Restaurants operator Tasty (LON:TAST) suffered from lockdowns in the past two years but it did bounce back into profit last year. The share price increased by 10% to 5.5p, which values the AIM-quoted company at £7.8m. That is less than the cash pile.

There was £11m in the bank at the end of 2021 and there are £1.25m of borrowings to offset against this. Even if deferred payments are taken into account, then net cash is still £6.8m, which is not far below the market capitalisation. Net assets are £1.9m.

Tasty has two brands. Wildwood is a pizza, pasta, grill restaurant that has high street and ...

Catenae Innovation shares tumble on suspension request

Catenae Innovation’s shares sank 50% to 0.2p on Wednesday following the request for ‘temporary suspension’ of shares trading on the AIM due to the company not being a position to complete the audit of their financial results.

The company also said a dispute had arisen around the acquisition for Hyperneph Software.

Catenae Innovation said they will not be able to release their audited financial statements by 31 March 2022 and request ‘temporary suspension’ of its shares trading on the AIM.

The company’s shares will suspend trading from 7:30 a.m. on 1 April 2022 until the company audited reports have been published. The audited reports are expected to be published around 29 April 2022.

The request for suspension came as Catenae Innovation announced a dispute with minority shareholders of Hyperneph.

Catenae said they would not be issuing new ordinary shares as part of the consideration for Hyperneph, or make the final cash instalment of £52,500.

Catenae Innovation acquired Hyperneph Software in May 2021 for a total consideration of £270,000, yet to be paid in full.

Chancellor’s Spring Statement fails to bring adequate relief to struggling households

Chancellor Rishi Sunak’s Spring Statement brought a mixed bag of results, with a tiny dent in soaring fuel costs and a cut to income tax rates which is scheduled for 2024. However, there was minimal relief for suffering households on Wednesday as the UK’s inflation hit a 30-year high of 6.2%.

The inflation rate is expected to average 7.4% for the remainder of 2022, with a peak of 8.4% expected in the final quarter of the year when winter bites a massive chunk out of household budgets with rising energy costs.

The Office for Budget Responsibility (OBR) also reported that the UK economy is forecasted to grow at a reduced level of 3.8% compared to 6% in 2021, serving up bad news for struggling consumer brands and retail companies.

Fuel and Energy

Sunak announced that fuel duty will be cut by 5p per litre until March 2023, however, the concession will provide little comfort for households dealing with the skyrocketing cost of filling up their cars.

“The giveaway for motorists was in the cutting of fuel duty by 5p litre, saving British motorists £7m a day,” said AJ Bell head of personal finance Laura Suter.

“This means for the average 55 litre car someone will save £3.30 each time they fill up.”

“However, this is a tiny portion of the amount we’ve all seen fuel costs rise by: since the start of the month alone petrol prices have risen by 13p and diesel prices by 21p.”

Global sales trader at Saxo Markets Mike Owens added: “Fuel duty cut by 5p per litre feels like a drop in the ocean compared to the price rises we’ve seen at the pump and also when you consider the energy bill cap is rising 54% in April.”

The Chancellor also announced that additions of energy-efficient upgrades to houses will not be subject to VAT for the coming five years, however, this move will probably only benefit households that already have the extra money to spend on solar panels and new energy-efficient infrastructure, providing little assistance to households dangling dangerously close to poverty.

Standard of Living

The Chancellor announced a rise in the income threshold for national insurance of £3,000 to £12,570 per year.

The move will undoubtedly elicit a sigh of relief from households, who stand to keep an extra £330 a year on average.

“As concessions go, raising the National Insurance threshold to £12,570, in line with the personal allowance, is a big one,” said interactive investor head of savings and pensions Becky O’Connor.

“It will come as a relief to those worried about the impact of the Health and Social Care levy. The typical saving of £330 a year is significant.”

Despite this announcement, the Office for Budget Responsibility said the UK was facing “the biggest fall in living standards in any single financial year since ONS records began in 1956-7”.

Sunak further announced an increase to the household support fund by £500 million, to be given to local authorities from April, resulting in a total fund of £1 billion to assist vulnerable households with rising living costs.

However, these measures are unlikely to provide sufficient relief in the face of soaring inflation.

“The big rabbit out of Rishi Sunak’s hat was announcing a cut to income tax rates from 2024, and while that will grab the headlines it’s precisely zero help to families struggling with the cost-of-living crisis now – or indeed for the next two years,” said Suter of AJ Bell.

Small & Mid Cap Roundup: Plus500, Catenae Innovation, Tullow Oil and ITM Power

The FTSE 250 index slipped 0.7% to 20,964 and AIM market fell 0.65% to 1,030 on Wednesday as investors digested record high inflation.

The FTSE 250 was dragged by companies reliant on consumer spending while homebuilders and REITs took a big hit.

FTSE 250 Fallers

Plus500 shares fell 0.5% to 1,458p after the company reported a 25% loss in EBITDA due to a 33% decrease in new customers acquired.

Ultra Electronic shares were trading down 0.24% to 3,334p despite seeing an increase in orders to £1.3bn. The acquisition of Ultra Electronics by Advent Cobham is still pending government approval and will not meet the previously expected deadline of Q1 2022.

TBC Bank Group shares dropped 1.6% to 1,033p following the announcement that the bank’s subsidiary JSC TBC Bank will issue a tender offer for an outstanding $300m 5.75% notes due 2024.

FTSE 250 Risers

Harbour Energy shares are up 2.97% to 464p following the company’s reported increase of revenue to $3.6bn and a post-tax profit of $101m as opposed to the $778m loss in 2020.

Increased sales and lower impairment charges from exploration and evaluation costs drove the Harbour Energy’s profit.

Tullow Oil shares gained 3.2% to 52.6p as oil price rose following the recent sale of Occidental Petroleum’s share in the Jubilee and TEN fields in Ghana to Kosmos Energy increased Tullow’s interest in the project.

AIM Fallers

Capital Metals shares fell 3.3% to 7.2p after the company experienced backlogs associated with the analysis of mineral samples from their Eastern Minerals Project in Sri Lanka.

ValiRx, the biomedical innovator saw shares plummet 13% to 23p due to delays in licensing the VAL201 drug to TheoremRx because of insufficient funds.

Catenae Innovation shares plummeted 56% to 0.18p following the announcement the company made the decision not pay part of the £270,000 consideration for the acquisition of Hyperneph, and requested a suspension of trading.

88 energy shares sank 6.7% to 2.1p despite favourable results from the Merlin-2 well.

AIM Risers

4D Pharma saw shares soared 59% to 71p – before falling back – as the company announced positive results regarding the Phase I and II study for the treatment of Renal Cell Carcinoma using the combination of MRx0518 and KEYTRUDA.

TPXImpact, the digital transformation provider, saw shares jump as much as 22% to 195p following the announcement of their broadening artificial intelligence capacity with the acquisition of Peak Indicators and Swirl IT.

Restaurant operator Tasty saw shares gain 10% to 5.5p with reported revenues of £34.9m in 2021, almost £10m greater than 2020. The company also saw post-tax profits of £1.2m compared to a loss of £12.7m in 2020 as a result of restaurants reopening post covid.

ITM Power and Ceres Power shares rose 2.8% and 0.5% respectively as the Chancellor announced VAT cuts in green home improvements during Wednesday’s Spring Statement.

Surgical Innovations shares gained as the company said they were expecting higher sales with an increase in elective surgeries post-pandemic.

FTSE 100 dips as inflation hits 30-year high

The FTSE 100 saw a 0.1% fall as sterling slightly weakened against the dollar following Chancellor Rishi Sunak’s Spring Statement in early afternoon trading on Wednesday.

The market was anchored by a 4.2% rise to $120 per barrel in the price of Brent Crude.

The FTSE 100 had gained in morning trade and clawed back most of its year-to-date losses after the shock of Russia’s invasion of Ukraine in late February.

Retail stocks have been on shaky ground over the past few weeks, and major retailers held their breath to see if Sunak’s Spring Statement would give consumer spending budgets a modicum of relief in the coming months.

“Shares in retail companies have been weak in recent months as investors speculate there could be a sharp drop in consumer spending once the energy price cap goes up in April,” said Russ Mould of AJ Bell.

“Any measures by Sunak to help with the cost-of-living crisis could trigger a relief rally in the retail sector on the stock market.”

Mini-Budget

The Chancellor announced several minor concessions for households to assist consumers with the back-breaking rate of inflation, which is predicted to peak at 8.7% in the final quarter of 2022.

Sunak said the threshold for national insurance payments is set to rise to £12,570 a year, giving the average taxpayer a slight amount of room to breathe in the coming year.

“The average worker who earns more than the £12,570 threshold will save £330 a year, once the change kicks in,” said AJ Bell head of personal finance Laura Suter.

“The Government says that 70% of people currently paying National Insurance will see a reduction in their bill, even with pushing ahead with the increased 1.25% levy.”

Oil Strength

The top risers on the FTSE 100 included BP with a 3.4% rise to 384.1p on the back of the rising Brent Crude price following disruption to Russian and Kazakh oil supplies through the CPC pipeline.

Shell also benefited from the surge in oil prices with a 3.2% increase to 2,072.5p.

Electrocomponents rose 2.8% to 1,060p following an increase in market share and a widening customer base over the last few months.

The FTSE 100 top fallers were led by Persimmon’s decline of 3.1% to 2,211.5p on the back of increased housing prices and the cost of construction continued to climb.

The Reckitt Benckiser Group saw a dip of 2.7% to 5,717p as the company led other consumer staples lower over consumer spending fears.

Kingfisher continued its downward spiral with a 2.5% fall to 266p as consumer spending on DIY and home improvement looked set to decline following record high inflation and a gradual increase in hybrid and office work systems.

Oil surges to $120 on scarcity fears following CPC pipeline disruption

Brent Crude rose to $120 per barrel on the back of recent disruption to the Caspian Pipeline Consortium (CPC) pipeline.

The pipeline is currently struggling due to storm-damaged berths in the Black Sea, and accounts for approximately 1% of the global oil supply.

The estimated toll of the disruption will see exports of up to one million barrels of oil per day stalled in the Russian and Kazakhstan region.

Repairs are predicted take up to two months, according to current projections, leaving the global oil market in a precarious situation on the back of continued economic sanctions against Russia.

“Prices are primarily rising on the loss of CPC Blend crude exports out of Novorossiisk, which accounts for about 1.3 million barrels per day of exports, adding further bullish fuel to the fire as the drop in Russian crude exports finally appears underway,” Kpler lead oil analyst for the Americas Matt Smith said via Reuters.

The news follows crippling fuel prices across the UK, with a reported spike on Tuesday to £1.67 per litre and £1.80 per litre of diesel.

The current average cost of fuelling a family car amounted to over £92 and almost £99 for diesel.

Chancellor Rishi Sunak announced a 5p per litre price cut for petrol in the Spring Statement today, however the attempt at respite failed to make a significant dent in skyrocketing household costs.

US and UK banish Trump-era steel tariffs

Months of tension have been eased as the UK and US agreed to lift tariffs on British steel exports which were implemented during the Trump era.

With the new agreement, steel and aluminium industries will be protected in both countries, leaving the sole focus on ‘China’s unjust trade policies’, according to a joint statement by UK’s international trade minister, Anne-Marie Trevelyan and US commerce secretary, Gina Raimondo.

The agreement is also reportedly set to ease inflationary pressure on the US, with reduced costs of manufacturing as a by-product of tariff-free steel.

The UK will receive a ‘duty-free import quota’ of more than 500,000 tonnes of steel each year under the new agreement, with larger volumes subject to a 25% tariff.

The agreement will also require aluminium importers to report the origin of raw aluminium in order to restrict subsidised metal from China and other countries.

Under the agreement, UK steel businesses owned by Chinese companies will be required to disclose their financial records with the US to determine any involvement with the Chinese government.

Following the introduction of tariffs imposed during Trump’s tenure, the UK retaliated with tariffs on American goods such as Levi’s jeans and Harley Davidson bikes.

These tariffs are reportedly set to be removed following the agreement announced today.

Alasdair McDiarmid, operations director for the steelworkers’ union Community, said in an article with the Guardian: “the news the US steel tariffs are being lifted is welcome, though we need to understand the full detail of the agreement.”

“To protect jobs our steelmakers must compete on a level playing field, and it is vital the UK does not suffer a further competitive disadvantage with EU producers.”

“The EU secured their deal with the US back in October, so a UK-US deal is well overdue, and it must be implemented without delay to prevent further damage to our industry.”

Petrofac strikes $195m loss with climbing costs and tumbling revenue

Petrofac saw its share price fall 9.2% to 107.4p following a reported $195 million net loss and 25% decline in revenue to $3.1 billion in 2021.

The oil company’s underlying cash profits tumbled to $104 million against $211 million in 2021 as a result of climbing costs and a double-digit fall in Energy Services and its Energy and Construction sectors.

Petrofac suffered further losses due to asset sales, unplanned production disruption and Covid-19-related hurdles.

The firm warned shareholders to expect a “subdued” outlook in the near term.

Analysts commented on the market’s reaction to Petrofac’s delayed recovery.

“The market was understandably disappointed by management’s forecast for subdued margins and tepid revenue growth,” said Hargreaves Lansdown equity analyst Laura Hoy.

“The group’s recovery appears to be pushed back another year and given the ongoing volatility sooner would have been better.”

However, there might be cause for slight optimism for Petrofac following the close of its Serious Fraud Office (SFO) investigation.

“A recovery could be in the works,” said Hoy.

“The group’s interests in Russia have taken 0.6% of potential projects off the table, but the conclusion of the SFO investigation means it’s no longer barred from trading in some of the most lucrative markets in the world.”

“The group can bid on $37bn worth of projects which will be awarded by the end of 2022 and with an impressive win rate so far, we could see a marked increase in next year’s order book.”

Two Inflation Winners, Bidstack and Upcoming Events with Alan Green

The UK Investor Magazine was kindly joined by our good friend Alan Green for a rundown of the key markets themes and discussion around a number of UK equities.

UK inflation has hit 6.2% and a cost of living crisis is in full swing with everyday items and fuels cost soaring. It is evident from the fallers on the FTSE 100 today there is some concern among investors in companies linked to the health of UK household finances.

We questions whether this a knee-jerk reaction, or the pressure of these companies share prices could persist.

There is consideration paid to two shares we feel could be ‘inflation winners’. We have picked out two companies that are set to outperform the market in a period of higher inflation in Rio Tinto and Metrobank.

Bidstack has released a number of updates recently and we take a look at what this means for the company and access some of the strategic decisions made by the in-game native adverts provider.

Surgical Innovation sees revenue grow 44% despite postponed elective surgeries

Surgical Innovation, the invasive surgery product providers, saw revenue grow 44% from £6.3m to £9.1m in 2021 due to sales recovery from the pandemic’s impact with fourth-quarter sales at par with pre-pandemic levels.

Surgical Innovation sales suffered from the constant impact of covid-19, which affected the demand for their products.

The revenues reported will be able to support the business needs for 2022, the company said.

Despite the Omicron variant affecting staff shortages to perform invasive surgeries, the firm said their revenues from January and February 2022 were roughly 40% higher than of 2021.

Adjusted EBITDA for the group bounced back to profits of £0.5m from a loss of £0.66m in 2020 as a result of the group controlling their operating expenses.

Surgical Innovation saw a decrease in adjusted operating loss before tax from £1.6m to £0.3m in 2021.

The company reported an adjusted EPS loss of 0.022p compared to 0.19p in 2020.

Surgical Innovation noted net cash excluding leases of £1.7m in 2021, compared to £3.1m in 2020.

Going forward, the company had restructured their debt financing to leave financial headroom of £4.06m instead of £5.78m in 2020 to create a ‘lower risk environment’.

Surgical Innovation is focused on gaining growth by increased product development and marketing investments.

‘Resposable’ Technology

Surgical Innovation develops ‘resposable’ products, which are reusable or part-disposable in an attempt to reduce both waste and costs associated with elective surgery.

During the pandemic, many elective surgeries were not a priority, resulting in a reduced number of surgeries performed.

Post the pandemic, postponed elective surgeries are increasing. During the second half of 2021, a 24% increase in elective surgeries from the first of half of the year was observed in the UK markets.

The company is in hopes of rolling out ‘resposable’ products to the UK market to meet the needs of the NHS’ sustainability targets.

Nigel Rogers, Chairman of Surgical Innovations, said, “the UK market continues to be strong and is trending ahead of pre-pandemic levels and, as patient waiting lists continue to rise, it is likely that this momentum will continue.”

“Demand in the European and the Rest of the World markets is steadily increasing but remains more muted.”

“However, both the US and APAC markets continue to grow significantly ahead of pre-pandemic levels.”

“In addition, we are committed to enhancing and expanding our product portfolio through new product launches, investing in sales and marketing to drive our sustainability messaging, and developing key partnerships, all of which will further support the expansion of revenue in 2022 and beyond.”

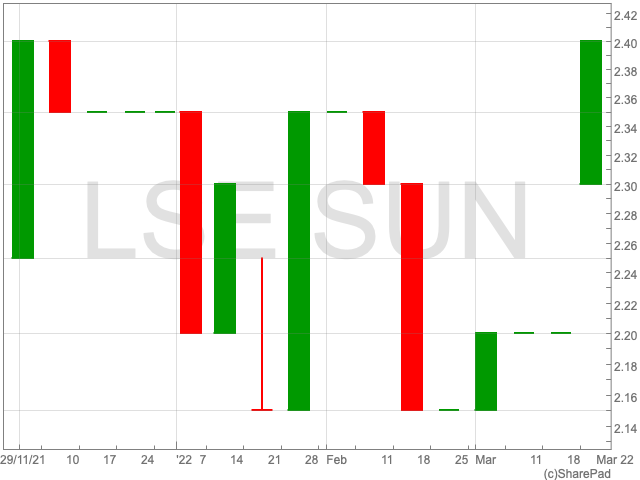

Surgical Innovation shares surged 4.3% to 2.4p in early morning trade on Wednesday following optimism around the company’s 2022 outlook regarding recovery from the pandemic.