House broker Zeus has come out with another upgrade for domain name and online marketing services provider CentralNic (LON: CNIC) after its first quarter trading statement. Organic growth was impressive last year, and it is accelerating this year. Yet, the share price has been drifting downwards in recent weeks.

The organic growth is being supplemented by acquisitions and first quarter revenues were $156m. The growth is predominantly coming from online marketing with the domain names business providing solid growth from more predictable revenues.

In 2021, organic growth was 39%. In the 12 mont...

Mind Gym meets board expectations in Q1

Mind Gym announced a trading update for its financial year ended 31 March 2022 on Monday where it said its core business has returned to pre-Covid levels, resulting in a strong performance in line with the board’s expectations.

The group also announced that the adjusted pretax profit for the year meets the board’s expectations.

For Mind Gym, FY22 has been a year of steady success and major investment. With the launch of its new digital coaching platform on January 22 and a solid pipeline of new POVs – ‘Leadership’ and ‘Wellbeing’ due in the coming months, the group is exiting the Covid crisis with a reinforced pitch to its clients in some important areas.

Despite Covid’s prolonged headwind, with Omicron creating significant delays in client decision-making and course enrollment in the second half and early in the new financial year, both the UK and the US delivered good growth compared to FY21.

The global provider of human capital and business improvement solutions, Mind Gym reported that revenue is estimated to be £47.9m, up 25% in constant currency from FY21 and 5% higher than pre-Covid levels.

The group’s digitally enabled revenues of £36.8m were up 25% from FY21 and 156% from FY20, when the majority of deliveries were still done in person and accounted for 77% of revenue in FY21 and 32% in FY20.

Mind Gym’s digital 1:1 coaching SaaS platform, Performa, was introduced in January 2022 and has sold over £500,000 in annualised revenue so far.

The product is based on Mind Gym’s exclusive Precision coaching methodology and gives clients a leadership development solution that can be coupled with other Mind Gym products.

Mind Gym bought the diagnostic IP of 10X Psychology in administration in March 2022 for £0.1 million in cash, boosting Mind Gym’s burgeoning digital strategy.

The acquisition of 10X’s diagnostic IP was the culmination of 7 years of development and around £10m in previous investment by 10X, which is expected to help Mind Gym’s digital strategy of providing highly personalised therapies to participants and insightful data and analysis to customers.

Following considerable investment in its new digital goods throughout the financial year, net cash was £10m at the end of March 2022, compared to £16.8m in 2021.

To facilitate further growth investment, a new undrawn debt facility has been established for Mind Gym. The group signed into a £10m debt facility with £6m RCF and £4m accordion throughout the year, which was undrawn as of March 31, 2022.

Octavius Black, CEO of Mind Gym, said, “We are encouraged with Mind Gym’s performance despite the Covid headwinds, with good revenue growth ahead of last year and pre-pandemic levels.”

“We are excited by the recent launch of Performa our digital 1:1 coaching SaaS service and delighted with the positive reception it has already received from new and existing clients.”

“We have a clear strategy for accelerating revenue growth based on market-leading IP, delighting clients and a significant digital transformation.”

Arecor Therapeutics widens post-tax loss, celebrates diabetes treatment breakthroughs

Arecor Therapeutics shares were at 380p in late afternoon trading on Monday, after the company reported a total income of £1.8 million against £2.1 million in 2020 and a post-tax loss of £6.2 million compared to £2.9 million last year.

However, the biopharmaceutical group announced a successful IPO of £20 million on AIM, alongside a cash and cash equivalents rise to £18.3 million from £2.9 million in the last year.

Arecor Therapeutics also confirmed that it was debt-free following the conversion of £4.4 million shareholder in loan notes into new ordinary shares.

The company’s highlights included a successful Phase one clinical trial for its AT278 ultra-concentrated ultra-rapid acting insulin for diabetes, with data scheduled for oral presentation by Arecor at the Advanced Technologies and Treatments For Diabetes meeting (ATTD) on 28 April this year.

The firm secured five new technology partnership agreements and was awarded a £2.8 million Innovate UK grant to support the Phase two development of its AT247 ultra-rapid acting insulin treatment.

Arecore Therapeutics also confirmed the expansion of its global patent portfolio with the grant of US, Canadian and European patents underpinning Arestat, its innovative proprietary formulation technology platform.

“After a year of significant progress in 2021, we are well positioned to continue to execute our strategy in 2022 and beyond as we develop enhanced therapeutic products that can truly transform patient care,” said Arecor Therapeutics CEO Sarah Howell.

“As we look forward, I am excited about the opportunities ahead in 2022, especially within our proprietary pipeline with additional clinical data for AT247 expected later in the year following the excellent clinical results for the AT278 first-in-man study.”

“We have a strong pipeline of opportunities ahead within our Specialty Hospital portfolio and I look forward to us continuing to build on our strong partnering performance.”

musicMagpie to launch on Back Market

musicMagpie shares were up 36.6% to 64.9p in late afternoon trading on Monday, following the company’s announcement that it would be trading on the UK and US Back Market, the online refurbished electronics marketplace.

The re-commerce business is set to open for trading on the refurbished technology platform by the end of April in the UK, with a US launch scheduled for mid-May 2022.

The agreement includes musicMagpie’s sale of mobile phones, games consoles, tablets, wearables and MacBooks under the market’s technology catergories.

The company confirmed that the new trading channel would supplement the existing sales from its websites, alongside its sales from Amazon and eBay.

The Back Market currently has six million customers across 16 countries, and reportedly acts as a third-party vendor to connect customers with verified companies selling second-hand refurbished technology devices.

“Back Market is committed to working with the best resellers and refurbishers to ensure that buying renewed is easier, cheaper and more appealing for everyone,” said Back Market CEO Thibaud Hug de Larauze

“We’re delighted to join forces with musicMagpie, the pioneers of the refurbished tech industry in the UK, and this partnership represents an opportunity to further expand the refurbished tech market in the UK.”

MusicMagpie said it aimed to leverage Back Market’s investment in the market and increase its current registration of 7.5 million customers across its Amazon, eBay and website operations.

“I am delighted that musicMagpie’s wide range of high-quality refurbished consumer technology products will be available on Back Market’s fast-growing marketplace,” said musicMagpie CEO Steve Oliver.

“musicMagpie enjoys immense brand trust, developed over 15 years of recommerce activity, which will further encourage Back Market’s users to choose a refurbished device.”

“musicMagpie and Back Market operate complementary models and have a shared mission to challenge consumers to rethink their tech product consumption, make restored devices mainstream, and tackle the growing problem of e-waste.

Leveraging alternative data to drive investor insights

Investors can use all the data they can get their hands on. Analyzing a company is a tough task, and to find an edge, you must search for hidden indicators that can offer context to financial data. In this regard, alternative datasets are making a mark on investor portfolios and helping them deploy capital in better ways.

On the surface, alternative data might seem like a viable option only for institutional investors. However, when combined with other elements of rich investor intelligence reports, even casual investors can uncover insights into companies that investors from bigger financial funds are less interested in.

Here are a few key ways to use alternative datasets to power your opportunity analysis process.

Investigate New Trends

Catching a company at the start of a new trend is a great way to realize massive portfolio growth. However, spotting trends is tough. Many trends seemingly burst onto the scene with little warning, leaving little time for small investors to capitalize on them.

However, with access to the right data signals, it’s possible to identify trends before it’s too late. Zoom is often cited as an example of a product that took the market by storm (and surprise) following the onset of the COVID-19 pandemic. However, web traffic data indicated that Zoom was consistently outperforming its competition even before the pandemic.

While the pandemic pushed Zoom’s growth to unprecedented heights, the ingredients for an exponential rise were already present. Alternative data intelligence can alert you to budding trends that web consumers are looking at. For instance, are they searching for a cluster of keywords and products that only a few companies offer? Conversely, are they highlighting increasing issues with a company’s product that can make it a potential short in your portfolio?

Most investors look at financial data to discover such opportunities. However, those datasets are often extremely outdated. What’s more, quarterly earnings are not independently audited and are thus less reliable. What’s more, earnings represent only one aspect of a company’s business success and often don’t correlate to changes in stock value.

In contrast, alternative data offers you a real-time view of a company’s health.

Discover Hidden Performance Indicators

Technological progress has meant that many small investors are quantitatively-driven. Put simply, quant modeling is more accessible these days. However, feeding these models with the right data is challenging. Feed them conventional data, and you’ll receive average results. If average ROI is what you’re after, you’re better off sticking to plain-vanilla ETFs instead of spending resources developing a model.

Data quality and context are the keys, and alternative datasets can offer you an edge. For instance, what if you could feed GPS data derived from mobile phone signals to decipher footfall to a retailer’s location? You could extend these datasets to analyze consumer demand at all of their locations.

Web scraping can also be a great way for quantitative investors to keep tabs on their portfolio companies and prospects. For instance, is social media sentiment trending against your company? Have users consistently adopted negative tones, and the company’s marketing has failed to address their concerns?

You can feed these seemingly unstructured datasets into your models to uncover hidden insights. Alternative data like this is best used to complement traditional analysis. For instance, if the company’s 10-K mentions increased customer demand for a certain product or service, you can correlate these claims with alternative datasets.

You can also track trends in the statements within the MD&A sections of annual reports using analytics. How well does management understand their business, and are they presenting an accurate picture to investors? Alternative data sheds a lot of light in this regard, and with a creative approach, any investor can leverage it.

Research Market Impact

Traditional financial data offers deep insights into how well a company is managed. However, in modern business landscapes, it tends to lag significantly. By the time you’ve analyzed the data, the company is dealing with a new trend that renders previous conclusions obsolete.

Web traffic data and related alternate sources of digital performance can shed a light on the market impact a company is having. For instance, you can discover the brand impact of a company on its market compared to its competitors.

Answers to questions such as What does traffic engagement on the company’s website look like? and What is the company’s social share of voice? offer important clues as to its investment potential.

Companies these days face threats from any number of sources. Changes in the sector’s economics and the rise of new competitors threaten a company’s profitability. Digital performance data can reveal troublesome trends well before the financial statements catch up. For example, are consumers complaining about excessive prices on social media?

Are terms such as “expensive,” “poor quality,” or “low value for money” dominating conversations surrounding the company’s product? These can be useful indicators that a company is going downhill, and management must take immediate action.

Alternative data thus provides context to management’s decisions in the short term. It also reveals trends that are likely to leave an impact in the long term.

Better Insights

Alternative data is largely unstructured. However, by augmenting traditional datasets with it, you can develop intelligent company analysis models. The more data you have as an investor, the better your analysis will be. After all, you never know where an edge might exist.

Alternative data helps you uncover hidden catalysts that can cause your portfolio returns to increase exponentially.

Audioboom reports revenue rose by 125%

Global podcast company, Audioboom, announced a 125% rise in its 2021 revenue to $60m due to “continued growth” in the US podcast market on Monday.

Audioboom’s revenue rose by 125% to $60.3m from $26.8m in 2020 out of which 96% of group revenue was generated from the continued growth in the United States and its developing podcast market.

The company’s revenue growth in 2021 outpaced the predicted wider industry average growth by 108% and Audioboom had to increase expectations on its performance for 2021, 7 times.

On average, Audioboom’s global monthly downloads for Q4 rose by 39% to 113m compared to 2020’s Q4 with 81.7m, and global downloads broke a record with 115.7m downloads in October 2021.

The average global revenue per 1,000 downloads in the fourth quarter for Audioboom rose by 49% to $55.85 compared to $37.55 in Q4 2020, and the average brand advertiser count for Q4 was 396, a 32% increase from 301 in Q4 2020.

Audioboom’s revenue streams are bifurcated as direct revenue, marketplace, Audioboom Studios and Sonic Influencer Marketing. The gross margins differed for these segments by yielding 22%, 26%, 36% and 12% respectively.

The group’s adjusted EBITDA for 2021 was profitable and amounted to $3.1m compared to the loss of $1.8m in 2020 as the company recorded positive EBITDA in every month of 2021.

Audioboom’s annual net pre-tax profit was $1.7m compared to the loss of $3.3m in 2020, and total profit amounted to $7m compared to the loss of $3.2m, due to the recognition of a $5.3m of deferred tax asset.

Podcast company, Audioboom’s cash outflow from operating activities reduced by 76% to $800,000 from $3.3m in 2020.

The $4m loan facility with SPV Investments expired at the end of the period, and Audioboom has arranged a £1.5m overdraft with HSBC to deal with any working capital needs. SPV Investments’ $4 million content finance facility is set to expire in June 2022.

Audioboom Developments

Audioboom has continued its development of Audioboom Studios, its production arm, through the commercial success of Dark Air with Terry Carnation, as well as the extension of our production partnership with Formula 1.

The company has enhanced its creator network through new commercial partnerships with leading podcasts, including Redhanded, The Way I Heard It with Mike Rowe, Zane & Heath Unfiltered, Dark History, Hacks on Tap, and Spitballers.

Audioboom also launched its key advertising technology, including inventory creation tool, AdRip, and its global automated advertising marketplace, Showcase.

For the rest of 2022, the company says its “set to be another successful year for Audioboom with continued revenue expansion and growth in profitability.”

Audioboom has noted record sales in Q1 with a 107% increase in revenue from Q1 2021 amounting to $19.7m and adjusted EBITDA of $900,000.

Stuart Last, CEO of Audioboom, commented, “I am delighted to report on a defining year for the business which saw top-line growth of 125%, our maiden EBITDA and net profit, and the transformation of shareholder value.”

“Our phenomenal performance has positioned us as the world’s leading pure-play podcast business and increased our market-share significantly. Our innovation led to the launch of new best-in-class advertising technology tools, the scaling of our platform and new levels of success for our creator partners and advertisers.”

“Our ambition is to build the world’s leading podcasting business, and I am delighted with the start we have made in 2022 and look forward to the future with confidence. I would like to thank our creators, clients, customers and partners, as well as our incredibly talented Audioboom team and our supportive shareholders as we look forward to another exciting and successful year.”

Audioboom shares have dropped 0.7% to 2,035 despite fantastic results in FY21 on Monday.

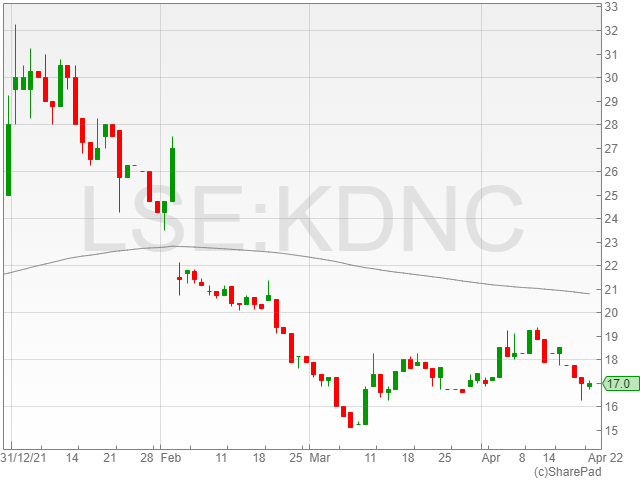

Cadence Minerals reports fourth Amapa iron ore shipment

Cadence Minerals shares were up 0.5% to 17.1p in early afternoon trading on Monday, after the company announced the completed sale and shipment of Iron Ore by DEV Mineraco S.A’s (DEV) from the Amapa Iron Ore Project in Brazil.

The sale was completed on 23 April and marked the fourth shipped batch of iron ore from the company’s stockpiles, consisting of 48,492 wet tonnes of iron ore sinter fines of approximately 58% iron at Companhia Docas de Santana.

The company commented that it was the first batch of iron ore exported since Cadence vested its 27% equity interest in the Amapa Project earlier in 2022.

Cadence Minerals confirmed a current stockpile of 1.2 million tonnes of iron ore in DEV’s wholly-owned port.

The shipment followed the initial three shipments which were carried out in H1 2021, and were reportedly approved through a court petition, which limited the sales of iron ore from the stockpiles to $10 million in net profits.

The company said that the approved court disposal funds were applied according to the approved court petition, with DEV retaining an agreed portion of the net profits.

The firm added that the net profits and earnings from the current shipment would be paid to the secured banks creditors in line with the settlement agreement announced on 29 December 2021.

Pantheon Resources announce higher oil projections at Theta West operations

Pantheon Resources shares were down 1.3% to 139.6p after the oil and gas company reported an update on its Lower Basin Floor Fan resources at Theta West, and an Oil in Place estimate on the Slope Fan System at Talitha.

The firm upgraded its Theta West resource estimate to 17.8 billion barrels of oil, representing a 61% increase compared to its previous estimates.

Pantheon Resources also highlighted a recoverable resource of 1.78 billion barrels in the most likely scenario, marking a 48% rise against its previous estimates.

“This season has been a great one for Pantheon resulting in material resource upgrades,” said technical director Bob Rosenthal.

The company said it believes that its 1.78 billion estimate could be categorised as a Contingent Resource on the basis of oil discoveries confirmed at Theta West, Talitha #A and Pipeline State #1.

The group also noted the new discovery of oil in the Slope Fan System at Talitha, which management estimates could hold up to 2.2 billion barrels of oil in place, however Pantheon clarified that additional examination would need to be carried out before it could estimate the recoverable resource in the Slope Fan System.

Pantheon Resources said its three existing well penetrations into the Lower Basin Floor Fan have confirmed oil resources with high quality light oil encountered across samples of the entire section, and have boosted company confidence in the area reservoir.

“The Theta West project continues to improve as we do further technical work, proving itself as a significant discovery with an estimated 1.78 billion barrels of recoverable resource,” said Pantheon Resources CEO Jay Cheatham.

“Coupled with our initial estimate of 2.2 billion barrels of oil in place in the Slope Fan System, this recent analysis further validates the potential impact of our 100% owned projects on the North Slope. We met our expectations of improved reservoir at the updip Theta West #1 location for the LBFF.”

“I would like thank shareholders for their continued support and for sharing our belief in the potential of our projects.”

Cost of living rise felt in 9 out of 10 UK adults

According to recent data from the Office for National Statistics, over nine out of ten adults feel their cost of living has increased, up from 62% in November last year.

Compared to 2021, 23% of people stated it was “difficult or extremely difficult” to pay their regular household costs in March. This is an increase from the 17% who said the same thing in November 2021.

Nearly one-fifth said they were borrowing or using more credit since 2021, and 43% said they will not be able to save up in the next 12 months, up from 34% in November.

About 43% indicated it was somewhat or very difficult to afford their power bills, while 3% said they were behind on rent or mortgage payments.

The fallout from the month’s increase in the energy price cap which was a record £693 per year increase, or 54% on average, is not included in the numbers because they do not cover April.

Other hikes, such as increases in council tax and National Insurance, will further strain finances starting in April. In addition to all the rising costs, fuel prices are also high, and inflation is likely to rise even higher.

The rise in the cost of living is said to be affecting people’s “financial resilience” as more and more consumers find it difficult to pay their bills, said Hugh Stickland from the Office for National Statistics.

We’ve published new analysis on the impact of rising costs of living on adults in Great Britain (for the period 16-27 Mar 2022).

— Office for National Statistics (ONS) (@ONS) April 25, 2022

Around 9 in 10 (87%) adults reported an increase in their cost of living over the past month – compared with 62% in Nov 2021 https://t.co/d8t4fYgfTi pic.twitter.com/JkxfJa7zsA

Senior Economist at the Resolution Foundation, Jack Leslie, added that the figures from the ONS report showed the cost of living crisis is “already hitting UK families hard”.

“The combination of shrinking pay packets and rising costs mean that the pressure on households is building, with lower-income families set to feel the squeeze the most, and over a third of the most deprived fifth of households in England already saying it has been difficult or very difficult to pay their usual bills.

“This is set to get worse, with the estimated number of households experiencing fuel stress hitting five million this month.”

Chancellor Rishi Sunak did try to curb these costs with 5p reductions in fuel prices and a decrease from 20p to 19p in National Insurance during his Spring Statement, however, consumers remain overwhelmed with the rise in the cost of living.