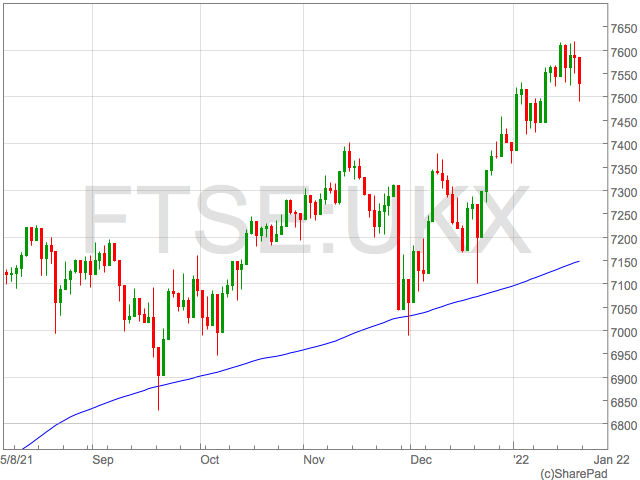

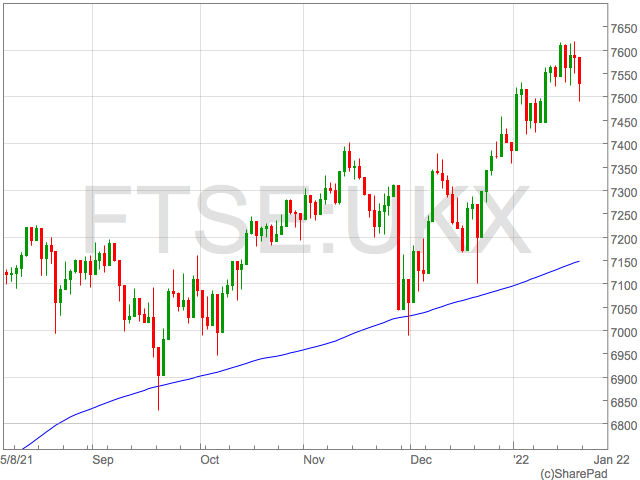

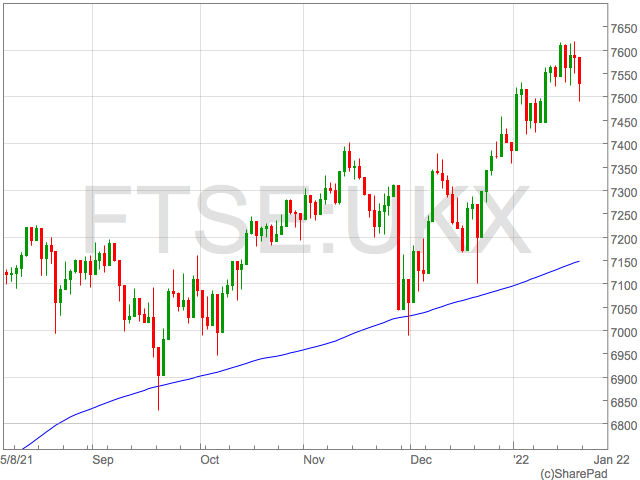

The FTSE 100 dropped on Friday as the market digested a tranche of disappointing news including poor UK retail sales, falling oil prices and negative moves in US tech stocks.

The FTSE 100 was down 54 points or 0.7% at 7,530 in mid morning trade on Friday. The selling accelerated through the day and the FTSE 100 broke 7,500 to trade lower by over 1.4% as we approached the close.

Declines in London’s leading index were broad with most cyclical sectors falling. Mining companies, the Housebuilders and travel shares were among the top fallers on Friday.

UK economy

Concerns grew over the health of the UK economy following news retails sales were destroyed in the key December festive trading period by the Omicron variant.

Retail sales fell by 3.7% in December after consumers choose to do their shopping early and stay away from the high streets as Omicron spread. There were also concerns the drop in retail sales could be the first signs UK consumers were feeling the pinch of rising inflation.

“The decline in retail sales illustrated by today’s report continues to indicate rising prices and economic uncertainty as some of the key reasons for the slowing down of sales,” said Walid Koudmani, market analyst at financial brokerage XTB.

FTSE 100 shares

Given FTSE 100 shares largely earn their revenue overseas, the declines on Friday were driven predominantly driven by concerns the UK’s poor retail sales environment could be a signal inflation could be about to impact other global economies.

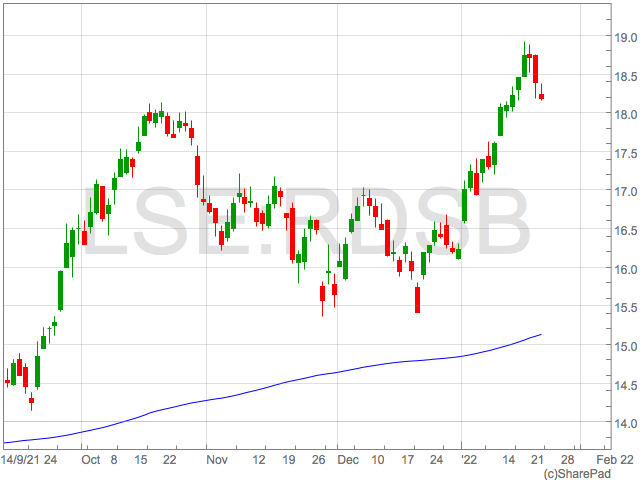

After having a strong start to 2022, BP and Shell were also among the losers as oil prices retreated.

Oil prices have also had a buoyant 2022 on hopes demand would recover as economies reopened.

UK housebuilders faced heavy selling as news of poor retail spending means home buyers could soon be facing a war on two fronts, with the prospect of rising interest rates increasing mortgage payments whilst consuming spending power declines.

Taylor Wimpey was 2.5% weaker and Persimmon gave up 1.7% at the time writing.

Netflix

Netflix shares declined 20% in the premarket after they missed expectations of subscriber numbers as people returned to normal life after the pandemic.

Although the news was devastating for Netflix investors, it also raised the question of market implications during the transition from the COVID economy to one that resembles life before the pandemic.

There are growing fear higher interest rates, a lack of government stimulus and support, and a shift in consumer behaviour will expose more cracks as 2022 progresses.

The drop in Netflix accentuated selling in other US tech stocks and the NASDAQ is now down around 10% in 2022.

The tech-heavy Scottish Mortgage Investment Trust was one of the top fallers on the FTSE 100.