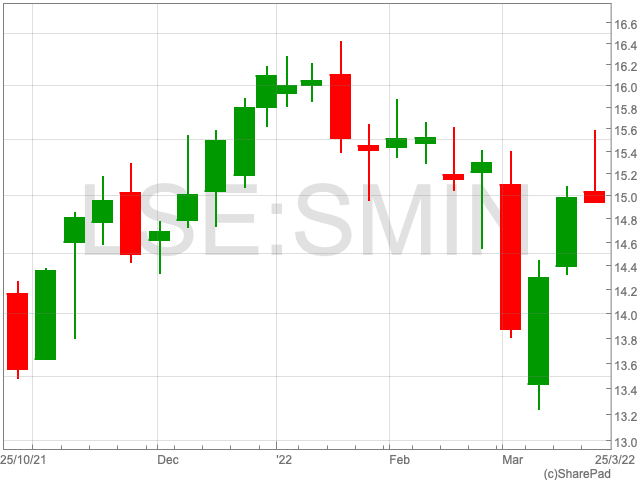

Open Orphan subsidiary hVIVO reported a £5 million study contract win with a European biotechnology company to test its intravenous antiviral candidate in a study on the respiratory syncytial virus (RSV).

Open Orphan saw its share price surge 8% to 14.5p in late morning trading on Friday after the announcement.

The company anticipates revenues from the contract to be recognised across 2022 and 2023.

RSV currently affects an estimated 50 million people globally and accounts for four million hospitalisations and 75,000 in-hospital deaths of children under five years old.

The study is expected to break new ground in the medical community’s understanding of the disease, in particular concerning adult patients.

Open Orphan and European biotech have reportedly collaborated in previous clinical work conducted by the Venn Breda team.

“I am pleased to announce this £5m contract to test our client’s antiviral candidate using the hVIVO RSV Human Challenge Study Model,” said Open Orphan CEO Yamin ‘Mo’ Khan.

“RSV is a significant threat to public health, and we are delighted to support this European biotech in the development of its antiviral candidate.”

hVIVO Chief Scientific Officer Dr Andrew Catchpole added, “This contract is a further demonstration of the significant value of human challenge studies.”

“Efficacy data provided by the Company following the completion of the study can lead to entry into Phase II as well as optimisation of a Phase III programme.”

“For Big Pharma as well as smaller biotechs, the substantial time and financial savings compared to typical field-based studies is increasingly making human challenge the trial design of choice for achieving early proof of concept data.”