By Ben Ritchie and Georgina Cooper, Investment Managers, Dunedin Income Growth Investment Trust PLC

- There has been a decisive move among investors to incorporate environmental, social and governance (ESG) considerations into their analysis of companies.

- Poor management of risks around carbon emissions, water or labour rights put businesses in peril.

- For Dunedin Income Growth Investment Trust, we wanted to formalise our ESG process and make it clearer to our investors.

Even before the pandemic wrought profound and enduring changes on the world, ‘disruption’ had become commonplace. Industries as diverse as financial services, healthcare or car manufacturing have all seen technology force change in recent years. Post-pandemic, many of these structural shifts have accelerated and it has become even more important for investors to stay ahead.

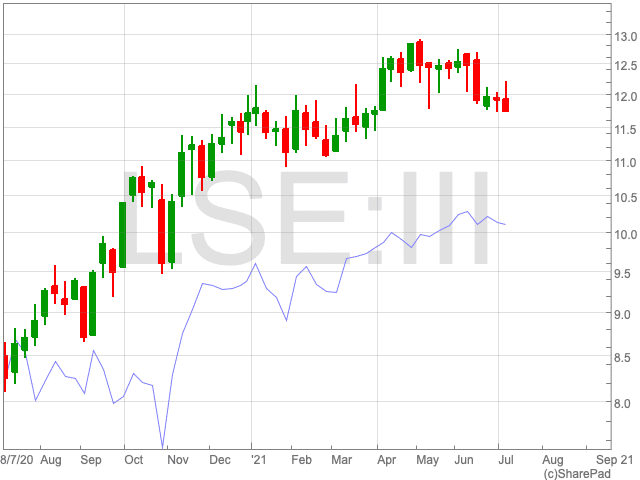

At Dunedin Income Growth Investment Trust, we have pivoted towards these trends over the past five years, bringing in higher growth companies on the right side of structural economic change. As we see it, these companies should be in a good position to grow their pay-outs to investors over time, but also deliver higher capital growth.

This has seen the Trust take exposure to trends such as the digitalisation of industry, the growing wealth of emerging market consumers and rising healthcare spending. Today, we believe the Trust is positioned for economic recovery, without being vulnerable should it fade. Importantly, it is relevant for a changing world.

However, there is one area where we wanted to be clearer about our decision-making. Over the past few years, there has been a decisive move among investors to incorporate environmental, social and governance considerations into their analysis of companies. It has become far more than simply a ‘nice to have’, but an integral part of risk and performance management.

Why? Governments across the world, from the US to China, have committed to low carbon targets. Companies that are on the wrong side of this movement have found their businesses under greater scrutiny, subject to fines and regulatory sanctions. Their cost of capital has increased as banks and other lenders have considered them at greater risk. In this way, poor management of risks around carbon emissions, water or labour rights puts businesses in peril.

At the same time, there are a lot of exciting companies emerging that address these problems in sectors such as renewable energy, waste management or environment technologies. These companies are benefitting from an increasing wave of government and private sector capital. While this means that investors need to be wary on valuations, particularly among some of the companies involved in emerging technologies, there are a range of new opportunities.

Environmental considerations

We have lengthy experience of managing ESG risks at Dunedin Income Growth Investment Trust and across all Aberdeen Standard Investments portfolios: every business in our portfolios has been graded on ESG by our investment analysts. However, we recognise that some of the language in this area can be alienating and investors often don’t know what they’re getting. As such, we wanted to formalise our ESG process and make it clearer to our investors. This is why we asked shareholders to support more formal screening in the portfolio. It doesn’t change the investment philosophy or dividend policy. It simply formalises our existing research work.

In building our plan for the Trust, we didn’t want to make too many value-based judgements. We recognise that investors’ ethical priorities can vary considerably. With this in mind, we focused largely on the environment, tobacco and weapons. This follows Aberdeen Standard Investments’ socially responsible investing (SRI) approach, which has been well-established and rigorously reviewed. We also see these as the areas of greatest regulatory pressure. Companies that don’t align themselves with those requirements are going to face a cost of capital and/or fines and sanctions. Today, we see that pressure building for oil, big tobacco and weapons companies. It could happen to other sectors and if so, we will be ready to adapt.

In practice

We are automatically excluding those companies that make weapons and tobacco, plus those oil and gas companies that don’t have a meaningful weighting in renewables and natural gas. We are also excluding companies that get low scores based on our proprietary ESG quality ranking and the bottom 10% of the index ranked on our in-house scoring metrics.

This makes a small difference to our universe of stocks. Around 6% are excluded on the sector screen, another 13% on quality analysis and another 10% are excluded on the in-house score. On current analysis, 29% of the market is screened out, once some overlap is taken account of.

This change will have an impact on our income options in the portfolio. Areas such as tobacco are significant dividend payers, so their exclusion inevitably reduces choice. However, if anything, it pushes us to re-allocate into other, higher growth ideas. Having the flexibility to invest up to 20% overseas is helpful. In terms of sectors, we might see a bigger swing towards financials and away from commodities. We believe though that this impact is more manageable with the investment opportunities that we have available to us.

To our mind, the move to formally incorporate environment, social and governance considerations in investments analysis is a significant and long-term shift in the way financial markets operate. It cannot be ignored and will increasingly be reflected in the price of shares. We wanted to make it an explicit part of our Trust’s mandate for the future.

Important Information

Risk factors you should consider prior to investing:

- The value of investments and the income from them can fall and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

Find out more at www.dunedinincomegrowth.co.ukor by registering for updates. You can also follow us on Twitter and LinkedIn.