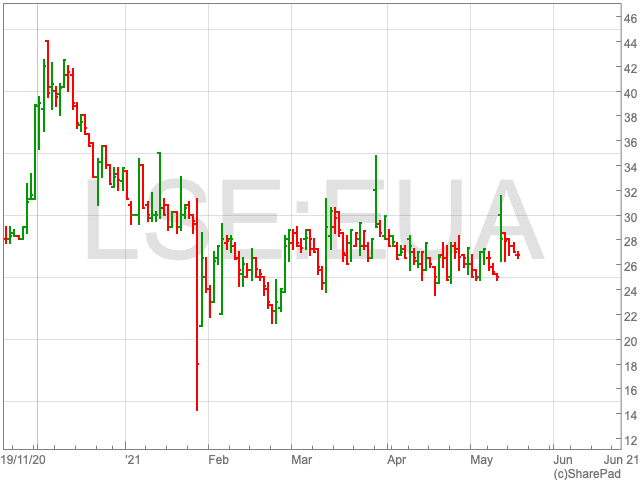

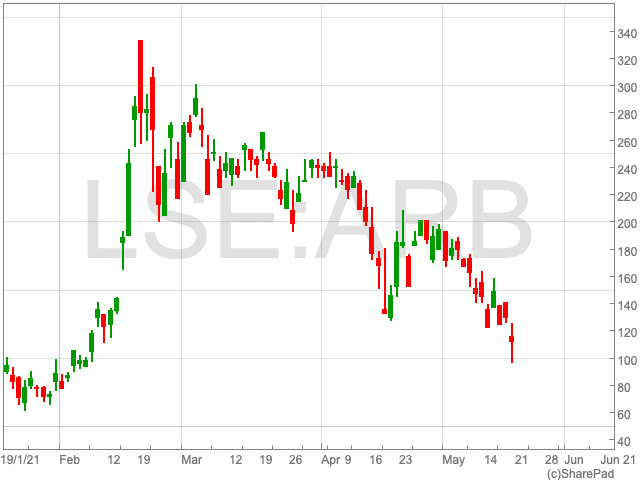

Argo Blockchain Share Price

The Argo Blockchain share price (LON:ARB) has fallen by over 13% to 112.70p per share on Wednesday. Having closed at 149p per share last Friday, the bitcoin mining company is down by over 30%. As bitcoin continues to plummet, shareholders in Argo will be concerned about its immediate prospects.

Bitcoin Crash

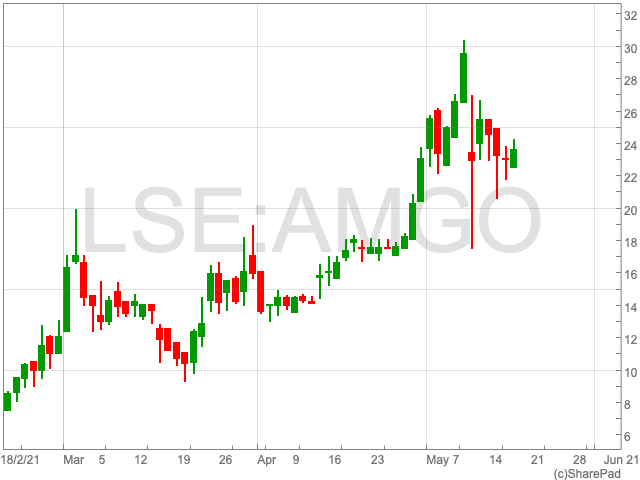

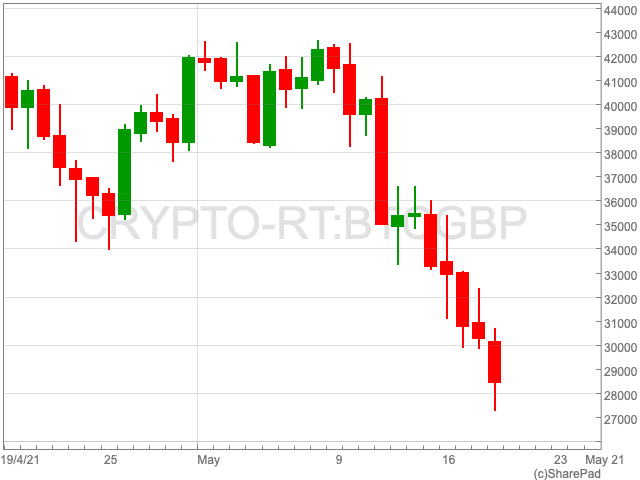

As a bitcoin miner, the performance of the Argo Blockchain share price is closely correlated to the performance of bitcoin. If the price of bitcoin falls, then Argo’s share price is likely to do the same.

Having reported earlier today that bitcoin crashed to below £28,000, the cryptocurrency is now at £25,000. At one point today it got below £23,000 as its recent bull-run came to a devastating end. Wednesday’s decline means bitcoin’s loss over the past week now stands at over 40%.

Outlook

The question now is what does the dip mean for the future of bitcoin. According to Laith Khalaf, financial analyst at AJ Bell, today has highlighted the extreme risk in buying bitcoin.

“The price of Bitcoin has tumbled by a third over the last month, which highlights the extreme risk inherent in cryptocurrency. Risk cuts both ways however, and Bitcoin is still trading above where it started the year, so many investors will remain in profit, albeit trimmed back by the recent fall.”

Khalaf also suggested that in recent weeks there have been significant developments which undermine bitcoin’s long term prospects.

“The tide has turned on Bitcoin because environmental concerns and regulatory risks have materialised, which have raised doubt over the long term adoption of cryptocurrency by businesses and consumers,” Khalaf said.

Consumers and investors may also start to shun cryptocurrency, particularly younger Bitcoin fans, who are also likely to be sensitive to climate issues.

“Bitcoin mining uses up a phenomenal amount of energy, and unlike traditional metal mining, doesn’t actually produce anything which is useful in the economy. Even celebrity endorsements may dry up as public figures become wary of being associated with an environmentally unfriendly product,” Khalaf says.

If nothing else, today’s crash will serve as a reminder of the risks of investing in cryptocurrencies and related companies. The future looks will be a testing time for both the Argo Blockchain share price and the world of crypto.