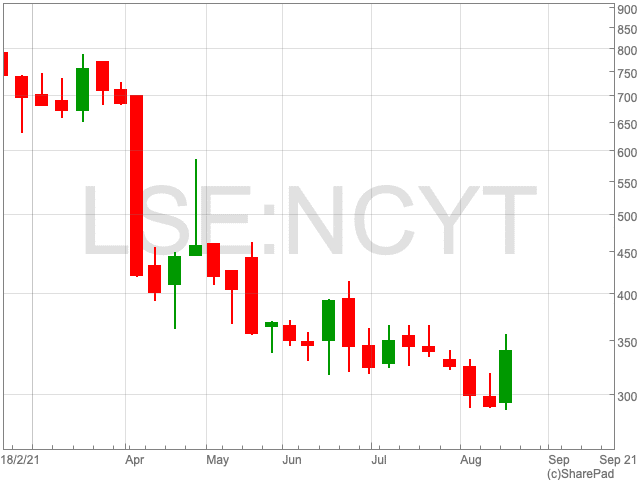

Novacyt Share Price

The Novacyt share price (LON:NCYT) was trading up on Wednesday as the biotech company delivered its trading update for the first half of the year. At the time of writing, the company has added 13.54% to its stock value. Despite the move today, year-to-date, the Novacyt share price is still down 59.76%. A wave of uncertainty gathered around the future direction of the company following the pandemic, causing its share price to dip in 2021. However, today’s update suggests a brighter outlook.

Trading Update

Novacyt reported on Wednesday that its revenue rose by 50% to £94.7m. The AIM-listed firm said that £54m came from the UK private testing market and overseas sales.

Its wholly-owned subsidiary Primerdesign was awarded a new contract under the Public Health England (PHE) National Microbiology Framework, effective immediately, for the supply of ‘PROmate’ Covid-19 tests to the NHS.

The PROmate tests were developed to run on the company’s ‘q16’ and ‘q32’ PCR instrument platforms.

Novacyt said the q16 and q32 near-patient PCR instrument platforms, using the PROmate Covid-19 test, had been validated and could be used at selected NHS hospitals.

The AIM-listed company has also entered into a two-year Long-Term Agreement (LTA) with the World Health Organization for the supply of its genesig COVID-19 tests. UNICEF has also confirmed that its existing LTA has been extended by 12 months to July 2022.

Graham Mullis, Group CEO of Novacyt, commented:

“Novacyt is continuing to address COVID-19 testing for both current and future demand. We continue to ensure that innovation is at the centre of our strategy and that our growing portfolio of COVID-19 tests are available to customers in both private and public health settings to expand existing, and support new, partnerships. Throughout the pandemic, NHS testing demand has remained a key priority for the Company and the contract award under the PHE National Microbiology Framework is a testament to our continued commitment.”

“We believe our long-term strategy also supports the growth of Novacyt post-COVID-19. In particular, our progress and growth potential in the private sector will not only help us maximize the COVID-19 testing opportunity but also ensure we are well placed, with both technologies and partners, for sustainable growth beyond COVID-19. We therefore believe Novacyt is well positioned to continue to build on its business transformation.”