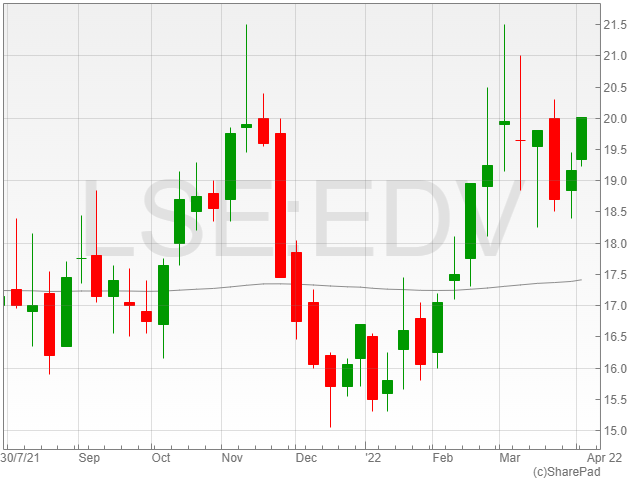

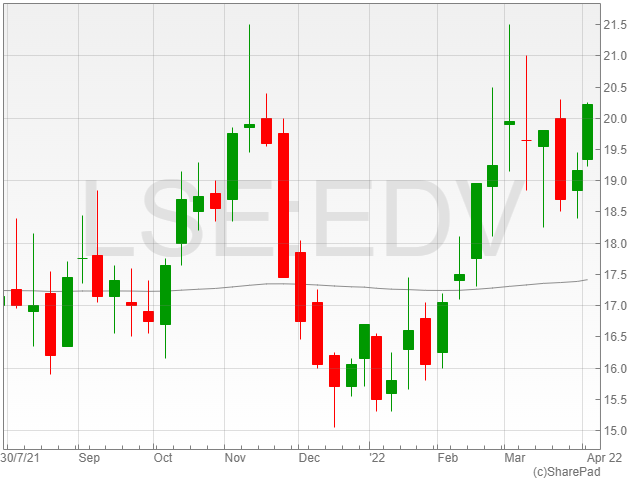

Increased levels of elective surgery and contributions from recent acquisitions have helped radiology services provider Medica Group (LON: MGP) to have a much stronger second half to 2021. Investment in technology is making the business even more efficient.

Revenues from elective surgery where slightly lower in the first half because of the effect of lockdowns and restrictions. The full year revenues improved from £12.5m to £17.3m as surgery activity built back to previous levels. Along with growth in the NightHawk emergency screening services business, this contributed to a doubling of UK ope...

Zoo Digital extends global expansion with Zoo Denmark

ZOO Digital expanded its global growth initiative with the launch of a new Copenhagen facility to support demand from clients for Scandinavian content with ZOO Denmark.

As part of its global expansion strategy, ZOO Digital, the provider of end-to-end, cloud-based localisation and media services to the global entertainment industry, has announced the opening of ZOO Denmark on Monday.

The facility in Copenhagen will serve as ZOO’s Nordic hub for localization services, and it will contain a cutting-edge dubbing studio that is completely linked with the company’s cloud-based ecosystem.

ZOO Denmark provides clients in the entertainment business with a local base for Danish dubbing. An expanding network of dubbing talent will use the Copenhagen facility, helping to meet the industry’s capacity needs and supporting a considerable and extensive public demand for localised media in the region.

ZOO Denmark meets the highest technical requirements expected in media localisation as part of the ZOOdubs enabled network of recording and mixing facilities and is backed by the company’s end-to-end dubbing platform, ZOOdubs, to ensure consistent audio quality and security.

Content makers and recording artists have more freedom, choice, and scalability for dubbing projects with this consistency across in-studio and remote recording situations.

“Scandinavia is an important region for our clients, so we want to be right there with them – providing the choice, talent capacity and quality of services they’ve come to expect from ZOO,” said Stuart Green, Chief Executive Officer, ZOO Digital.

“ZOO Denmark also enables us to support our cloud-based dubbing network with an in-territory base as needed, offering greater flexibility and a modern approach to dubbing.”

“This is another important regional launch as we continue to scale and build capacity in key growth regions for our clients.”

Look to the JPM Global Equity Income Fund for reliable global brands

The JPM Global Equity Income Fund will provide investors with stability in times of uncertainty through exposure to the world’s largest brands.

The tragic Russian invasion of Ukraine has sent waves through financial markets and will likely continue to cause uncertainty for months to come.

In such a period, investors may seek out those companies with reliable cashflows generated from resilient business models.

These characteristics are typically associated to the world’s largest companies – a focus of the team at JPM Global Equity Income.

The JPM Global Equity Income Fund has provided the highest returns for 1, 3, and 5 years amongst OEICS focused on the global equity sector.

JPM Global Equity Income Fund

The fund size is £185mn with a current yield of 2.07%, and their benchmark is the IA Global Equity Income index.

The JPM Global Equity Income Fund has consistently outperformed the IA Global Equity Income index. The funds’ 1 and 5-year returns were 13.5% and 65.6%, significantly higher than the IA benchmark of 8.3% and 35.2% over the same period.

Portfolio

JPM Global Equity Income Fund has invested mainly in the US, Europe, and the Middle East, excluding the UK and emerging markets with weights of 59.6%, 20.1%, and 6.2%. The fund has 3.2% of holdings in the UK.

Investors will be pleased to see that JPM Global Equity Income Fund has limited exposure to Russia and China and the volatility those markets are experiencing.

The fund has focused its investments in the technology sector associated with hardware and software with 11.4% and 6.6% holdings followed by banking and pharmaceuticals with 11% and 9.9%.

Microsoft has a weight of 4.9%, making it the top holding for JPM Global Equity Income Fund. Microsoft is a technology giant in the US whose shares remain stable. The company has a dividend yield of 0.8% and the shares have climbed by 354% in the past 5 years.

JPM Global Equity Income Fund has a 2.4% investment in McDonald’s, the global fast-food chain. McDonald’s has a dividend yield of 2.3% and has seen profits increase by 59% in 2021 to $7.5bn from 2020.

The fund includes the beverage giant Coca-Cola and has a holding of 3.9% in the company. The company has a dividend yield of 2.93% and shares have seen a 43% increase.

In addition, JPM Global Equity Income Fund has invested in Mastercard and Abbvie, to add to their diverse portfolio of income producing heavyweights.

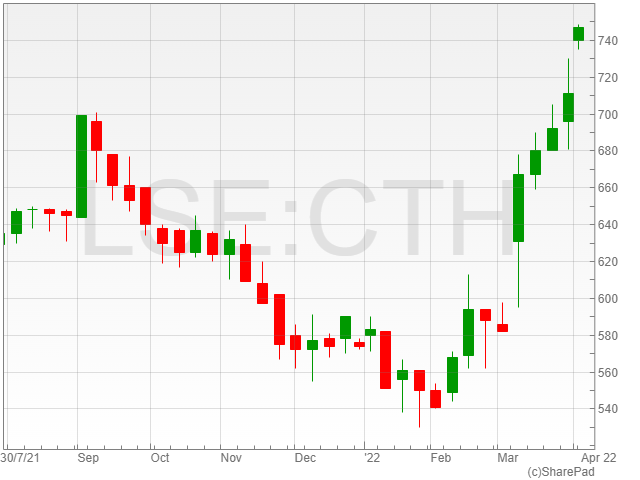

CareTech report possible offer from DBAY Advisors

CareTech shares rose 4.7% to 745p in early afternoon trading on Monday after the company reported a possible takeover offer from DBAY Advisors.

The care provider group confirmed that it received a non-binding indicative proposal from DBAY Advisors for a possible offer for the firm’s entire share capital, both issued and yet to be issued.

CareTech announced that DBAY Advisors recommended an offer price of 750p in cash per group share.

The firm mentioned that the proposal included a non-voting share “alternative offer” for shareholders to roll-over part of their investment to retain an interest in CareTech’s prospects beyond the potential acquisition, which the company confirmed would remain limited to up to 30% of issued capital.

CareTech said that discussions were currently in the early stages, and the group highlighted that could be no certainty that an offer would be made.

Ebiquity completes acquisition of Media Management

Ebiquity, a global leader in media investment research, announced the completion of its acquisition of Media Management, a US-based media audit company on Monday.

All conditions in the agreement for the acquisition of Media Management have been satisfied, and the acquisition of Media Management has now been completed, following the admission of 1,737,261 new ordinary shares in Ebiquity’s share capital to trading on AIM earlier this morning and compensation by the company for the balance of the initial consideration, both in accordance with the terms of the agreement for the acquisition of Media Management.

Total Voting Rights

The total number of Ordinary Shares in issue after admission will be 84,891,181, with each share carrying one vote.

To satisfy awards under the company’s share option plan, the Ebiquit Employee Benefit Trust holds 4,200,000 issued Ordinary Shares.

These share options have yet to be exercised, and the trustee has agreed to abstain from voting the Ordinary Shares it owns. As a result, 4,200,000 Ordinary Shares are not considered to have voting rights.

Belvoir Group marks 25th year of unbroken profit growth

Belvoir Group shares rose 3% to 263p as the company reported the 25th year of unhindered profit growth in its latest financial results.

A REIT, Belvoir Group noted a 39% increase in pre-tax profit from £6.7m to £9.3m in 2021 with strong growth in revenue.

The group revenues increase 37% to £29.6m from £21.7m in 2020 as a result of growth in the group’s underlying business and acquisitions of Nicholas Humphreys and Nottingham Mortgage Services.

During the year, corporate acquisitions and disposals added a net of £1.8m to the revenue which climbed £6.1 million on a like-for-like basis. In an attempt to expand the company’s property and financial services networks, Belvoir acquired Nicholas Humphreys and Nottingham Mortgage Services in 2021. Nottingham Mortgage Services added £0.5m to the revenue in the last five months of 2021.

Acquisition and organic growth contributed to the rise in revenue in the financial services division which increased by £4.7m to £14.4m in 2021.

The property division increased the group’s revenue by £3.2m with the property division’s revenue summing up to £15.2m in 2021.

The acquisition of White Kite Group 202, which operates under the name Nicholas Humphreys, increased revenues by £2.1m.

Meanwhile, between August 2020 and January 2021, the projected franchising of five Lovelle corporate-owned offices lowered revenue by £0.8m.

Management service fees (MSF) increased 18% to £10.7 million, with £0.3 million coming from the 17 Nicholas Humphreys franchise offices and five newly franchised Lovelle locations. The £1.6m rise came from a £0.7m increase in lettings MSF and a £0.9m increase in property sales.

In 2021, Belvoir increased house sales by 54% to 12,320 homes, opened 45 new offices and managed a portfolio of 72,900 properties.

Belvoir noted an increase in year-end cash to £7.4m compared to £5.9m in 2020 whilst reporting a 65% decrease in net debt to £1.3m.

The group’s total dividend increased by 18% to 8.5p compared to 7.2p in 2020, with a final dividend of 4.5p in 2021. Belvoir’s dividend cover is 2.3x according to the company.

Dorian Gonsalves, Chief Executive Officer, Belvoir said, “2021 was the busiest year for our sector in recent times with residential property sales transactions at their highest level since 2007, which boosted both our growing estate agency and financial services businesses.”

“We worked closely with our property franchisees and financial services advisers to ensure that they were best placed to respond to the strong market conditions, which drove significant organic growth of 25%.”

“Adding the national Nicholas Humphreys franchise network to the Group has enabled us to extend our professional lettings service to encompass the specialist student lettings market.”

“We also further strengthened our strategic alliance with the Nottingham Building Society, through the acquisition of its mortgage advisory arm, giving us access to its online savers who we hope will be our future mortgage clients.”

Belvoir shares gained 2% to 260p following the company’s robust revenue growth and continued increase in profits.

Small & Mid Cap Roundup: EasyJet, Genedrive, Oilex

With Covid-19 cases on the rise again, airlines have been heavily hit by staffing issues leading to the decline in airline shares on Monday.

Regardless, the FTSE 250 rose 0.39% to 21,300 and AIM increased 0.36% to 1,048 helped by a number of oil and gas companies, despite falling oil prices.

Oil prices fell 0.07% to $104 a barrel on Monday.

FTSE 250 Risers

Retirement specialist Just Group shares were trading up 5.9% to 95.5p after Barclays changed the group’s rating to overweight from equalweight.

Indivivour shares gained 3.9% to 296p following the rating change from buy to overweight by Jefferies.

FTSE 250 Fallers

Carnival shares fell 0.04% to 1,360p, despite UBS raising the group’s rating to ‘buy’.

Pets at Home shares dropped 1.7% to 357p after Deutsche Bank cuts the company’s rating to ‘buy’.

Page Group shares lost 1.2% to 477p after Barclays cut the group’s price target from 770p to 700p.

Airline company EasyJet shares sunk 2.3% to 542p after the company had to cancel 222 flights over the weekend due to staffing shortages as a result of rising Covid cases.

WizzAir lost 1.2% to 2,820p, despite the budget airline company reporting a 480,203 increase to 2.5m in passenger numbers during March and a load factor of 78.2% compared to 63.9% in 2021.

Hochschild Mining completed the acquisition of Amarillo on Friday, and the group’s shares dropped 0.5% to 129p in early morning trade on Monday.

AIM Risers

Genedrive shares continue its gains with a 28% increase on Monday due to the company’s Antibiotic Induced Hearing Loss test, MT-RNR1 being accepted across various healthcare institutions including Inspiration Healthcare and Manchester University Hospital Trust.

Chariot Oil & Gas shares rise 21% to 23p on news of an upgrade in the net gas estimates for the Anchois-2 well.

Thor Mining shares increased 5.7% to 0.93p on the approval to drill at Rim Rock and Section 23, Groundhog, from San Miguel County, Colorado.

Restaurant operator, Fulham Shore shares were boosted 6.5% to 16.5p as the company saw a return of consumers with Covid restrictions being eased, allowing the group to assume earnings will exceed expectations.

Induction Healthcare shares rose 3.7% to 42p as the company signed on 4 South West London NHS Trusts to use its Induction Zesty platform

i3 Energy shares gained 12% to 23p as the company said the oil production will exceed expectations. In Q1 2022, the weekly average production of barrels of oil per day increased from 8,856 to 20,312.

AIM Fallers

Red Rock Resources shares plummeted 17% to 0.38p despite the company establishing a lithium subsidiary in Zimbabwe, African Lithium Resources.

Keras lost nearly 16% to 0.08p after the company announced the complete takeover of Falcon Isle Resources and Falcon Isle Holdings from Helda Living Trust for $3.2m.

Oilex shares sunk 13% to 0.22 following the news of hindrance in restarting production at its Cambay field in India due to licensing issues.

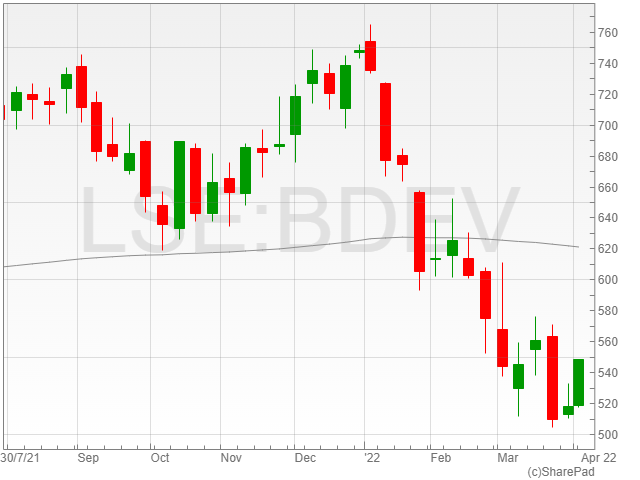

FTSE 100 rises on surging housebuilders and US jobs report

The FTSE 100 was up 0.2% to 7,554 in late morning trading on Monday, following a strong jobs report on Friday that revealed 431,000 jobs added to the US payroll in March, and that the American unemployment rate fell to 3.6%, the lowest rate in two years.

Oil continued its decline to $104 per barrel of Brent Crude as US President Biden’s announced that the country would release one million barrels of oil per day from the Strategic Petroleum Reserve last week which calmed the spiking prices and brought it down from previous heights of $120.

A recent ceasefire between the UAE and the Houthi group which is set to see a suspension of military operations on the border between Saudi-Arabia and Yemen has also served to alleviate concerns about supply issues in the area.

Housebuilders Gain

The market enjoyed positive gains across the housing sector, with Persimmon, Taylor Wimpey, Barratt Developments, Berkeley Group Holdings and Rightmove joining the FTSE 100 risers today after the UK government discarded demands on housebuilders to contribute to its £4 billion cladding fund to fix faulty cladding on houses across England.

Barratt Developments rose 5.2% to 545.6p following the £4 billion cladding fund news.

Persimmon enjoyed a boost of 5.2% to 22,615p also on the back of the cladding fund report, alongside the group’s acquisition of Bootham Crescent from York City football club for £7 million earlier today.

The top risers also included Endeavor Mining, which increased 5.3% to 2,180p after it reported the expansion of its Sabodala-Massawa mine in Senegal.

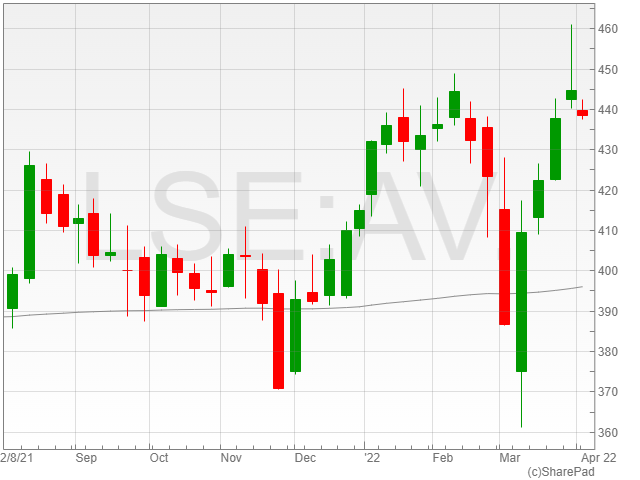

The top fallers were led by Aviva, after the British insurance company announced former Jupiter Fund CFO Charlotte Jones as its new CFO on Monday.

IAG took a hit of 1.4% to 139.1p after it experienced cancelled flights amid the spiking surge of Covid-19 cases among airline staff over the weekend.

“Hot on the heels of long delays at Heathrow and Manchester airports is news that EasyJet has cancelled 100 flights and British Airways owner International Consolidated Airlines also unable to operate all of its scheduled flights,” said AJ Bell investment director Russ Mould.

“These issues stem from airlines and airports having insufficient staff to cope with rising demand. A resurgence in Covid cases hasn’t helped, with many workers off sick.”

International banking services firm, Standard Chartered fell 1.2% to 503.4p.

Endeavour Mining report $290m Sabodala-Massawa expansion

Endeavour Mining announced the upcoming construction of its Sabodala-Massawa expansion based in Senegal for $290 million in upfront capital, following supporting results from a recent Definitive-Feasibility Study (DFS).

Endeavour Mining reported that its DFS recommended the expansion of the mine by supplementing its present 4.2 million tonnes per annum (mtpa) Carbon-in-leach (CIL) plant with a 1.2mtpa BIOX plant in order to process high-grade refractory ores sourced from the company’s Massawa Central Zone and Massawa North Zone deposits.

The group estimated that the first gold production could be expected by early 2024.

The mining firm said that the Expansion Project is projected to yield an incremental production of 1.35 million ounces (Moz) of gold at a low all-in sustaining cost (AISC) of $576/oz throughput the life of mine.

The company also said the extension boasts robust economics, and will provide an after-tax IRR of 72% and a fast 1.4-year payback period based on a gold price of $1,700/oz.

The news follows Endeavour Mining’s sale of its 90% stake in its non-core Karma mine in Burkina Faso to Nere Mining for a $25 million total consideration.

“We are extremely pleased with both the current performance of Sabodala-Massawa and the Definitive Feasibility Study results announced today, as they demonstrate the asset’s potential to be a top tier mine capable of producing in excess of 400,000 ounces per year at an industry-leading AISC,” said Endeavour Mining CEO Sébastien de Montessus.

“Given the robust project economics, which significantly exceed our investment criteria, and the strong exploration upside potential, we are excited to launch this low-capex intensive brownfield expansion project as it will continue to improve the quality of our operating portfolio and contribute to driving the Group’s return on capital employed above our 20% target.”

“In line with our capital allocation framework, we are very pleased to be able to pursue this organic growth opportunity while maintaining a healthy balance sheet and the financial flexibility to continue to deliver strong capital returns to shareholders.”

“We believe we are well positioned to unlock the full value of the Sabodala-Massawa complex as we have significantly de-risked the project by integrating key changes into the DFS, based on experience gained from operating the asset and the results of further technical analysis, and we have highly experienced operating and construction teams already in place.”

Endeavor Mining shares were up 4.5% to 2,004p in late morning trading on Monday following the news.