Greatland Gold shares dipped on Friday morning just a day after the gold explorer said it has received ‘outstanding results’ from their flagship Havieron project.

The latest results comprised of 22 new drill holes from the Infill and Growth Drilling programmes, in addition to 11 holes previously reported.

Greatland Gold said significant mineralisation was reported in 18 of the new holes.

The Havieron joint venture with Newcrest has now completed a total of 210,629 of drilling from 254 holes. All the latest completed holes at the world class asset continuing to intersect mineralisation, and all but one reporting significant presence of gold.

HAD117W6 returned 120.4m @ 10g/t Au & 0.66% Cu from 764.6m. This is the best gram metre intercept drilled to date at Havieron.

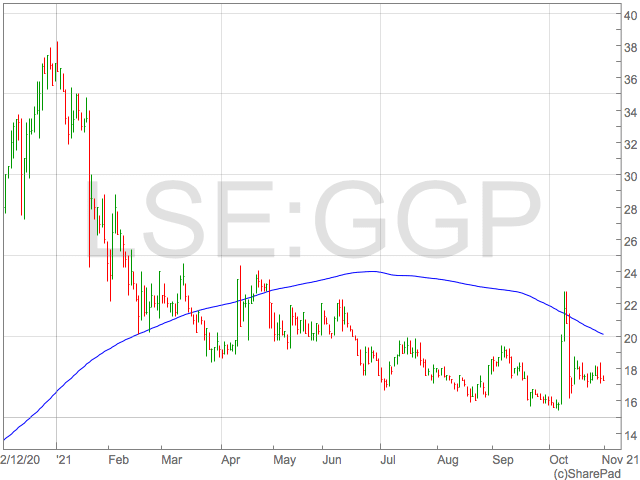

Despite the positive news from the company, the Greatland Gold share price continued to slip on Friday, trading as low as 17.2p on Friday morning. Greatland Gold shares have consistently made lower highs through 2021, even as investors digest upbeat Havieron results.

Shaun Day, Chief Executive Officer of Greatland Gold plc, commented on the results:

“The volume and quality of results at Havieron continue to impress as we observe increases in both grade and thickness at depth. This supports continuity of the high grade zonations and potential upgrades to the mineralisation. It speaks volumes for the tremendous quality of Havieron that after reaching a milestone of 200,000 metres of drilling, the best gram metre intercept ever drilled was just delivered, located at the high grade South East Crescent Zone.

“The results of the 90,000 metres Growth Drilling programme continue to extend mineralisation across multiple zones across Havieron. These outstanding results expand the high-grade South East Crescent Zone and add further scale to the Havieron deposit in multiple directions including within the Northern Breccia and in the Eastern Breccia.”

“The ongoing success from each set of drill results confirm Havieron as a world class gold-copper project and its potential to expand further in scale. The Pre-feasibility study highlighted the low capex, low risk approach to developing Havieron, which puts this asset in a class of its own as we progress it forward and add further upside to its future economic outcomes.”

The Greatland Gold share price is down 53% year-to-date and has remained stubbornly beneath the 200-day moving average.