AGM season is in full swing and these days it is no longer certain that shareholders will back all the resolutions set out by a company. Nearly all the resolutions are passed but sometimes a significant minority of shareholders revolts.

If a company does not take note of the revolt, then it can grow in subsequent years. For example, there was a 21.5% vote against the latest remuneration report of veterinary practices operator CVS Group (LON: CVSG). The previous year there was a 11.1% vote against the same resolution and the year before it was 0.69%.

Government assistance has helped many compan...

ikigai launches first fintech in the UK to combine everyday banking and wealth management in one app

This week Maurizio Kaiser and Edgar de Picciotto, co-founders of ikigai, join the UK Investor Podcast ahead of launching their crowdfunding campaign.

With more and more young people getting into investing in the wake of the pandemic, it’s never been more important to engage with new investors – especially as millennials are hitting their prime earning and spending years.

ikigai is a brand new fintech and the first app in the UK to combine wealth management and everyday banking tools in one place. Here, we discuss their mission and vision for ikigai, how they’re helping a growing audience of affluent millennials, and why they’re reimagining the future of wealth.

In this podcast you’ll also hear more about their crowdfunding campaign, launching on Crowdcube and aiming to raise £1.2 million. As a listener, you can also gain exclusive early access to their private phase and become a shareholder in ikigai.

Find out more on their crowdfunding page here.

When investing your capital is at risk.

Covid policies raises government debt to highest point since World War Two

UK public debt at 97.7% of GDP

Britain borrowed more money than at any point since World War Two as it attempted to deal with the damage caused by the coronavirus pandemic.

That is according to the Office for National Statistics (ONS), which said that the UK borrowed £303.1bn in the year ending in March. That is up from £57.1bn the year before, an increase of £246.1bn.

While the thee level of government borrowing was historically large, it was not as much as some anticipated it could be. Subsequently, the Treasury told financial markets on Friday morning that it would be issuing £43.3bn less debt in 2021/22 than initially planned, according to the Financial Times.

The budget deficit remains wide, however, as tax revenues plummeted and spending on health and furlough schemes rose due to the impact of the coronavirus pandemic.

Tax revenues fell while public spending on health services and furlough schemes surged.

Last year the UK government borrowed as much as 14.5% of GDP, an amount last surpassed after World War Two, when the UK borrowed 15.2% of everything produced in the economy.

The level of borrowing pushed the UK’s total accumulated public debt to 97.7% of GDP, the highest level since the early 1960s.

Michal Stelmach, senior economist at KPMG, said thee surge in debt was necessary to stave off further harm to the economy which could have resulted during the pandemic.

“Doing otherwise could have created long-lasting scars which would be far worse for fiscal sustainability,” he said.

Covid-19 cases well down for second week in a row

Last week 1 in 610 people had Covid-19

The number of people with Covid-19 has significantly fallen for the second consecutive week according to figures released by the Office for National Statistics (ONS).

Over the course of last week 1 in 610 people had Covid-19, down from 1 in 480 the week before.

There were also sharp falls in cases in Northern Ireland, Scotland and Wales.

England, as of now, has finished the second stage of its route out of lockdown, as hospitality business and non-essential shops have now reopened.

The ONS’s figures come as the UK has been removed from the list of 20 countries worst impacted by the pandemic.

The successful vaccine roll-out, in addition to the third nationwide lockdown, has brought the daily death tally down from its peak of just under 2,000 to the single digits.

Over 33m have now received their first dose of the vaccine, 11m of which are fully vaccinated.

The FTSE 100 stayed quiet despite UK retail sales hitting a nine-month high.

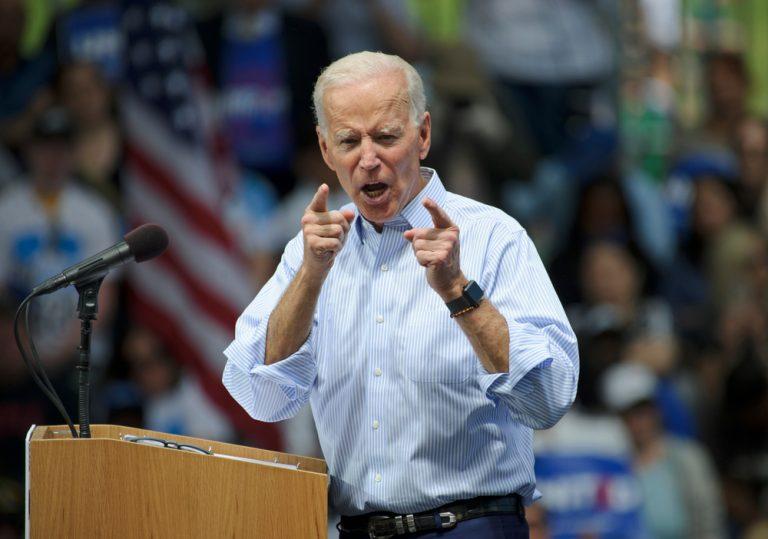

Joe Biden pledges to cutting US carbon emissions by 50% by 2030

Other leaders from around the world made commitments to reduce emissions

Joe Biden announced yesterday that America is committed to halving its carbon emissions by 2030.

The President made the pledge during a global summit where the world’s leaders met virtually.

Biden began his address by saying: “The science is undeniable.”

“The cost of inaction just keeps mounting… we have to step up,” he added.

Since Biden replaced Trump in January 2021 he haas made a concerted effort to put climate change at the forefront of the nation’s agenda. The pledge is goes further than previous commitments by nearly double.

Biden continued: “Scientists tell us this is the decisive decade. This is the decade we must make decisions that will avoid the worst consequences of the climate crisis.”

Biden delivered a warning that it would be up to nations to come together to to solve the climate crisis.

“This is a moral imperative and an economic imperative… but also a moment of extraordinary possibilities.”

UK Prime Minister Boris Johnson heaped praise on the move by the US President.

“It is vital for all of us to show that this is not all about some expensive, politically-correct green act of bunny hugging,” Johnson said.

“Let’s use this extraordinary moment and the incredible technology we are working on, to make this decade the moment of decisive change in the fight against climate change – and let’s do it together.”

The President of China Xi Jinping, who has come under much scrutiny over his country’s emissions, also spoke at the summit.

“strive to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060,” Xi said.

He added: “Mother nature has nourished us and we must treat nature as our root – respect it, protect it.”

President Joe Biden will also put forward a plan to raise taxes on America’s wealthiest people, including the largest-ever rise on taxes on investment gains.

The proposal is aimed at funding $1trn in childcare, universal pre-kindergarten education and paid leave for workers, Reuters reported.

Nova Financial Group positive on UK property post pandemic

Nova Financial Group advises thousands of property investors looking to build their portfolios across the UK. Nova sets itself apart in an industry which is typically equities focused by giving its clients control and flexibility of property and buy to let investments.

Strategy

“If you don’t know where you are and where you want to go then you are less likely to make progress,” said Paul Mahoney, managing director and founder, who presented at April’s UK Investor Magazine conference. Nova’s mission is to figure out a blueprint for people who want to invest money they’ve saved over a long period, but who may not have the expertise to do so. The company’s vast wealth of experience ensures its clients will avoid common mistakes and make savvy property investments.

Nova helps its clients to source specific properties, taking care of the research and due diligence that goes into the process. In addition, the firm has an in-house mortgage broker to it advises on and arranges the finances for the sale of properties across the UK. Finally, the company helps its clients to review their portfolios and re-invest as time goes on. The company does not sell its own stock of properties which allows it to better guarantee impartial advice, ensuring a “focus on the financial outcome for its clients”, said Mahoney.

Leveraged Property Investing

Nova makes the case that when it comes to property, it can be preferable to gain debt. “Some debt is good debt. It can help you utilise your funds and can make them go further,” Mahoney said. Nova only looks at properties that provide a net yield on funds applied of 5-10%. In addition, clients with Nova are able to grow the value of their portfolios through capital growth. Mahoney made the case that Nova can generate 20% growth on funds invested per annum as the value of a property rises. This means that clients could stand to earn a yearly return of between 25-30% when the yield and capital growth on funds invested is combined. Nova is able to achieve these returns consistently and with a low level of risk, Mahoney stated.

Market Trends

Nova will assist its clients in identifying market trends to allow them to make secure long-term investments. Young professionals, Mahoney says, are more focused on lifestyle as opposed to family. Therefore, they are more focused on living in the areas in which they are working rather than commuting i.e. city centres. Mahoney does not feel the trend of people moving away from city centres, as often reported by the media during the pandemic, is going to be permanent as things return to normal.

Low to middle income earners, generally young professionals, are also increasingly finding it difficult to live in London. “20 years ago London wages were relatively higher and the cost of living was much lower than it is now,” said Mahoney. “Wages haven’t grown a lot, especially for low to middle income earners,” he added. This is resulting in that demographic either staying in – or moving to – other major UK cities, including Liverpool, Bristol and Manchester.

Other major changes over the past five years in the buy-to-let market include a greater focus on yield, mortgage serviceability and stamp duty premiums. Lower value, high-yield properties are becoming more sought after, in-line with a transition way from London and the South East.

India Capital Growth Fund: positioning for India’s recovery

The India Capital Growth Fund (LON:IGC), which focuses on Indian mid-cap listed equities, is managed by Gaurav Narain, based in Mumbai, along with a team of seven analysts who work on a sector by sector basis. The trust is listed on the London Stock Exchange.

Covid-19 in India

Initially it looked as though India had avoided a second wave, however, that proved to not be the case. The situation on the ground, according to Narain, who spoke at April’s UK Investor Magazine conference, “is grim, as the peak of the current second wave is far exceeding the first peak which occurred in August 2020”. “It has caught many people by surprise,” Narain added. There are approximately 1.9m active cases in India with a mortality rate of 0.5%. The second comes as the vaccination roll-out is well under way with 8% of people – and 29% of the 45+ age group – receiving the first dose. “My sense is that the worry factor is not as much as it was in the first lockdown,” said Narain. “The central government is very clear that they’re not going to impose a strict lockdown, and the state governments have realised how damaging the lockdowns have been.” Despite the second wave the IMF is forecasting India to grow more than any other major economy in 2021 (11.5%) and 2022 (6.8%).

Disruptive Reforms

Since Modi came to power in 2014 the government has been trying to make India a better place to do business. The country introduced demonetisation, bankruptcy reform and changed the tax system. “These reforms were ultimately driven by digitisation,” said Narain and have led to a clean up of the banking sector in particular, an industry that emerged in good shape from the coronavirus-induced crisis.

The last five years in India have been about a structural overhaul, which caused an initial slowdown in India, but will prove beneficial for the country’s economy further down the road. This has created scepticism on the part of international investors, however, India Capital Growth Fund is of the view that growth is on the agenda moving forward.

“The government has identified $1.5trn worth of infrastructure projects over the next five years which will accelerate growth,” says Narain. He also outlined the government’s willingness to let the private sector lead the way, which represents a shift in how private enterprise is viewed in India. This has coincided with the privatisation of a number of government entities.

India Capital Growth Fund Portfolio

There have been several structural changes made to the fund towards a more cyclical portfolio. The fund has also switched a lot of its exposure from staples to consumer discretionary businesses. Materials (20.1%), financials (18.1%), consumer staples (12.8%) and consumer discretionary (10.5%) are the industries that make up the largest proportion of its holdings. The fund is also diversified in terms of market capitalisation with small-caps making up 27.2%, mid-caps at 57.5% and large-caps at 13.8%. India Capital Growth invests mostly in small and mid-cap companies because it feels that is where the engine room for growth is in the Indian economy.

China vs India

A large number of companies are now moving their manufacturing bases from China to India. At present, India’s costs are one third of China’s, while in the 1980’s the countries were on a par. This has led to a number of company’s being incentivised to move their production facilities to India.

Apple is planning to shift 20% of its production capacity, while Samsung will double production in Noida factory to 120m units per annum. Amazon has also committed to exporting $10bn of made-in-India goods by 2025.

Emerson PLC: potash vital in feeding the world’s growing population

Emerson PLC’s (LON:EML) primary focus is on developing the Khemisset Potash Project located in Northern Morocco. Potash is a fertiliser used to increase crop yields and improve the quality of plants – it plays a central role in helping feed the world’s growing population. The importance of potash as a commodity within the world economy is set to increase further, representing an opportunity for investors, as outlined by Emerson PLC.

Demand for Potash is Growing

The world’s population is growing at a rapid rate which will significantly increase the demand for potash. In addition, the amount of available farmland to grow food is reducing. “By 2050, we have to produce 60% more food than today,” said Graham Clarke, CEO of Emmerson, who presented at April’s UK Investor Magazine conference. Therefore agricultural productivity per acre must keep improving in order to ensure sustainable food security. This requires the right use of fertilizers, using potash, in order to maximise crop production, Clarke argues. In addition, Emerson’s project is in Africa, which is where most of the world’s future arable land exists.

Potash Price Rising

The prices of cultivated grains are rising while potash continues to grow. Grains including wheat, soybeans and corn which are critical to feeding the world’s population and are reliant on potash for improved yields. “The price of these crops are an indication of the price of potash, and they are continually growing,” said Clarke. Potash demand is set to increase further over the coming decade.

Competitive Advantage

When comparing Emerson’s Khemisset Project to a typical Canadian project it becomes clear that Emerson boasts logistical advantages. By having zero port development costs, low infrastructure costs, and easy mine access, the Khemisset Project operates at an $80/t advantage over its Canadian competitors. This is a result of being in a location with developed infrastructure and advantageous geology. For example, at the Khemisset Project, the deposits are 500m below the surface, compared to approximately 1000m in Canadian projects, and there are no aquifers, making access far easier. The beneficial logistics produces costs of around $35m, whereas a typical Canadian project, with deep shafts going through an aquifer, can cost up to $1bn.

FirstGroup shares soar as it sells off US bus business in £3.3bn

FirstGroup under pressure from its largest shareholder

FirstGroup (LON:FGP) are up by nearly 10% on Friday after the company confirmed its plans to sell US school bus business to investor EQT in a £3.3bn.

The FTSE 250 company has been coming into pressure from activist investors to sell its American business.

FirstGroup has been engaged in an ongoing battle with its largest shareholder, US investment company Coast Capital Management for some time now. The dispute previously led to the departure of former chairman Wolfhart Hauser in 2019.

FirstGroup chairman David Martin, formerly chief of rival transport group Arriva was drafted in to oversee the business’ break-up.

AJ Bell investment director Russ Mould commented on its decision to sell the US arm of its business:

“It’s another win for the activist investor community as FirstGroup strikes a deal to sell two US operations. Its biggest shareholder Coast Capital had been putting pressure on FirstGroup to do something about this part of the business, initially suggesting a demerger but the sale should go down well given the good price achieved,” said Mould.

“There are still some bits to tidy up with the remaining operations, such as the likely sale of its Greyhound business. That should then leave it focused on the UK bus and rail market.”

“The rise in working from home has put a question mark over the level of commuter demand going forward. It could be another year before there is more clarity on the new operating models for companies and how much flexibility is given to staff regarding their working location. However, FirstGroup is no doubt taking a long-term view that demand for public transport will remain robust.”

““On the rail side, the UK Government is moving to a more predictable contract model whereby operators such as FirstGroup will be paid a fixed management fee with performance incentives for delivery against specific punctuality and other operational targets.”