Hurricane Energy share jumps by over 3%

Hurricane Energy (LON:HUR) slumped to a $625.3m loss as the company implements its financial restructuring on the back of a testing year.

A major factor behind the losses for the year ending in December were the $567.1m impairment charges to do with its flagship Lancaster field.

The AIM-listed company said the past year had been “profoundly challenging” on a number of levels.

Hurricane Energy confirmed that Lancaster field had produced an average of 14,900 bopd in 2020, although it was lower than expected as the field underperformed against its expectations.

Having once been considered the keystone to a 2.6bn-barrel portfolio, the field was downgraded to 7.1m barrels of proven plus probable reserves via a report in April.

A restructuring plan was outlined last month, but the board said it was most likely that the field would be discontinued when Lancaster stops producing in 2024.

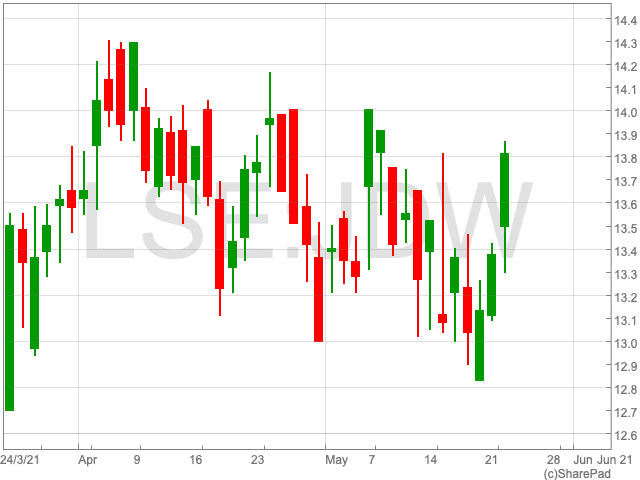

Approaching lunchtime on Tuesday, the Hurricane Energy share price is up by 3.77% to 1.35p.

Antony Maris, chief executive of Hurricane, commented:

“This has been a profoundly difficult period for Hurricane and its stakeholders. The understanding of the West of Shetland fractured basement play has changed significantly. As a result, the potential of the Lancaster field is much smaller than originally thought and cannot support the level of debt in the Company which was sized for a much larger Reserves and Contingent Resources base.”

“Against this extremely challenging backdrop, the Company has explored all potential options to resolve the Company’s financial situation, with the proposed financial restructuring ultimately being deemed the best possible outcome. We understand the impact this will have on our shareholders and the strong feelings that have been expressed as a result, but this was a necessary move in order to secure the Company’s future.”

“If the proposed restructuring is approved and implemented, we will focus our efforts on maximising Lancaster cash flows to pay down debt, as well as making the case for further development of our West of Shetland asset base”