Managed IT and networking services provider AdEPT Technology (LON: ADT) reassured the market that the 2021-22 figures will be in line with expectations. There will be additional costs this year, but the poor performance of the share price is puzzling considering that the prospective earnings multiple is so low.

There was a good finish to the financial year and that meant that the revenues and profit will be broadly in line with forecasts. Managed services revenues continue to increase. New clients include the TUC and Rolls-Royce.

There was some disruption from electronic component shortages an...

Small & Mid Cap Roundup: Sensyne Health, EasyJet, Ferrexpo, CMC

Strong corporate updates helped the FTSE 250 and the AIM index finish the week on a positive note, adding to a reasonable week of gains in the UK’s small and mid caps markets.

Travel shares enjoyed a positive session after airline regulators urged airline companies to set deliverable schedules in light of recent flight cancellations due to staffing issues as a result of the latest wave of Covid.

This lead to airline company’s such as EasyJet and Wizz Air shares to rebound after a turbulent week with over 200 flight cancellations between them.

FTSE 250 Risers

The iron ore miner, Ferrexpo shares flew 11% to 186p despite the company’s production update stating an 11% fall in iron ore pellet production due to operational and logistical constraints following the Russia-Ukraine war.

Ferrexpo reported a total iron ore pellet production of 2.7m tonnes in Q1 2022, in line with the same period in 2021.

The group generated sales of 2.6m tonnes in Q1 2022, scaling production activities to meet the accessible pellet demand in the market.

“Ferrexpo’s production was remarkably down just 2% year-on-year in the first quarter – its operations are after all outside the main conflict zones,” said Russ Mould, Investment Director, AJ Bell.

“However with the limitations associated with exporting to Europe via rail and barge, management are understandably looking for alternative seaborne options while activities at its usual hub – the Black Sea port of Pivdennyi – remain suspended.”

CMC shares gained 9% to 262p after the online trading company said it expects its annual profit to come at the upper end of forecasts after enjoying its “strongest quarter” of its financial year. The company saw annual net operating income amount to £280m, on the top end of expectations, in Q4 2021.

CMC saw a hike in usage during the pandemic despite market volatility leading to a net operating income of £409.8m, 32% higher than Q4 2021 figures. However, compared to pre-pandemic times, CMC’s net operating income increased 11% from £252m.

Volution Group shares rose 3.3% to 425p after Jefferies raised the company’s price target from 480p to 560p.

JP Morgan cut Countryside Properties’ price target from 280p to 250p helping the shares increase by 3.7% to 276p.

EasyJet and Wizz Air shares gained 3.3% and 2.3% on Friday after the UK aviation regulator urged airlines to set “deliverable” schedules after staffing issues disrupted operations leading to flight cancellations.

FTSE 250 Fallers

International Public Partnerships shares dropped 4% to 164p after the company announced its plans to raise £250m through an equity issue. The funds raised will be used towards part-payment of a corporate debt facility and investing in its pipeline.

888 Holdings’ shares fell after the company announced an accelerated bookbuild to acquire William Hill yesterday. At the time, 888 also announced the enterprise value of William Hill assets has been lowered to £1.95bn on Thursday.

UBS cut Victrex’s price target to 1,750p from 2,150p leading the company’s shares to drop 0.7% to 1,800p today.

On Friday, abrdn Private Equity Opportunities Trust, NCC Group, Spirent Communications and Homeserve saw their shares lose 2.3% to 500p, 2.2% to 192p, 1.5% to 237p and 0.8% to 873p.

AIM Fallers

Sensyne Health cratered 80% to 2p after the company had to raise £15m to save the sinking ship leading to worried investors as the company already was not generating returns.

Uru Metals’ shares rebounded 18% to 325p after seeing highs of 400p on Thursday.

Engage XR shares rebounded 8.8% after the share gained 50% yesterday following the company’s statement regarding funding being provided to Engage’s US partner VictoryXR by Meta Immersive Learning to help roll out 10 ‘digital twin’ university campuses in the metaverse using Engage’s platform.

Osirium Technologies stumbled on Friday after a transformational week for the company following the company’s announcement of a record quarter for bookings in Q1 2022 on Tuesday.

Sound Energy shares sank 8% to 2.1p after the company decided against making a bid for Angus Energy.

Sound Energy’s decision to not make an offer to Angus Energy lead Angus’ shares to fall 5.5% to 1.3p on Friday.

AIM Risers

The transport system services provider’s shares soared 38% to 146p after Journeo signed a 3 year deal with FirstGroup’s First Bus UK for £9m, marking it the largest deal till date for Journeo.

Webis Holdings gained 13% to 3.5p after the company said its US subsidiary, WatchandWager.com inked a deal for the next 5 years to operate at a racetrack in Arizona.

Avacta Group’s shares rallied 9.5% to 97.5p after drug developer and diagnostics company said AffyXell Therapeutics, its joint venture with Daewoong Pharmaceutical, signed an agreement with Biocytogen to collaborate on a new immune disease in vivo models, testing the toxicity of and conducting proof-of-concept for AffyXell’s drug candidates, using the developed disease model.

Jet2 shares increased 4% to 1,204p after the company reassured investors that signs of recovery are being seen its order books as travel restrictions ease. The company noted a 14% increase in summer sale seat capacity compared to the summer of 2019.

Invinity Energy Systems rose 12% to 90.5p after the manufacturer of utility-grade energy storage announced the completion of a successful test and validation program by Hyosung Heavy Industries and subsequently signing a non-binding MoU for a global partnership with an exclusive relationship in Korea.

Nightcap shares gained 5% to 17.5p after the group announced its plan to open a new cocktail club in Birmingham later this year.

Oncimmune Holdings signed 2 new contracts for ImmunoINSIGHTS which lead the company’s share to rise 6.3% to 133p.

Physiomics, oncology consultancy company, signed a new contract with Servier Group to provide specialist mathematical modelling services using the Virtual Tumour software platform. The deal helped the company’s shares gain 0.5% to 4.5p on Friday.

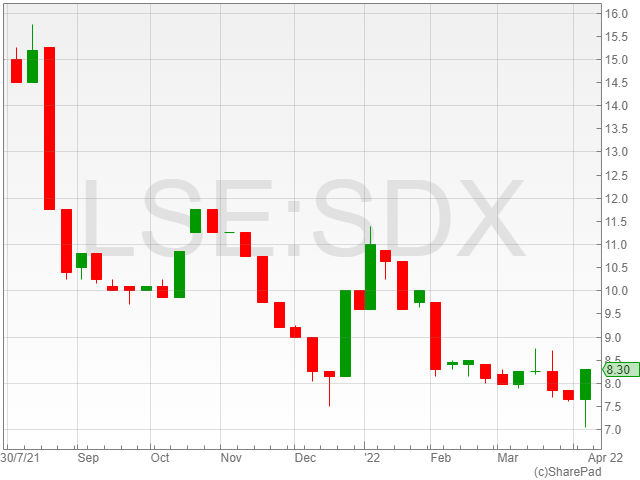

SDX Energy reports third West Gharib spudding

SDX Energy shares were up 2.1% to 8.2p in late afternoon trading on Friday after the energy firm reported the successful spudding of its MSD-20 infill development well on its Meseda field.

The company began drilling operations at the site on 5 April, and is currently aiming for the Asl formation reservoir at approximately 3,1800ft true vertical depth subsea (TVDSS).

The well is estimated to take around six weeks to drill, finish and tie-in to the group’s existing infrastructure.

The MSD-20 is expected to cost around $900,000 to $1 million to drill and tie-in, with an initial production of 300 barrels of crude oil per day.

The resulting contribution to the company’s cashflow is projected to recoup the project’s costs in an estimated five to six months, based on the current price of oil.

The well is the third of 13 total wells in the company’s drilling project on the Meseda and Rabul oil fields based in the West Gharib concession in the Egyptian Eastern Desert.

The energy firm’s first two wells have already been tied-in and are actively contributing to the company’s oil production.

SDX Energy is currently aiming for a production growth to 3,500 to 4,000 barrels of crude oil per day from its 13 wells by early 2023.

“I am pleased that we have spud MSD-20, the third well in the campaign, so quickly after bringing MSD-21 and MSD-25 onto production, which is testament to the efficiency of the operations team in country and bodes well for the rest of the campaign,” said SDX Energy CEO Mark Reid.

“West Gharib is a very high margin asset in our portfolio with a Netback of US$37/bbl at US$71/bbl Brent in FY2021.”

“I look forward to updating the market further as the campaign progresses.”

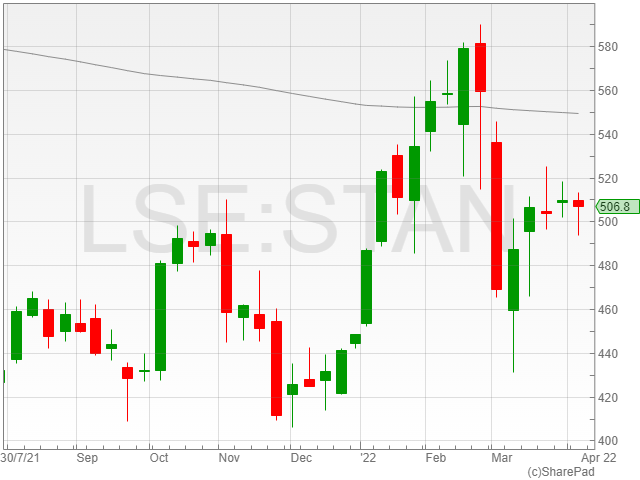

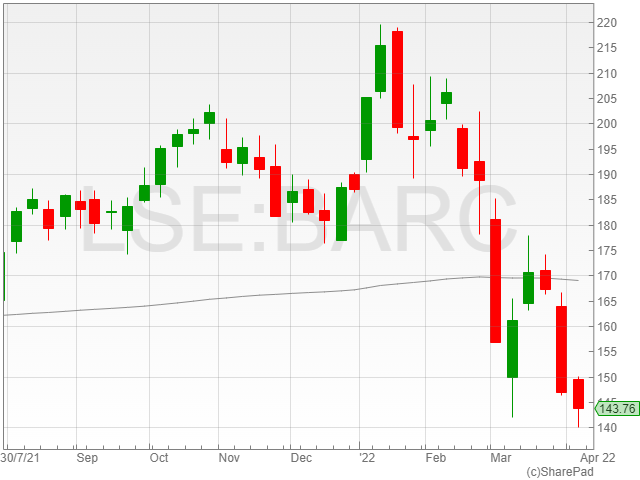

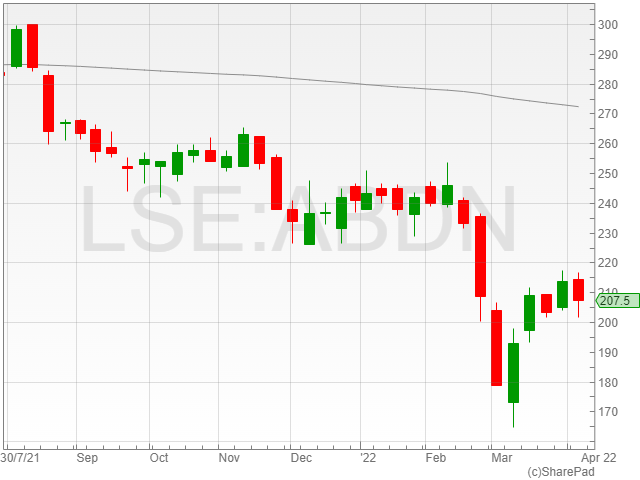

FTSE 100 gains amid optimism around rising UK wages

The FTSE 100 gained more than 1% on Friday after the market enjoyed a wave of optimism, as reports from REC and KPMG revealed that UK starting salaries rose at their fastest rate in March since records began in the late 1990s.

It was a great day for miners, banking and investment groups, and oil companies, with the stocks swept up in a commodities rally and hopes of a stronger global economy.

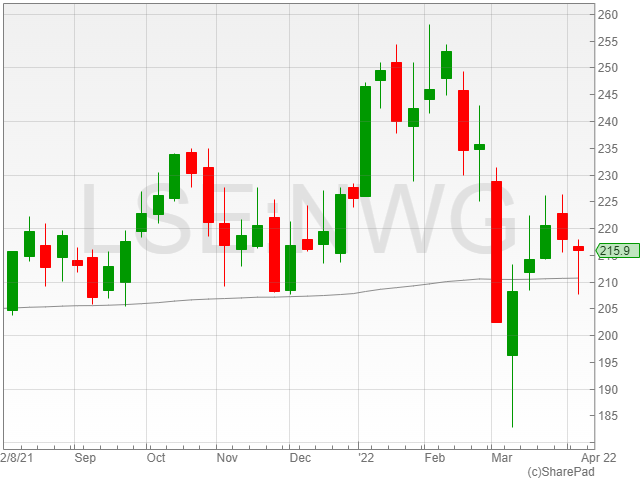

The FTSE 100 was anchored by the financial companies, with Standard Chartered rising 2.8% to 508.6p, Barclays shares increasing 2.7% to 144.5p, abrdn gaining 2.3% to 207.7p and NatWest receiving a 2% boost to 216.6p.

“Commodities firms and financial stocks, the latter boosted by expectations of faster rate hikes, helped lead the charge higher,” said AJ Bell investment director Russ Mould.

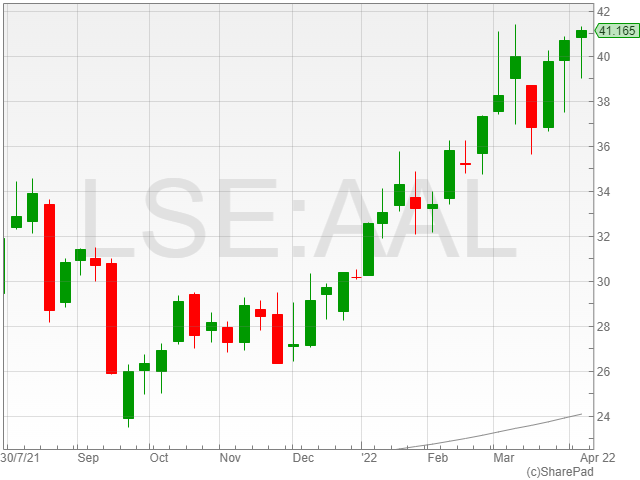

Anglo American shares enjoyed a boost of 3.2% to 41,065p and Endeavor Mining rose 2% to 19,485p.

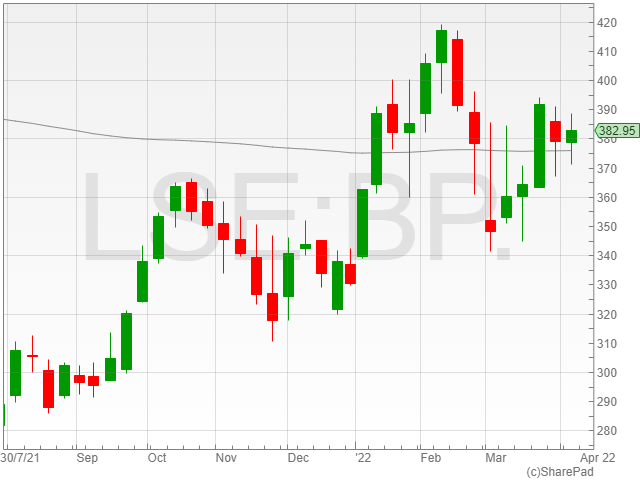

BP shares rose 2% to 385p, following the minor 0.5% upswing in the Brent Crude price to $101 per barrel.

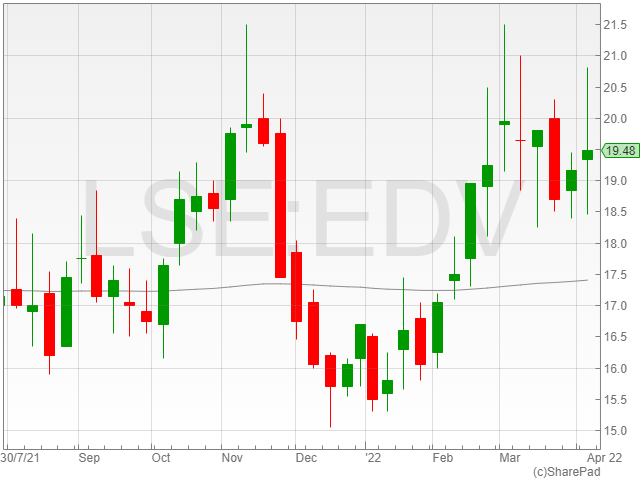

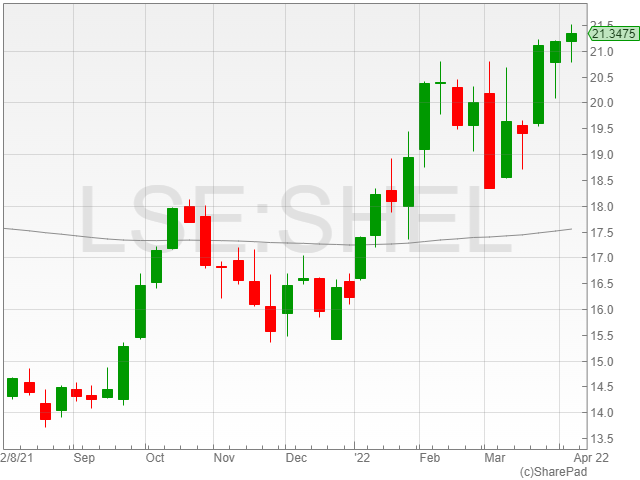

Shell shares increased 2.9% to 21,477p as the company gained back ground after its nasty shock yesterday, following the announcement that its exit from Russia would cost it an estimated $5 billion.

Although investors might be celebrating today, there does remain the risk that the increase in salaries will not work as a counterbalance to the spiking rates of inflation.

“Investors continue to wrestle with the challenges posed by rising interest rates and surging inflation with the latest data on wages in the UK offering an indication of how entrenched inflationary pressures are,” said Russ Mould.

“The risk is even the most generous salaries will see their buying power severely pinched by the rapidly escalating cost of living.”

Avacta and Daewoong’s AffyXell Therapeutics enter into agreement with Biocytogen

AffyXell Therapeutics, a joint venture between Avacta and Daewoong Pharmaceutical, has entered into a collaboration agreement with Biocytogen, a Chinese company specialising in developing new biological drugs, and the Korea Non-Clinical Technology Solution Center (KNTSC), according to Avacta Group, a clinical-stage oncology drug company.

The partnership will focus on the development of new immunological illness in vivo models as well as proof-of-concept and toxicity assessment of AffyXell’s therapeutic candidates utilising the disease models created.

Biocytogen’s gene-editing platform, which develops mouse models capable of manufacturing human antibodies, will benefit these models.

The alliance aims to improve AffyXell’s programme translation into human trials and speed up medication development.

KNTSC’s involvement in the partnership is to provide pre-clinical trial infrastructure and management.

AffyXell was formed in January 2020 as a joint venture between Avacta and Daewoong to explore innovative mesenchymal stem cell therapeutics.

AffyXell is merging Avacta’s Affimer platform with Daewoong’s mesenchymal stem cell platform to genetically modify stem cells so that they can manufacture and secrete therapeutic Affimer proteins in the patient.

The Affimer proteins are meant to boost the therapeutic effects of mesenchymal stem cells, resulting in a cutting-edge cell therapy platform.

Dr Alastair Smith, CEO of Avacta stated, “The quality of pre-clinical disease models and their ability to translate into humans is critical for reducing risk and timelines associated with drug development. This collaboration has the potential to significantly accelerate AffyXell’s programmes.”

“We expect this contract to allow Affyxell to exert a synergistic effect on developing next-generation cell gene therapy for overcoming immune diseases based on our non-clinical animal model development and non-clinical experimental know-how related to immune diseases,” added Biocytogen CEO, Yuelei Shen.

Avacta shares rose 17% to 103p after the company announced its joint venture Affyxell enter into an agreement with Biocytogen and KNTSC.

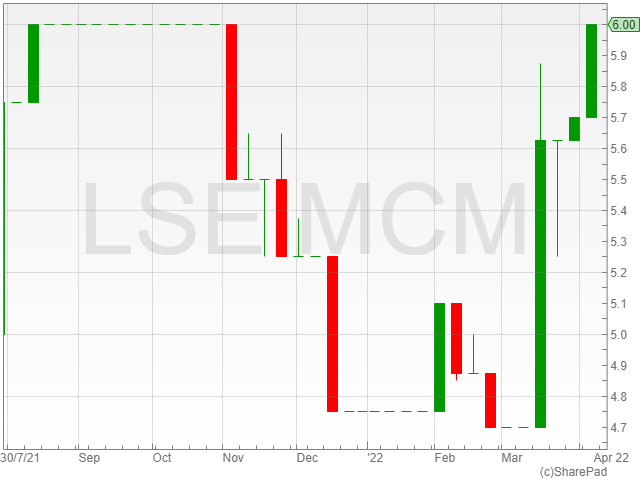

MC Mining executive director resigns

MC Mining shares were up 2.9% to 6.1p in late afternoon trading on Friday, after the company reported the resignation of executive director Sam Randazzo.

Randazzo has reportedly agreed to stay on as interim CEO of the company while the MC Mining board looks for his replacement.

The former executive director joined the mining group in November 2019 as a non-executive director, before rising to interim CEO and executive director from February 2021.

Randazzo’s time in the position included the successful stabilisation of MC Mining’s portfolio during a turbulent and challenging time for the firm due to social unrest in South Africa, causing trouble for its operations in the region.

The additional highlights over his tenure included diligent cash management, successful negotiations to extend company debt facilities and vendor payments, alongside the conclusion of a $5.7 million funding package announced by the company on 1 February 2022.

Randazzo also initiated and directed a bankable feasibility study carried out for the group’s Makhado hard coking coal project, and conducted talks with a selection of potential key cornerstone financers for the venture.

“On behalf of the Board I would like to thank Mr Randazzo for his significant contributions as Executive Director,” said MC Mining chairman Khomotso Mosehla.

“Mr Randazzo agreed to serve in this role during a challenging time and has successfully guided MC Mining during difficult business conditions.”

“He has been instrumental in setting the foundation for the Company to complete a funding package for the development of the Makhado Project. The Board is very grateful for his commitment.”

Journeo announces new framework agreement with First Bus UK

Journeo, a provider of IT services to the transportation industry, has signed a new framework agreement with First Bus UK, based on its SaaS platform and is expected to generate £9m in revenue.

The contract, which is the group’s largest to date and will initially last for three years until March 2025 with the option to extend for another 2 years until March 2027.

For the tracking, video management, and remote condition monitoring of on-vehicle devices, First Bus completed an extensive and successful trial of Journeo’s IoT EDGE car gateway and cloud SaaS portal.

Work on the rollout of the other 3,300 vehicles in their fleet, in addition to the 1,200 that are currently connected, will begin immediately.

Since 2010, Journeo has provided safety and security solutions to First Bus, and under the terms of the agreement, the company will continue to provide the ‘latest high-performance CCTV and safety-critical digital wing mirror systems’, as well as technical design, new technology assessment, and project management services backed up by nationwide technical support.

The total number of vehicles connected and using Journeo’s SaaS platform will exceed 13,000 once the rollout phase is concluded.

The agreement’s contracted revenues were factored into management’s performance expectations for the current fiscal year along with adding to the company’s order book, increasing future revenue visibility.

With a fleet of roughly 5,000 buses, First Bus is the second-largest regional bus operator in the UK, operating around a fifth of local bus services in the deregulated market outside of London.

Despite Covid-19, they carried 465,000 passengers each day in 2020-21, serving 40 of the UK’s main towns and cities, including two-thirds of the country’s 15 largest metropolitan areas.

They have purchased around 2,000 new buses since 2010, which has boosted punctuality, fuel and cost efficiency, and lowered its environmental impact.

First Bus has committed to operating a zero-emission bus fleet by 2035 as a forerunner in the decarbonization future for public transportation and has no plans to purchase any new diesel buses beyond December 2022.

The business currently comprises two divisions, fleet operator solutions and passenger transport infrastructure solutions

Journeo

Journeo collaborates widely with local authorities and global transportation companies, assisting them as their systems converge toward a greener future for smarter cities.

Journeo offers flexible, scalable solutions and services that can interact with existing technology while preparing for future developments thanks to an IoT strategy and open standards, as well as field-proven and reliable engineering.

Using local Wi-Fi or the 4G capacity of the EDGE vehicle gateway, Journeo’s cloud-based SaaS solution gives authorised users verified, high-security access to video and relevant data from any connected car.

Journeo’s machine learning software delivers important in-service performance data for ‘predictive maintenance’ plans, as well as the transfer of vital information in real-time from the vehicle to back-office business systems, making it a secure foundation for linking other vehicle services.

The company has invested over £5 million in R&D over the past four years, allowing it to build and deliver new solutions for the customers’ demands and the challenges of modern public transport.

“We are delighted that First Bus have selected Journeo’s cloud-based video management solution for their entire UK bus fleet. We designed our SaaS solution specifically for the transport sector where secure and scalable communications and open-architecture standards offer a clear path for operators and authorities to connect assets using a range of IoT gateways and sensors to benefit from the data insights that it provides,” commented Russ Singleton, CEO of Journeo.

Journeo shares soared 34% to 142p following the news of its new agreement with First Bus UK on Friday afternoon trade.

Oilex resumes production at Cambay Field

Oil and gas company, Oilex received Consent to Operate from the Gujarat Pollution Control Board allowing the company to resume production and gas sales through its Cambay Field in India.

“The re-establishment of production from the Cambay gasfield has occurred soon after the Indian government announced that the price of domestic gas would more than double from $2.9 per mmbtu to $6.1 per mmbtu. This will provide a material benefit to Oilex’s cash flow,” said Roland Wessel, Chief Executive Officer, Oilex.

Oilex shares fell 3% to 0.29p despite the good news of resuming production in the Cambay Field for the company.