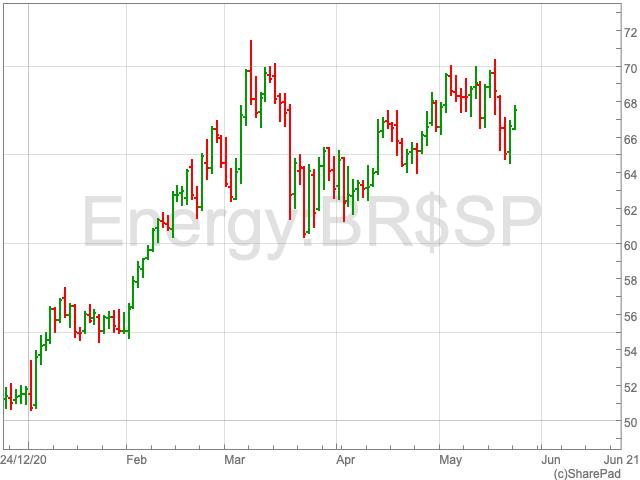

Iron ore still up by over 20% over past three months

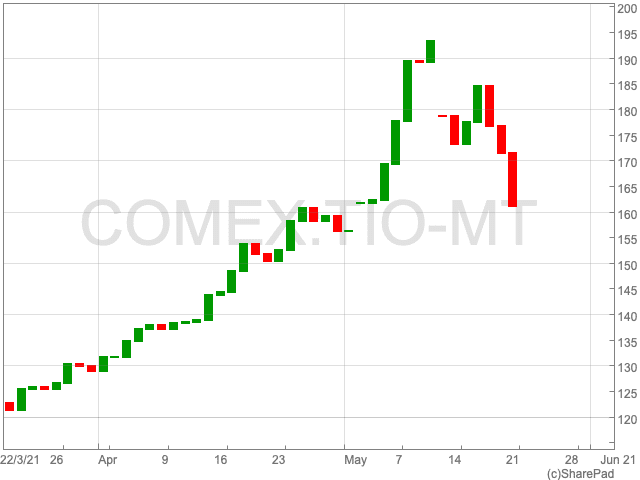

The price of iron ore, the ingredient used to make steel, dived on Monday as China suggested that it would aim to calm rising prices amid concerns over inflation.

On Monday China’s economic planning agency said it would come down on monopolies in commodities markets, as well as the spread of false information.

Following a recent surge, the iron ore composite fell by 6.03% to $161.09 as the announcement by the Chinese government made its way through markets. Although the commodity remains up by 20.1% over the past three months.

Despite rising commodity prices boosting China’s recovery from the pandemic, it remains concerned.

“I think there is increasing evidence of speculative excess,” Robert Rennie, head of market strategy at Westpac, told the Financial Times. Rennie also anticipates further intervention by the Chinese state.

China is easily the world’s largest consumer of commodities and higher raw material prices will affect production costs.

Two weeks ago iron ore reached its highest ever point thanks to strong demand for steel in China.

The FTSE 100 traded higher despite miners’ share prices being pulled down by falling iron ore prices as Chinese authorities warn of excessive speculation.

Fresnillo, Antofagasta and BHP have all lost ground on Monday.