Drug developer BiVictriX Therapeutics has a low capital cost model which outsources the main operations. The company also works with the University of Liverpool and Swansea University.

BVX001 has already indicated an anti-tumour effect in animal models. No adverse effects were observed. The cash raised will accelerate the optimisation of BVX001, so it reaches pre-clinical milestones. Further cash will be required to commence clinical trials and invest in other potential treatments. Further fundraisings could be dilutive, although the shares got off to a good start.

The share price opened at 22...

USD on the backfoot and bond yields fall as US CPI meets expectations

Inflation at 5.4% and in line with analysts’ expectations in July

The price of goods and services in America rose again in July, albeit in line with analysts’ expectations, on high levels of pent-up demand.

The consumer price index increased by 5.4% in July year-on-year, as reported by the Labor Department, in a continuation of the levels seen in June.

Commenting on the market reaction to US CPI coming in line with expectations, Mike Owens, Global Sales Trader at Saxo Markets, said: “With US CPI having beaten expectation for most of 2021, it’s almost a surprise to see the numbers come out in line with expectations.”

The dollar is down by 0.14% against the pound following the news to £0.721655, while it is down by 0.13% to €0.852225.

“It certainly appears that the market was set up for a beat as we’re seeing USD on the backfoot and bond yields fall back since the figures came out,” said Owens. “We’ve had a predictably positive reaction from equity futures with growth and value stocks both taking something from the numbers, and the debate over whether this current bout of inflation is transitory will continue.”

Core inflation, which discounts energy and food, rose by 3% last month, 0.1% below its forecasted level.

Experts suggest that the core CPI measure is a better indicator since it doesn’t take into account the volatility of petrol and food prices.

Could investors benefit from the US infrastructure bill?

In an effort to upgrade America’s transport systems, the US Senate has passed a $1trn infrastructure bill.

“After years and years of ‘infrastructure week’, we are on the cusp of an infrastructure decade that I truly believe will transform America,” Biden remarked at the White House following the vote.

Over the next five years the infrastructure bill will allocate $550bn in federal spending, improving roads, tunnels and bridges across America, in addition to the power grid, rail networks and airports.

Investments into access to broadband and clean drinking water have also been included in the bill.

The infrastructure bill will put specific companies, especially those who could receive government contracts, on high alert. This could lead to investment opportunities, although some analysts have suggested markets have priced the infrastructure bill in already.

“The passage of the infrastructure bill is a nice headline but unlikely to be a big market mover at this point,” Brian Price, head of investment management at Commonwealth Financial Network, said.

“The $1.2 trillion piece of legislation has secured the votes it needs in the Senate and that’s giving a lift to companies that stand to be winners like Nucor and Caterpiller. It’s a huge investment and a huge victory for the Biden administration but it’s not the end of the story and the bill now faces a difficult path as it negotiates its way through the House,” said Danni Hewson, AJ Bell financial analyst.

After the bill passed, the Dow Jones Industrial Average is up by 0.34% during the morning session on Wednesday, while the S&P 500 has added 0.27%.

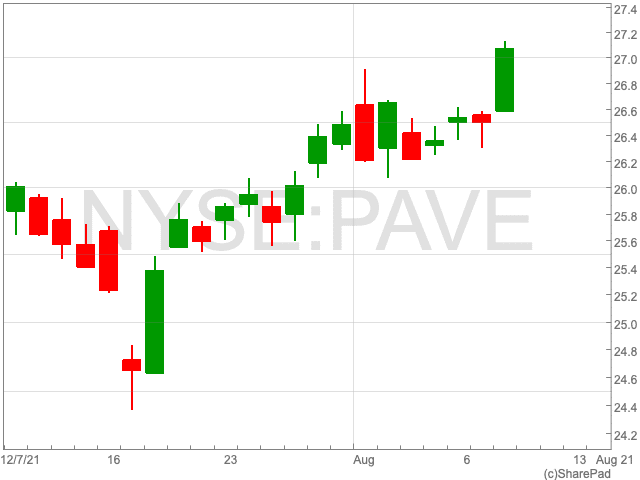

More specifically, the Global X U.S. Infrastructure Development ETF, an exchange-traded fund that offers exposure too shares that will be directly impacted by the infrastructure bill, has added 0.45%.

It has been on an upwards trajectory, as seen below, in the run-up to the passing of the infrastructure bill over the past month.

The Global X U.S. Infrastructure Development ETF has holdings in 100 companies, ranging from small to large-cap, that make at least half of their revenue from infrastructure construction, materials or a related service in America.

The top three stocks in the ETF are Nucor Corp, a steel producer, Eaton Corp, a power management company, and Trane Technologies, an industrial manufacturing firm.

However, it might not be obvious exactly which stocks will stand to benefit.

“There’s going to be a lot of spending in areas that people don’t necessarily associate with infrastructure,” said Scott Helfstein, head of Thematic Investing at ProShares.

In the meantime, investors will continue on their search for stocks that could benefit from a potential splurge in infrastructure spending.

Tesla car sales drop amid slowdown in Chinese economy

Tesla Car Sales

Tesla reported that shipments of its vehicles made in China dropped during July. Domestic China shipments of Tesla cars dived by 69% to 8,621 units last month, as reported by Bloomberg. With Europe-bound deliveries rising, overall shipments of Teslas made in China fell by 0.6% to 32,968 in July.

Since its warm reception in China earlier in the year, when Elon Musk spoke highly of the country, it has been a bumpy road for the carmaker. Issues surrounding crashes and protests led Tesla to receive some concerning publicity, which appears to have impacted some of its sales.

Competition

Additionally, Tesla is facing stiff competition within China. Namely, from Nio and Xpeng. Nio, the maker of the ES8 and ES6 electric sport-utility vehicles, delivered a total of 7,931 vehicles in July, an increase of 124.5% compared to the same period a year ago. While Xpeng, which makes the P7 sedan and G3 sport-utility vehicles, delivered 8,040 vehicles, an increase of 228%.

July is the first month on record that domestic companies have recorded similar local delivery numbers to Tesla.

Tesla Share Price

Over the past six months the Tesla share price has dropped by 12.53%. Having been as high as $880 per share at the end of 2020, it now stands at $709.99. However, as the news broke of the fall in deliveries in China, the American company’s share price didn’t react.

While local deliveries at less than 9,000 units came as a surprise, it appears to be following a pattern, which is why investors are not spooked. The figures are a repeat of April, the first month of Q2, when Tesla’s deliveries to the Chinese market were 12,000. Come June, however, the end of Q2, Tesla shipped 28,000 vehicles to the Chinese domestic market. It would seem that Tesla exports more cars at the beginning of the quarter and then focuses on local deliveries towards the end.

Delta Variant

A significant outbreak of coronavirus is causing concerns over the level of economic activity in China. Travel restrictions and mass testing have come back as officials seek a solution to curb the onset of infections.

Recently released data suggests that China’s recovery, which was ahead of other major economies following the pandemic, is now under pressure. Over the second quarter, China’s economy grew by 7.9% year-on-year, and 1.3% compared to the quarter before.

Zhiwei Zhang, chief economist at Pinpoint Asset Management, told the Financial Times that “inflation is rising and growth is slowing”. This is likely to add further pressure to supply chains. With Tesla already dealing with chip shortages, these factors could create difficulties in bringing domestic delivery back to satisfactory levels.

“With global vehicle demand at record levels, component supply will have a strong influence on the rate of our delivery growth for the rest of this year,” Tesla said.

The case for UK equities

- The UK economy has seen a strong rebound since the lows of the pandemic

- The stock market has also moved forward as market leadership has changed

- Companies are in good shape, with dividends and earnings coming back strongly

The UK is bouncing back. Economic growth is accelerating and the stock market has surged since the start of the year. It is a marked contrast from the pattern of the last few years, when the UK was laid low by Brexit and then by a confused response to the pandemic. Can this economic strength endure and will it translate into continued strong returns for investors?

Sree Kochugovidan, Senior Economist at Aberdeen Standard Investments, says that while the global economy is set for a sharp rebound and above trend growth, there is significant divergence across countries in the timing, speed and strength of that recovery. The UK is emerging as one of the stronger economies, thanks largely to the fast pace of its vaccine programme and swifter reopening schedule.

She says: “At the moment, we expect strong momentum for UK growth as we enter this new phase of reopening. In addition, we’ve seen that the UK economy has been quite resilient in the recent lockdown, consumers and businesses have reacted well to the latest set of restrictions. Growth numbers haven’t been as severely affected. At the same time, the labour market has been well-protected by furlough schemes.”

That said, Sree expects to see a rotation in terms of the different sectors and the type of spending. Retail spending has led to date, but there is likely to be a shift from household spending on durable goods towards leisure, services and hospitality as the economy reopens.

This has been seen in stronger UK stock market performance since the start of the year. Partly, this is a result of the dissipation of key risks such as Brexit and Covid. However, it is also because many of the more ‘old economy’ or ‘value’ type companies that dominate the UK market had become extremely cheap and the successful vaccines roll-out prompted a reappraisal of those sectors and a rotation in markets.

There has also been a significant improvement in the earnings and dividend outlook for many of these companies. Thomas Moore, manager of Aberdeen Standard Equity Income Trust, says: “We’re seeing quite a dramatic increase in earnings and dividends across a range of sectors. This is coming from good strong fundamentals – companies with robust governance are often survivors in their sectors, they are well-run with good long-term drivers. They’re coming from a low base in terms of earnings and dividends and we’re looking at some quite spectacular increases.”

This includes sectors such as mining, where Thomas points to a 90%+ increase in dividends this year. He has seen similar increases in sectors such as industrials, construction, housebuilding, consumer discretionary and the financial sector.

Following this strong performance, can the UK continue to do well? Ken Wotton, manager of the Strategic Equity Capital trust, believes that there are a number of elements in the UK market’s favour: “In spite of the outperformance of the last few months, the UK is still trading on a material discount to other developed markets, particularly the US. UK small caps, where we invest, are on multi-year discounts. Those discounts are starting to drive flows back into smaller companies.”

He also sees takeover activity driving the market as private equity buyers with deep pockets look for undervalued assets. Strategic Equity Capital is a 20-stock portfolio and has seen three takeover offers in the last three or four months. “Healthcare in particularly has seen a number of private equity bids in UK small and mid cap equities. We are seeing elevated deal flow and a hot IPO market.”

That said, Ken believes the environment remains difficult to forecast, given heightened uncertainty. This may create volatility, as the trajectory of earnings recovery for individual companies does not go quite as predicted. “It will be stock and sector-specific and should be a good environment for stockpickers that are focused on the longer-term.”

Georgina Cooper, manager on the Dunedin Income Growth Investment Trust agrees that investors will need to pick with caution. In some cases, the market has got ahead of itself, reflecting increased earnings in the share price before they have been completely realised. Nevertheless, she believes that in many areas there is still scope for upgrades to forecasts: “Management teams have generally been conservative with their expectations because of the continued uncertainty, particularly for operationally levered companies. The UK market still looks cheap and we are more advanced in economic recovery. In our view, the market can keep ticking up and the opportunity to close that valuation gap is still there.”

Thomas is encouraged by the significant cash flows building up in UK households, believing they could generate significant economic momentum if they are put to work. Plus, he says, positive trading updates are coming in “thick and fast” from companies. “It’s easy, after the last 10 years, to lure yourself into a doomsday view but that is not what we’re seeing.”

The fear, for both Georgina and Sree, is higher inflation. Georgina says some companies are starting to see cost inflation, and Sree says it is a risk she is keeping a close eye on. Nevertheless, she believes the current pressures will be transitory.

Although the UK economy tends to be associated with ‘old economy’ sectors such as banking, mining or oil and gas, Thomas says it is more dynamic than it appears. Capital tends to flow to new and productive areas of the economy. Increasingly, those structural trends accelerated by the pandemic, such as ecommerce, digital transformation, sustainability or healthcare innovation, are reflected in the UK market. Ken says that there are a host of new businesses coming to market for fund managers to consider.

The UK has seen a good run, but with valuations low, some key risks diminishing and corporate prospects improving, there should be more to come from UK companies. That said, there may be a rotation in stock market leadership and greater volatility. Careful stock picking should help avoid the pitfalls.

Important Information

Risk factors you should consider prior to investing:

- The value of investments and the income from them can fall and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the companies may not be appropriate for investors who plan to withdraw their money within 5 years.

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

GB-150721-153180-1

For more information, please visit:

Aberdeen Standard Equity Income Trust

Dunedin Income Growth Investment Trust

Strategic Equity Capital Trust

Find out more by registering for updates or by following us on social media here: Twitter and LinkedIn.

Deliveroo, US Infrastructure and Gold with Alan Green

The UK Investor Magazine Podcast is joined by Alan Green for our regular markets and UK equities debate.

The main topic of discussion from a macro perspective is the passing of the Infrastructure bill through the Senate. Although the bill faces the next hurdle at the House of Representatives, there is a significant level of optimism the world’s largest economy is set for an injection of fiscal stimulus.

We run through earnings from Deliveroo who posted a sharp jump in revenue but again failed to produce a profit and the latest updates from ECR Minerals.

We discuss Deliveroo (LON:ROO), Ashtead (LON:AHT) and ECR Minerals (LON:ECR).

Deliveroo doubles orders while long-term outlook remains uncertain

Deliveroo share price down by over 4% during morning session

During H1 2021 Deliveroo (LON:ROO) doubled its orders despite the easing of coronavirus restrictions.

The London-listed food delivery firm confirmed orders of 149.9m during the six months to the end of June, compared to 75.4m over the same time period a year ago.

Deliveroo’s revenues soared to £922.5m, an increase of 82%.

As a result, the food delivery company narrowed its losses. Deliveroo confirmed a pre-tax loss of £104.8m during H1, compared to a loss of £128.4m for the first half of last year.

“The growth momentum in the second quarter is still really strong,” said Will Shu, chief executive and co-founder of Deliveroo.

“Our lockdown love affair with takeaways shows little sign of cooling just yet, with Deliveroo bringing home resilient sales even when restaurants have opened back up,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“Deliveroo appears to be dominating the takeaway scene in many towns and cities where its distinctive mint green jacketed riders operate, despite Uber Eats and Just Eat rivals breathing down their neck. But investors appeared to have lost a little appetite for shares in early trading, with the company expecting customer behaviour to moderate later in the year,” Streeter added.

But Deliveroo’s business model has been given a vote of confidence after its Berlin based rival Delivery Hero snapped up a £300m stake this week, pushing up shares to the highest level since the company’s stock market flop.

“One of Deliveroo’s strengths is that it offers higher quality restaurant options than some rivals, which, coupled with its personalised app content and hyper-localised delivery approach, could be a major draw.”

However, the Deliveroo is down on Wednesday morning by 4.21%, despite the positive results.

Last month Deliveroo confirmed plans to cease its services in Spain because of the high costs involved in operating in the country.

“The pandemic has clearly offered a structural growth opportunity for Deliveroo”, said Streeter, “but the longer-term outlook depends on how demand holds up in a post-pandemic world, and if that road to profitability looks any clearer.”

FTSE 100 higher ahead of US inflation data

The FTSE 100 added 0.39% on Wednesday morning, bringing the UK index to 7,188.84.

“The FTSE 100 built on Tuesday’s gains to trade around a one-month high suggesting investors have moved on from the latest set of jitters over Covid variants for now,” say AJ Bell financial analyst Danni Hewson.

“Progress on a huge US stimulus package helped stocks close in positive territory on Wall Street, providing a positive cue for European equities – while the carving up of the UK market by overseas buyers continues apace as Avast agrees to a merger with NortonLifeLock.”

The other key threat stalking the markets is inflation. US inflation figures are out this afternoon and could provide a test for the current sunnier sentiment.

FTSE 100 Top Movers

Avast (2.99%), Spirax-Sarco Engineering (2.53%) and JD Sports (2.38%) are leading the way on the FTSE 100 on Wednesday.

While at the bottom end, Phoenix Group (-1.70%), Flutter Entertainment (-1.15%) and National Grid (-1.01%) have lost the most ground so far today.

Coinbase profit soars as volatility brings high trading levels

Coinbase has lowered its expectations for the coming quarter

Coinbases’s (NASDAQ:COIN) revenue soared during Q2 of 2021, compared the year before, as volatility characterised crypto markets.

The exchange’s revenue rose by more than 1,000% during the past quarter, although Coinbase warned against expecting that to continue as it lowered its expectations for the coming year.

Coinbase confirmed net revenue of $2.03bn, an increase of 27% compared to the previous quarter, the only other time it has posted results since going public in April. Year-on-year it represents a 1,042% rise in net revenue.

Net income also rose by a substantial amount to $1.6bn, up from $32m the previous year.

Trading volumes rose to $462bn for the quarter ended in June, up from the $335bn during the quarter ended in March.

The proportion of trades being made up by bitcoin fell from 39% during Q1 to 24% in Q2.

However, for Q3, trading volumes are expected to be lower than Q2, as the surge in trading levels will cool off, according toto the company.

Coinbase, which generates revenue by facilitating trades on its platform, has benefitted from the adoption of crypto and such assets. The volatility is an area of concern for some and has brought about calls for further regulation.

Chief Financial Officer Alesia Haas said Coinbase is keeping an eye on comments by the US Securities and Exchange Commission (SEC) Chair Gary Gensler, who turned to Congress a week ago seeking more authority to better police cryptocurrency trading, lending and platforms.

“We’re eager to understand the legal framework for the concerns that he has raised and how any of those may impact our product road map,” Haas said. However, the platform is carrying on with plans to expand its range of assets on the platform.

The Coinbase share price closed 3.85% down on Wednesday at $269.67.

Coinbase shares traded at $381 on its New York debut in April, over 50% above its $250 reference price, on a day hailed as a watershed moment for cryptocurrencies on the world financial markets.

Greatland Gold confirms appointment of new group mining engineer

Richter hired by Greatland Gold in newly created role

Greatland Gold (LON:GGP) confirmed the appointment of Otto Richter as Group Mining Engineer effective from Monday 16 August 2021.

Richter comes to the role with over twenty years of experience in international mining and consulting roles.

He has held key technical and operational positions with multiple underground and open-pit operations in Australia and other locations.

Richter’s consulting experience has covered mining projects at all levels, Greatland said, including technical and due diligence reviews and independent technical advisory roles to multiple international companies.

With an operational and consulting background, Otto has a solid foundation in a broad range of mining methods. This includes: sub-level caving, block caving and open pit, across various commodities, including gold and base metals.

Richter’s recent roles include Group Study Manager for Resolute Mining Ltd, Principal Consultant for Snowden Mining Industry Consultants and Mine Planning Manager for Newcrest Mining Ltd – Telfer Mine.

Shaun Day, chief executive of Greatland, expressed his delight at the hire: “To appoint someone of Otto’s calibre and skillset in this newly created role is a significant addition to the company and reflects the scale of the opportunity ahead.

“His underground expertise across multiple mining methods coupled with local knowledge of Telfer will be invaluable as we progress with mine development at Havieron. This appointment further enhances Greatland’s organisational capability as we continue to transition into a leading development and exploration company.”

The Greatland Gold share price is up by 0.53% during the morning session on Wednesday.