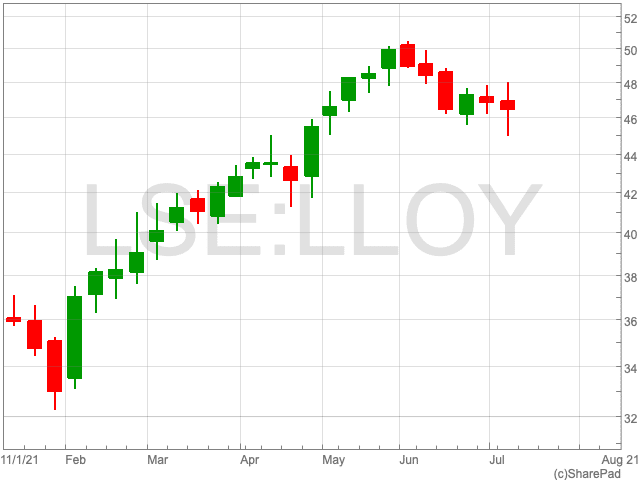

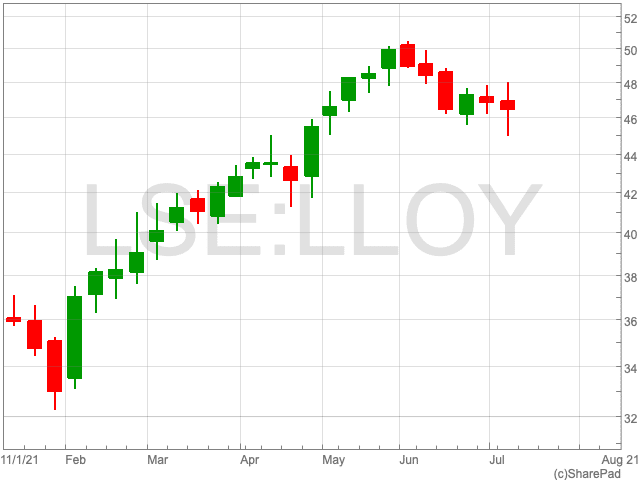

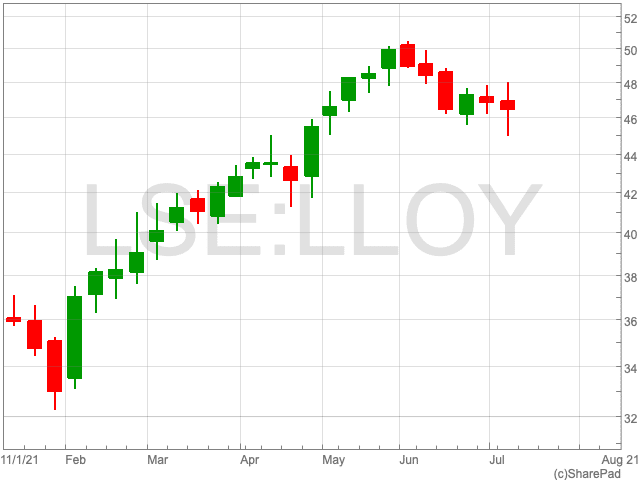

Lloyds Share Price

The Lloyds share price is up by 2.07%, as the FTSE 100 recovered from a wave of negative sentiment that knocked it over on Thursday. It is been a difficult period for the major bank over the past month, amid creeping uncertainty over the strength of the UK’s economic recovery, as the Lloyds share price fell by 3.56% over the past 30 days. However, some investors may see at an opportunity to secure shares in the bank for a reasonable price, especially as it looks to resume its impressive dividend.

UK Recovery

While investors are taking a pause to examine the outlook of the UK economy further, in recent months they have been optimistic about its prospects. There of course is the possibility that this level of optimism could return. Boris Johnson and Savid Javid have both hinted at the final removal of restrictions, which would bode well for the Lloyds share price. Having said that, the Lloyds share price remains subdued for a reason. Risks remain over the continued spread of the Delta variant, as infections are spiking at present despite the ‘success’ of the vaccine roll-out.

Analysts’ View

Analysts at Barclays are behind the Lloyds share price, suggesting that UK investors should keep faith with the bank. The analysts have suggested that owners of Lloyds shares who are thinking of selling could potentially lose out, even if they have already made gains from their investments. This is according to a note sent to clients earlier this week.

Barclays’ view comes as rumours swirl around whether or not the Bank of England’s Prudential Regulation Authority will allow banks to resume dividend payments. However, while there is an expectation among investors that the dividend payments will be allowed again, Barclays suggests that “the sustainable yield is more relevant”.