The FTSE 250 was down 1.3% to 20,235.6 and the AIM was down 0.8% to 1,004.7 in early afternoon trading on Wednesday as investors held their breath for the latest interest rates decision from the US Federal Reserve.

Analysts predicted a 0.5% rise as the country fights to tackle the sweeping levels of inflation spikes across the global markets, with the US struggling under 8.5% inflation and the UK stumbling under a 7% rise in the CPI over April.

The Bank of England is expected to raise interest rates by 0.25% to 1% during its announcement on Thursday, dampening investor enthusiasm in the lead-up to the decision.

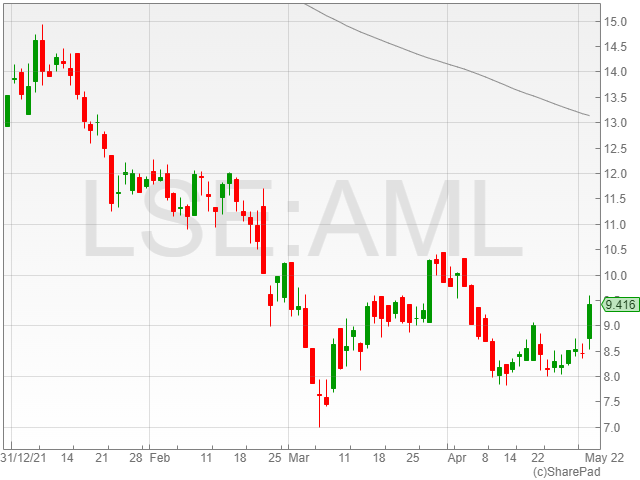

Aston Martin Lagonda shares soared 10.1% to 931.7p after the luxury car manufacturer reported a 4% increase in revenue, 18% rise in EBITDA and the appointment of former Ferrari CEO Amedeo Felisa as the new CEO of the company.

Felisa is scheduled to replace former CEO Tobias Moers with immediate effect, and will remain with the group until the end of July to ensure a smooth transition.

PureTech Health shares were up 3% to 174.1p following positive data from the GS200 weight loss drug developed by its Gelesis Holdings entity.

The recent trial results discovered six out of the ten adults on the GS200 treatment achieved a minimum of 5% body weight loss, losing an average of 11% over 24 weeks.

Direct Line Insurance shares fell 5.7% to 240.7p on the back of a 2.4% drop in total gross written premium and service fees to £734.3 million from £752.3 million for Q1 2022 year-on-year.

The group blamed the inflation and the Financial Conduct Authority’s price reforms for the sub-par report.

Tritax Big Box shares fell 4.1% to 213.6p following the company’s heads-up to investors that inflation was impacting its near-term development pipeline.

However, the REIT enjoyed some positive news, with a reported 10.4 million sq ft of take up in Q1 2022, representing a 102% year-on-year rise for the fund management group.

Sunrise Resource shares gained 30.4% to 0.1p in light of discussions with new parties to start a joint development of the CS Natural Pozzolan-Perlite project in Nevada, US.

“The industry in the US is committed to net-zero emissions and our recent discussions have underlined the role of natural pozzolan in meeting these targets,” said executive chair Patrick Cheetham.

Reabold Resources shares increased 26.9% to 0.4p after the company reported a non-binding conditional takeover offer for Corallian Energy, of which it owns 49.9%.

The agreement will see Reabold acquire Corallian’s portfolio of six exploration and appraisal licenses for £250,000.

“We look forward to providing further updates in the weeks ahead,” said co-CEO Sachin Oza.

Atome Energy shares rose 18.4% to 135p following a power purchase agreement for 60 megawatts with Paraguay national electricity company Ande.

CAP-XX shares gained 17.2p to 5.4p on the back of a reported joint-venture with Melbourne energy storage developer Ionic Industries.

The joint-venture will see CAP-XX own 51% of the operation, which is set to commercialise reduced graphene oxide for supercapacitors and other energy storage devices.

eEnergy Group shares plummeted 27.3% to 8.3p after the company confirmed expected revenues and EBITDA behind current market expectations as a result of Covid-19 lockdowns and the energy crisis kicked off by Russia’s invasion of Ukraine.

Joules Group shares dropped 23.8% to 41.8p following CEO Nick Jones’ resignation from the company in light of a poor slate of results in Q1 2022.

The group warned investors of trading disruptions coming over 2022, with Joules reporting a “cautious” near-term financial outlook.

“Building on the strategic progress made so far, over the coming months we will continue to deliver against the clear priorities that the board and I believe will create a strong foundation for Joules to achieve its significant long-term potential, as well as helping the business to navigate the current challenging trading environment,” said Jones.

Boohoo shares fell 12.7% to 69.7p after the fashion retailer announced a 94% plummet in profits to £7.8 million compared to £124.7 million.

The company attributed the tanking profits to high item return rates, dampened consumer confidence and international transaction disruptions.

Kodal Minerals shares declined 11.1% to 0.3p following the mining group’s announced fundraise for its Mali lithium project, which is set to see the company issue 1 billion new shares, with placing shares issued at a price of 0.28p each.