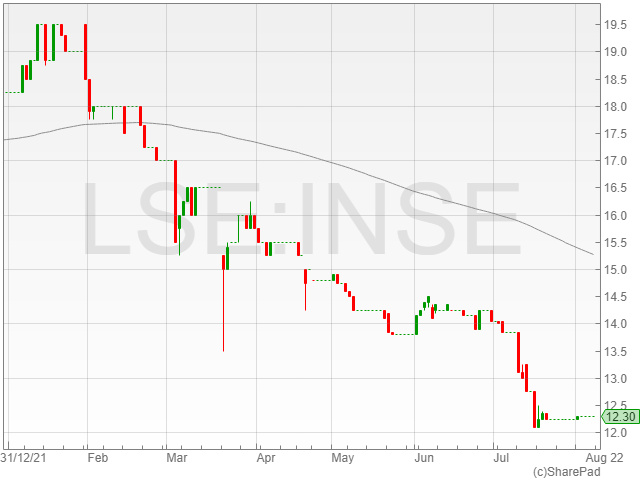

Light Science Technologies Holdings shares dropped 9% to 7.5p in late afternoon trading on Friday after the company announced a widened pre-tax loss of £1.3 million in HY1 2022 compared to £900,000 the year before.

The firm reported a slightly reduced margin of 20.9% against 23.6% in the previous year.

However, Light Science Technologies highlighted a revenue climb of 42.% to £3.6 million from £3.4 million in HY1 2021.

The company also confirmed the launch of its planned programme of investment in across the FY period.

Its post-period highlights included the commencement of its SensorGROW SaaS (Software as Services), which is set to growers with business intelligence to optimise plant growth and optimise business operations.

Light Science Technologies also reported the launch of its ‘slimline’ low profile tuneable light, which is designed to maximise growing space in Vertical farm projects, expanding the group’s reach of its nurturGROW CEA lighting solutions.

“With Group revenue increasing by 4.2% for the six months to 31 May 2022, alongside our forward order book and contracts worth £18 million, we have seen an increase in our pipeline of quoted business due to a demand for reshoring manufacturing to the UK, as customers look to increase product security and reduce risk,” said Light Science Technologies Holdings CEO Simon Deacon.

“As much as the macro trends are challenging in the short term, we are confident that the medium and long-term outlook for the Group is promising, as the market continues to grow.”

“With our experienced team, our technologies and energy saving products feeding into the growing pipeline, we are in a strong position to take advantage of the opportunities and achieve our objectives. We remain confident in our ability to achieve our revised forecasts as announced on 10 June 2022.”