AIM-quoted OptiBiotix Health (LON: OPTI) has floated its former subsidiary ProBiotix Health on the Aquis Stock Exchange, although it still retains a 44% stake. This enables the company to raise cash to finance its growth plans, while OptiBiotix can focus on its SlimBiome and SweetBiotix products.

One of the major reasons for spinning off ProBiotix at this time is that as an independent business it is eligible for EIS and VCT investment. OptiBiotix is not eligible. Joining Aquis is much cheaper than a flotation on AIM, particularly for such a small company.

ProBiotix is already generating reven...

Inland Homes complete two land sales

Specialist housebuilder, Inland Homes announced the completion of two land sales, the former Telephone Exchange in Staines and Phase 3 Gardiners Park Village in Basildon, on Wednesday.

The proceeds generated from the sale of both the Telephone Exchange and Phase 3 Gardiners Park Village will be used towards reducing Inland Homes’ net debt which is a priority for the company.

Telephone Exchange, Staines

A private housebuilder has bought the former Telephone Exchange on Elmsleigh Road in Staines.

In January 2022, Inland Homes received approval for 206 houses on the site.

The Staines scheme, with a gross development value of £65m, is part of Inland Homes’ asset management business, which discovers sites on behalf of investors and secures planning consent using its substantial land and planning experience.

This is a high-growth division of the group that generates significant service revenues with minimal investment and capital expenditure.

Phase 3 Gardiners Park Village, Basildon

Phase 3 of Gardiners Park Village in Basildon, which has 74 units and a gross domestic value of £27.5m has been sold to a private housebuilder.

In October 2021, the group received approval for a residential-led, mixed-use design at Gardiners Park Village with up to 700 houses and 25,000 sqm of commercial space.

Homes England, the government organisation entrusted with expediting housing delivery, is executing the plan through a public-private partnership strategy. Homes England, which owns a majority stake in the site, inked a development agreement with the group in 2020, and it (Homes England) will acquire the land in five phases.

Inland Homes will deliver new and enhanced services and infrastructure within the site as the masterplan developer, including renovating highways and moving sports facilities.

“We are delighted to have achieved these two land sales following receipt of planning consent,” said Stephan Wicks, CEO, Inland Homes.

“Demand for our quality land assets remains strong, with Inland owning and managing a land portfolio which is attractive to private housebuilders, affordable housing providers and build to rent operators.

“In line with our strategy, we will seek to maximise value from our land bank, with the fees and funds generated being used to further reduce the group’s net debt.”

Inland Homes shares lost 8% to 40.5p despite the announcement of completing two land sales.

Gaming Realms launches content in Ontario

Gaming Realms, a provider and licensor of mobile gaming material, said that its content was formally introduced in Ontario, Canada on April 4, 2022, the first day of the province’s regulated gaming market.

Rush Street Interactive (BetRivers), Kindred, and BetMGM have launched seven games from Gaming Realms’ Slingo portfolio in Ontario.

More of the company’s material is expected to be authorised soon, and it has agreements to go live with several other major operators.

“With thirteen deals signed for Ontario, and many more in the pipeline, this expands and strengthens our global presence while bringing our hugely popular and innovative Slingo content to a new audience,” said Executive Chairman of Gaming Realms, Michael Buckley.

“Ontario has a population of about 15 million people, and with the recently announced deal with Loto-Québec, our games are now available to more than 20 million people in Canada.”

Gaming Realms results for the year 2021 will be released on 26 April 2022.

Gaming Realms shares fell 5% to 29p following the company’s launch in Ontario.

BrandShield signs contract with leading pharmaceutical company

Cybersecurity solutions company, BrandShield has signed a contract with a major pharmaceutical firm on Wednesday.

BrandShield Systems has announced the signing of a new deal with a major pharmaceutical manufacturer. The deal follows a period of continued sales growth and the signing of several new customers since the start of 2022.

BrandShield will provide enhanced brand protection for the pharmaceutical company, using its highly automated SaaS product to detect and eliminate online risks such as fraudulent pharmacies.

Geographically, BrandShield will focus on using its innovative software services to protect the pharmaceutical company’s operations from cybercriminals across Asia and Oceania, as well as safeguarding users and improving the customer experience.

The mandate adds to BrandShield’s growing roster of pharmaceutical clients, which includes collaborations with the Pharmaceutical Security Institute and Bristol-Myers Squibb to detect and remove rogue pharmacies and fake medicine listings from the internet.

Yoav Keren, Chief Executive Officer, BrandShield said, “This win is an example of one of several new mandates BrandShield has already secured in 2022, strengthening our reputation as a leading provider of digital risk protection solutions for companies across a wide array of sectors.”

“BrandShield has a proven track record of successfully identifying and eradicating critical online threats to global pharmaceutical companies and we look forward to extending our leading position in the pharmaceutical space, one of many exciting opportunities in our pipeline for the near to medium term.”

BrandShield shares gained 2% to 10.8p following the news of its new deal with a leading pharmaceutical company on Wednesday.

Are Eve Sleep shares ready for a nap?

Eve Sleep has enjoyed an interesting 2022 so far, with the announcement of a potentially lucrative deal with DFS and reports of steady financial results in 2021.

The company reported a revenue uptick of 11% to £26.6 million against £25.2 million in 2020. Eve Sleep announced an increase in gross profit to £14.7 million compared to £14.4 million in 2020.

The firm announced that Q1 2020 was its strongest quarter due to rising lockdown restrictions, with a normalisation in its comparatives by the start of May the same year.

Eve Sleep reported that January and February trading were softer than in 2020, but the year overall represented a 6% uptick in 2021.

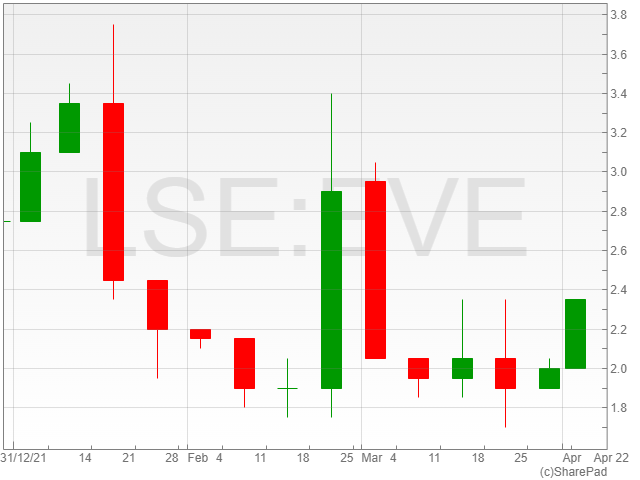

However, despite steady growth, the AIM listed company has so far fallen 24.5% year-to-date.

The firm attributed its increased £3.4 million pre-tax loss to higher marketing investment in France.

Eve Sleep shares fell 25% on 19 January 2022 to 2.6p on the back of reported delivery and customer service issues ahead of its final results for 2021, including strain on its delivery chain over the Christmas trading period, leading to customer service problems.

DFS Partnership

However, Eve Sleep saw its shares surge 95% in late February after it announced its partnership to sell its range of mattresses on the DFS site with a later rollout to its showrooms, with the share price rising to 2.9p on the day of the announcement.

However, it appears that the DFS partnership was only a temporary break in Eve Sleep’s shares continual downward spiral, with the price largely giving up all its gains since.

Sleep Wellness

Eve Sleep has also highlighted its ambition to break into the relatively untapped market of digital sleep wellness services.

“Our push into sleep wellness space will continue at pace in 2022, including the launch of our first digital services,” said eve Sleep CEO Cheryl Calverley.

“Sleep wellness is a large, fragmented and growing market, where we have a substantial lead over our more mattress focused competitors.”

“There is a real opportunity to create the world’s first digital sleep wellness retailer.”

Potential trouble ahead

However, the company noted growing geopolitical uncertainty as the Russian invaded Ukraine, and said that despite its unchanged goals to capitalise on its momentum in 2022, the firm’s situation remained subject to conflict-linked volatility in its supply chain.

It’s worth highlighting that 40% of the group’s revenue in 2021 came from its premium range; with inflation hitting new highs at a 30-year record of 6.2% and the energy price cap rising 54% in April, it’s possible that consumers will be less-inclined to spend cash on higher-end offerings from Eve Sleep if the tsunami of expenses coming up in 2022 empty their wallets beyond the cost of a new fancy mattress.

Eve Sleep’s rise to 2.9p on the DFS partnership announcement did not keep the attention of investor for as long as the company probably hoped for, as the shares have fallen back to stand at 2.1p at the time of writing.

Are investors growing impatient with Canadian Overseas Petroleum?

Canadian Overseas Petroleum and its joint venture Shorecan have projects in Converse County, Wyoming and sub-Saharan Africa.

The company’s Wyoming operations are environmentally friendly due to its low gas flaring and methane emissions along with the production facilities being powered by electricity generated by a neighbouring wind farm.

Canadian Overseas Petroleum

Canadian Overseas have flirted with investors throughout the last year by announcing optimistic updates including encouraging production figures and significant oil discoveries. However, a series of set backs and disappointing results has led to the company today having to clarify a storm of what the company calls ‘disinformation posted on social media and internet chat forums’.

Increased Oil Production

Around late November 2021, COPL announced increased oil production at its operated Barron Flats Shannon Unit rebounding the company’s shares.

The company reported a 35% increase in crude oil production from the Shannon Unit as a result of completing the infrastructure to reduce the surface working pressures on the field’s most efficient producing well.

The completion of infrastructure to reduce the surface working pressures on the fields most capable of producing well has increased oil output. This horizontal well, which was previously produced at a restricted rate of 150 barrels per day, has responded very well to the miscible flood scheme and was responsible for the field’s peak oil production in August.

The company also announced delays in the completion of the Barron Flats Federal (Deep) Unit due to problems with isolating the perforated Frontier Sands from the wellbore, which provoked investor sentiment once again.

Significant Oil Discovery

In Wyoming’s Converse and Natrona Counties, the company made a large oil discovery on its leasehold during the start of 2022 resulting in COPL shares gaining traction again with investors hoping the outlook for 2022 follows the trend.

Canadian Overseas estimated that the overall oil reserve would hold 1.5b to 1.9b barrels, with its lease covering 1.3b to 1.6b barrels.

COPL had already applied for licences for four horizontal wells and the company expected to exploit the discovery.

Each well was projected to produce 1,000 to 3,000 barrels of oil per day at first. One discovery well had already started producing at a rate of 100 to 120 barrels per day.

Meanwhile, output at the company’s Barron Flats Shannon field, also in Wyoming, was producing 2,000 barrels per day, exceeding expectations following a gas injection programme that began in April 2021.

$8m Accelerated Bookbuild

At the end of 2021 Canadian Overseas Petroleum announced the need for an accelerated bookbuild amounting to $8m.

By way of a placing and subscription, COPL planned to perform an accelerated bookbuild to raise net proceeds of roughly $7.5m, which would be used towards making a bid for Cuda Energy.

Tennyson Securities placed a total of 30,250,000 Common Shares with institutional investors for 20p per placing share.

The net proceeds of the offering, along with COPL’s other financial resources, were to be used to fund a bid for Cuda Energy or its assets, as well as general working capital.

Director Purchase

Chief Executive Officer Arthur Millholland purchased COPL shares as he said, “This share purchase shows my confidence in the company’s recently announced deep discovery and the performance of our miscible flood at our Barron Flats project in Wyoming.”

Millholland purchased 665,000 shares at an average price of CAD0.58, worth CAD385,700 which was approximately £225,315. At the time, this was welcomed by investor and shares rose on the news.

2021 Results

COPL announced its year-end and Q4 results in which they said it was “a year of major positive change for COPL.”

The company discussed the impact of the acquisition of Atomic Oil & Gas which led COPL to operate 3 assets in the Powder River Basin in Wyoming.

At the start of the financial year, COPL completed the acquisition of Atomic Oil & Gas which has been transformative for the Company. COPL now operates three assets – Barron Flats Unit, Cole Creek and Barron Flats Federal (Deep) Unit in the Powder River Basin in Wyoming with a working interest of 58%, 67% and 56% respectively.

From the start of the acquisition, COPL stated the assets produced “1,100 barrels of light oil” which grew to 1,900 barrels a day after COPL implemented a ‘works programme’. However, facility constraints restricted production which raised alarms for investors.

Although COPL acquired significant acreage in the Wyoming asset, only a portion of it was in production, again instilling concern in investors.

Regarding the oil discovery made in January 2022, the company has permits and will begin initial delineation later in 2022 through horizontal wells from 16 drilling locations.

Southwestern Production, COPL’s operational affiliate, was obtaining a drilling rig for the delineation drilling programme as well as the planned drilling of 8 additional production wells and 1 injection well at the producing Barron Flats Shannon Field.

Crude Sales

In terms of COPL’s financials, the company noted average net crude oil sales before royalties were 1,094 barrels per day in Q4 2021 which was higher than Q3 producing 1,071 barrels. The fourth quarter averages were limited due to facility constraints.

For the full year of 2021, net crude oil sales before royalties averaged 972 barrels per day.

Petroleum sales, net of royalties, were $5.8m in Q4 2021, offset by a $1.4m realised loss on crude oil hedge contracts, compared to $5.2m in Q3, offset by a $0.6 million realised loss on crude oil hedge contracts.

For FY22, petroleum sales were $15.0 million net of royalties, along with a $2.3 million realised loss on crude oil hedge contracts.

In the fourth quarter, COPL realised a gain of $1.6m on butane hedging contracts, compared to a gain of $1.1m in the third quarter of 2021.

In terms of the full year, COPL realised a gain of $2.8 million on butane hedge contracts concerning the miscible flood injection programme.

In the third quarter of 2021, the operational netback was $43.97 per barrel, which included a $2.76 per barrel net realised gain on crude oil and butane commodities contracts, compared to $26.85 per barrel in the third quarter of 2021, which included a $4.31 per barrel realised loss on crude oil and butane commodities contracts.

The operating netback was $33.10 per barrel, including a net realised gain of $1.92 per barrel on crude oil and butane commodity contracts for FY22.

Facility constraints and decreases in net realised gains seemed enough for investors to start moving their money from COPL.

2022 Outlook

Millholland looks forward “to the future with renewed confidence.” However, are investors patient enough to wait with him to see if they finally deliver?

In 2022, COPL is aiming to refinance the COPL America credit facility to reduce the company’s cost of capital. The company is also planning to optimize and increase oil production at the operated Barron Flats Shannon Unit miscible flood, and commence Phase 1 of the delineation of the Barron Flats Deep Oil discovery.

COPL Valuation

Canadian Overseas Petroleum has a market cap of £40m after shares gained 20% to 25p following the company’s move to clarify market speculation.

Canadian Overseas shares peaked at 42p in August 2021. The company has since lost 37.4%, however, YTD COPL shares have gained 53%.

It is evident from today’s release that Canadian Overseas Petroleum is aware of investor discontent which will need to be met with solid updates in the near future to avoid further downside in the stock.

Small & Mid Cap Roundup: Tui, Osirium Technologies, Sosandar, IP Group

The FTSE 250 fell 1% to 21,104 on Wednesday alongside a 0.5% drop to 1,051 in the AIM as concerns over Russia sanctions and Fed rates triggered a wave of caution from investors.

Moonpig shares sank 8% to 208p despite the company lifting annual revenue expectations to £300m yesterday as pandemic restrictions lowered across the UK.

Baltic Classifieds Group shares fell 5.6% to 172p as the stock faded back from to yesterday’s gains after the bounce back from losses sustained from the start of Russia’s invasion of Ukraine.

Tui shares lost 3.6% to 233p despite the company recruiting 1,500 new employees to focus on digitalisation and destinations due to the company’s expectations of summer 2022 bookings to return close to pre-pandemic levels.

IP Group announced First Light’s achievement of the first-ever fusion with a projectile approach, which gained approval from the UK Atomic Energy Authority.

After the achievement, IP Group said it will be doubling its stake in its portfolio company First Light Fusion. However, the intellectual property commercialisation company shares fell nearly 3% to 90.77p.

Ascential shares rose 3% to 344p and Premier Foods’ shares gained 6.3% to 124p in early morning trade on Wednesday.

Osirium Technologies shares soared 30% to 16.8p, continuing the stock’s rise from yesterday when the company reported “continued growth in contract values.” In Q1 of 2022, the Osirium secured 5 contracts, each having “larger value than any individual contract” the firm obtained in 2021.

Avacta shares flew 19% to 76p despite the drug developer and diagnostics company reporting an increase of nearly £11m in pretax loss and no dividends for 2021. However, Avacta did note an £800,000 increase in revenue to £2.9m.

Sosandar shares increased 19% to 28.5p after the company announced that its annual results are currently projected to exceed market expectations, with a substantial reduction in losses and revenue reaching £29m, which is more than double its result for 2021.

Premium drinks retailer Distil shares increased 17% to 1.4p following strong Q4 results. The company saw a 32% jump in revenue from 2021 and volumes rose by 38%. The firm also more than doubled its investments in brand marketing and new product development.

Eco Atlantic Oil & Gas shares plummeted 16% to 30p due to a discounted equity fundraise to raise £19.5m to fund the drilling of the Gazania-1 well on Block 2B, offshore South Africa.

Chariot, the Africa-focused transitional energy company, announced that it has signed a Memorandum of Understanding with the Port of Rotterdam International, a global energy hub linked to the green hydrogen project in Mauritania. However, Chariot’s shares suffered a fall of 8% to 20p.

BrandShield Systems’ shares gained 2% to 10.8p after the company announced that it had signed a new business agreement with a major pharmaceutical firm.

Price Target Changes

FTSE 250

Close Brother shares dropped 2% to 1,186p after UBS cut the company’s price target from 1,485p to 1,200p.

Berenberg raised Hochschild Mining’s price target from 130p to 160p, however, the shares still dropped 0.2% to 133p.

Centamin shares are down 0.6% to 91.6p despite Berenberg increasing the price target to 114p from 108p.

Tullow Oil shares fell 1% to 57p following Barclays raising the oil and gas price target to 87p from 85p.

Tritax Eurobox shares lost 0.5% to 105p after Barclays cut Tritax Eurobox’s price target from 145p to 135p.

Harbour Energy shares gained 2% to 478p and Capricorn Energy increased 0.5% to 227p as Barclays increased the price targets by 100p and 40p respectively.

AIM

Berenberg raised Pan African Resources’ price target by 1p to 28p, however, the company’s shares lost 4.5% to 22p.

Jubilee Metals’ shares gained 3% to 15p as Berenberg raised Jubilee Metals’ price target to 22p from 21p.

Griffin Mining shares rose 0.8% to 116p following Berenberg’s move to raise the company’s price target to 175p from 170p.

Greatland Gold shares increased by 0.8% to 13p following the price target increased from 24p to 26p by Berenberg.

FTSE 100 drops on US inflation worries

The FTSE 100 dropped 1% in afternoon trading on Wednesday after the new tax year brought a wave of caution from investors in light of inflation worries from the US Fed.

Despite the market benefiting from subsiding concerns that the Ukraine conflict could be the start of World War Three, investors remained slightly cautious due to uncertainty around the Fed.

Federal Reserve Governor Lael Brainard warned on Tuesday that the central bank must work quickly to reduce its balance sheet and simultaneously increase interest rates to control inflation before it spikes out of control.

“There remain significant headwinds for equities and the latest trouble spot is what the Federal Reserve might do to curb inflation,” said AJ Bell investment director Russ Mould.

“While investors have been expecting the Fed to do something about inflation for some time, it’s the likely pace of action that really worries the market.”

“Tighten monetary policy too quickly and the economy could fall into recession.”

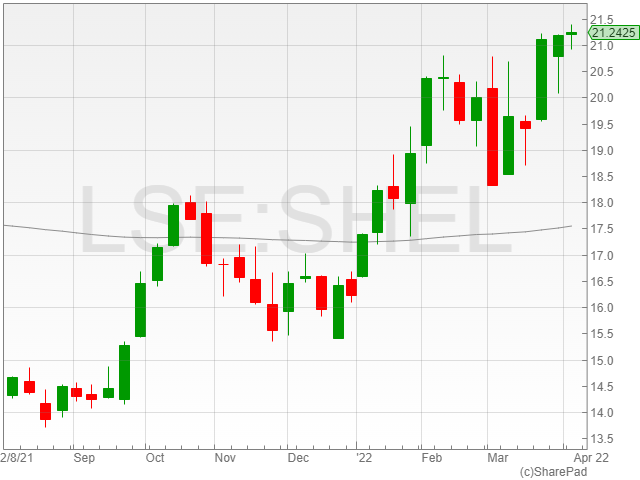

It was a good day for oil companies as Shell gained 0.7% to 21,375 after the price of Brent Crude went up to $108 per barrel, following its plummet to $104 earlier this week.

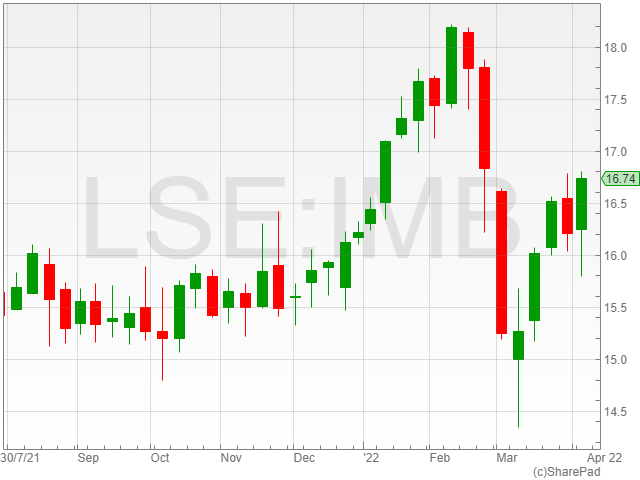

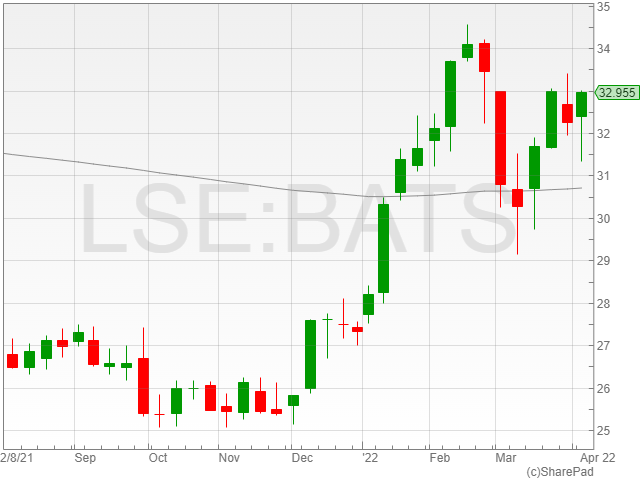

Tobacco brands performed strongly, with Imperial Brands rising 3.3% to 16,700p and British American Tobacco shares gaining 1.4% to 32,752p after Imperial Brands announced projected tobacco price rises in the latter half of the year bringing in a boost in revenue despite a weakened slate of tobacco sales in Europe.

“Gains in the US, UK and Australia more than offset declines in Germany and Spain,” a spokesperson for Imperial Brands said.

“These share gains were achieved while maintaining strong pricing discipline, and overall tobacco volumes are in line with expectations.”

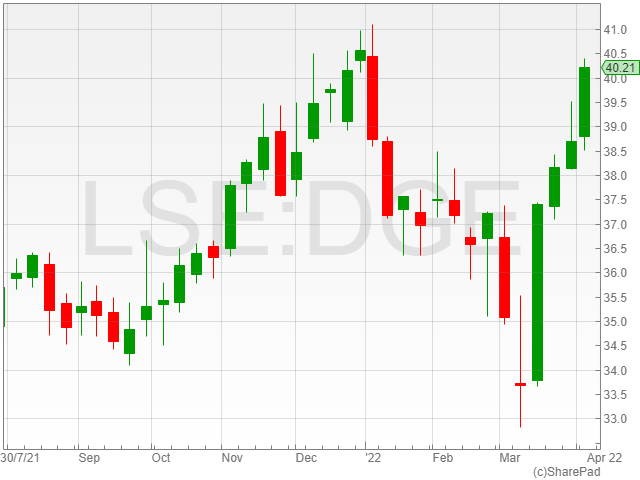

Diageo shares increased 1% to 40,195p following the company’s launch of priced fixed-rate sterling and euro-denominated bonds on Tuesday, from which the proceeds will reportedly be used “for general corporate purposes”, according to a statement from the drinks producer.

Smurfit Kappa led the FTSE 100 fallers with a 3.8% decline to 32,035p following the packaging group’s exit from Russia on the back of a fresh wave of sanctions. The company confirmed that its Russian business accounts for approximately 1% of its projected sales.

“This exit will be effected in an orderly manner, during which we will continue to pay our employees and fulfil our legal obligations,” said a spokesperson for the firm.

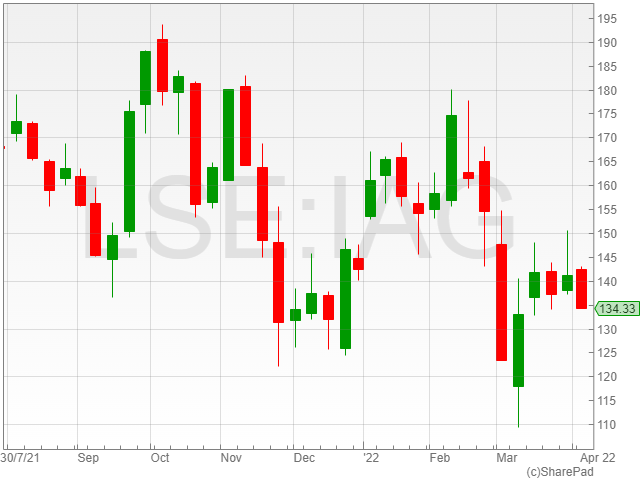

More bad news added to IAG’s worries as the travel company’s share price lost 2.9% to 135.6p following an announcement that flight groups including British Airways and EasyJet had axed over 100 UK flights from their Wednesday schedule due to surging rates of coronavirus among company staff.

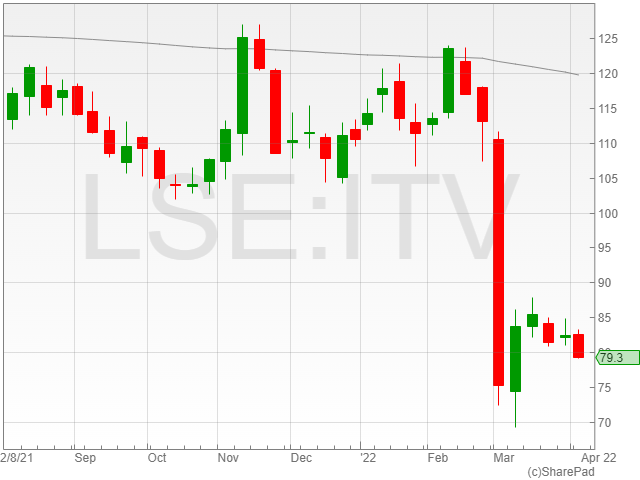

ITV shares suffered a 2.2% drop to 80,180p after the company reported a potential £1 billion bid for Channel 4, which is set to be privatised by 2024. The company is projected to face a bidding war between competing parties including Paramount Global, Sky and Discovery.

Twitter, Elon Musk, and Sovereign Metals with Alan Green

Alan Green joins the Podcast for our weekly rundown of global markets and equities.

Equities are continuing to trade headline to headline as horrifying evidence of war crimes in Ukraine is met by further sanctions on Moscow. Market sentiment is also suffering from Federal Reserve rumblings around rate hikes this year.

Elon Musk has taken a near 10% stake in Twitter, driving the social media’s stock higher on the announcement.

We question whether this is the start of a period of dramatic change at Twitter that could see it take on tech heavy weights, or simply a passion investment for Musk.

Sovereign Metals yesterday released a bumper upgrade to their Kasiya Titanium Rutile resource, making it the largest Titanium Rutile asset in the world. We look at what we can expect from the company going forward.

Logistics Development Group has £131.9m in the bank which equates to 19p of cash per share. The current share price is 16p. We look at this massive disconnect and what it means for investors.