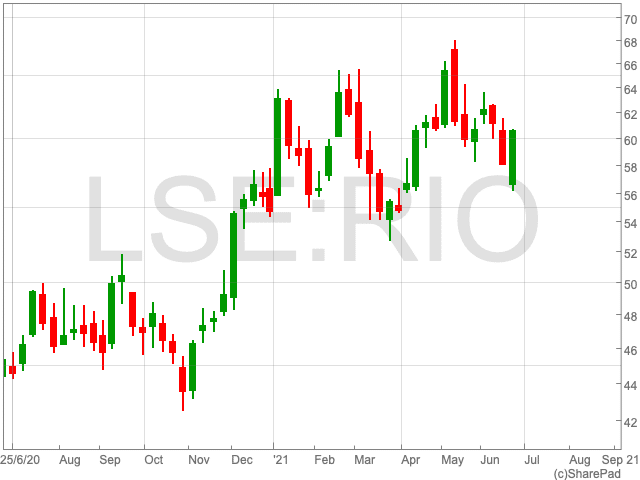

Stock levels fall to their lowest point in 38 years

UK retailers have disclosed their highest seasonal sales levels for more than four years in June, the CBI has revealed.

Consumers flocking back to the high street have caused stock levels to fall to their lowest point in nearly 40 years.

“This was the latest sign that the success of the vaccination programme is feeding through to stronger consumer confidence,” CBI economist Ben Jones said.

The Bank of England is monitoring whether bottlenecks in supply due to the pandemic will result in inflationary pressures going forward.

“After a generally gloomy 2021 so far, the sun finally shone for retailers in June, with seasonal sales volumes the strongest since November 2016,” said Jones.

Such is the of demand that retails are struggling to keep pace with stock levels compared with expected sales reaching the lowest level since the CBI began recording figures back in 1983.

Clothing shops’ sales are down for the time of year, as the lack of clarity of travel restrictions means people are delaying purchasing new items ahead of the summer.

The CBI expects sales to continue into July with some exceptions.

“The sector remains a long way from a full recovery,” said Jones. “The return of demand is patchy, with inner-city footfall still well down. The outlook is clouded somewhat by supply pressures, with stocks seen as too low compared with expected sales, as logistical and capacity challenges continue to hamper global activity.”