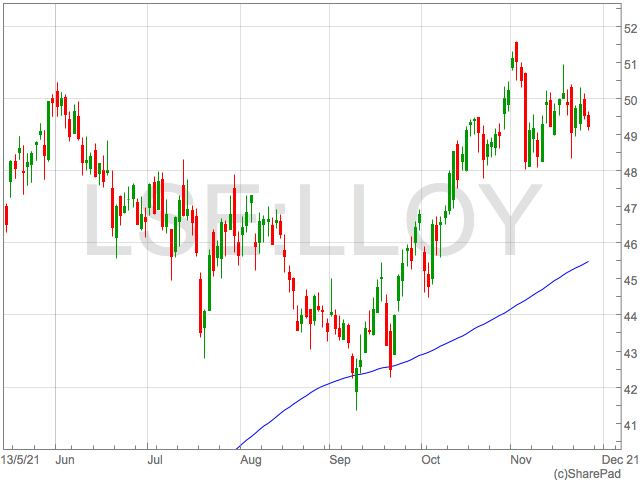

Lloyd share price has enjoyed a stellar year of performance as the bank bounces back from the pandemic-induced market volatility and economic strife.

Lloyds shares are up roughly 35% YTD at 49p, having dipped from their 52-week highs around 51.5p. However, this is still some way off their pre-pandemic highs and bulls could view the recent dip as an opportunity to pick share up.

If you are bullish on the Lloyds share price, here’s three reasons you may want to buy Lloyds shares now.

Increasing interest rates

Although though the Bank of England is yet to deliver a rate hike, the market is pricing a steady increase in rates over the next 12 months.

Futures traders have priced in a hiking cycle starting with the first increase in December continuing to a 1% Bank Rate by June next year.

Soaring inflation has left the Bank Of England with little choice but to hike rates given a robust UK employment market, an economic indicator the BoE said they were keen to see improve before moving on rates.

Higher interest rates traditionally boosts the Net Interest Margins of banks, and with it the profitability of UK banks, including Lloyds.

Strong UK housing market

Lloyds is the UK’s largest mortgage lender and enjoyed the benefits of their market position in Q3 as profits rose to £2 billion for the quarter. This is largely driven by strength in their mortgage business that rose by £2.7 billion in the last quarter and totalled £15.3 billion.

As the UK’s largest lender, ongoing resilience in the UK housing market will support further Lloyds earnings growth by continually increasing their open mortgage book and keeping a lid of defaults.

Despite government support through Stamp Duty reductions ending some months ago, house prices have remained strong, although mortgage applications has trended down throughout the year.

Lloyds share price technicals

Lloyds shares have began the form a series of higher lows over the past month which are consistent with the key features of an uptrend.

In the very short term, the Lloyds has formed a base around 49p which will be crucial to whether Lloyds shares can revisit recent highs around 51.5p.

Assuming this level is held, a move through 50.4p will open up a test of the 52-week high, which once broken will see little resistance to the Lloyds share price as it moves towards the pre-pandemic trading range 60p-64p.