Ilika (LON: IKA) should be ready to ramp up production at its new battery plant in Chandler’s Ford by the beginning of the next financial year. The battery technology developer will then be able start generating revenues from its Stereax batteries.

The production lines have been installed and the process and product qualification is underway. Production of the lithium-ion batteries could start before the end of April, but there will be little in the way of revenues by then. Longer-term there will be licensing opportunities.

Stereax batteries are smaller than competitors. Medical sensors provid...

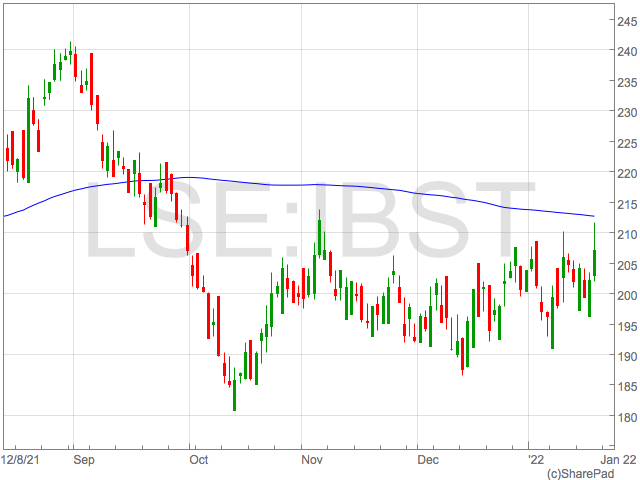

Ibstock lifts profit guidance on robust demand

Brickmaker Ibstock has today raised their EBITDA guidance for 2021 after enjoying robust demand from both new houses and the home improvement markets.

The group said revenues were £409m, 29% higher than 2020. Ibstock also noted improvements in cash generation that saw Net Debt fall to £40m from £69m.

In relation to price inflation within the industry, Ibstock said they had managed to mitigate the impact of rising input cost with product price increases.

“Customer demand remained resilient in the final quarter and a combination of a strong operational performance and proactive management of inflationary pressures have ensured that Ibstock was able to deliver a strong financial performance for 2021,” said Joe Hudson, CEO of Ibstock.

“Whilst we are mindful of ongoing uncertainties, including industry supply chain pressure and cost inflation, the good momentum achieved to the end of the year provides us with a strong platform for significant further financial and strategic progress in 2022.”

The increase in profit guidance was generally well accepted by the market and shares rose 1.9% in early trade on Thursday.

“The housing market’s resilience in the face of economic uncertainty, rising mortgage rates and cost inflation is part of the reason brickmaker Ibstock expects to outdo its profit guidance at the full year,” said Laura Hoy, Equity Analyst at Hargreaves Lansdown.

“The group’s been successful in passing on ballooning materials costs to customers without upsetting demand, no mean feat considering inflation is at a 30-year high.”

“Ibstock’s in a strong position as concerns about a cooling housing market start to creep in as well – the group gets paid as long as the houses are being built, so some stagnation won’t topple the tower.”

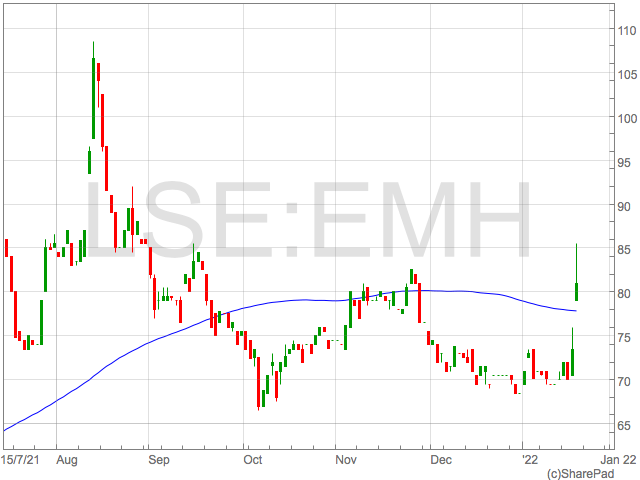

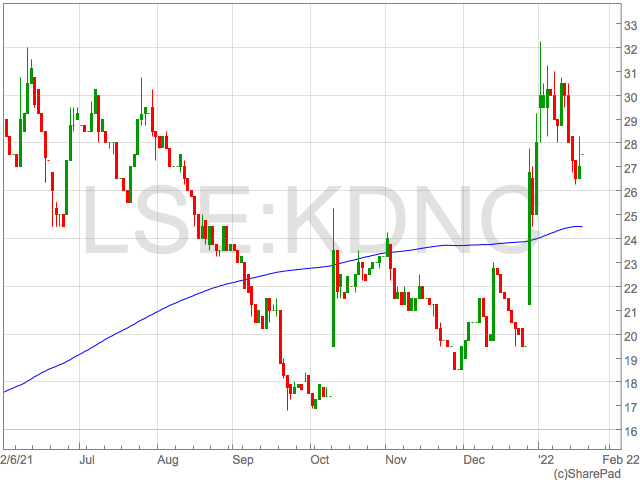

Cadence Minerals’ lithium asset upgrade after Cinovec’s ‘outstanding results’

Cadence Minerals have enjoyed a dramatic improvement in the quality of their lithium investments after ‘outstanding’ results from the Cinovec mine in the Czech Republic.

The Cinovec mine is operated by European Metal Holdings which has a 49% in the mine. Cadence Minerals holds 8.7% of the equity in European Metal Holdings.

In an announcement made this week, the Cinovec asset received significant upgrades to the resources that included revisions higher to the annual output and the impact of higher lithium prices.

The most recent feasibility study found it is possible to amend the mining process to incorporate the use of paste backfill which will be instrumental in increasing the mines output by 16%.

As a consequence, the Cinovec mine’s expected output has been increased from 25,267 tpa to 29,386 tpa.

The combination of rising lithium prices and the increased production means the projects NPV8 (post tax) increases from $1.108B to $1.938B. This is based on lithium prices of $17,000 which is significantly below the current market price.

“An increased mine life and a resource upgrade that takes the NPV8 from USD1.1bn to USD1.94bn adds substantial value to Cinovec’s already exceptional potential as a future battery grade lithium supply hub for Europe and the rest of the world,” said Cadence CEO Kiran Morzaria.

“Cadence are pleased to remain shareholders and supporters of EMH, and we look forward to further developments.”

The news has seen European Metal Holdings share soar this week to trade at 81p.

Cadence Minerals owns approximately 8.7% of European Metal Holdings following a placing conducted by European Metal Holdings to raise A$14.4 million.

Cadence Minerals stake is worth circa £12.4m with European Metal Holdings shares trading at 81p.

To put this in to context, Cadence Minerals entire market cap is £41m so the market is effectively currently attributing a value of just £28.5m to the rest of Cadence’s assets.

Cadence Minerals Portfolio

Although the latest developments at Cinovec adds tremendous value to a publicly-traded holding of Cadence’s portfolio, their flagship project is the Amapa Iron Ore project which has targets to produce $725 million iron ore per annum.

Cadence Minerals has additional exposure to lithium at the Sonora mine operated by Bacanora Minerals, as well as interest in Northern and Western Australia.

Cadence also has a 30% interest in the Yangibana Rare Earths project operated by Hastings Technology Metal in Western Australia.

Superdry revenues fall

Superdry revenues are down 1.9% as it continues to suffer amid the pandemic.

Losses before tax narrowed from £10.6m to £2.8m whilst statutory pre-tax profit increased to £4m.

The group is expected to achieve expectations for the full-year. The retailer ended the half-year with £3.9m net debt. The group has started to unwind a £10m repayment in debt.

“In line with our full-price strategy, we have not held an end of season sale in our stores and, over the past 11-weeks, have seen a +4.1% gross margin improvement compared to two years ago,” the company said in a statement.

“Our performance over the peak trading period has given us confidence that we will achieve current market expectations for FY22 adjusted PBT.”

Workspace reports strong Q3

Workspace Group has posted a strong third quarter despite the guidance for people to work from home.

The flexible office space has been running at 43% of pre-Covid levels, falling in January as Covid rates rose over Chrismas.

“It has been a good quarter, with continued positive momentum in occupancy and pricing,” said chief executive, Graham Clemett.

“We are seeing strong demand for our space, with good levels of enquiries, viewings and lettings despite the renewed work from home guidance issued by the Government in December.”

“Our performance in the third quarter and early signs of trading in the fourth show that SMEs are looking through the current short-term uncertainty to choose the right space for their business longer-term. They are looking for flexible terms and attractive, sustainable office space in well-connected locations and Workspace is ideally placed to continue to capture this demand.”

ABF shares drop as rising prices hit profits

ABF has said that it will increase the costs of its groceries amid inflationary pressures.

The group, which owns a grocery, sugar, agriculture and ingredients businesses as well as the retailer Primark, has said the rising costs are impacting profits.

“In our Grocery, Sugar, Ingredients and Agriculture businesses we have seen an escalation in the cost of energy, logistics and commodities,” said ABF in a statement.

“We have been implementing plans to offset these through operational cost savings and, where necessary, the implementation of price increases. We expect an increase in the adjusted operating profit for Sugar. We expect reduced adjusted operating profit margins in Grocery and Ingredients at the half year, due to phasing in fully recovering cost but a recovery in the run rate of these margins by the financial year end.”

In Primark, sales are still lower than they were before the pandemic. ABF is proposing to cut 400 roles to simplify management at the store.

“The effect of inflationary pressure on raw materials and supply chain in this first quarter has been broadly mitigated by a favourable US dollar exchange rate compared to last year and a reduction in store operating costs and overheads.”

“We are proposing to simplify our in-store UK retail management structure as part of our ongoing programme to improve the efficiency of our store retail operations.”

FTSE 100 bounces back shaking off record UK inflation

The FTSE 100 rose on Wednesday and bounced back from heavy selling on Tuesday as bargain hunters stepped in despite UK inflation hitting 5.4% – the highest reading in 30 years.

The FTSE 100 had gained 26 points to 7,590 in midday trade on Wednesday bouncing back, but not fully recovering yesterday’s losses.

Soaring inflation is being regularly used in arguments for higher interest rates so it may have been a surprise to see equities rise today after the prospect of higher rates in the US rocked markets yesterday.

“While UK inflation has hit a 30-year high at 5.4%, this is only marginally ahead of expectations, and certainly shouldn’t shock the markets. Indeed, the FTSE 100 and FTSE 250 indices barely budged on the news,” says Russ Mould, investment director at AJ Bell.

“Ongoing weakness among tech-related stocks was offset by strength in housebuilders, retail and oil producers in the FTSE 100. Brent Crude continues to charge ahead with a 0.4% gain to $87.84 per barrel, stoking speculation that it could soon return to $100 per barrel amid supply constraints and robust demand.”

Oil is facing growing pressures of geopolitical risk whilst big consumers such as the US are experiencing growing demand.

Houthi rebels used drones to target UAE oil installations driving concerns about ongoing supply disruptions and the prospect of rising oil prices.

“The damage to the UAE oil facilities in Abu Dhabi is not significant in itself, but it raises the question of even more supply disruptions in the region in 2022,” said Rystad Energy’s senior oil markets analyst Louise Dickson to Reuters.

Having gained yesterday on the news, BP and Shell continued to rise inline with oil prices, providing welcome support for the overall FTSE 100 index.

Burberry jumps

Burberry provided a positive update which was well received by the market and provided reason to send shares 6% higher.

Burberry has been highly dependant on tourism which was evident in earnings. However, the market looks past this to the prospect of increased travel and the resumption of spending in the not too distant future.

“By all accounts, Burberry is in a better position than some had feared. With further news of rising inflation coming out, the brand is also in a better position than some,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

“Luxury customers tend not to be as swayed by economic ups and downs, including when money in the bank is losing its value at a faster rate than normal. That’s something that simply can’t be said of mid-market high street names.”

Burberry, the Metaverse, and UK Inflation with Alan Green

The UK Investor Magazine Podcast is joined by Alan Green to jump into this week’s key markets themes and the UK equities grabbing the attention of investors.

We start by looking at the Microsoft takeover of Activision and what the biggest cash takeover of the pandemic means for the Metaverse.

UK inflation has jumped to 5.4%, the highest levels in 30 years. There is consideration paid to what this means for UK investors that focus on London-listed shares and the sectors that could benefit in an inflationary environment.

Although Burberry noted rising prices in their recent update, their biggest issue was the lack of spending by tourists. Despite this dent in sales figures, the market seems to looking past the short term impact of COVID to a resumption of normal consumer behaviour.

JD Wetherspoon was ravaged by the pandemic and the reduction in spending was still evident in the latest figures. With shares trading around 900p there could be a rebound as drinkers return to their bars.

We also touch on Technology Minerals and the establishment of their operations in the Circular Economy.

WH Smith travel arm struggles to recover amid Omicron

WH Smith has reported a slump in spending across airports and train stations amid Omicron.

The group’s travel arm has been hit by the pandemic. Airport stores were trading at 58% of 2019 levels in January. Stores at train stations were trading at 69% in December.

“We have seen a small impact from the Omicron variant in January but, as elsewhere, we believe this will be short term,” said WH Smith.

The group’s high street stores faired better and were trading at 87% of 2019 levels in January.

“Looking ahead, although we are seeing a small impact from the Omicron variant, we anticipate a resumption in the recovery of our travel markets over the coming months,” said chief executive, Carl Cowling.