term structural imbalances facing many Western economies and the corporate sector continues to thrive. As such, its recent weakness may represent an opportunity.

China has been weighed down by a series of difficulties: a regulatory clampdown on a number of key industries, a zero-Covid policy that has shut down key cities, geopolitical tensions, plus a broader weakening of its growth momentum. Investors are understandably worried about its long-term prospects. This has seen Chinese stock markets fall, with many other Asian stock markets caught up in its weakness.

However, the situation in China is not as bad as sentiment suggests – and the long-term growth trajectory remains intact. Adrian Lim, co-manager of Asia Dragon Trust, says: “It’s been a tough start to 2022 because of China’s zero Covid policy, which has softened demand in the country. It has been compounded by some restrictions in the technology space, and geopolitical stresses as well. These are short-term headwinds to Chinese prospects, but the long-term hypothesis is sound.”

Elsewhere in the region, growth is re-emerging. In India, for example, momentum is picking up after two years of weakness, particularly in the corporate sector. Kristy Fong, manager of Aberdeen New India Investment Trust, says: “The country is not immune to what’s happening externally and the global growth slowdown might temper momentum, but the companies we’re talking to are distinctly upbeat.”

abrdn Asian Income Fund manager Yoojeong Oh, says that while Asian markets are experiencing some of the challenges seen in the US, UK and Europe, with supply bottle-necks and rising input costs, government and corporate balance sheets are in better shape, giving them more firepower. In general, Asian economies are not facing the looming threat of sharply higher interest rates to the same extent. China is loosening monetary policy.

In spite of this relatively stronger backdrop, share prices have been falling. Adrian points to a widening gap between corporate strength and share prices. He adds: “The gap between operational and share price performance has been acute. When we look at the Asia Dragon portfolio, earnings per share are growing at 5-15%, while share prices dropped by 5-8% in the first quarter alone.”

Navigating complex markets

This is creating opportunities, albeit selectively. Yoojeong says: “We are looking at our portfolio on a stock by stock level, checking to see how individual companies are managing input cost increases, either through hedging or substitution, or a supply chain Plan B. In our view, focusing on balance sheets is particularly important. Inflation can squeeze margins, but it’s reassuring that our companies aren’t adding operational risk onto already over-leveraged balance sheets.” More recently, she has rotated out of TSMC after a strong run, redeploying the capital into Mediatek, which designs semiconductors.

She says Asia remains a rich hunting ground for dividend stocks: “We’re able to find plenty of new ideas across countries and sectors. This includes new positions such as Bank Rakyat, which does micro-lending in Indonesia or Indian utility company PowerGrid which is investing in renewables.”

Kristy says the team working on Aberdeen New India Investment Trust is long-term in the way it thinks, but the macroeconomic environment has changed a lot. She adds: “We have been looking at that shift and what it does to the near-term earnings outlook. We have reduced exposure to areas that are more vulnerable to high inflation.” This has meant exiting holdings such as Gujarat Gas where there was some risk to profitability and introducing companies such as Hindalco, a low-cost provider of aluminium.

Adrian says they have sought to be nimble on Asia Dragon: “We have been taking advantage where prices have come off a bit. We are also looking for resilience. We’ve moved away from stocks that have run up a little bit, but not proved to be as resilient.” He retains ‘old favourites’ such as Samsung, but has added Techcombank in Vietnam, one of the more progressive banks in a segment that is relatively underdeveloped in the country.

There remain structural challenges but across Asia there is good growth available from individual companies. Yoojeong says: “There is a lot of macroeconomic uncertainty, but when we come back to company fundamentals, we see that corporate balance sheets are much less geared in Asia relative to the rest of the world. We believe strong balance sheets are key to being profitable through the cycle and giving company management teams options. They can invest in future growth or return capital to shareholders.”

Adrian agrees: “There are enough opportunities to make Asia attractive. In spite of the news flow, Asian companies are under-appreciated.” Investors may already be starting to recognise the gap, with June showing a revival in the Chinese stock market and Asian markets more broadly. It may be the start of an overdue reappraisal of the opportunities in Asia.

Companies selected for illustrative purposes only to demonstrate the investment management style described herein and not as an investment recommendation or indication of future performance.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- Movements in exchange rates will impact on both the level of income received and the capital value of your investment.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- The Company invests in emerging markets which tend to be more volatile than mature markets and the value of your investment could move sharply up or down.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

Find out more at:

abrdn Asian Income Fund Limited

Aberdeen New India Investment Trust plc

Asia Dragon Trust plc

You can also registering for updates via email, and follow us on Twitter or LinkedIn.