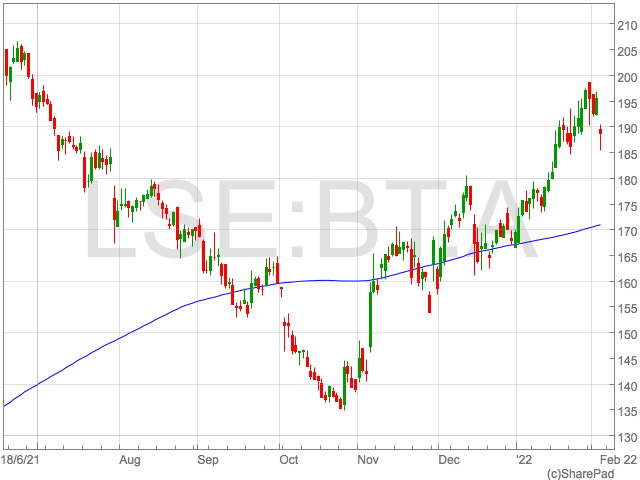

BT shares fell on Thursday after the company released Q3 earnings and said it saw revenue falling by 2% in the full year.

BT said their underlying revenue fell 3% to £15.7bn in the first nine months of the year.

The group said their revenue fell due to decline in their legacy BT voice product and lower postpaid mobile revenue.

The Openreach business unit saw a 4% increase in revenue, whilst all other units saw declines. The Global business unit saw the biggest decline in revenue falling 11%.

BT shares were down over 4% by midday in London trade.

“BT has had a good quarter with encouraging market share performance, and we continued to make significant improvements in customer service, although revenue from our enterprise divisions was softer than we expected,” commented BT CEO, Philip Jansen.

“We had another record-breaking quarter on our full fibre build and a pleasing 37% increase in FTTP connections following the launch of Openreach’s wholesale pricing offer. Our 5G build is also on track and now covers over 40% of the UK population with independently verified network leadership.”

Despite a strong market share, analysts pointed to the companies traditional businesses as a cause for disappointment .

“BT is making tracks to improve its content position, which in today’s climate is no bad thing. That said, there’s an argument that sport is a lot more sheltered from changing media habits than other mediums, so while BT can’t rest on its laurels, it has a bit more breathing room. BT Sport is a genuine asset,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

“It’s disappointing to see other areas of the business looking less bright as Covid disruption and supply issues continue. The telecoms giant is weighed down by a number of legacy products that have been falling out of favour for a while. The issue with being an internet or phone service provider is that the main differentiator on product, is price. That’s a tough place to be.”