Royal Mail “still needs to work hard at improving operations” says analyst

Many businesses benefitted during lockdowns as people were forced to change their habits due to being at home.

While airlines struggled, many spent their disposable income on renovating their homes, as they were now spending more time there.

One such company is Royal Mail, which saw deliveries surge during the pandemic, as people were unable to go out and buy things in the usual way.

However, the company appears to be finding it difficult to maintain its form as life returns to normal.

“There is a common theme in the markets, namely that lockdown winners haven’t been able to match the volume of product sales as in 2020 but they are ahead of the same period in 2019. That must be judged as progress, given how last year was such an unusual period for all businesses,” says AJ Bell investment director Russ Mould.

Royal Mail, with its latest update showing parcels down on last year but up versus 2019’s figure, is one such company.

“The company seems convinced that the world has changed permanently and we’ll all going to be sending parcels in greater volumes,” says Mould.

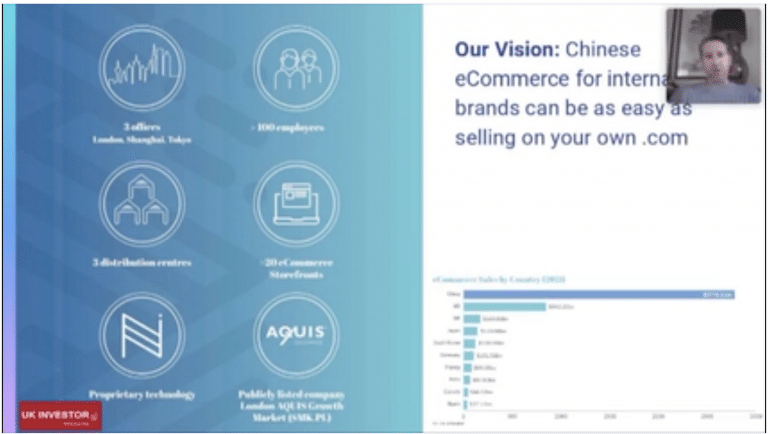

“There is a lot of merit to this view as the pandemic has accelerated the shift to e-commerce and so many people have realised it is a lot more convenient to order goods online and have them delivered to their doorstep than trudge round the shops.”

“Royal Mail seems unusually bullish, maintaining earnings guidance despite clear headwinds from cost pressures. That’s a dangerous stance to take as the stock market likes companies that under-promise and over-deliver, not the other way round.”

“The surge in parcel volumes has given Royal Mail a reason to be more optimistic but it isn’t necessarily the final solution to its years of disappointing investors.”

“Longer term Royal Mail still needs to work hard at improving operations and making them efficient. Parcel delivery remains an incredibly competitive space and letter volumes are likely to keep falling. To boost profit margins, Royal Mail must become a leaner, meaner business with even greater automation.”