In life, there is typically an easy or a hard way to do something.

When it comes to investing in stocks and assets, that sentiment is definitely true. Some traders spend hours and invest their hard-earned money trying to uncover the secrets of the market, hoping to find that ‘silver bullet’ that guarantees profits.

As seasoned investors could tell those naïve but well-intentioned individuals, no such thing exists.

Utilizing trading strategies that need volatility, such as swing and day trading, is fraught with risk and complications. So it’s easy to see why – in the end – so many choose a more relaxed, passive form of investment.

A buy-and-hold strategy may not sound that exciting to some, but it can eliminate many of the complications that can trip up even more experienced traders. The premise could not be simpler, and in the fullness of time, the results can be just as effective as for those who take a more hands-on approach.

You can probably guess what buy-and-hold investing is, but is it the right strategy for you?

What is buy-and-hold investing?

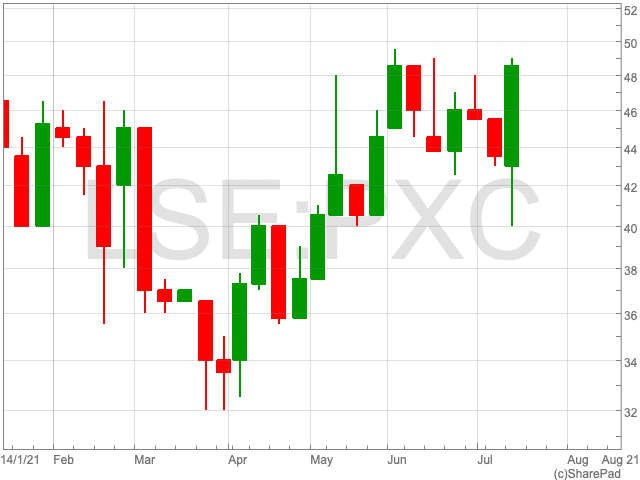

Yes, you guessed it, buy-and-hold investing is where you purchase a stock or other form of asset and simply sit on your hands for the medium or long term, riding out the market fluctuations until a pre-determined price is reached.

There’s not much more to it than that – buy-and-hold is a passive form of investment that allows you to profit from an open position without the rigmarole of daily interaction with the market. Buy-and-hold requires no technical expertise in reading charts or signals either.

It is no wonder the likes of Warren Buffett have opted for this approach in their investment portfolios.

Advantages and downsides of buy-and-hold investing

If you chart the long-term progress of the stock market, you will note that – despite many bumps in the road – the overall trajectory is one of growth and sustainability.

Indeed, with the emergence of new technologies and some rather large companies facilitating those, new highs are being reached all the time.

And so, in theory, buy-and-hold investments feel like a no-brainer.

Of course, it’s not as simple as that, and investing in the right brands from the get-go is essential for success with this particular strategy.

The advantages of buying and holding a position speak for themselves. You invest minimal time and effort, and that should – all being well – ensure that your returns are, pound for pound, more valuable than those who spend countless hours of the day scalping for small profits or taking their chances with swing trading.

There are tax perks to long-term investing too, and again these can yield benefits that active investors can’t take advantage of.

Naturally, there are some downsides to passive investing. Are you getting the most out of the market? Is your capital working as hard for you as it could be?

The phenomenon of ‘FOMO’ – the Fear of Missing Out – can be real for buy-and-hold investors, and so you will need to be disciplined and patient in securing the profit margin you seek.

Note also that some brokers charge overnight and weekend fees for holding open positions, and these will – over time – eat into your margin. Do your homework to find the brokers that offer the most agreeable conditions for long-term investments – Plus500 was reviewed at Ask Traders, and that’s a helpful starting point.

Is buy-and-hold investing for you?

The type of investing that is right for you will ultimately depend on your personality type.

Some people simply aren’t cut out for passive, buy-and-hold investing – it simply goes against the grain of their psyche.

Alternatively, some investors simply don’t have the time or inclination to study the charts and patterns, perform technical analysis, and dip in and out of the market on an hourly basis when the opportunity arises.

Passive investing *should* yield returns if the stocks and assets you buy grow in line with the overall market, and of course, they can far outperform the market baseline. If you had purchased stock in Apple ten years ago, you are probably reading this article somewhere exotic and hot, with outstanding air conditioning.

When you invest for the long term, you kiss goodbye to that money for months or even years, so as ever, you should only invest a) what you can afford to lose and b) what you can afford not to have for a prolonged period.

But when the moment is right, you should hopefully be able to sell at a handy profit without any of the blood, sweat, and tears that go into more active forms of investment.