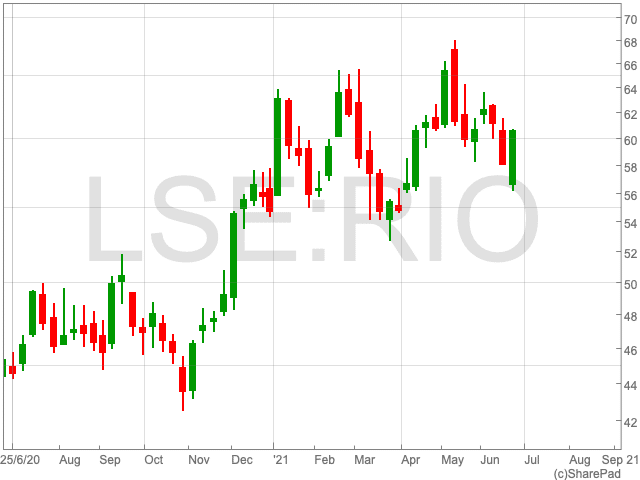

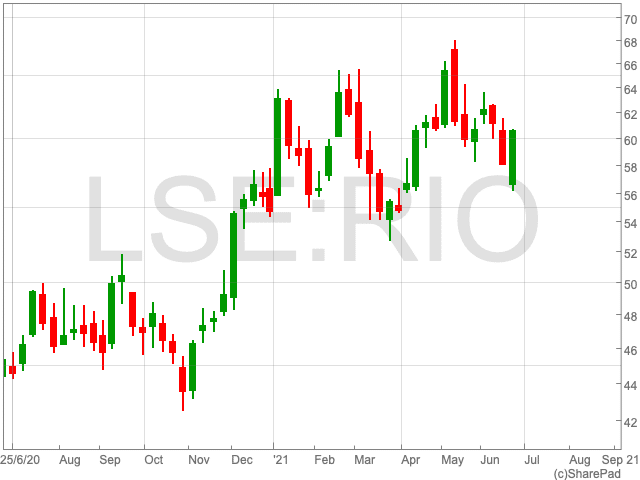

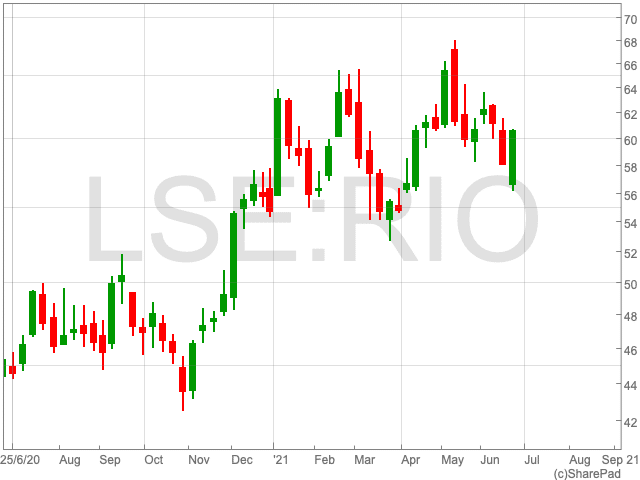

Rio Tinto Share Price

The Rio Tinto share price (LON:RIO) is up by 1% on Friday, bringing the mining giant to 5.53% since the beginning of the year. Following a steaming run towards the end of 2020, the FTSE 100 company’s performance has steadied out this year. The rise of the Rio Tinto was unsurprisingly aligned with the soaring price of iron ore. However, there are now question marks over the longer-term prospects of the commodity, which could have kick-on effects for the Rio Tinto share price.

Iron Ore

Analysts are way less bullish than before when it comes to iron ore. Analysts at UBS believe the commodity used to make steel could face some issues that put pressure on its price level over the coming months.

This includes concerns over excess supply. Brazilian iron ore is seeing an increase in supply levels, while there are abnormally large stockpiles at Chinese ports, as the country attempts to control the price of commodities.

UBS analysts say iron ore could drop by 50% or more ‘over 12-18 months’ and add that the current Rio Tinto share price is therefore unattractive based on the ‘normalised iron ore price’.

Price Target

UBS downgraded its buy rating for Rio Tinto from ‘neutral’ to a ‘sell’ this week. The investment bank added that Rio Tinto would still generate strong cash flow, while its dividends should remain high in 2021.

However, it added that it does not believe this will be sustained by Rio Tinto over the longer-term.

“Near-term risks for the commodity complex are increasing with the Fed turning more hawkish & China taking action to deflate commodities (eg by selling strategic base metal reserves note); we expect this to accelerate the unwinding of the ‘reflation trade’.”

After delivering outstanding long-term returns of 171.8% over five years, the Rio Tinto share price may have, for now at least, peaked.