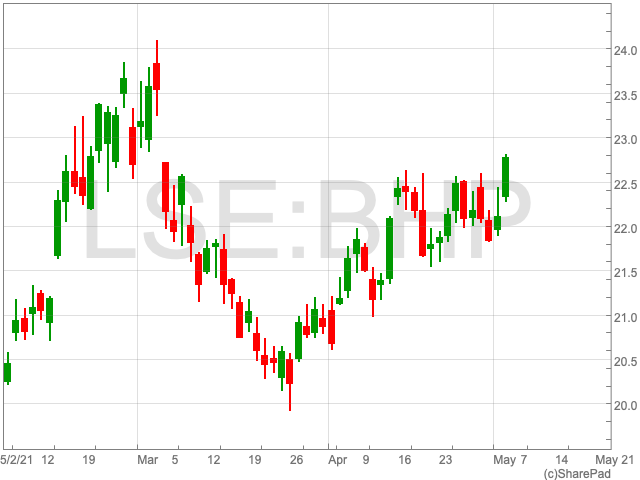

The BHP share price (LON:BHP) performed relatively well during the pandemic, making a swift recovery and then getting far beyond its pre-pandemic level during 2021. Since the turn of the year the FTSE 100 mining giant is up by 18.6% to 2,302p.

Iron Ore

UK Investor Magazine outlined earlier this year that BHP’s performance would be dependent on the price of iron ore during 2021. While there was a possibility that the Chinese government could move to suppress the price of iron ore, so far, the commodity is close to an all-time-high. Iron ore has been getting near a record $200 per tonne, over double its price 12 months ago.

The price of iron ore is high because of soaring Chinese steal prices, as reported by S&P Global Platts, in addition to output reductions for environmental reasons boosting an already overheated sentiment.

The question now is whether or not iron ore has much further to go? China’s steel output grew by 16% year-on-year during Q1, which suggests demand for iron ore is likely to rise. Another potential cause of a fall in the price of iron ore is a global increase of supply. However, S&P Global Platts has suggested that both outcomes are unlikely and that “the market expects steel prices to continue rising, supported by falling steel inventories and robust orders”.

Analysts’ Views

Stockopedia has reported that out of 16 analysts covering BHP, three have given ‘buy’ recommendations, 12 have said to ‘hold’ and one gave the stock a ‘sell’.