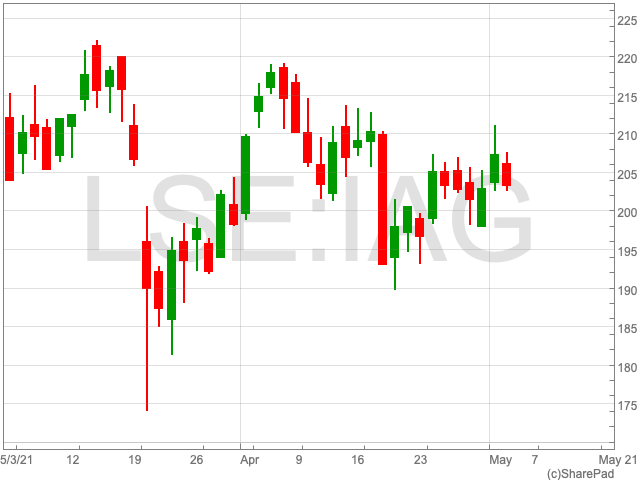

Trainline’s volume of UK passengers fell to 5% at outset of pandemic

Trainline (LON:TRN) announced on Thursday that it made a £100m loss as lockdown restrictions across the UK caused its passenger numbers to dive.

Having made a £2m profit the year before, Trainline posted an operating loss of £100m, as net ticket sales dropped by 79% to £783m.

The FTSE 250 company saw its revenue fall by 74%, down from £261m to £67m at the end of February.

At the outset of the pandemic, Trainline’s volume of UK passengers fell to 5%, in what was the beginning of a very challenging year for the company.

It is possible that consumer demand for train travel remains low as companies are often sticking with their hybrid working approaches.

Russell Pointon, Director, Consumer & Media at Edison Group commented: “Lockdowns, social distancing and a year of working from home impacted domestic train travel exponentially over the last year. It is, therefore, not surprising to see Trainline posting a poor set of full-year results today.”

However, Pointon suggests that the measures the train company took during the pandemic could allow it to bounce back strongly.

“As the pandemic hit, the company put in steps to reduce cash flow, halting marketing efforts and utilised the government furlough scheme for its teams. This resulted in its average cash burn being reduced to £5 million per month, outperforming its initial guidance of £8-9 million. With all furloughed teams back at work and marketing programmes beginning to be ramped up again, the Trainline is looking to bounce back strongly.”

While chief executive Jody Ford gave his thoughts on how Trainline is adapting itself to the future.

“Our continued investment in product and tech through COVID-19 means, despite the ongoing COVID-19 uncertainty, we are well positioned to support the wider industry recovery and continue driving the market shift to online and mobile tickets,” chief executive Jody Ford said.

“Looking ahead I feel very confident about Trainline’s prospects for the future. We remain committed to championing rail as a greener mode of travel for millions of customers around Europe, and to driving the significant long-term growth opportunity for this business.”