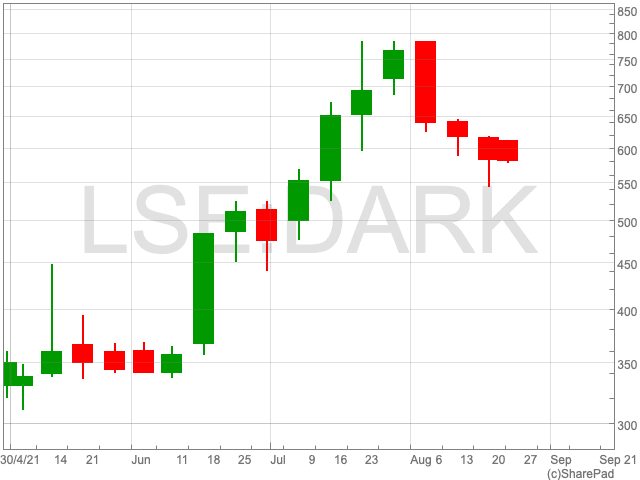

Market sentiment remained positive throughout the week and ended on Friday with a gap-up opening of Nifty 50 with the levels of the Nifty and Sensex trading around all time highs.

Economic News

Nirmala Sitharaman (Finance Minister of India) assured the public that the government is committed to work and perform. All the initiatives for boosting the economic growth in India will be taken.

Despite the heavy cases and closed economy, FDI or foreign direct investments has been flowing to India at an increasing rate. Indian market shows confidence over the stocks and rebounded buying is created in the market.

CRISIL – a credit rating agency, increased the value and Inc’s credit of India’s quality outlook. It is assumed that the sentiment of the market is positive till FY-22. With the increasing amount of vaccination in India, the impact of the virus is slowly decreasing. This led the agency to portray a futuristic positive picture with improvement for the Indian market.

The finance Cabinet in India has approved a fund of Rs.11,400 crore for the edible palm oil setup. This crucial decision has been initiated to reduce the dependence on edible oils. A price assurance has been given to the farmers producing palm oil in India.

On Friday, the government announced the reduction of subsidies for exporting sugar. The Sugar mills of India who currently export sugar, will be given an incentive to divert sugar to ethanol. A monthly quota will be proceeded to set for the sale of sugar in the Indian market.

Week’s Biggest Market Moves

Tata Steel and Bajaj Finance have been the top gainers during the week’s commencement. On Monday, the rise in metal prices and the doubling of the same within a year boosted the share price of Tata Steel. With the increase in metal prices, the company is generating higher revenue from steel metal products. Tata Steel has moved from the price of 1480 to reach its higher levels at 1500 in the mid-week, whereas a straight profit booking session has been observed on 20thAugust with the price settled at 1367.

Bajaj Finance is the most active and traded stock in the Indian markets. Financial services are at a high level in the Indian market and executing a silent growth. The company’s lookout is strong from its liability side and capability to extend digitization. Bajaj finance moved from the price of 6137 to 6637 through the week.

Other stocks: Apollo Hospitals and Fortis Healthcare brought positive results with all-time high profits. Thus, an increase in share price. A sharp spike has been seen in the stock- Shyam Metallics and Piramal enterprise remained on day’s high.

Tremendous growth has been seen in the IT sector stocks on 17thAugust which led to stocks like, Tech Mahindra, Infosys. Wipro and TCS trade at their highest. A minimum of 1-3% change has been observed in the IT stocks. What’s the reason behind the rolling of all the IT stocks in a single day?

Well, India’s IT sector is prominently inducing digitization and growing with improved work structure. Major IT companies allowed their employees to work from home for an extended year. Interestingly, it is bringing a faster pace of work and valuation for the company. In the IT sector, Work from home attracting increased use of the cloud and internet. The rally has been brought up by the Top-tier tech companies of India that are scoring high on the credit scores. These scores are provided by Crisil which is the reason behind a spike in the IT shares.

Other stocks: Maruti, L&T and Reliance Industries were the major stocks to gain in the Sensex. Glenmark Pharmaceuticals increased with the news of its good profits at 254 crores.

On Wednesday, the stocks traded with a smaller and high-low range in the Indian market. The market sentiment remained low throughout the day. HDFC Bank, Reliance, and ICICI Bank remained the focus for the indices to show positive gains.

Other stock: Ultratech Cement has been the top gainer with 3% up on the day whereas, Tech Mahindra – top loser with 1% down.

Indian markets were remained shut on Moharram on 19thAugust 2021. Due to the one-day off, a gap-up negative opening was observed in the market. The SGX-Nifty traded on the Singapore exchange signalled a negative opening earlier on Friday morning.

On Friday, the FMCG sector is responsible for holding the market into positivity. The stocks like HUL, Marico, Dabur, Nestle, Godrej consumers remained the focus in the Indian stock market.

NIFTY FMCG index gained around 0.87% in the retail rally on Friday. HUL was up by 3.66%, Nestle was up by 1% & Godrej was up by 2.26%.

The reason behind the FMCG rally is the setting up of funds for palm oil production in India. The decision has relieved the FMCG companies from the extra import duty in future.

Another reason for HUL to rise day’s high is Pizza hut is in news to have tied up with the company to add Quality walls ice cream in their menu. This reason led to an increase in orders from the franchise Pizza company leading its stock price higher.