Stoxx Europe 600 up by more than 1% on Wednesday

A strong start to the week for American companies fed through to European stocks on Tuesday, as the FTSE 100 is up by 1.64%, closing in on the 7,000 marker.

The Stoxx Europe 600, an index of European stocks, also rose by more than 1%.

“That comes despite Chinese efforts to undermine prices in key commodities, with the government laying out plans to auction reserves of zinc, aluminium, and copper,” Joshua Mahony, Senior Market Analyst at IG.

Following a delayed reaction from investors, reopening stocks seem to be back in favour, including travel companies and airlines.

98% of all Covid-19 cases in the UK are the Delta variant and the future economic outlook could depend on its effect on people going forward.

“There are concerns that those countries without high vaccination levels will be unable to cope without heavy restrictions, while the UK provides the blueprint for reopening efforts in the face of huge numbers of Covid cases,” said Mahony.

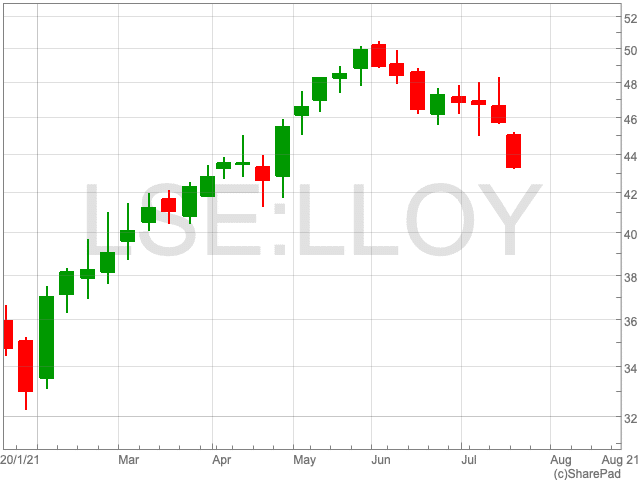

Commodity prices are under pressure, according to Mahony, in the wake of a Chinese announcement that they will auction reserves of copper, aluminium, and zinc in a bid to quell price pressures.

China intends to sell 170,000 tonnes of non-ferrous metals in another round of auctions, according to an announcement by state media, Xinhua, on Wednesday.

China will auction 30,000 tonnes of copper, 90,000 tonnes of aluminium, and 50,000 tonnes of zinc from state reserves in late July, Xinhua reported.

“The rise in Chinese PPI highlights how input costs are driving up inflation, and bulls will hope that this alleviates some of the underlying reasons behind the recent rise in headline CPI,” commented Mahony.

“Recent months have been dominated by the Chinese efforts to calm the price of key commodities, and today’s announcement represents an intensification of those efforts.”

“Nonetheless, with market in risk-on mode, there is a clear willingness to overlook short-term volatility in commodity prices to instead focus on the prospect of economic outperformance in the second half of 2021.”