The FTSE 250 was up 0.1% to 21,363 and the AIM was up 0.5% to 1,061 in early afternoon trading on Tuesday. Trustpilot helped the FTSE 250 higher with a 9% gain and raft of positive updates from AIM constituents.

Stronger commodities prices supported markets after Saudi Arabia said they were raising their May oil prices.

The price of Brent Crude oil rose to $109 per barrel following its plummet to $104 on Monday after state oil supplier Saudi Aramco increased its selling price for May to $9.35 per barrel for its Arab Light crude.

FTSE 250 Risers

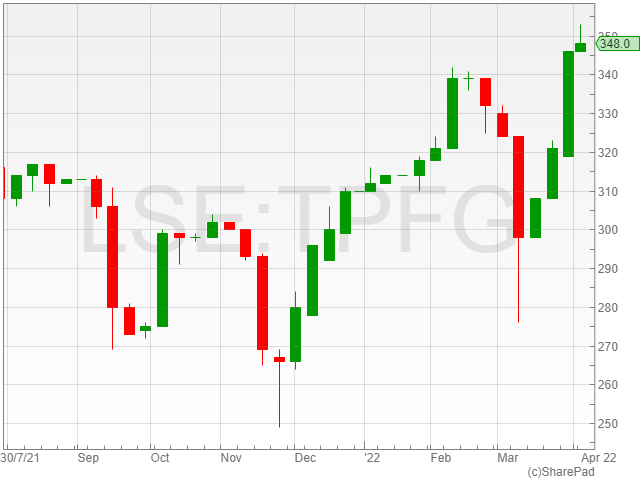

Reviews company Trustpilot Group enjoyed a rise of 6.8% to 153.3p as the stock began to recover from a sharp selloff in 2022 which has seen their shares halve in value.

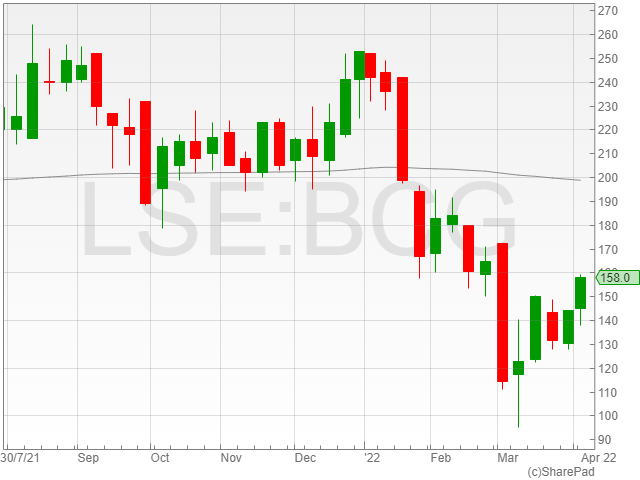

Lithuanian classifieds company Baltic Classifieds Group shares increased 4.9% to 153.8p as the stock continued to bounce back from significant losses sustained as the conflict in Ukraine began.

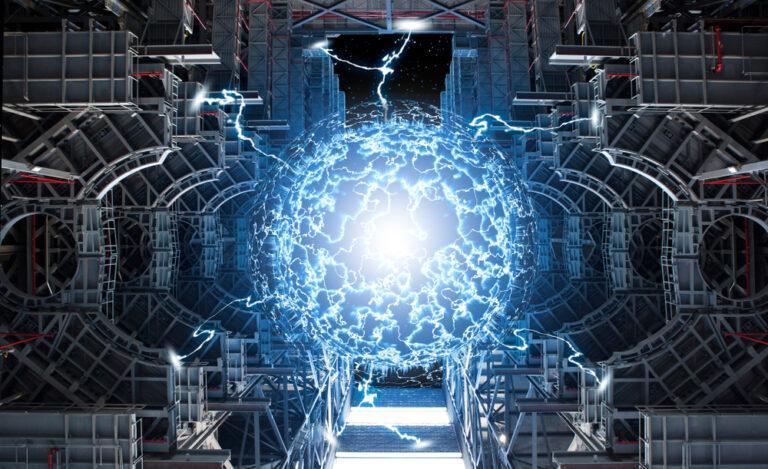

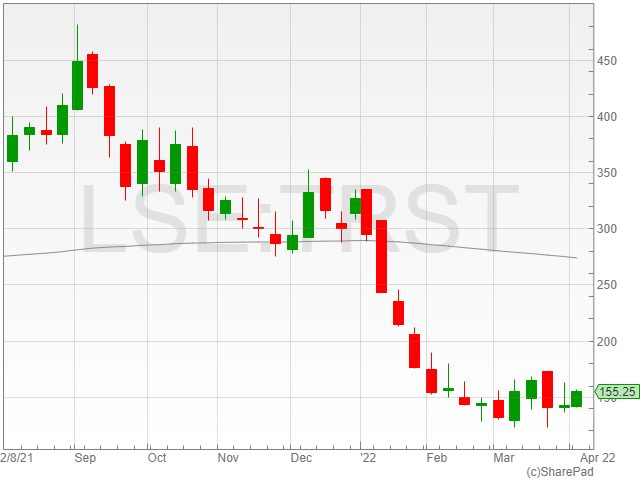

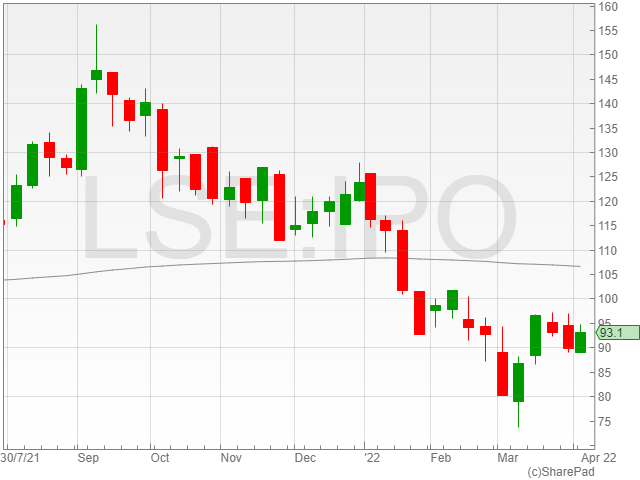

The IP Group surged 4.5% to 93.8p after the company’s First Light Fusion portfolio company reported a world first projectile-based fusion success which has the potential to open up the industry for faster and cheaper fusion energy.

FTSE 250 Fallers

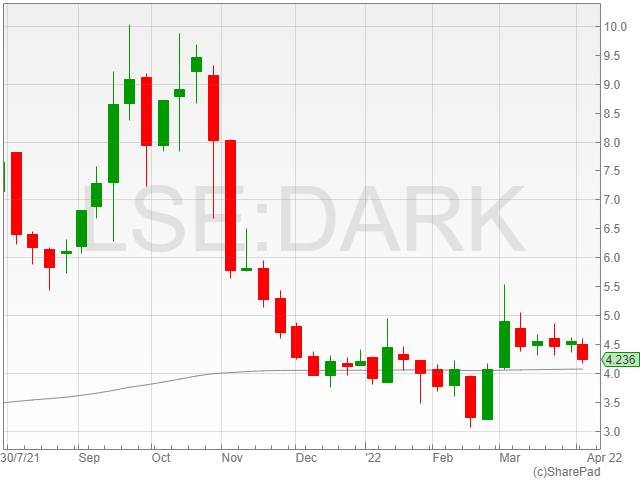

Darktrace shares suffered a dip of 6.2% to 422.7p after investors turned pessimistic following claims by JP Morgan that the company looks set to struggle with customer retention amid rising competition and a projected increase in customer acquisition expenses.

“High competition and low customer stickiness will likely translate to higher customer acquisition costs and prompt Darktrace to increase investments in existing and new product development – both of which will limit margin leverage going forward,” said a spokesperson for JP Morgan.

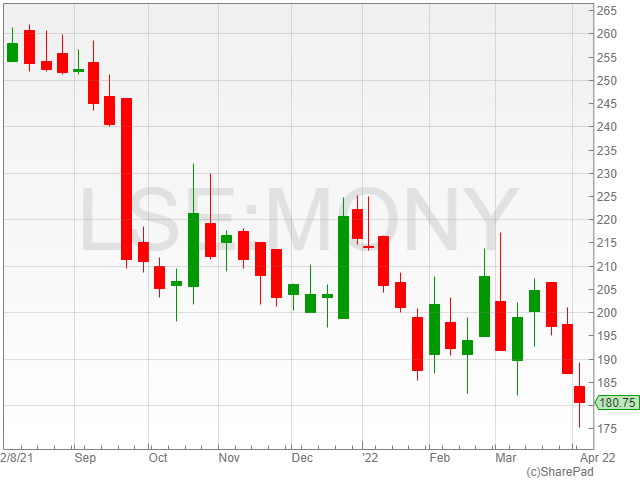

Moneysupermarket.com fell 3.9% to 181.7p following speculation from Barclays that the insurance broker looks like it’s set for a weak period in Energy, and a current drop in its Money and Travel divisions, resulting in the bank dropping its rating from overweight to equal weight.

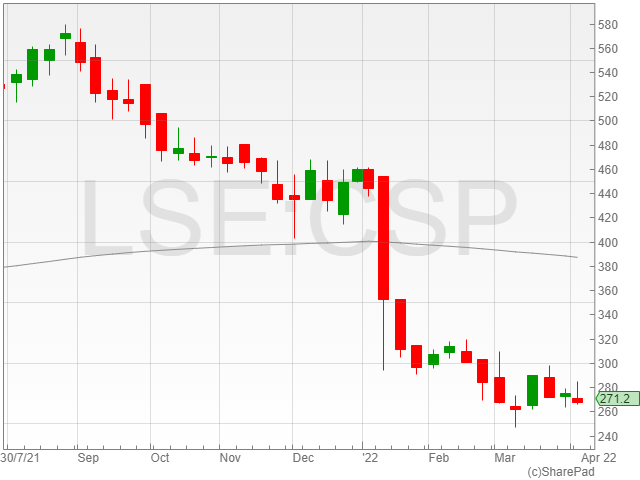

Housebuilding and urban regeneration group Countryside Properties dropped 2.6% to 271.4p as the rising cost of living impacts consumer spending.

AIM Risers

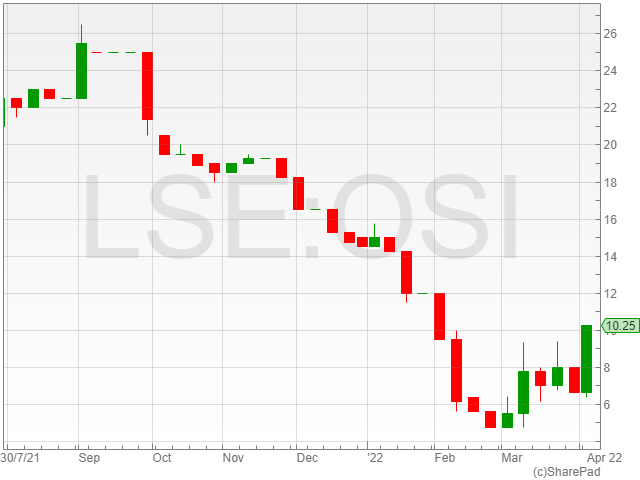

Osirium Technologies shares rose 45.1% to 9.2p following a strong Q1 report with growth in contract values along with a return to pre-pandemic levels.

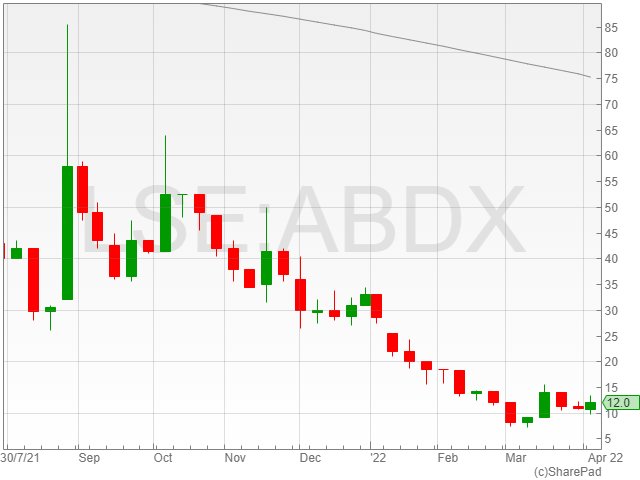

Abingdon Health enjoyed an uptick of 17% to 12p after the firm reported the completion of the technical transfer of its Vatic KnowNow Covid-19 antigen test for diagnostics technology group Vatic Health.

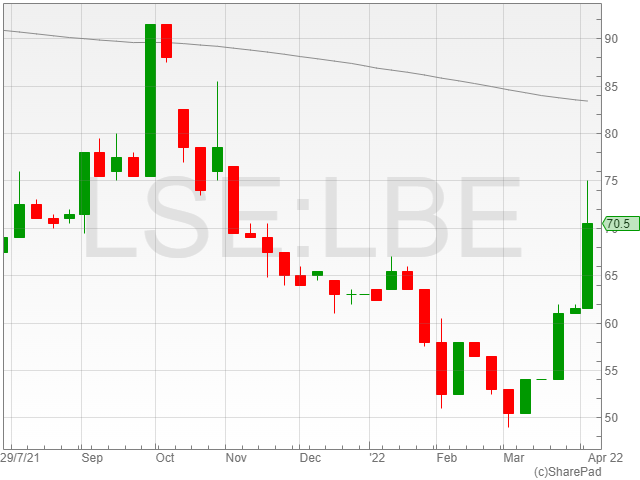

Longboat Energy saw an increase of 17% to 72p in light of the company’s recent Kveikje exploration well oil and gas discovery based in the Norweigan North Sea.

“Excellent reservoir quality, close proximity to infrastructure and multiple development options make this an important and valuable resource and we look forward to working with the operator to mature the forward plan,” said Longboat CEO Helge Hammer.

“We believe that this is an asset that can be commercialised via either development or transaction given the high-value barrels that we have discovered.”

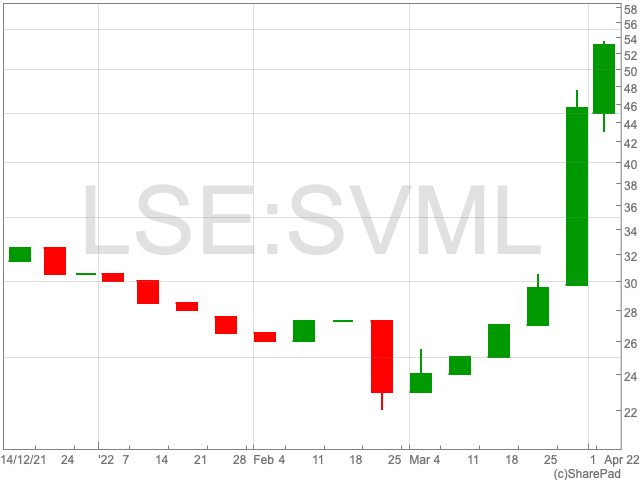

Sovereign Metals shares soared to touch all-time highs after the company announced their Kasiya Titanium Rutile project holds the world’s largest resource and is preparing for an updated scoping study.

Next Fifteen Communications rose as they released 2021 results that pointed to a 36% increase in revenue and encouraging organic revenue growth.

Echo Energy shares jumped 6% after production for Q1 2022 averaged 265 bopd, an increase of 10% compared to Q4 2021.

Borders and Southern Petroleum rose fractionally following the completion of a £1.35m funding round.

AIM Fallers

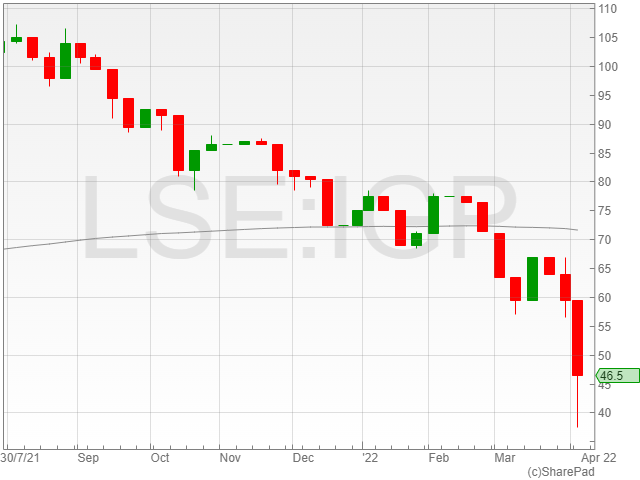

The Intercede Group plummeted 23.9% to 44.5p after the company reported an estimated 10% decline in revenue for 2021 on the back of delays in significant deals for the group.

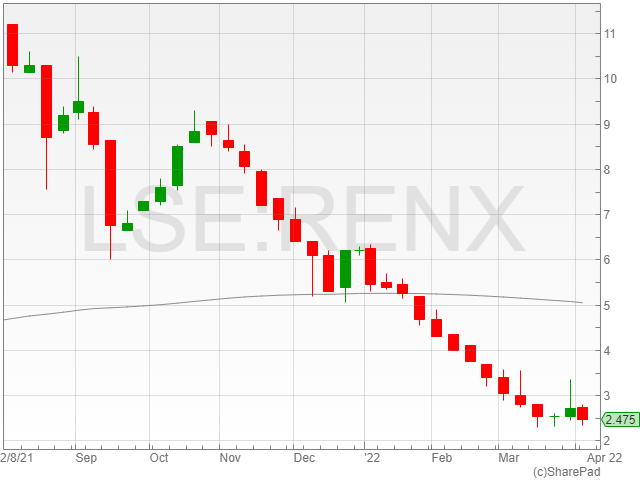

Renalytix AI fell 11.6% to 247.5p after the company’s $30 million financing package excitement wore off and the firm’s stock headed back to its spiral downwards.

Keras dipped 13.1% to 0.08p following a decline in interest after the shares surged to 0.09p from 0.04p after its acquisition of the Diamond Creek mine.

Gooch and Housego shares fell 4% after the group said revenue was expected to be weighted to the second half.