Hercules Site Services hopes to raise up to £5.5m of new money through a placing and PrimaryBid offer in order to benefit from the growing infrastructure investment in the UK. Existing shareholders also want to raise £4.5m from share disposals.

Labour supply company Hercules Site Services was established in 2008 and it is currently owned by Hercules Real Estate Ltd, where chief executive Brusk Korkmaz and Nicola Korkmaz.

There is expected to be £650bn of infrastructure investment over the next decade and it can be difficult to obtain people with the right skills. Staff turnover is relatively l...

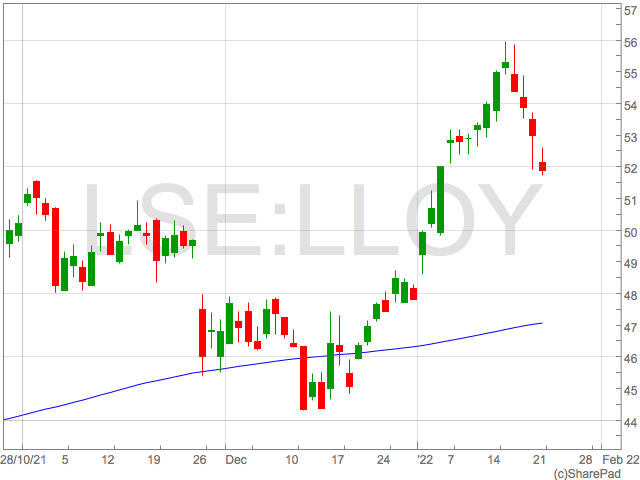

Lloyds share price set to be inflation winner in 2022

Lloyds share price is set to be a winner from soaring inflation in 2022 as the banking group enjoy the benefits of a hiking cycle in major global economies.

Lloyds shares have already had sterling start to 2022 adding 9% to trade at 51p. This is despite a significant retreat from the highest levels of the year for Lloyds share price.

There has been an ongoing and unavoidable discussion around inflation which started early last year. However, this is now starting to play out in markets with the threat of multiple interest rate hikes.

As inflation runs rampant, investors are recalibrating their expectations for Fed rate hikes. Federal-funds futures, a proxy for market expectations of interest-rate changes, now suggest a 98% chance of a rate hike by July 2022, up from 62% in November. pic.twitter.com/SLsb6AjIxb

— Steve Hanke (@steve_hanke) January 15, 2022

Concern has been most evident in the share prices of US technology stocks and the volatility in the tech-heavy NASDAQ index that counts the world’s largest tech companies as it’s constituents.

Fortunately for investors in Lloyds shares, the factors driving volatility in tech companies are the same factors helping Lloyds improve their profitability.

These are of course the associated benefits of higher interest rates on the Net Interest Margin of banks that thrive in higher interest rate environments.

Lloyds shares

Lloyds shares began their rally as soon as the Bank of England made a surprise interest hike in December and continue to reach intraday highs around 56p, before falling back.

With the debate raging whether the Federal Reserve will hike 3 or 4 times in 2022, it is almost certain the Bank of England will also embark on a series of rate hikes through 2022.

The tightening of monetary policy will have a deep impact on the economy as well as the positioning of investors.

Indeed, Lloyds shares may have the additional benefit investors rotating away from growth stocks to those that offer value in a dash for safety.

And Lloyds shares certainly fall into the category of being a value stock.

On both price-to-book and price-to-earnings multiples, Lloyds trades at a significant discount to the wider benchmark.

Notwithstanding the higher levels of profitability, the allure of relative value the company presents will certainly help support the Lloyds share price in 2022 and make it a winner during periods of high inflation.

Investor should note, however, a prolonged period of high inflation that damages household spending power and increases loan defaults – and possibly the housing market – will lead to negative outcomes for Lloyds shares.

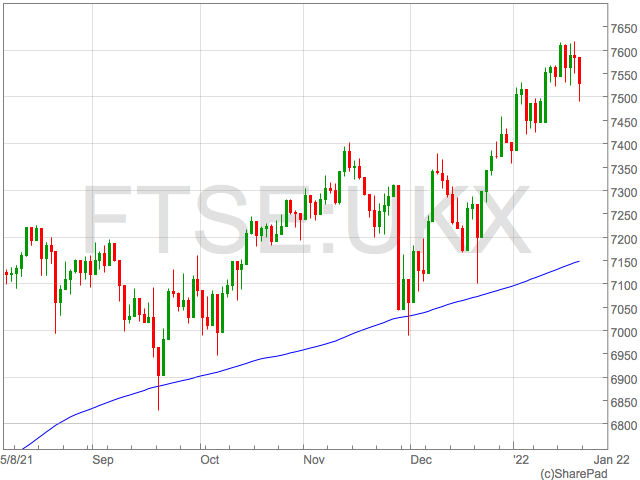

FTSE 100 tumbles as UK retail sales decline and US tech sinks

The FTSE 100 dropped on Friday as the market digested a tranche of disappointing news including poor UK retail sales, falling oil prices and negative moves in US tech stocks.

The FTSE 100 was down 54 points or 0.7% at 7,530 in mid morning trade on Friday. The selling accelerated through the day and the FTSE 100 broke 7,500 to trade lower by over 1.4% as we approached the close.

Declines in London’s leading index were broad with most cyclical sectors falling. Mining companies, the Housebuilders and travel shares were among the top fallers on Friday.

UK economy

Concerns grew over the health of the UK economy following news retails sales were destroyed in the key December festive trading period by the Omicron variant.

Retail sales fell by 3.7% in December after consumers choose to do their shopping early and stay away from the high streets as Omicron spread. There were also concerns the drop in retail sales could be the first signs UK consumers were feeling the pinch of rising inflation.

“The decline in retail sales illustrated by today’s report continues to indicate rising prices and economic uncertainty as some of the key reasons for the slowing down of sales,” said Walid Koudmani, market analyst at financial brokerage XTB.

FTSE 100 shares

Given FTSE 100 shares largely earn their revenue overseas, the declines on Friday were driven predominantly driven by concerns the UK’s poor retail sales environment could be a signal inflation could be about to impact other global economies.

After having a strong start to 2022, BP and Shell were also among the losers as oil prices retreated.

Oil prices have also had a buoyant 2022 on hopes demand would recover as economies reopened.

UK housebuilders faced heavy selling as news of poor retail spending means home buyers could soon be facing a war on two fronts, with the prospect of rising interest rates increasing mortgage payments whilst consuming spending power declines.

Taylor Wimpey was 2.5% weaker and Persimmon gave up 1.7% at the time writing.

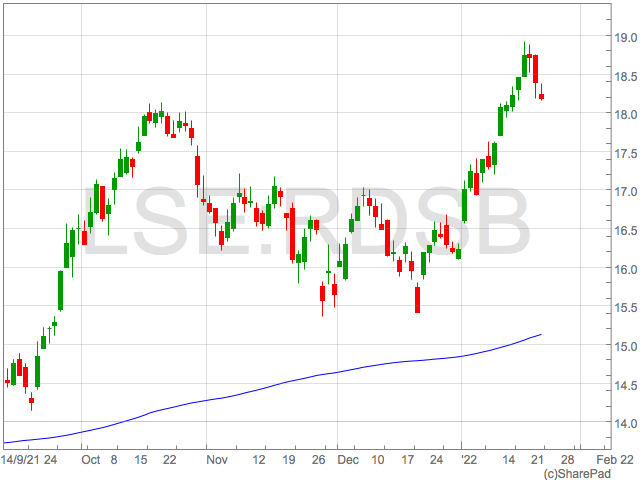

Netflix

Netflix shares declined 20% in the premarket after they missed expectations of subscriber numbers as people returned to normal life after the pandemic.

Although the news was devastating for Netflix investors, it also raised the question of market implications during the transition from the COVID economy to one that resembles life before the pandemic.

There are growing fear higher interest rates, a lack of government stimulus and support, and a shift in consumer behaviour will expose more cracks as 2022 progresses.

The drop in Netflix accentuated selling in other US tech stocks and the NASDAQ is now down around 10% in 2022.

The tech-heavy Scottish Mortgage Investment Trust was one of the top fallers on the FTSE 100.

Driver Group (AIM: DRV): Driving into the arms of a Swedish Suitor?

Driver Group (AIM: DRV) shares recovered to 50.5p (Mkt Cap £26m) after today’s brief news that the auditors have complete the finals for Y/E September which were due on 14th of December and will be reported on Monday 24th .

Driver Group is a global professional multi-disciplinary consultancy services for engineering and construction projects from ‘soup- to-nuts’, including claims, expert witness, and dispute resolution services it was founded in in 1978 and floated in 2005. There is a wide of sectors including transportation, Energy, Infrastructure building and marine. A new forensic accounting service is established, which compliments the construction-related, delay and technical expert services. It’s part of new strategy of focusing on higher margin business and upselling to existing clients and traction was being made in UK and Europe with weaker trading in the Middle East and Asia Pacific regions.

At the Covid infected Interims the Revenue was down 11% with an unchanged GP margin at 26% and an underlaying profit of £1,013k which is 19% lower, but the Interim Dividend was increased to 0.75p. The business development plans is to increase the proportion of sales represented by higher margin expert assignments, consequently, reducing the share of revenue derived from lower margin project services. The cost base was reduced by approximately 13% whilst maintaining the fee-earning capacity. DRV are inherently cash generative with a healthy net cash position of around £6.5m although growth has largely been organic. It was looking good as a recovery play.

Then came the shock announcement of an audit delay due to DRV’s principals in Oman investigating projections from a significant customer. Sales momentum had been building although 2021 is profitable with a maintained dividend it is not a growth year. Due to these delayed finals expectations for the September 2022 year-end could be reset from the existing forecast of £3m for an EPS of 4.7p with a 1.75p dividend, which would be a prospective P/E 12.8x with a 2% yield. Intriguingly supporting the recovery is AB Traction a Swedish Company which increased its stake last week from 19.56% to 20.5% and there are 41% of the shares in public hands…… if 2022 expectations are crashed Driver could be open to being taken-over. The finals are now due on Monday but let’s wait and watch for a less risk buying opportunity.

Retail sales down in December

Retail sales in the UK were down 3.7% in December.

Footfall on the high street dramatically fell as people avoided shopping centres amid the Omicron variant around Christmas.

Sales at department stores, household goods stores and clothing retailers were hit. The ONS said: “Clothing stores and department stores reported a fall of 8.0% and 6.3% over the month and were 7.2% and 10.6% below levels in February 2020.”

“The volume of household goods stores sales fell by 3.2% in December and were 1.4% below their levels in February 2020.”

Food store sales were down by 1% and petrol and diesel sales fell by 4.7%.

Oliver Vernon-Harcourt, head of retail at Deloitte, commented: “Continued rising inflation will put pressure on both consumer spending and confidence over the coming months. Rising household costs will also prompt some consumers to tighten purse strings, at a time when 72% of UK consumers are already concerned that prices for everyday purchases will go up.

Despite the adaptability shown by the industry throughout the pandemic, retailers will have to navigate not only inflation headwinds, but also manage continued supply chain disruptions and staff shortages.”

Netflix shares plunge as new subscribers slow down

Netflix has forecast a slowdown of subscribers as we emerge out of the lockdown and completion grows.

The streaming company expects to add 2.5 million subscribers in the first quarter of 2021, which is almost half of what was estimated by analysts. In the same period last year, subscribers grew by four million.

As a result, shares plunged almost 20%.

“While retention and engagement remain healthy, acquisition growth has not yet re-accelerated to pre-Covid levels,” said the group.

“Consumers have always had many choices when it comes to their entertainment time – competition that has only intensified over the last 24 months as entertainment companies all around the world develop their own streaming offering,”

“While this added competition may be affecting our marginal growth, we continue to grow in every country and region in which these new streaming alternatives have launched.”

Last year, Netflix added 18.2 million new subscribers. This is half the number it gained in 2020 amid the height of the pandemic.

“When Netflix released Don’t Look Up, was it trying to second guess what would happen when its fourth quarter numbers came out? The share price is doing exactly what was instructed by that film title – it’s looking down to the tune of a 20% decline in after-hours trading,” said Danni Hewson, financial analyst at AJ Bell.

“Fourth quarter earnings were well ahead of forecast and 8.3 million net new subscribers were better than the market consensus of 8.1 million, albeit less than the 8.5 million guided by Netflix.”

“Yet the big news was guidance for subscriber growth to slow massively, which therefore drags down earnings expectations and puts a question mark over Netflix’s goal to be cash flow positive every year from 2022.

Everyman shares rise on doubling of revenue

Everyman Media shares rose on Friday as the group released a 52-week trading update that revealed their revenue doubled from the year before.

Everyman reported a 101% rise in revenue to £48.7m in the 52 weeks to 30th December.

The group said they expected EDITDA to be ahead of current market forecast at approximately £8.3m.

Everyman benefited from the reopening and reduction of restrictions during a 33-week over the 52-weeks so one would expect revenue to further increase over the coming the period, if further restrictions are avoided.

The company current operates 36 venues and said they had plans to launch an additional 5 venues in the current financial year.

“Robust admissions seen across our estate in the second half of the year proves that demand for entertainment at Everyman remains strong,” said Alex Scrimgeour, Chief Executive Officer of Everyman Media Group.

“I would like to say a special thank you to our incredible team for making it happen in such exceptionally difficult circumstances. We are increasingly optimistic about 2022 performance and excited by our new opening pipeline. We are looking forward to a stimulating and diverse slate of films which will entertain our Everyman community.”

The Restaurant Group lifts profit expectations

The Restaurant Group has raised profit expectations after a strong Christmas period.

Although the Wagamama owner was affected by work from home guidance and Covid restrictions, sales remained strong in the previous quarter.

In October and November, sales were up 11% and 8% compared to the same periods in 2019. Sales in December dipped 10%.

Profits for 2021 are expected to be at the top end of expectations (£73-£79m).

The group has warned that it could take a while to recover, despite restrictions lifting next week.