Acquiring hard flooring distributor Cali Bamboo Holdings Inc not only provides a North American base for floorcoverings and tiles manufacturer Victoria (LON: VCP) it also provides other opportunities.

Victoria is paying $76.1m (£55.1m) for Cali and repaying $27.8m (£20.1m) of debt. In the year to April 2021, revenues were $171.6m (£124.3m) and EBITDA of $13.8m (£10m). Revenues have been growing at 17% a year over the past five years. Margins are lower than for the group because Cali is not a manufacturer.

This is the latest in a raft of acquisitions in recent months. Victoria has spent more th...

Supply issues and staff shortages set the tone ahead of tomorrow’s Bank of England meeting

The IHS Markit flash UK composite output index came in at 71.7

Inflationary pressure on UK businesses hit record highs this month, while growth narrowed a bit from May’s all-time high, as Covid restrictions were eased.

This is according to the IHS Markit/CIPS UK Composite Purchasing Managers’ Index (PMI), which showed one of the most robust month-on-month increases in business activity in over 20 years.

The IHS Markit flash UK composite output index came in at 71.7, 1.2 shy of a record May.

IHS Markit said businesses have hired staff at “an unprecedent rate” in response to rapidly increasing workloads.

The survey also drew attention to the fact that input and output costs have reached new highs on supply-chain disruptions.

Chris Williamson, chief business economist at IHS Markit, said: “Businesses are reporting an ongoing surge in demand in June as the economy reopens, led by the hospitality sector, meaning the second quarter looks to have seen economic growth rebound sharply from the first quarter’s decline.”

“There are some signs that the rate of expansion appears to have peaked, as both output and new order growth cooled slightly from May’s record performance, but full order books and a further loosening of virus-fighting restrictions should nevertheless help ensure growth remains strong as we head through the summer.”

Danni Hewson, AJ Bell financial analyst comments on today’s Flash PMI figures, added:

“The latest flash PMI figures set the tone ahead of tomorrow’s interest rate decision by the Bank of England. Supply chains are still fraught, some materials are still hard to come by and delays are pushing some companies to try and buy ahead, at a premium. All those cost pressures will work their way through and signal an uncomfortably bumpy period where inflation will continue on its upward trajectory.”

“Add in staffing shortages being felt by industries like hospitality and you have a recipe which will require businesses to weigh up whether it’s better to slim down provision or scale up wages. Of course, the end of the furlough scheme could solve that issue. No one really knows how many of those still being cushioned will return to their substantive posts or be looking for new ones.”

Liontrust ESG trust set for launch next week

10% of the management fees will go towards increasing ESG investment opportunities

Liontrust, the fund manager, is set to launch its investment trust next week, targeted at companies in the area of ESG (Environmental, Social, and Governance).

The “Liontrust ESG Trust” will have a portfolio of around 25-30 companies from all over the world.

The ESG investment trust is a more high octane version of Liontrust’s existing global fund, and will invest in ways which make it riskier, but with the potential for greater returns in the long-run, the company said.

The portfolio will be managed by Simon Clements, Chris Foster and Peter Michaels, who are all members of Liontrust’s sustainable investment team.

“The trust will make use of gearing straight from the off, and borrowing is expected to be around 10%, which should help to turbo charge long term returns in a rising market, but also accentuate drawdowns along the way. The investment trust will also invest in some smaller companies opportunities the fund can’t access, which again opens the door for a performance kicker, but at the cost of added risk,” Liontrust said in a statement.

The trust is also donating 10% of the investment management fee to projects that explore the potential for investment instruments relating to four Sustainable Development Goals that are “hard to invest in”.

Laith Khalaf, financial analyst at AJ Bell, commented on the timing of the launch, as well as some other advantages:

“A couple of high profile investment trust launches failed to get off the ground last year, but Liontrust has a few aces up its sleeve. The vaccine roll-out has delivered a significant boost to investor confidence, and Liontrust is launching this trust in the ESG space, where we know there is a lot of demand right now. Liontrust already has a well-established ESG range and the new investment trust will be run by the same team who manage the longstanding Sustainable Futures franchise, along similar lines to their existing Global Growth fund,” Khalaf said.

“The Liontrust sustainable investment team is one of the oldest in the business, having started life in 2001 at Aviva. Experience counts for nothing if it doesn’t deliver performance though, and the Sustainable Future Global Growth fund has shot the lights out on that front, ranking 15th out of 194 funds in the Global sector over ten years, with a total return of 310%, compared to 224% from the MSCI World Index*.”

Aegon closes property funds on liquidity issues

The Aegon Property Income Fund will close will close permanently as the asset management company has not been able to raise sufficient liquidity to meet redemption requests.

The £381m fund was suspended in March, along with other major UK property funds, as the pandemic brought about issues in ascertaining the value of underlying holdings.

Aegon said that it is closing its property investment funds to “ensure all investors are treated fairly”.

Initially, the asset manager was hopeful of reopening in Q2 of 2021, however liquidity issues and other factors meant that this didn’t happen.

“Accordingly, in order to ensure all investors are treated fairly, Aegon AM has decided to take steps to close the funds and return the proceeds to investors as quickly as possible, in a fair and orderly manner,” the company said in a statement.

The Aegon Property Income fund had amassed a cash level of 31.6% earlier in June.

Oli Creasey, property research analyst at Quilter Cheviot said the decision by Aegon to close its property fund did not come as a surprise.

“The fund was considered to be at risk earlier this year, a view that hardened following the news in May that a similar fund at Aviva was taking this same course of action,” said Creasey.

“The fund has been struggling for some time with one year returns particularly disappointing, especially when considering that a considerable percentage of assets were held as cash throughout this period. The broader UK property market returned c.6% over the same period, while the average property fund returned -1.6%, so significant underperformance will also have contributed to this decision.”

“The fund is not overly exposed to retail or leisure – arguably the biggest problem sectors in UK property at present – however, it is heavily underweight the high-flying industrial sector, and has significant exposure to regional (ex. London) office property, which has also struggled during the pandemic. With a high vacancy rate, the fund has clearly felt the full effects of the pandemic and have struggled to turn this around. Its vacancy rate has rocketed to 23% despite being at just 1.2% two years ago.”

Berkeley Group, Bitcoin and Rare Earths with Alan Green

Alan Green joins the Podcast for our weekly instalment of markets and UK equities.

This Podcast starts by looking at Bitcoin and the factors driving the recent selloff. China has implemented restriction on Bitcoin that sent the price spiralling and we look at both sides of the argument around whether now is a time to buy.

We explore Berkeley Group Holdings (LON:BKG) after the company updates the market on a bumper 2020 where the South East focused house builder managed to grow their top line despite the pandemic.

However, shares in the London-listed company fell in the immediate aftermath and we question whether investors were simply expecting too much from the company, or were nerves around a slowdown in the wider housing market driving sentiment.

Rightmove said they saw house prices rise 0.8% in June, down from 1.8% in May.

We also discuss Mosman Oil & Gas (LON:MSMN) and Altona Energy (LON:ANR).

FTSE 100 in consolidation mode on Wednesday

The FTSE 100 gained 8.84 points during the morning session today, or 0.12%. “The markets seem to be in consolidation mode on Wednesday after their see-saw start to the week,” says AJ Bell investment director Russ Mould.

US and Asian stocks built on their previous day’s gains overnight and the FTSE 100 was broadly unchanged at the bell this morning.

“While recent market sentiment has been dictated by the US Federal Reserve, their counterparts in the Bank of England will take centre stage later today when they deliver their monthly address,” Mould said.

The UK central bank is facing pressure to show it can keep inflation under control after it failed to accurately forecast inflation levels this year.

“Investors might expect some guidance on the future trajectory of UK interest rates although consumer prices are merely bubbling on this side of the Atlantic when compared with the boiling point they have already reached in the US.”

A lot will come down to how transitory the current elevated levels of inflation prove to be.

FTSE 100 Top Movers

Shell (2.21%), Anglo American (1.71%) and BP (1.7%) are heading up the FTSE 100 a couple of hours into the morning session on Wednesday.

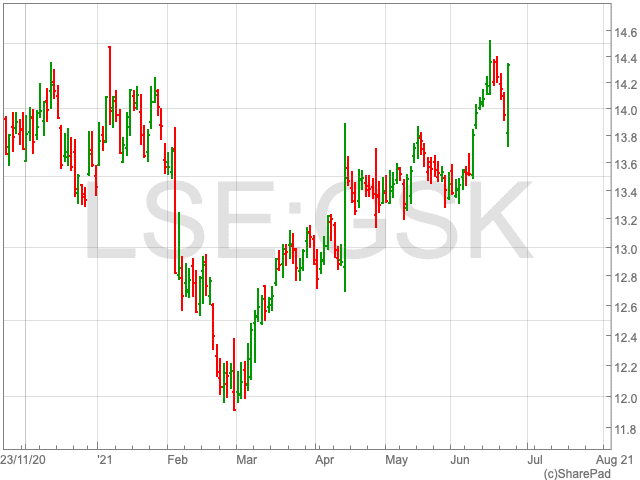

At the other end, Fresnillo (-2.09%), Phoenix Group Holdings (-1.95%) and GlaxoSmithKline (-1.41%), are trailing the pack.

Berkeley Group records pre-tax profit of £518.1m

Berkeley Group delivered in line with its guidance set before the pandemic

The Berkeley Group (LON:BKG) confirmed it made a pre-tax profit of over £518.1m during the past financial year.

It is an increase of £14.4m compared to the year before.

A specific driver of its profits was sales of properties worth in excess of £700,000.

The FTSE 100 homebuilder saw its revenue jump by £0.3bn to £2.2bn, as it sold 2,825 homes across London and the South East.

Andy Murphy, director at Edison Group, commented on Berkeley Group’s results and outlook: “The UK’s leading place-maker, Berkeley Group Holdings PLC, announced a strong set of financial results today. The company delivered in line with its guidance set before the pandemic, maintaining its annual £281 million shareholder return as well as adding ten new sites, with the capacity to deliver 6,650 new homes to its landholdings.

“The company ended the year with net cash of £1.1 billion, cash due on forward sales of £1.7 billion, and the estimated future gross margin in its land holdings having increased to £6.9 billion. This also resulted in a profit before tax increase from the previous year, up 2.9% to £518.1m. As of this past year, Berkeley now has 23 of its 29 long-term regeneration developments in production, supporting its anticipated 50% increase in housing delivery by 2024/25 from 2018/19 levels.”

The Berkeley Group share price is down by 1.34% during the morning session on Wednesday 4,578p per share.

Laura Hoy, Equity Analyst at Hargreaves Lansdown said: “It’s been a bumper year for housebuilders like Berkeley as pent-up demand following lockdowns flooded the market with eager buyers. It was no surprise to see that both the number of houses and the average selling price both ticked higher over the past 12 months.”

“But shares wobbled following the announcement as investors started to question whether the housebuilders’ run would slow to a walk now that the market is cooling. Data from the HRMC this week showed the pace of purchases has decreased, with the number of homes sold in May roughly 40% lower than March levels.”

The FTSE 100 firm has made firm commitments to reducing its carbon footprint across the business.

“The company announced its Vision 2030 this year, which sets out its ten strategic priorities for the next ten years, including its continued investment in modular housing to reduce its carbon footprint. As a result, Berkeley became one of the first 350 companies in the world to commit to limiting global warming to 1.5°C. This commits the company to reduce emissions from its sites, offices and sales venues by a further 50% between 2019 and 2030,” Murphy said.

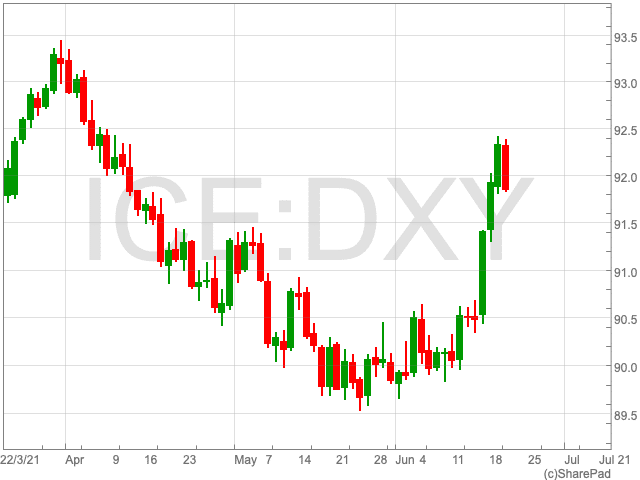

Dollar retraces as Fed confirms it will not yet raise interest rates

The dollar index was trading at 91.775 during the morning session in Asia

The dollar retreated on Tuesday against other major currencies as Chair of the Federal Reserve Jerome Powell confirmed that a tighter monetary policy was not on the cards anytime soon.

The dollar index was trading at 91.775 during the morning session in Asia, some way off its two-month high of 92.408 at the end of last week.

The dollar has retraced since a week ago when the Fed said that the first interest rate rise could come in 2023.

Both Powell and New York Fed President John Williams have said that the recovery needs time before a tapering of stimulus and higher interest rates are suitable.

“We will not raise interest rates pre-emptively because we fear the possible onset of inflation,” Powell said on Tuesday in a hearing before a U.S. House of Representatives panel. “We will wait for evidence of actual inflation or other imbalances.”

Attention will now turn to the producer price inflation data in the US, expected on Friday.

Vodafone European network to be powered by renewables

Vodafone’s wider goal is to cut emissions to net-zero by 2030

Vodafone (LON:VOD) confirmed on Wednesday that its operations across Europe will be fully powered by renewable energy sources as of July.

It is part of the FTSE 100 company’s wider goal of cutting its emissions to net-zero by 2030, including mobile networks, offices and data centres.

Just over a year ago, Vodafone set out its goal of being 100% reliable on renewable energy in Europe. Its previous target was 2025. The firm is now set on achieving the same target in Africa by 2025.

Last year Vodafone invested €65m to make its energy more efficient, allowing the company to save 135 GWh.

Key energy efficiency initiatives have also included sourcing and deploying more efficient network equipment, gradually switching off the relatively less energy efficient 3G network and decommissioning legacy equipment in our core network.

Vodafone Group CEO Nick Read said: “From 1 July 2021, Vodafone’s customers across Europe can be reassured that the connectivity they use is entirely powered by electricity from renewable sources. This is a major milestone towards our goal of reducing our own global carbon emissions to net zero by 2030, helping our customers reduce their own environmental footprint and continuing to build an inclusive and sustainable digital society in all of our markets.”

Vodafone’s plans are in-keeping with the Paris Climate Accord, which aims to limit global warming to 1.5°C.